Companies (Winding Up) Rules, 2020: An Overview

The Companies (Winding Up) Rules, 2020 provide guidelines for winding up a company by the Tribunal under the Companies Act, 2013. The rules cover various aspects such as modes of winding up, circumstances under which a company may be wound up by the Tribunal, definitions, forms, and more. It specifies that the rules apply to winding up under the Companies Act, 2013 and came into force on April 1, 2020. The provisions also address issues like fraudulent conduct, default in filing financial statements, and just and equitable winding up of a company.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

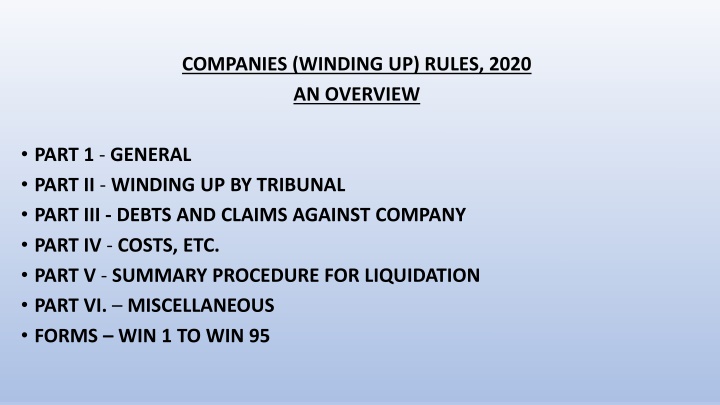

COMPANIES (WINDING UP) RULES, 2020 AN OVERVIEW PART 1 - GENERAL PART II - WINDING UP BY TRIBUNAL PART III - DEBTS AND CLAIMS AGAINST COMPANY PART IV - COSTS, ETC. PART V - SUMMARY PROCEDURE FOR LIQUIDATION PART VI. MISCELLANEOUS FORMS WIN 1 TO WIN 95

CHAPTER XX CHAPTER XX - - WINDING UP Modes of Winding Up. 270. The provisions of Part I shall apply to the winding up of a company by the Tribunal under this Act. WINDING UP 1. Short title, commencement and application.- (1) These rules may be called the Companies (Winding Up) Rules, 2020. (2) They shall come into force on the 1 st day of April, 2020. (3) These rules shall apply to winding up under of Companies Act 2013 (18 of 2013). 2. Definitions.- In these rules, unless the context or subject matter otherwise requires, - (a) "Act" means the Companies Act, 2013 (18 of 2013); (b) "Form" means a Form annexed to these rules; (c) "Registrar" means the Registrar of the National Company Law Tribunal or National Company Law Appellate Tribunal and includes such other officer of the Tribunal or Bench thereof to whom the powers and functions of the Registrar are assigned; (d) "Registry" means the Registry of the Tribunal or any of its Benches or of the Appellate Tribunal, (e) "Section" means section of the Act; (f) words and expressions used and not defined in these rules but defined in the Act respectively assigned to them in the Act. shall have the meanings

PART I PART I Winding up by the Tribunal Winding up by the Tribunal Circumstances in Which Company May be Wound Up by Tribunal 271.A company may, on a petition under section 272, be wound up by the Tribunal, (a) if the company has, by special resolution, resolved that the company be wound up by the Tribunal; (b) if the company has acted against the interests of the sovereignty and integrity of India, the security of the State, friendly relations with foreign States, public order, decency or morality; (c) if on an application made by the Registrar or any other person authorised by the Central Government by notification under this Act, the Tribunal is of the opinion that the affairs of the company have been conducted in a fraudulent manner or the company was formed for fraudulent and unlawful purpose or the persons concerned in the formation or management of its affairs have been guilty of fraud, misfeasance or misconduct in connection therewith and that it is proper that the company be wound up (d) Default in filing with the ROC its financial statements or annual returns for immediately preceding five consecutive financial years; or (e) if the Tribunal is of the opinion that it is just and equitable that the company should be wound up."

Petition for Winding Up. 272. (1) A petition to the Tribunal for the winding up of a company shall be presented by (a) the company; (b) any contributory or contributories; (c) all or any of the persons specified above; (d) the Registrar; (e) any person authorised by the Central Government in that behalf; or (f) in a case falling under clause (b) of section 271, by the Central Government or a State Government. (2) A contributory may present a petition even if it holds fully paid-up shares, or company has no assets or no surplus assets left for distribution among the shareholders after the satisfaction of its liabilities, and shares in respect of which he is a contributory or some of them were either originally allotted or have been held by him, and registered in his name, for at least 6 months during the 18 months immediately before the commencement of the winding up or have devolved on him through the death of a former holder.

Petition for Winding Up. Contd (3) The ROC shall be entitled to present a petition for winding up under section 271, except on the grounds specified in clause (a), Provided that ROC shall obtain the previous sanction of the Central Government to the presentation of a petition, Provided further that the Central Government shall not accord its sanction unless the company has been given a reasonable opportunity of making representations. (4) A petition presented by the company for winding up before the Tribunal shall be admitted only if accompanied by a statement of affairs in such form and in such manner as may be prescribed. (5) A copy of the petition made under this section shall also be filed with the ROC and the ROC shall, without prejudice to any other provisions, submit his views to the Tribunal within 60 days of receipt of such petition. 3. Petition for winding up.- (1) For the purposes of sub-section (1) of section 272, a petition for winding up of a company shall be presented in Form WIN 1 or Form WIN 2, as the case may be, with such variations as the circumstances may require, and shall be presented in triplicate. (2) Every petition shall be verified by an affidavit made by the petitioner or by the petitioners, there are more than one petitioners, and in case the petition is presented by a body corporate, Director, Secretary or any other author ised person thereof, and such affidavit shall be in Form WIN 3. where by the

Petition for Winding Up. 5. Admission of petition and directions as to advertisement.- Petition shall be posted before the Tribunal for admission and fixing a date for the hearing and for appropriate directions as to the advertisements to be published and the persons, if any, upon whom copies of the petition are to be served, and where the petition has been filed by a person other than the company, the Tribunal may, if it thinks fit, direct notice to be given to the company before giving directions as to the advertisement of the petition. petitioner to bear all costs of the advertisement. 6. Copy of petition to be furnished.- Every contributory of the company shall be entitled to be furnished by the petitioner or by his authorised representative with a copy of the petition within 24 hours of his requiring the same on payment of Rs. 5/- per page. 7. Advertisement of petition.- Subject to any directions of the Tribunal, notice of the petition shall be advertised not less than 14 days before the date fixed for hearing in any daily newspaper in English and vernacular language widely circulated in the State or Union territory in which the registered office of the company is situated, and the advertisement shall be in Form WIN 6. 8. Application for leave to withdraw petition.- (1) A petition for winding up shall not be withdrawn after presentation without the leave of the Tribunal subject to compliance with any order of the Tribunal, including as to costs. (2) An application for leave to withdraw a petition for winding up which has been advertised in accordance with the provisions of rule 7 shall not be heard at any time before the date fixed in the advertisement for the hearing of the petition.

