Effective Pitch Deck Strategies for Investor Presentations

Learn the key components of a successful pitch deck, avoid common mistakes, and follow a structured outline to craft a compelling narrative that captivates investors. This comprehensive guide covers elevator pitches, identifying problems and solutions, market validation, financial projections, team composition, and funding requirements, all presented succinctly in 10-13 slides.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

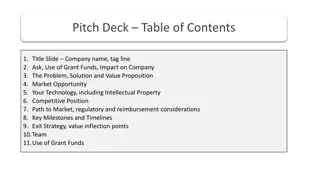

Pitch Deck Template

This pitch deck is made... ...to give you exemplary slides that help you tell your story to the investors, to open their minds to your vision. It is utterly important not to overload them with information; share only as much as needed to get their attention. It should stand on it s own - the slides you are including in your presentation are for similar purposes as a one-pager. The deck should be brief, containing a maximum of 10-13 slides. Merging Traffic | mergingtraffic.com

Common Mistakes Information overload - too many slides, too many details. Using too much text - using actual visual aids can help grab the investors attention. Underestimating competitors. Making assumptions that can t be backed by data or reasoning. Arrogance and overconfidence. Merging Traffic | mergingtraffic.com

Pitch Deck Outline 1. Elevator Pitch/Vision 2. The Problem 3. The Solution: Your Product/Service 4. Market & Validation 5. Revenue/Business Model 6. Growth/Marketing Strategy 7. Team Composition 8. Finances 9. Competition 10. The Funding Needed Merging Traffic | mergingtraffic.com

Slide 1 -Elevator Pitch/Vision A very short (one line long) summary or mission statement of your company. It is important to make it both short and memorable. Making it relatable can do wonders: (eg. We are the Uber of Air Traffic, etc.) Merging Traffic | mergingtraffic.com

Slide 2 -The Problem The more common the problem, the better! The problem should be one your investor is familiar with, and even better one the investor can identify with. Authentic, real problems supported by facts removes uncertainty and creates trust. Example: you may have a hard time pitching a tech investor the benefits of a certain type of baby food if there is no tech element present. Your goal is to make the problem both as specific and as universal as possible. Give the investor a common, relatable, everyman problem, and you will create real interest in learning about your solution. Merging Traffic | mergingtraffic.com

Slide 3-The Solution Here, a clear definition of the problem you are providing a solution for should be included. Furthermore, include/list the currently existing solutions for the previously mentioned issues, mention what they are getting wrong, highlight the points where your solution is an improvement over theirs. Describe how the product helps the customer, how the customers gain value from the product/service. Use images and visuals. Merging Traffic | mergingtraffic.com

Slide 4The Market& Validation Here, define the market; the environment you business is in. Include the size of the niche, the target segments. Define the target group. Give insights about the most important macro trends of the niche. Be sure to specify milestones and to draw a timeline. Include reasonable growth metrics. Try to specify exact partnerships (press, sponsors, etc.) even at this early point. If the company is already operating, add customer testimonials. Merging Traffic | mergingtraffic.com

Slide 5-Revenue/Business Model Define the target customer and highlight how exactly money is made. Introduce the pricing model. Current number of customers and revenue; describe the math behind the calculations. Explain the lifetime value of the average customer. Merging Traffic | mergingtraffic.com

Slide 6-Growth/Marketing Strategy List the platforms where the prospective customers are looking for solutions. Explain how the company is going to get the information to them. Describe the way the growth will be achieved. List the methods of customer acquisition. Merging Traffic | mergingtraffic.com

Slide 7-Team Composition Introduce the key team members. List their experiences and explain how those experiences are relevant to the smooth running of the company. Merging Traffic | mergingtraffic.com

Slide 8-Finances Include at least 3 years of financial predictions and visualize them. Include the key assumptions in your financial model, the expenses and the numbers concerning the market penetration, in a yearly breakdown. Merging Traffic | mergingtraffic.com

Slide 9-The Competition Define your current position in the market space/niche. List your advantages. Explain why the current space occupied in the market is a good starting point for growth, how is it unique to you. List the main competitors, list the key points that differentiate your firm from them. Merging Traffic | mergingtraffic.com

Slide 10-The Funding Needed Start with indicating how much capital you need. Include the timing of the capital raise. List your current investors. Describe how the raised funds will be distributed in the company. Merging Traffic | mergingtraffic.com