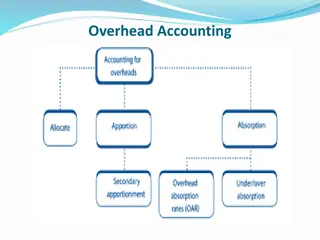

Cost Apportionment in Production and Service Departments

Extracted figures and particulars from multiple manufacturing companies regarding production and service department costs. Tasked to apportion costs using various methods.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

EX1 LTD has three production department A,B and C and six service departments ,the following figures are extracted from the records of the company: Production Departments: A 16000 $ $ B 10000 $ $ C 12000 $ 38000 $ Service Departments: Stores 2000 Timekeeping 3000 Maintenance 1000 $ Power Welfare Supervision 2000 $ Total 49000 $ 2000 $ 1000 $

The other information available in respect of the production departments : Particulars Production Departments B A C Employees 40 30 500 30 20 500 20 10 600 Stores Requisition Hours Power of Machines Machine Hours 2500 1500 1000 You are required to apportion the costs of various service departments to production departments.

EX2 DGL manufacturing company has tow production departments A and B and three service departments , Timekeeping , Stores and Maintenance .The departmental summary showed the following expenses for Dec 2016: production departments : $ A 32000 B 10000 Service departments : Timekeeping 8000 10000 Stores Maintenance 6000 Total Overhead Expenses 66000 The following about department is available and is used as a basis for distribution

Particular Production Departments Service departments A B Timekeeping Stores Maintenance Employees 20 15 10 8 5 Stores Requisition 12 10 - - 3 Machine Hours 1200 800 - - - You are required to apportion these costs to production departments.

EX 3 The following Particulars related to a manufacturing company has three production department : P and Q and R and tow service departments X and Y: Production Departments: Service Departments : P 2000 $ S 500 $ Q 1500 $ T 400 $ R 1000 $ The Service Departments expenses are charged on a percentage basis as follows :

Productions Departments Service Departments Service Depts.: P Q R S T S 20% 30% 40% - 10% T 30% 30% 20% 20% - Prepare a statement showing the distribution of the tow service departments expenses to three productions departments under (1) Simultaneous Equation Method and (2) Repeated distribution Method.

EX1 The following is a list of manufacturing costs incurred by Orleans Products CO. during the month of July : Direct materials used ---------------------------------- 21000 $ Indirect materials used---------------------------------- 5000 Direct labor employed--------------------------------- - 15000 indirect labor employed--------------------------------- 3000 Rent expense---------------------------------------- 4000 Utilities expense -------------------------------------- 1200 Insurance expense ------------------------------------- 500 Depreciation expense ( machinery and equipment) ------------ 1500 Prepare the journal entries to record the preceding information and to transfer Factory Overhead to work in process .

EX2 Bristol manufacturing ,Inc , uses the job order cost system of accounting , the following information was taken from the company's book after all posting had been completed at the end of May : Direct Labor Cost Factory Overhead Unit Direct Materials Cost Jobs Completed Completed 3600 $ 2380 1800 Required : 400 240 200 1600 $ 1000 680 4000 $ 2500 1700 50 51 52 Prepare the journal entries to charge the costs of materials. Compute the total production cost of each job. Prepare the journal entry to transfer the cost of jobs completed to finished good (a) (b) (c) Analysis Variance EX1 During the month 1200 unit of TOCO were produced Actual direct labor required 650 direct labor at an Actual total cost of $ 6435, according to the Standard cost card for TOCO one-half hours of labor should be required per unit of TOCO produced, at a Standard cost of $10 per labor hour. Required: compute the labor rate and efficiency variances ,indicating whether the variance are favorable or un favorable. EX2 The Standard cost per unit of material $13.50 per pound ,during the month 4500 pounds of were purchase at actual at a total cost of $ 60975 in addition 3900 pounds of were used during the month ;however the Standard quantity allowed of actual production is 3800 pounds . Required: compute the material purchase price variance, price usage variance and quantity variance, indicating whether the variance are favorable or un favorable. EX3 The normal capacity of the Assembly Department is 12000 machine hours per month , At normal capacity the Standard factory overhead rate is $ 12.50 per machine hour based on $ 96000 of budget fixed expenses per month and a variable expense rate of $4.50 per machine hour ,During April the Department operated at 12500 machine hour ,with actual factory overhead of $166000 ,the number of standard machine hours allowed of the production actually attained is 11000. Required: compute overall factory overhead variance and analysis it using the tow- variance method indicate whether the variance are favorable or un favorable.