(a) Where a petitioner - (i) is not entitled to present a petition; or (ii) fails to advertise his petition within the time prescribed by these rules or by order of Tribunal; or (iii) consents to withdraw the petition, or to allow it to be dismissed, or fails to appear in support of his petition when it is called on in Tribunal on the day originally fixed for the hearing thereof, or any day to which the hearing has been adjourned; or (iv) if appearing, does not apply for an order in terms of the prayer of his petition; or, (b) where in the opinion of the Tribunal there is other sufficient cause for an order being made under this rule, the Tribunal may,, substitute as petitioner any other person who, in the opinion of the Tribunal, would have a right to present a petition, and who is desirous of prosecuting the petition. 10. Procedure on substitution.- Where the Tribunal makes an order substituting a contributory as petitioner in a winding up petition, it shall adjourn the hearing to a date to be fixed by the Bench and direct such amendments of the petition as may be necessary and such contributory shall, within 7 days from the making of the order, amend the petition accordingly, and file 2 legible and clean copies thereof together with an affidavit in duplicate setting out the grounds, on which he supports the petition and the amended petition shall be treated as the petition for the winding up of the company and shall be deemed to have been presented on the date on which the original petition was presented. 11. Affidavit-in-objection.- Any affidavit in objection to the petition under sub-section (1) of section 272 shall be filed within 30 days from the date of order, and a copy of the affidavit shall be served on the petitioner or his authorised representative forthwith and copies of the affidavit shall also be given to any contributory appearing in support of the petition who may require the same on payment of five rupees per page within 3 working days. 12. Affidavit in reply.- An affidavit in reply to the affidavit in objection to the petition shall be filed not less than seven days before the day fixed for the hearing of the petition, and a copy of the affidavit in reply shall be served on the day of the filing thereof on the person by whom the affidavit in objection was filed or his authorised representative. 9. Substitution for original petitioner.-

Powers of Tribunal. 273. (1) The Tribunal may, on receipt of a petition for winding up under section 272 pass any of the following orders, namely: (a) dismiss it, with or without costs; (b)make any interim order as it thinks fit; (c) appoint a provisional liquidator of the company till the winding uporder; (d) make an order for the winding upof the company with or without costs; or (e) any other order as it thinks fit: Provided that an order under this sub-section shall be made within 90 days from the date of presentation of the petition: Provided further that before appointing a provisional liquidator under clause (c), the Tribunal shall give notice to the company, unless for special reasons to be recorded in writing, the Tribunal thinks fit to dispense with such notice: Provided also that the Tribunal shall not refuse to make a winding up order on the ground only that the assets of the company have been mortgaged for an amount equal to or in excess of those assets, or that the company has no assets. (2) Where a petition is presented on the ground that it is just and equitable that the company should be wound up, the Tribunal may refuse to make an order of winding up, if it is of the opinion that some other remedy is available to the petitioners and that they are acting unreasonably in seeking to have the company wound up instead of pursuing the other remedy.

4. Statement of affairs.- The statement of affairs, as required to be filed under section 272 or section 274, shall be in Form WIN 4 and shall contain information date which shall not be more than 30 days prior to the date of filling the petition or filling the objection as applicable and the statement be made in duplicate, by an affidavit, concurrence of the statement of affairs shall be in Form WIN 5. Directions for Filing Statement of Affairs. 274. (1) Where a petition for winding up is filed before the Tribunal by any person other than the company, the Tribunal shall, if satisfied that a prima facie case for winding up of the company is made out, by an order direct the company to file its objections along with a statement of its affairs within 30 days of the order in such form and in such manner as may be prescribed: Provided that the Tribunal may allow a further period of 30 days in a situation of contingency or special circumstances: Provided further that the Tribunal may direct the petitioner to deposit such security for costs as it may consider reasonable as a precondition to issue directions to the company. (2) A company, which fails to file the statement of affairs as referred to in sub-section (1), shall forfeit the right to oppose the petition and such directors and officers of the company as found responsible for such non-compliance, shall be liable for punishment under sub- section (4). (3) The directors and other officers of the company, in respect of which an order for winding up is passed by the Tribunal under clause (d) of sub-section (1) of section 273, shall, within a period of thirty days of such order, submit, at the cost of the company, the books of account of the company completed and audited up to the date of the order, to such liquidator and in the manner specified by the Tribunal. (4) If any director or officer of the company contravenes the provisions of this section, the director or the officer of the company who is in default shall be punishable with imprisonment for a term which may extend to six months or with fine which shall not be less than Rs. 25,000/- but which may extend to Rs. 5 Lakhs, or with both. (5) The complaint may be filed in this behalf before the Special Court by ROC, provisional liquidator, CL or any person authorised by the Tribunal. sub-section sub-section (4) (1) of of up to the of affairs duly affidavit shall verified and of

Company Appointments. 275. (1) For the purposes of winding up of a company by the Tribunal, the Tribunal at the time of the passing of the order of winding up, shall appoint an OL or a liquidator from the panel maintained under sub-section (2) as the CL. (2) The provisional liquidator or the CL, as the case may, shall be appointed by the Tribunal from insolvency professionals registered under the IBC, 2016; (3) Where a provisional liquidator is appointed by the Tribunal, the Tribunal may limit and restrict his powers by the order appointing him or it or by a subsequent order, but otherwise he shall have the same powers as a liquidator. (4) [Omitted] Liquidators and Their 13. Applicability.- Unless specified otherwise, the rules hereinafter shall apply to all types of liquidators. 14. Appointment of provisional liquidator or Company Liquidator.- (1) Tribunal may appoint a provisional liquidator of the company, pending final orders on the winding up petition, and where the company is not the applicant, notice of the application for appointment of provisional liquidator shall be given to the company in Form WIN 7 and the company shall be given a reasonable opportunity to make its representation unless the Tribunal, for reasons to be recorded in writing, dispenses with such notice. (2) The order appointing the PL shall set out the restrictions and limitations and shall be in Form WIN 8, with such variations as may be necessary. amongst the (3) The order shall also state that it will be the duty of every person, who is in possession of any property, books or papers, cash or any other assets of the company, to surrender such property, books or papers, cash or other assets, as the case may be, to the provisional liquidator. (4) Where an order for the appointment of provisional liquidator or CL has been made, the Registrar shall within a period not exceeding 7 days, send intimation to the CL or provisional liquidator in Form WIN 9 and a copy of the order for the appointment of provisional liquidator or CL shall also be sent to the ROC together with a copy of the petition and the affidavit filed in support thereof.

Company Liquidators and Their Appointments. (5) The terms and conditions of appointment of a provisional liquidator or Company Liquidator and the fee payable to him or it shall be specified by the Tribunal on the basis of task required to be performed, experience, liquidator and size of the company. (6) On appointment as provisional liquidator or Company Liquidator, as the case may be, such liquidator shall file a declaration within seven days from the date of appointment in the prescribed form disclosing conflict of interest or lack of independence in respect of his appointment, if any, with the Tribunal and such obligation shall continue throughout the term of his appointment. (7) While passing a winding up order, the Tribunal may appoint a provisional liquidator, if any, appointed under clause (1)of section 273, as the Company Liquidator for the conduct of the proceedings for the winding up of the company. (5) The PL or the CL appointed by the Tribunal shall file a declaration in Form WIN 10 disclosing conflict of interest or lack of independence, with the Tribunal within 7 days from the date of appointment. (6) The provisional liquidator or the CL shall be appointed by the Tribunal from amongst the insolvency professionals registered under the IBC unless the official liquidator is appointed. 15. Rules applicable to PL.- The rules relating to CL shall apply to PL, subject to such directions as the Tribunal may give in each case. 16. Costs, etc., of PL.- All the costs, charges and expenses incurred by the PL shall be paid out of the assets of the company and if the company does not have sufficient assets or any assets to pay the costs, charges and expenses, the Tribunal may make appropriate orders in this regard. 21. Declaration by CL.- The declaration by the CL regarding disclosing conflict of interest or lack of independence In respect of his appointment shall be filed In Form WIN 10 with the Tribunal. qualification of such (c)of sub-section

Removal and Replacement of Liquidator. 276. (1) The Tribunal may, on a reasonable cause being shown and for reasons to be recorded in writing, remove the provisional liquidator or the Company Liquidator, as the case may be, as liquidator of the company on any of the following grounds, namely: (a) misconduct (b)fraud or misfeasance; (c) professional incompetence or failure to exercise due care and diligence in performance of the powers and functions; (d) inability to act as provisional liquidator or as the case may be, Company Liquidator; (e) conflict of interest or lack of independence during the term of his appointment that would justify removal. (2) In the event of death, resignation or removal of the PL or CL, the Tribunal may transfer the work assigned to him or it to another CL for reasons to be recorded in writing. (3) Where the Tribunal is of the opinion that any liquidator is responsible for causing any loss or damage to the company due to fraud or misfeasance or failure to exercise due care and diligence in the performance of his or its powers and functions, the Tribunal may recover or cause to be recovered such loss or damage from the liquidator and pass such other orders as it may think fit. (4) The Tribunal shall, before passing any order under this section, provide a reasonable opportunity of being heard to the PL or CL.

