Edkaagmik Nbiizh Neyaashiinigamiingninwag Trust Overview

Edkaagmik Nbiizh Neyaashiinigamiingninwag Trust, established in 2012 by Chippewas of Nawash Unceded First Nation Coldwater Trust, aims to benefit the First Nations community through various initiatives such as land acquisition, education advancement, and cultural preservation. The Trust is managed by five trustees and focuses on long-term benefits for the community. Through funding programs and governance support, the Trust strives to promote economic development and enhance the overall well-being of its beneficiaries.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

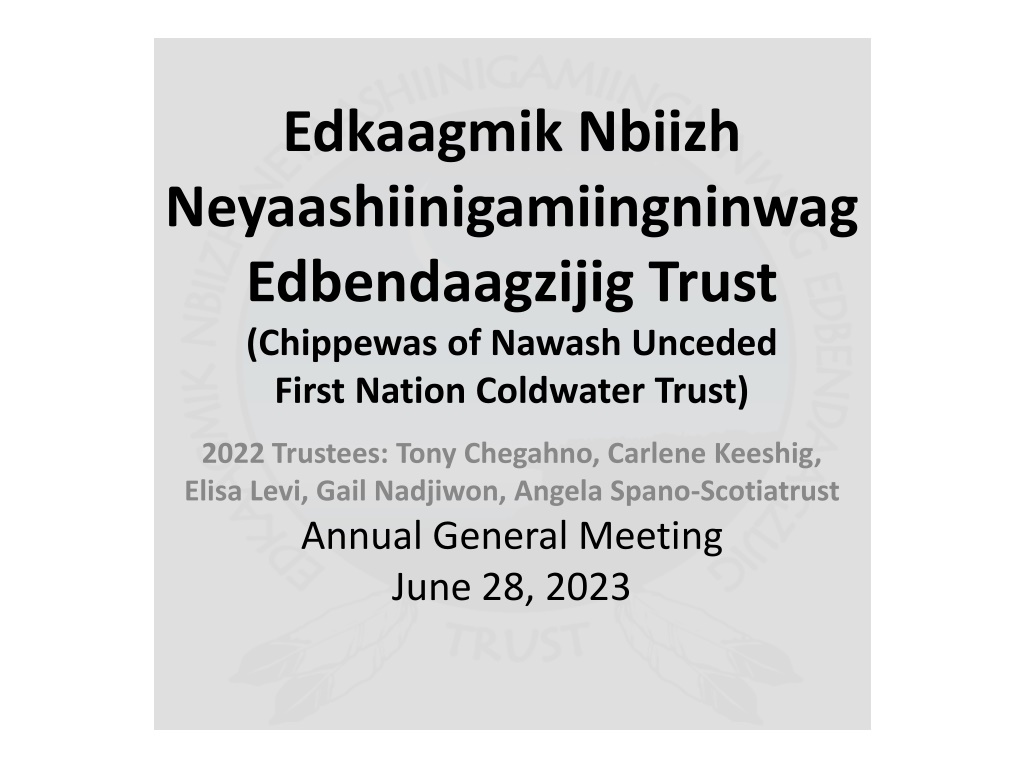

Edkaagmik Nbiizh Neyaashiinigamiingninwag Edbendaagzijig Trust (Chippewas of Nawash Unceded First Nation Coldwater Trust) 2022 Trustees: Tony Chegahno, Carlene Keeshig, Elisa Levi, Gail Nadjiwon, Angela Spano-Scotiatrust Annual General Meeting June 28, 2023

AGENDA What is a trust? What is the purpose of the Trust? A brief history of the Trust to date How is the Trust managed? How much did the Trust spend? How much have Community members/programs received? How much will Band Council receive?

What is a trust? A trust is an arrangement whereby one or more persons (the trustees) hold legal title to property (the trust property) for the benefit of another person or a group of persons (the beneficiaries). The person or party who creates the trust and puts (settles) property into it is called the settlor.

