Updated Disclosure Rules for Financial Relationships in Continuing Education

ACCME updated its Standards for Integrity and Independence in Continuing Education, requiring disclosure of financial relationships with specific "ineligible companies" by all involved parties. The rules aim to enhance transparency and mitigate conflicts of interest in accredited continuing education programs. Disclosures must cover the 24-month period preceding the declaration, and no disclosure requirements exist for spouses/partners. The new guidelines prioritize disclosing all financial relationships with ineligible companies, informing attendees of speaker conflicts, and sharing conflict of interest status for all speakers. The definition of ineligible companies includes various entities in the healthcare industry. Individuals must provide specific details about financial relationships with these entities, such as the company name, nature of business, and type of financial relationship.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

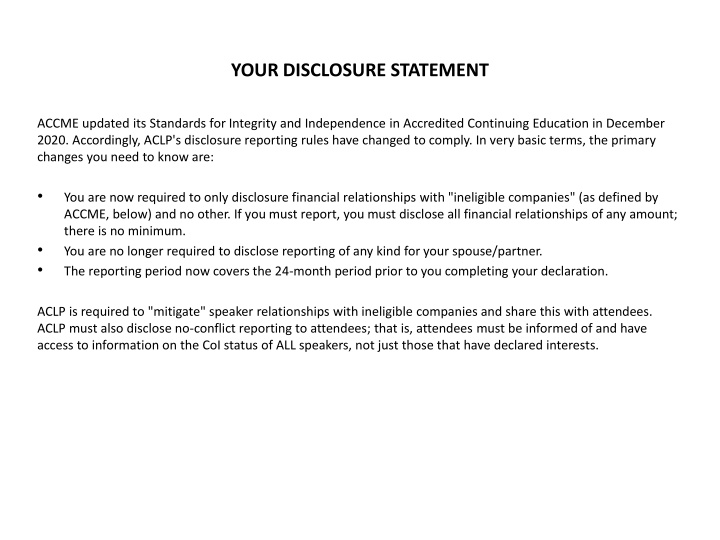

YOUR DISCLOSURE STATEMENT ACCME updated its Standards for Integrity and Independence in Accredited Continuing Education in December 2020. Accordingly, ACLP's disclosure reporting rules have changed to comply. In very basic terms, the primary changes you need to know are: You are now required to only disclosure financial relationships with "ineligible companies" (as defined by ACCME, below) and no other. If you must report, you must disclose all financial relationships of any amount; there is no minimum. You are no longer required to disclose reporting of any kind for your spouse/partner. The reporting period now covers the 24-month period prior to you completing your declaration. ACLP is required to "mitigate" speaker relationships with ineligible companies and share this with attendees. ACLP must also disclose no-conflict reporting to attendees; that is, attendees must be informed of and have access to information on the CoI status of ALL speakers, not just those that have declared interests.

WHAT IS AN INELIGIBLE COMPANY? As defined by ACCME: Advertising, marketing, or communication firms whose clients are ineligible companies Bio-medical startups that have begun a governmental regulatory approval process Compounding pharmacies that manufacture proprietary compounds Device manufacturers or distributors Diagnostic labs that sell proprietary products Growers, distributors, manufacturers or sellers of medical foods and dietary supplements Manufacturers of health-related wearable products Pharmaceutical companies or distributors Pharmacy benefit managers Reagent manufacturers or sellers If you have a financial relationship of any kind and of any amount in respect of any of the above, you must provide three data points: 1. 2. 3. The name of the company in this relationship The nature of the company's business The nature of the financial relationship. Examples of financial relationships include employee, researcher, consultant, advisor, speaker, independent contractor (including contracted research), royalties or patent beneficiary, executive role, and ownership interest. Individual stocks and stock options should be disclosed; diversified mutual funds do not need to be disclosed. Research funding from ineligible companies should be disclosed by the principal or named investigator even if that individual's institution receives the research grant and manages the funds. You are not obliged to disclose the amount of compensation involved in your financial relationships. Example reporting: ABC Company, Inc; device manufacturer; patent beneficiary.

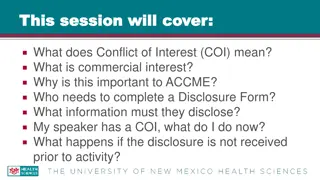

You are encouraged, but not required to use the Academys official design template. Select ONE of the next two slides for your presentation. Delete the red-lined boxes once you have decided which slide to use. Disclosure of commercial support must never include the use of a trade name or a product- group message. Acknowledgment of commercial support may state the name, mission, and areas of clinical involvement but may not include corporate logos and slogans. ACLP will contact you to resolve any potential conflict of interest prior to the start of your presentation. Example reporting: ABC Company Inc; device manufacturer; patent beneficiary. Nature of your financial relationship Entity name Nature of business This is the extent of required disclosure

Use this slide template if there is nothing to disclose CLP 2022 Disclosure: FName LName, MD With respect to the following presentation, in the 24 months prior to this declaration there has been no financial relationship of any kind between the party listed above and any ACCME- defined ineligible company which could be considered a conflict of interest.

Use this slide template when financial disclosure is necessary CLP 2022 Disclosure: FName LName, MD In the 24-months prior to this presentation, I declare the following ineligible company financial relationships: 123 Corporation; pharmaceutical company; speaker honorarium Made-up Inc; diagnostic lab; stock-holder XYZ Press; marketing firm for AAAA, a dietary supplements manufacturer; consultant Fake Name LLC; reagent manufacturer/seller; research funding My presentation involves a study titled, Investigation into Diagnosis of Delirium and Encephalopathy Coding Trends, that was part funded by Psychiatrists for Changing the Coding LLC.