Intimation to CL, PL and ROC 277. (1)Where appointment of PL or for the winding up, it shall, within 7 days, cause intimation thereof to be sent to the CL or PL and ROC. (2)On receipt of the copy of order of appointment of PL or winding up order, the ROC shall make an endorsement to that effect in his records relating to the company and notify in the Official Gazette that such an order has been made and in the case of a listed company, the Registrar shall intimate about such appointment or order, as the case may be, to the stock exchange or exchanges where the securities of the company are listed. (3) The winding up order shall be deemed to be a notice of discharge to the officers, employees and workmen of the company, except when the business of the company is continued. (4) Within 3 weeks from the date of passing of winding up order, the CL shall make an application to the Tribunal for constitution of a winding up committee to assist and monitor the progress of liquidation proceedings by the CL in carrying out the function as provided in sub-section (5) and such winding up committee shall comprise of the following persons, namely: (i) Official Liquidator; (ii) nominee of secured creditors; and (iii) a professional nominated by the Tribunal. WINDING UP ORDER the Tribunal makes an order for 17. Order to be sent to liquidator and form of order.- (1) The order for winding up shall be in Form WIN 11 and the order for winding-up shall be sent by the Registrar after it is signed and sealed within 7 days from the date of receipt of the order by the Registrar, to the CL and the ROC in Form WIN 12 and Form WIN 13, along with a copy of the petition and the affidavit filed in support thereof if not already sent at the time of appointment of the PL. (2) The CL shall cause a sealed copy of the order to be served upon the company in accordance with the provisions of section 20, at its registered office or if there is no registered office, at its principal or last known principal place of business, or upon such other person or persons or in such manner as the Tribunal may direct. (3) A copy of the order made by the Tribunal shall also be filed by the liquidator within 30 days of the receipt with the Registrar of Companies in form INC-28 of the Companies (Incorporation) Rules, 2014. 18. Contents of winding up order.- An order for winding up a company shall inter-alia contain that it will be the duty of such of the persons as are liable to submit the books of account of the company completed and audited upto the date of the order, to attend on the CL at required time and place and give him all the information, and it will be the duty of every person who is in possession of any property, books or papers, cash or any other assets of the company, including the benefits derived therefrom, to surrender forthwith such property, books or papers, cash or other assets and the benefits so derived, as the case may be, to the Company Liquidator. 19. Directions on making winding up order.- At the time of making the winding up order, the Tribunal shall give directions to the petitioner as to the advertisement of the order and the persons, if any, on whom the order shall be served.

Intimation to Company Liquidator, Provisional Liquidator and Registrar. Contd . (5) The CL shall be the convener of the meetings of the winding up committee which shall assist and monitor the liquidation proceedings in following areas of liquidation functions, namely: (i) taking over assets; (ii) examination of the statement of affairs; (iii) recovery of property, cash or any other assets of the company including benefits derived therefrom; (iv) review of audit reports and accounts of the company; (v)sale of assets; (vi) finalisation of list of creditors and contributories; (vii) compromise, abandonment and settlement of claims; (viii) payment of dividends, if any; and (ix) any other function, as the Tribunal may direct from time to time. (6) The CL shall place before the Tribunal a report along with minutes of the meetings of the committee on monthly basis duly signed by the members present in the meeting for consideration till the final report for dissolution of the company is submitted before the Tribunal. (7) The CL shall prepare the draft final report for consideration and approval of the winding up committee. (8) The final report so approved by the winding up committee shall be submitted by the CL before the Tribunal for passing of a dissolution order in respect of the company. 20. Advertisement of order.- The order for the winding up of a company by the Tribunal shall, within 14 days of the date of the order, be advertised by the petitioner in a newspaper in English and a newspaper in vernacular circulating in the State where the registered office of the company is situated and shall be served by the petitioner upon such person, if any, and in such manner as the Tribunal may direct, and the advertisement shall be in Form WIN 14. 23. Form of proceedings after winding up order is made.- After a winding up order is made or a PL is appointed, every subsequent proceeding in the winding up shall bear the original number of the winding up petition besides its own distinctive number, but against the name of the company in the cause-title, the words 'in liquidation' or 'in provisional liquidation' as the case may be, shall appear in brackets. language widely

278. The order for the winding up of a company shall operate in favour of all the creditors contributories of the company as if it had been made out on the joint petition of contributories. and all creditors and

Stay of Suits, etc., on Winding up Order. 279. (1) When a winding up order has been passed or a provisional liquidator has been appointed, no suit or other legal proceeding shall be commenced, or if pending at the date of the winding up order, shall be proceeded with, by or against the company, except with the leave of the Tribunal and subject to such terms as the Tribunal may impose: Provided that any application to the Tribunal seeking section shall be disposed of by the Tribunal within sixty days. (2) Nothing in sub-section (1)shall apply to any proceeding pending in appeal before the Supreme Court or a High Court. APPLICATION FOR STAY OF SUITS ETC. ON WINDING UP ORDER 24. commence or proceeding.- An application under sub-section (1) of section 279 for leave of the Tribunal to commence or continue any suit or other legal proceeding by company shall Form WIN notice to the Company Liquidator and the parties to the suit or proceeding be commenced or continued. Application for continue leave to or suit or against made 15 the in be leave under this upon sought to

Jurisdiction of Tribunal. 280. The Tribunal shall, notwithstanding anything contained in any other law for the time being in force, have jurisdiction to entertain, or dispose of, (a) any suit or proceeding by or against the company; (b) any claim made by or against the company, including claims by or against any of its branches in India; (c) any application made under section 233 (Merger or Amalgamation of Certain Companies); (d) any question of priorities or any other question whatsoever, whether of law or facts, including those relating to assets, business, entitlements, privileges, responsibilities, obligations or in any matter arising out of, or in relation to winding up of the company, whether such suit or proceeding has been instituted, or is instituted, or such claim or question has arisen or arises or such application has been made or is made or such scheme has been submitted, or is submitted, before or after the order for the winding up of the company is made. actions, benefits, rights, duties,