What is the intention of the Trust? the Trust Property is intended to be held for the long-term benefit of the First Nations as Beneficiary (Clause 2 of Deed of Trust)

What is the purpose of the Trust? Trust Property and Income can be used for: 1. To acquire Land for the benefit of the First Nation. 2. To advance the Education of the Membership. 3. To promote the of Health of Membership. 4. To preserve and protect Culture & Heritage of the First Nation. 5. To improve Infrastructure on the reserve or land owned by the First Nation or its Corporations. 6. To provide funding for enhanced Governance. 7. To promote the Economic Development of the First Nation and Corporations

A Brief History of the Trust The Trust was established when the Deed of Trust was signed by Band Council (the Settlor) and the original Trustees on October 16, 2012 The five original Trustees were appointed by Council 2012 The Trustees designed the per capita distribution process based on community votes In December, settlement proceeds of $29,626,424 were received from the Government of Canada T. E. Wealth was hired as Investment Consultant

In 2022: The Trust funded a Good Life Program, reaching 1136 members In 2022 the Trustees received 34 proposals; a significantly higher amount compared to the 11 proposals received in 2021. Of the 34 proposals received 20 received funding

2022 Statistics TOTAL PAYOUTS TO THE COMMUNITY $ 70,514.46 Per Capita Distribution including Minors on their 18thbirthday and Adults $ 284,122.00 Good Life (1136 members/applications) $ 695,560.00 Approved Projects/Applications (20) $ 1,050,196.46 Total Note an additional $305,191.74 will be paid to the First Nation. Actual total paid to Community - $1,355,388.20

How is the Trust managed? In February 2013, T. E. Wealth began the selection process to hire investment managers to manage the Trust assets The Trustees decided to hire Dixon Mitchell and Guardian Capital to manage separate portfolios Dixon Mitchell employs a value investment style, whereas Guardian Capital uses a growth approach Market Value of Trust portfolios: Dec 31, 2022 Dixon Mitchell $16,670,222 Guardian Capital $16,232,224 $32,902,446 ** Financial assets are $33,726,453.00 based on 2022 Financial Statements **

How much did the Trust spend? The Deed of Trust directs the Trustees to use their best efforts in limiting Authorized Expenses in any fiscal year to 1% of the market value of the Trust for that year Authorized Expenses includes all expenses reasonably incurred by the Trustees in administering the Trust, such as administrative, accounting, legal and investment fees and costs associated with member/Trustee meetings In 2022, the Trust expenses totaled $297,637.00 which was approximately .88% of the Trust s market value as at December 31, 2022

2022 Expenses Audit/Professional fees Office and other Trustee Honoraria Trustee fee - Scotiatrust Dixon Mitchell Guardian Capital T.E. Wealth $ 25,898.00 $ 13,591.00 $ 7,560.00 $ 63,939.00 $ 79,883.00 $ 80,544.00 $ 26,222.00 $ 297,637.00

2023 Budget (Draft) Trustee Out of Pocket Website Maintenance Election/Education Annual General Meeting Community Consultant (2022/2023) Trustee Honoraria Miscellaneous Auditor/Professional Publicity/Communication Advisor TE Wealth Guardian Capital Dixon Mitchell Corporate Trustee $ 2,000.00 $ 3,000.00 $ 4,000.00 $ 1,000.00 $ 62,500.00 $ 15,000.00 $ 5,000.00 $ 20,000.00 $ 2,500.00 $ 35,000.00 $ 85,000.00 $ 85,000.00 $ 65,000.00 $ 388,000.00

How much will Council receive? The Deed of Trust directs the Trustees to pay to the First Nation any surplus income unutilized in a fiscal year Surplus income is determined by the Auditor following completion of the annual financial statements For 2022, the First Nation, will not be receiving any surplus income from the Trust. Council will be receiving is $305,191.74. These funds represent approved and unfunded projects between 2014-2020. These funds were held in a distribution account (accumulating interest) while waiting for additional information from the applicants. These funds are now unclaimed, therefore, being paid to the First Nation as set out in the Trust agreement.

THANK YOU QUESTIONS?