CPD Requirements for Retired Professionals

Retirement impacts CPD requirements for professionals. The need for CPD varies based on volunteering, governance roles, working status, or field relevance. Declarations, competencies, and continuous learning are essential for compliance. Exemptions are granted for unrelated fields, with annual declarations ensuring accurate records. CPAs must stay informed and engaged in professional development even after retirement.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Retirement and Continuing Professional Development (CPD)

How does being retired affect my CPD requirements? Were you working in any capacity during the year? If yes, you have a full CPD requirement. If no, and there was no reliance by a third party, you may not have a requirement. However you must still make an annual declaration.

Did you volunteer during the year? Did you volunteer: Where your role involves signing financial statements, information returns or other government filings, grants, applications or similar documents. Were you serving on a body with governance or oversight responsibilities where you: Served on a finance, audit or similar committee; Are the chair of the organization; or Are looked to for financial guidance if something went wrong financially. If you volunteered in any of these capacities, you have a full CPD requirement.

Competencies of a CPA Competencies include technical and enabling and are not limited to financial activities. Technical competencies: Financial Reporting Management Accounting Strategy and Governance Taxation Finance Audit and Assurance Enabling Competencies: Professional and ethical behavior Problem-Solving and Decision-Making Communication Self-Management Teamwork and leadership

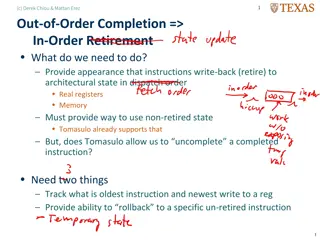

Retired during the year? Working in any capacity during the calendar year results in a full CPD requirement. Reflect on anything you learnt during the year not just courses, conferences or seminars, but all learning opportunities. Can this learning be verified by tangible evidence or a third party? If you still don t meet the CPD requirement, declare non-comply and tell us why the CPA Alberta Compliance Team will contact you to discuss your options.

Working in an unrelated field? If you are working in an unrelated field you may request an exemption from CPD requirements. Examples of unrelated fields would be: Department store greeter Golf course attendant Gas station attendant Restaurant server

Do I have to complete a declaration every year? Every member must complete the CPD declaration annually, even if your situation has not changed from the prior year. Other benefits of annual CPD declaration: Singular touch point every year to ensure our member records are correct/accurate; Allows CPA Alberta to notify members of any change to the CPD requirements.

In Review: Retirement may or may not affect your CPD learning activity requirement. All members must make a CPD declaration annually. Contact the Member Registrations team at cpdreporting@cpaalberta.ca call toll free: 1-800-232-9406