Submission of Report by Company Liquidator. REPORTS BY COMPANY LIQUIDATOR UNDER SECTION 281 281. (1) Where the Tribunal has made a winding up order or appointed a Company Liquidator, such liquidator shall, within 60 days from the order, submit to the Tribunal, a report containing the following particulars, namely: (a) the nature and details of the assets of the company including their location and value, stating separately the cash balance in hand and in the bank, if any, and the negotiable securities, if any, held by the company: Provided that the valuation of the assets shall be obtained from registered valuers for this purpose; (b) amount of capital issued, subscribed and paid-up; (c) the existing and contingent liabilities of the company including names, addresses and occupations of its creditors, stating separately the amount of secured and unsecured debts, and in the case of secured debts, particulars of the securities given, whether by the company or an officer thereof, their value and the dates on which they were given; (d) the debts due to the company and the names, addresses and occupations of the persons from whom they are due and the amount likely to be realised on account thereof; (e) guarantees, if any, extended by the company; (f) list of contributories and dues, if any, payable by them and details of any unpaid call; (g) details of trade marks and intellectual properties, if any, owned by the company; 25. Report by CompanyLiquidator.- (1) The report to be submitted by the Company Liquidator under sub- section (1) of section 281 shall be in Form WIN 16 (2) It shall be the duty of promoters, directors, officers, employees and every person who has made or concurred in making of the statement of affairs, to attend on the Company Liquidator and answer all such questions as may be put to him, give all such further information and provide assistance (3) The Tribunal shall, within 7 days from the receipt of such report, fix a date for the consideration thereof by the Tribunal and notify the date on the notice board of the Tribunal and to the Company Liquidator. 26. Inspection of statementof affairs and report.- Every creditor or contributory, by himself, or by his agent, shall be entitled to inspect the statement of Company Liquidator submitted under sub-rule (1) of rule 25, on payment of a fee of Rs. 1,000/- and to obtain copies thereof or extracts therefrom on payment of a fee of Rs. 5/- per page. affairs and the report of the 27. Considerationof report by Tribunal.- The consideration of the report made by the Company Liquidator pursuant to section 281, shall be placed before the Tribunal, and the Company Liquidator shall personally or by authorised representative attend the consideration of the said report and give the Tribunal any further information or explanation with reference to the matters contained therein which the Tribunal may require and on consideration of the aforesaid report, the Tribunal may pass such orders and give such directions as it may think fit.

Submission of Report by Company Liquidator. Contd. 28. Provisional list of contributories.- (1) Unless the Tribunal dispenses with the settlement of a list of contributories, the Company Liquidator shall prepare and file in the Tribunal not later than 21 days after the date of the winding up order, a provisional list of contributories of the company with their names and addresses, the number of shares or the extent of interest to be attributed to each contributory, the amount called up and the amount paid up in respect of such shares or interest, and distinguishing in such list the several classes of contributories. (h) details of subsisting contracts, joint ventures and collaborations, if any; (i) details of holding and subsidiary companies, if any; (j) details of legal cases filed by or against the company; and (k) any other information which the Tribunal may direct or the Company Liquidator may consider necessary to include. (2) The Company Liquidator shall include in his report the manner in which the company was promoted or formed and whether in his opinion any fraud has been committed by any person in its promotion or formation or by any officer of the company in relation to the company since the formation thereof and any other matters which, in his opinion, it is desirable to bring to the notice of the Tribunal. (3) The Company Liquidator shall also make a report on the viability of the business of the company or the steps which, in his opinion, are necessary for maximising the value of the assets of the company. (4) The Company Liquidator may also, if he thinks fit, make any further report or reports. (5) Any person describing himself in writing to be a creditor or a contributory of the company shall be entitled by himself or by his agent at all reasonable times to inspect the report submitted in accordance with this section and take copies thereof or extracts therefrom on payment of the prescribed fees. (2) The list shall consist of every person who was a member of the company at the commencement of the winding up or his representative, and shall be divided into two parts, the first part consisting of those who are contributories in their own right, and the second part, of those who are contributories as being representatives of, or liable for the debts of others, as required under sub-section (1) of section 281, and the list shall be in Form WIN 17. 29. Notice to be given of date of settlement.- (1) Upon the filing of the provisional list of contributories mentioned in rule 28, the Company Liquidator shall obtain a date from the Tribunal for settlement of the list of contributories and shall give notice of the date appointed to every person included in such list, stating in such notice in what character and for what number of shares or extent of interest such person is included in the list, the amount called up and the amount paid up in respect of such shares or interest, and informing such person by such notice that if he intends to object to his being settled as a contributory in such character and for such number of shares or interest as mentioned in the list, he should file in Tribunal his affidavit in support of his contention and serve a copy of the same on the Company Liquidator not less than two days before the date fixed for the settlement, and appear before Tribunal on the date appointed for the settlement in person or by authorised representative and such notice shall be in Form WIN 18, and shall be sent in the mode set out in section 20 so that it reaches the contributories not less than fourteen days before the date fixed for the settlement. (2) The person who posted the notice shall swear by an affidavit in Form WIN 19 relating to the dispatch thereof, and file the same in the Tribunal not later than two days before the date fixed for the settlement of the list.

Directions of Tribunal on Report of Company Liquidator. 282. (1)The Tribunal shall, on consideration of the report of the Company Liquidator, fix a time limit within which the entire proceedings shall be completed and the company be dissolved: Provided that the Tribunal may, if it is of the opinion, at any stage of the proceedings, or on examination of the reports submitted to it by the Company Liquidator and after hearing the Company Liquidator, creditors or contributories or any other interested person, that it will not be advantageous or economical to continue the proceedings, revise the time limit within which the entire proceedings shall be completed and the company be dissolved. (2) The Tribunal may, on examination of the reports submitted to it by the Company Liquidator and after hearing the Company Liquidator, creditors or contributories or any other interested person, order sale of the company as a going concern or its assets or part thereof: Provided that the Tribunal may, where it considers fit, appoint a sale committee comprising such creditors, promoters and officers of the company as the Tribunal may decide to assist the Company Liquidator in sale under this sub- section. (3)Where a report is received from the Company Liquidator or the Central Government or any person that a fraud has been committed in respect of the company, the Tribunal shall, without prejudice to the process of winding up, order for investigation under section 210, and on consideration of the report of such investigation it may pass order and give directions under sections 339 to 342 or direct the Company Liquidator to file a criminal complaint against persons who were involved in the commission of fraud. (4) The Tribunal may order for taking such steps and measures, as may be necessary, to protect, preserve or enhance the value of the assets of the company. (5)The Tribunal may pass such other order or give such other directions as it considers fit.

Custody of Company's Properties. 283. (1) Where a winding up order has been made or where a provisional liquidator has been appointed, the Company Liquidator or the provisional liquidator, as the case may be, shall, on the order of the Tribunal, forthwith take into his or its custody or control all the property, effects and actionable claims to which the company is or appears to be entitled to and take such steps and measures, as may be necessary, to protect and preserve the properties of the company. (2) Notwithstanding anything contained in sub-section (1), all the property and effects of the company shall be deemed to be in the custody of the Tribunal from the date of the order for the winding up of the company. (3) On an application by the Company Liquidator or otherwise, the Tribunal may, at any time after the making of a winding up order, require any contributory for the time being on the list of contributories, and any trustee, receiver, banker, agent, officer or other employee of the company, to pay, deliver, surrender or transfer forthwith, or within such time as the Tribunal directs, to the Company Liquidator, any money, property or books and papers in his custody or under his control to which the company is or appears to be entitled. 22. Company Liquidator to take charge of assets and books and papers of company.- (1) On a winding up order being made, the Company Liquidator shall, forthwith take into his custody or under his control all the properties and effects, actionable claims and the books and papers of the company, and it shall be the duty of all persons having custody of any of the properties, books and papers, cash or any other assets of the company, to deliver possession thereof to the Company Liquidator. (2) Where the company, its promoters, its key managerial personnel or any other person required to cooperate with the liquidator do not so cooperate, the liquidator may make an application to the Tribunal for an appropriate order. (3) The Tribunal, on receiving an application under sub- rule (2), shall by an order, direct such promoters, key managerial personnel or other contractual counter party, supplier, service provider or auditor) - (a) to provide the information requested by the liquidator; and (b) to comply with the instructions of the liquidator and to cooperate with him in collection of information and taking custody of the assets, properties and books of accounts. person (including

Promoters, Directors, etc., to Cooperate with Company Liquidator. 284. (1) The promoters, directors, officers and employees, who are or have been in employment of the company or acting or associated with the company shall extend full cooperation to the Company Liquidator in discharge of his functions and duties. (2) Where any person, without reasonable cause, fails to discharge his obligations under sub-section (1), he shall be punishable with imprisonment which may extend to 6 months or with fine which may extend to Rs. 50,000/, or with both.

Settlement of List of Contributories and Application of Assets. 285. (1)As soon as may be after the passing of a winding up order by the Tribunal, the Tribunal shall settle a list of contributories, cause rectification of register of members in all cases where rectification is required in pursuance of this Act and shall cause the assets of the company to be applied for the discharge of its liability: Provided that where it appears to the Tribunal that it would not be necessary to make calls on or adjust the rights of contributories, the Tribunal may dispense with the settlement of a list of contributories. (2) In settling the list of contributories, the Tribunal shall distinguish between those who are contributories in their own right and those who are contributories as being representatives of, or liable for the debts of, others. (3) While settling the list of contributories, the Tribunal shall include every person, who is or has been a member, who shall be liable to contribute to the assets of the company an amount sufficient for payment of the debts and liabilities and the costs, charges and expenses of winding up, and for the adjustment of the rights of the contributories among themselves, subject to the following conditions, namely: 30. Settlement of list.- On the date appointed for the settlement of the list referred to in rule 29, the Tribunal shall hear any person who objects to being settled as a contributory or as a contributory in such character or for such number of shares or extent of interest as is mentioned in the said list, and after such hearing, shall finally settle the and the aforesaid list when settled shall be certified by the Tribunal under its seal and shall be in Form WIN 20. 31. Notice of settlement to contributories.- (1) Upon the receipt of the settled list of contributories, as certified by the Tribunal in terms of rule 30, the CL shall within a period of 7 days issue notice to every person on the list of contributories, stating in what character and for what number of shares or interest he has been placed on the list, what amount has been called up and amount paid up in respect of such shares or interest and in the notice he shall inform such person that any application for the removal of his name from the list or for variation of the said list, must be made to the Tribunal within 15 days from the date of service of notice, in Form WIN 21. (2) An affidavit of service by the person, who dispatched the notice, shall be filed in Tribunal within 7 days in Form WIN 22. 32. Supplemental list of contributories.- The Tribunal may add to the list of contributories by a supplemental list or lists.

Settlement of List of Contributories and Application of Assets. Contd 33. Variation of list.- Save as provided in rule 31, the list of contributories shall not be varied, and no person settled on the list as a contributory shall be removed from the list, or his liability in any way varied, except by order of the Tribunal and in accordance with such order. (a) a person who has been a member shall not be liable to contribute if he has ceased to be a member for the preceding one year or more before the commencement of the winding up; (b) a person who has been a member shall not be liable to contribute in respect of any debt or liability of the company contracted after he ceased to be a member; (c) no person who has been a member shall be liable to contribute unless it appears to the Tribunal that the present members are unable to satisfy the contributions required to be made by them in pursuance of this Act; (d)in the case of a company limited by shares, no contribution shall be required from any person, who is or has been a member exceeding the amount, if any, unpaid on the shares in respect of which he is liable as such member; (e) in the case of a company limited by guarantee, no contribution shall be required from any person, who is or has been a member exceeding the amount undertaken to be contributed by him to the assets of the company in the event of its being wound up but if the company has a share capital, such member shall be liable to contribute to the extent of any sum unpaid on any shares held by him as if the company were a company limited by shares. 34. Application for rectification of list.- If after the settlement of the list , the CL has reason to believe that a contributory who had been included in the provisional list has been improperly or by mistake excluded or omitted or that the character in which or the number of shares or extent of interest for which he has been included in the list as finally settled or any other particular requires rectification, he may, contributory concerned, apply to the Tribunal for such rectification and the Tribunal may rectify or vary the list as it may think fit. contained upon notice to the therein, 35. List of contributories consisting of past members.- It shall not be necessary to settle a list of contributories consisting of the past members of a company, unless so ordered by the Tribunal and where an order is made for settling a list of contributories consisting of the past members of a company, the provisions of these rules shall apply to the settlement of such list in the same manner as for the present members.

DEBTS AND CLAIMS AGAINST COMPANY 100. Notice for proving debts.- (1) Subject to the provisions of the Act and directions of the Tribunal, the CL in a winding up by the Tribunal shall, within a period of 30 days from the date of order of winding up, fix a certain day, and give a notice of 14 days thereof (i) by advertisement in Form No. WIN 43 in one issue of a daily newspaper In the English language and one issue of a daily newspaper In the regional language widely circulating in the State or Union territory where the registered office is situated concerned to the creditors of the company to prove their debts or claims and to establish any title they may have to priority under section 326 or 327, or to be excluded from the benefit of any distribution made before such debts or claims are proved, or, as the case may be, from objecting to such distribution; (ii) by such mode of communication as is permitted under section 20 to every person mentioned in the statement of affairs, as a creditor, who has not proved his debt and to every person mentioned in the statement of affairs as a preferential creditor, whose claim to be a preferential creditor has not been established or is not admitted, or where there is no statement of affairs, to the creditors as ascertained from the books of the company and, to each person who, to the knowledge of the CL, claims to be a creditor or preferential creditor of the company and whose claim has not been admitted, to the last known address or place of residence of such person. (2) All the rules hereinafter set out as to the admission or rejection of proofs shall apply with necessary variations to any claim to priority as a preferential creditor. 101. Proof of debt.- (1) In a winding up by the Tribunal, every creditor shall, subject as hereinafter provided, prove his debt, unless the Tribunal in any particular case directs that any creditors or class of creditors shall be admitted without proof. (2) Formal proof of the debts mentioned in clause (d) of sub-section (1) of section 327 shall not be required, unless the CL in any special case otherwise directs.

102. Mode of proof and verification thereof.- A debt may be proved by delivering or sending to the CL by such mode as set out in section 20, an affidavit verifying the debt made by the creditor or by some person authorised by him and if the affidavit is made by a person authorised by the creditor, it shall state the authority and means of knowledge of the deponent and a creditor need not attend upon the examination unless required so to do by the CL. 103. Contents of proof.- An affidavit proving a debt shall contain or refer to a statement of account showing the particulars of the debt, and shall specify the vouchers, if any, by which the same can be substantiated and the affidavit shall state whether the creditor is a secured creditor, or a preferential creditor, and if so, shall set out the particulars of the security or of the preferential claims, and the affidavit shall be in Form WIN 44. 104. Workmen's dues.- In any case where there are numerous claims for wages or any accrued remuneration by workmen and others employed by the company, it shall be sufficient if one proof in Form WIN 45 for all such claims is made either by a foreman or some other person on behalf of all such creditors and such proof shall be annexed thereto as forming part thereof, setting forth the names of the workmen and others and the amounts severally due to them in the schedule in the said form, and any proof made in compliance with this rule shall have the same effect as if separate proofs had been made by each of the said workmen and others. 105 Production of bills of exchange and promissory notes.- Where a creditor seeks to prove in respect of a bill of exchange, promissory note or other negotiable instrument or security of a like nature on which the company is liable, such bill of exchange, note, instrument or security shall be produced before the CL and be marked by him before the proof is admitted.

106. Value of debts.- The value of all debts and claims against the company shall, as far as is possible, be estimated according to the value thereof at the date of the appointment of the Provisional Liquidator or the order of the winding up of the company, whichever is earlier: Provided that where before the presentation of the petition for winding up, a resolution has been passed by the company for winding up, the date for estimation of debts and claims shall be the date of the passing of such resolution. 107. Discount.- A creditor proving his debt shall deduct therefrom all trade discounts, if any. 108. Interest.- On any debt or certain sum payable at a certain time or otherwise, whereon interest is not reserved or agreed for, and which is overdue at the date of the winding up order, or the resolution, as the case may be, the creditor may prove for interest at a rate not exceeding 6% per annum or as decided by the Tribunal up to that date from the time when the debt or sum was payable, if the debt or sum is payable by virtue of a written instrument at a certain time, and if payable otherwise, then from the time when a demand in writing has been made, giving notice that interest will be claimed from the date of demand until the time of payment. 109. Periodical payments.- When any rent or other payment fa1ls due at the time referred to in rule 108, and the order or resolution to wind up is made at any time other than one of those times mentioned in rule 108, the persons shall be entitled to the rent or payments for a proportionate part thereof up to the date of winding up order or resolution accrued due from day to day: Provided that where the CL remains in occupation of the premises demised to a company which is being wound up, nothing in this rule shall prejudice or affect the right of the landlord of such premises to claim payment by the company, or the liquidator, of rent during the period of the company's or liquidator's occupation.

.110. Proof of debt payable at future time.- A creditor may prove for a debt not payable at the date of the winding up order, as if it were payable presently, and may receive dividends equally with the other creditors, deducting only thereat a rebate of interest at the rate of 6% p.a. computed from the date of declaration of the dividend to the time when the debt would have become payable according to the terms on which it was contracted. 111. Examination of proof.- The CL shall, as soon as possible but not later than 30 days or within such time as may be allowed by the Tribunal on an application by the liquidator, examine every proof of debt lodged with him and the grounds of the debt and he may call for the production of the documentary proof if any referred to in the affidavit of proof or require further evidence in support of the debt, and if he requires further evidence, or requires that the creditor should attend the investigation in person, he shall fix a day and time at which the creditor is required to attend or to produce further evidence and send a notice to such creditor in Form WIN 46 by pre-paid registered post or speed post so as to reach him not later than 7 days before the date fixed. 112. CL's right to call any person in connection with investigation.- The CL may call upon any person whom he may deem capable of giving information respecting the debts to be proved in liquidation and may require such person to produce any documents in his custody or power relating to such debts and shall tender with the call such sum as appears to the CL sufficient to defray the traveling and other expenses of the person called for attendance and where the person so called fails without lawful excuse to attend or produce any documents in compliance with the call or avoids or evades service, the CL may report the same to the Tribunal and apply for appropriate orders, and the Tribunal may pass any order as it may think fit. 113. Affidavit.- For the purpose of his duties, in relation to the admission of proof of debts, where applicable, the CL may take affidavits and the CL may at his discretion dispense with this requirement and he may also permit the taking of an affidavit or undertaking in lieu of an oath.

114. Costs of proof.- Unless otherwise ordered by the Tribunal, a creditor shall bear the costs of proving his debt. 115.Acceptance or rejection of proof to be communicated.- As soon as possible, but not later than 14 days, from the date of conclusion of the examination referred to in rule 111, the CL shall, in writing admit or reject the proof in whole or in part, every decision of the liquidator accepting or rejecting a proof, either wholly or in part, shall be communicated to the creditor concerned by means permitted under section 20 when the proof is accepted or rejected, provided that it shall not be necessary to give notice of the admission of a claim to a creditor who has appeared before the liquidator and the acceptance of whose claim has been communicated to him or his agent in writing at the time of acceptance and where the liquidator rejects a proof, wholly or in part, he shall state the grounds of the rejection to the creditor in Form WIN 47, and notice of admission of proof shall be in Form WIN 48. 116. Appeal by creditor.- (1) If a creditor is dissatisfied with the decision of the CL in respect of his proof, the creditor may, not later than 21 days from the date of service of the notice upon him of the decision of the liquidator, appeal to the Tribunal against the decision. (2) The appeal shall be made in Form WIN 49, supported by an affidavit which shall set out the grounds of such appeal, and notice of the appeal shall be given to the CL and on such appeal, the Tribunal shall have all the powers of an appellate court under the Code of Civil Procedure, 1908 (5 of 1908). 117. Procedure where creditor appeals.- (1) The CL shall, upon receiving notice of the appeal against a decision rejecting a proof wholly or in part, file with the Registry such proof with the order containing the grounds of rejection. (2) It shall be open to any creditor or contributory to apply to the Tribunal for leave to intervene in the appeal, and the Tribunal may, if it thinks fit, grant the leave subject to such terms and conditions as may be just, and where such leave has been granted, notice of the hearing of the appeal shall be given to such creditor or contributory.

118. CL not to be personally liable for costs.- The CL shall in no case be personally liable for costs in relation to an appeal from his decision rejecting any proof wholly or in part. 119. Proofs and list of creditors to be filed in Tribunal.- The CL shall, within 30 days from the date fixed for the submission of proofs under rule 100 or such further time as the Tribunal may allow, file in the Tribunal a list of the creditors, in Form WIN 50, who submitted to him proofs of their claims in pursuance of the advertisement and the notice referred to in rule 100, mentioning the amounts of debt for which they claimed to be creditors, distinguishing in such list the proofs admitted wholly, the proofs admitted or rejected in part, and the proofs wholly rejected, and the proofs, with the memorandum of admission or rejection of the same in whole or in part, as the case may be, endorsed thereon, shall be filed in Tribunal along with the certificate. 120. List of creditors not to be varied.- The list of creditors filed in Tribunal shall be the list of the creditors of the company, and shall not be added to or varied except under the order of the Tribunal and in accordance with such orders and where an order is made adding to or varying the list of creditors, the CL shall amend the list in accordance with such order. 121. Notice of filing list and inspection of same.- Upon the filing of the list of creditors as settled by the CL, the Registry shall notify the filing thereof on the Tribunal's notice board and on the website of the Tribunal, and the list of creditors as settled and the proofs relating thereto shall be open to the inspection of every creditor or contributory on payment of fee of Rs. 1,000/-. 122. Expunging of proof.- (1) If after the admission of a proof, the CL has reason to believe that the proof has been improperly admitted or admitted by a mistake, he may immediately apply to the Tribunal upon notice to the creditor who made the proof, to expunge the proof or reduce its amount, as the case may be.

123. Procedure on failure to prove debt within time fixed.- If any creditor fails to file proof of his debt with the CL within the time specified in the advertisement referred to in rule 100, such creditor may apply to the Tribunal for relief within 15 days from the time specified in such advertisement, and the Tribunal may, thereupon, adjudicate upon the debt or direct the liquidator to do so. 124. Right of creditor who has not proved debt before declaration of dividend.- Any creditor who has not proved his debt before the declaration of any dividend or dividends shall be entitled to be paid out of any money for the time being in the hands of the CL available for distribution of dividend, any dividend or dividends which such creditor may have failed to receive before that money is applied to the payment of any future dividend or dividends, but he shall not be entitled to disturb the distribution of any dividend declared before his debt was proved by reason that he has not participated therein. 125. Payment of subsequent interest.- In the event of there being a surplus after payment in full of all the claims admitted to proof, creditors whose proofs have been admitted shall be paid interest from the date of the winding up order or of the resolution, as the case may be, up to the date of the declaration of the final dividend, at a rate not exceeding 6% p.a. or such other rate as may be decided by the Tribunal, on the admitted amount of the claim, after adjusting against the said amount the dividends declared as on the date of the declaration of each dividend.

Obligations of Directors and Managers. 286. In the case of a limited company, any person who is or has been a director or manager, whose liability is unlimited under the provisions of this Act, shall, in addition to his liability, if any, to contribute as an ordinary member, be liable to make a further contribution as if he were at the commencement of winding up, a member of an unlimited company: Provided that (a) a person who has been a director or manager shall not be liable to make such further contribution, if he has ceased to hold office for a year or upwards before the commencement of the winding up; (b) a person who has been a director or manager shall not be liable to make such further contribution in respect of any debt or liability of the company contracted after he ceased to hold office; (c) subject to the articles of the company, a director or manager shall not be liable to make such further contribution unless the Tribunal deems it necessary to require the contribution in order to satisfy the debts and liabilities of the company, and the costs, charges and expenses of the winding up.

Advisory Committee 287. (1) The Tribunal may, while passing an order of winding up of a company, direct that there shall be, an advisory committee to advise the Company Liquidator and to report to the Tribunal on such matters as the Tribunal may direct. (2) The advisory committee appointed by the Tribunal shall consist of not more than twelve members, being creditors and contributories of the company or such other persons in such proportion as the Tribunal may, keeping in view the circumstances of the company under liquidation, direct. (3) The Company Liquidator shall convene a meeting of creditors and contributories, as ascertained from the books and documents, of the company within thirty days from the date of order of winding up for enabling the Tribunal to determine the persons who may be members of the advisory committee. (4) The advisory committee shall have the right to inspect the books of account and other documents, assets and properties of the company under liquidation at a reasonable time. (5) The provisions relating to the convening of the meetings, the procedure to be followed thereat and other matters relating to conduct of business by the advisory committee shall be such as may be prescribed. (6) The meeting of advisory committee shall be chaired by the Company Liquidator. 36. Meeting of creditors and contributories.- The meeting of the creditors and contributories in accordance with the provisions of subsection (3) of section 287 to determine the persons who may be the members of the advisory committee, shall be convened, held and conducted in the manner hereinafter provided in these rules for the holding and conducting of meeting of creditors and contributories. 37. CL to report result of meeting.- (1) Within 7 days after the meeting, the CL shall report result to the Tribunal in Form WIN 23. (2) Where the creditors and contributories have agreed upon the constitution and composition of the AC and the persons who are to be members thereof, an AC shall be constituted in accordance with such decision, and the CL shall set out in his report the names of the members of the committee so constituted. (3) If creditors and contributories have not agreed upon the composition of the AC and the persons who are to be members thereof, the CL shall apply to the Tribunal for directions, which shall fix a date for the consideration of the report of the CL and the notice of the date shall be advertised by the CL in such manner as the Tribunal shall direct; 7 days before the date so fixed in Form WIN 24. (4) On the date fixed for hearing, the Tribunal may, after hearing the CL and any creditor or contributory who may appear, decide as to who would be the members of the said AC or pass such orders or give such directions in the matter, as the Tribunal may think fit.

Advisory Committee Contd. 38. Filling -up of vacancy in AC.- (1) On a vacancy occurring in the AC, the CL shall summon a meeting of creditors or of contributories, as the case may require, to recommend for filling the vacancy and the meeting may, by resolution, recommend for re-appointing the same, or propose for appointing another creditor or contributory, as the case may to fill the vacancy: Provided that if the CL is of the opinion that it is unnecessary for the vacancy to be filled, he may apply to the Tribunal and the Tribunal may make an order in this regard. (2) The continuing members of the AC, if not less than two, may act notwithstanding any vacancy in the said committee. (3) Where the creditors or contributories, as the case may be, fail to fill the vacancy for whatever reason, the CL shall forthwith report such failure to the Tribunal and Tribunal may, by order, fill such vacancy. 39. CL and members of AC dealing with company's assets.- Neither the CL nor any member of the AC shall, while acting as such liquidator or member of such committee in any winding up, either directly or indirectly, by himself or through his employer, partner, clerk, agent, servant, or relative, become purchaser of any part of the company's assets, except by leave of the Tribunal and any such purchase made contrary to the provisions of this rule may be set aside by the Tribunal on the application of the said liquidator or of a creditor or contributory, as the case may be, and the Tribunal may make such order as to costs as it may think fit.

Submission of Periodical Reports to Tribunal. 288. (1)The CL shall make periodical reports to the Tribunal and in any case make a report at the end of each quarter with respect to the progress of the winding up of the company in such form and manner as may be prescribed. (2)The Tribunal application by the CL, review the orders made by it and make such modifications as it thinks fit. 76. Submission of periodical reports to the tribunal.- The CL shall make quarterly reports, referred to in sub-section (1) of section 288, to the Tribunal in Form WIN 37 with respect to the progress of winding up of the company. may, on an

Power of Tribunal on Application for Stay of Winding Up. 289. Omitted

ATTENDANCE AND APPEARANCE OF CREDITORS AND CONTRIBUTORIES Powers and Duties of Company Liquidator. 290. (1) Subject to directions by the Tribunal, if any, in this regard, the Company Liquidator, in a winding up of a company by the Tribunal, shall have the power (a) to carry on the business of the company so far as may be necessary for the beneficial winding up of the company; (b) to do all acts and to execute, in the name and on behalf of the company, all deeds, receipts and other documents, and for that purpose, to use, when necessary, the company s seal; (c) to sell the immovable and movable property and actionable claims of the company by public auction or private contract, with power to transfer such property to any person or body corporate, or to sell the same in parcels; (d) to sell the whole of the undertaking of the company as a going concern; (e) to raise any money required on the security of the assets of the company; (f) to institute or defend any suit, prosecution or other legal proceeding, civil or criminal, in the name and on behalf of the company; (g) to invite and settle claim of creditors, employees or any other claimant and distribute sale proceeds in accordance with priorities established under this Act; (h) to inspect the records and returns of the company on the files of the Registrar or any other authority; (i) to prove rank and claim in the insolvency of any contributory for any balance against his estate, and to receive dividends in the insolvency, in respect of that balance, as a separate debt due from the insolvent, and rateably with the other separate creditors; (j) to draw, accept, make and endorse any negotiable instruments including cheque, bill of exchange, hundi or promissory note in the name and on behalf of the company, with the same effect with respect to the liability of the company as if such instruments had been drawn, accepted, made or endorsed by or on behalf of the company in the course of its business; (k) to take out, in his official name, letters of administration to any deceased contributory, and to do in his official name any other act necessary for obtaining payment of any money due from a contributory or his estate which cannot be conveniently done in the name of the company, and in all such cases, the money due shall, for the purpose of enabling the Company Liquidator to take out the letters of administration or recover the money, be deemed to be due to the Company Liquidator himself; (l) to obtain any professional assistance from any person or appoint any professional, in discharge of his duties, obligations and responsibilities and for protection of the assets of the company, appoint an agent to do any business which the Company Liquidator is unable to do himself; (m) to take all such actions, steps, or to sign, execute and verify any paper, deed, document, application, petition, affidavit, bond or instrument as may be necessary, (i) for winding up of the company; (ii) for distribution of assets; (iii) in discharge of his duties and obligations and functions as Company Liquidator; and (n) to apply to the Tribunal for such orders or directions as may be necessary for the winding up of the company. (2) The exercise of powers by the Company Liquidator under sub-section (1)shall be subject to the overall control of the Tribunal. (3) Notwithstanding the provisions of sub-section (1), the Company Liquidator shall perform such other duties as the Tribunal may specify in this behalf. 126. Attendance at proceedings.- (1) Save as otherwise provided by these rules or by an order of the Tribunal, every contributory and every creditor shall be at liberty at his own expense to attend the proceedings before the Tribunal or before the CL and shall be entitled upon payment of the costs occasioned thereby to have notice of all such proceedings as he shall, by request in writing addressed to the CL, desire to have notice of; but if the Tribunal shall be of opinion that the attendance of any such person has occasioned any additional costs which ought not to be borne by the funds of the company, it may direct such costs or a gross sum in lieu thereof to be paid by such person and such person shall not be entitled to attend any further proceedings until he had paid the same. (2) No contributory or creditor shall be entitled to attend any proceedings before the Tribunal, unless and until he or an authorised representative on his behalf has filed an appearance with the Registry and the Registry shall keep an "Appearance Book" in which all such appearances shall be entered. 127. Representation of creditors and contributories before Tribunal. The Tribunal may, if it thinks fit, appoint from time to time anyone or more of the creditors or contributories to represent before the Tribunal at the expense of the company, all or any class of creditors or contributories upon any question or in relation to any proceedings before the Tribunal, and may remove any person so appointed, if more than one person is appointed under this rule to represent one class, and the persons so appointed, shall employ the same authorised representative to represent them, and where they fail to agree as to the authorised representative to be employed, the Tribunal may nominate an authorised representative for them. COLLECTION AND DISTRIBUTION OF ASSETS IN WINDING UP BY TRIBUNAL 128. Powers of CL.- The duties imposed by sub-section (1) of section 290 with regard to the collection of the assets of the company and the application of the assets in discharge of the company's liabilities shall be discharged by the CL subject to the control of the Tribunal. 129. CL to be in position of receiver.- For the discharge by the CL of the duties imposed by sub-section (1) of section 290, the CL shall, for the purpose of acquiring and retaining possession of the property of the company, be in the same position as if he were a Receiver of the property appointed by the Tribunal, and the Tribunal may on his application enforce such acquisition or retention accordingly. 130. Company's property to be surrendered to CL on requisition.- Any contributory for the time being on the list of contributories, trustee, receiver, banker, agent, officer or other employee of a company which is being wound up under order of the Tribunal, shall on notice from the CL and within such time as he shall by notice require, pay, deliver, convey, surrender or transfer to or into the hands of the CL any money, property or books and papers in his custody or under his control to which the company is or appears to be entitled and where the person so required fails to comply with the notice, the CL may apply to the Tribunal for appropriate orders and the notice shall be in Form WIN 51.

Provision for Professional Assistance to Company Liquidator. 291. (1)The Company Liquidator may, with the sanction of the Tribunal, appoint one or more chartered accountants or company secretaries or cost accountants or legal practitioners or such other professionals on such terms and conditions, as may be necessary, to assist him in the performance of functions under this Act. (2) Any person appointed under this section shall disclose forthwith to the Tribunal in the prescribed form any conflict of interest independence in appointment. 77. Employment of additional or special staff by OL. Where the OL is of the opinion that the employment of additional staff is necessary in any liquidation, he shall apply to the Tribunal for sanction, and the Tribunal may sanction such staff as it thinks fit on such salaries and allowances as the Tribunal may deem appropriate. 78. Declaration by professional.- The professional, referred to in section 291, appointed by the CL with the sanction of the Tribunal shall file a declaration in Form WIN 38 disclosing any conflict of interest or lack of independence in appointment with forthwith. any special or his duties and or lack of of his respect respect the of Tribunal his

Exercise and Control of Company Liquidator's Powers. 292. (1) Subject to the provisions of this Act, the Company Liquidator shall, in the administration of the assets of the company and the distribution thereof among its creditors, have regard to any directions which may be given by the resolution of the creditors or contributories at any general meeting or by the advisory committee. (2) Any directions given by the creditors or contributories at any general meeting shall, in case of conflict, be deemed to override any directions given by the advisory committee. (3) The Company (a) may summon meetings of the creditors or contributories, whenever he thinks fit, for the purpose of ascertaining (b) shall summon such meetings at such times, as the creditors or contributories, as the case may be, may, by resolution, direct, or whenever requested in writing to do so by not less than one-tenth in value of the creditors or contributories, as the case may be. (4) Any person aggrieved by any act or decision of the Company Liquidator may apply to the Tribunal, and the Tribunal may confirm, reverse or modify the act or decision complained of and make such further order as it thinks just and proper in the circumstances. MEETINGS OF CREDITORS AND CONTRIBUTORIES 44. Application of rules to meetings.- Subject to any directions given by the Tribunal, rules as hereinafter set out shall apply to meetings of creditors and contributories as may be convened in pursuance of subsection (3) of section 287 and sub-section (3) of section 292. 45. Notice of meeting.- (1) The CL shall summon meetings of creditors and contributories by giving not less than 14 days' notice by sending individually respective creditor or contributory by registered post or speed post or by electronic means so as to reach such person not less than 14 days before the datefixed for the meeting: Provided that where the number of creditors or contributories, as the case may be, exceeds 500, the CL shall also give a 14 days' notice by advertisement in one daily newspaper in the English language and one daily newspaper in the principal regional language circulating in the State. Liquidator (2) The notice to each creditor or contributory shall be sent to their respective addresses given in proof / Statement of Affairs / books of the Company / other address as may be known to the person summoning the meeting, as may be applicable. their wishes; and (3) The notices shall be in Forms WIN 25 to 29 as may be applicable. 46. Place and time of meeting.- Every meeting shall be held at such place and time as the CL considers convenient for the majority of the creditors or contributories, as the case may be. 47. Notice of first or other meeting to officers of company.- (1) The CL shall also give, to each of the officers of the company, who in his opinion ought to attend the first or any other meeting of creditors or contributories, 14 days' notice in Form WIN 30 and it shall be the duty of every such officer to attend, if so required by the CL, and if any such officer fails to attend, the Liquidator may report such failure to the Tribunal for necessary directions. (2) The CL, if he thinks fit, may instead of requiring any of the officers of the company to attend the meeting, require such officer to answer any interrogatories or to furnish in writing any information that he may require for purposes of such meeting, and if such officer fails to answer the interrogatories or furnish such information, the liquidator shall report such failure to the Tribunal for directions.

Exercise and Control of Company Liquidator's Powers. Contd . 48. Proof of notice.- An affidavit by any person who sent the notice, that such notice has been duly sent, shall be sufficient evidence of the notice having been sent to the person to whom the same was addressed and the affidavit shall be filed in the Tribunal in Form WIN 31. 49. Costs of meeting.- The cost of convening and conducting the meeting of the creditors or contributories shall be met out of the assets of the company. 50. Chairman of meeting.- The CL or some person nominated by him shall be the Chairman of the meeting and the nomination shall be in Form WIN 32. 51. Resolution at creditors' meeting.- At a meeting of creditors, a resolution shall be deemed to be passed, when a majority in value of the creditors present personally or by proxy and voting on the resolution have voted in favour of the resolution and in a winding up by the Tribunal, the value of a creditor, shall, for the purposes of a first meeting of the creditors held under section 287, be deemed to be the value as shown in the books of the company, or the amount mentioned in his proof as referred to rule 101, whichever is less and for the purposes of any other meeting, the value for which the creditor has proved his debt or claim. 52. Resolution of contributories' meeting.- At a meeting of the contributories, a resolution shall be deemed to be passed when a majority in value of the contributories present personally or by proxy and voting on the resolution have voted in favour of the resolution and the value of the contributories shall be determined according to the number of votes to which each contributory is entitled as a member of the company under the provisions of the Act, or the articles of the company, as the case may be. 53. Copies of resolution to be filed.- The CL shall file in the Tribunal a copy certified by him of every resolution passed at a meeting of the creditors or contributories and the Registry shall keep in each case a file of such resolution.