401(k) Basics, Part 4 Notes to Financial Statements & Current Topics

Explore the details of ERISA Section 103(a)(3)(C) audits versus non-Section 103(a)(3)(C) audits, including topics such as statutory and regulatory basis, reporting, financial statement disclosures, DOL proposed changes, and more. Learn about key parties, internal controls, investment considerations, and the Department of Labor's rules and regulations governing ERISA reporting and disclosures.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Employee Benefit Plan Audit Quality Center AICPA 401(k) Basics, Part 4 Notes to Financial Statements & Current Topics

Handouts for todays event You can download presentation slides (in PDF format) and other handouts by clicking on in the toolbar at the bottom of your screen Webinar presentation slides Instructions on how to obtain your CPE Certificate EBPAQC Tools and Resources (Updated) EBPAQC Tools: Primer, ERISA Section 103(a)(3)(C) audits of employee benefit plans Tool, Documentation of the auditor s evaluation of management s assessment of an ERISA Section 103(a)(3)(C) audit certification Tool, Common Deficiencies in ERISA Section 103(a)(3)(C) audit certifications Tool, ERISA EBP financial statement audit special considerations 2023

Presenters Marilee Lau Moderator Jennifer Moore PriceKubecka, PLLC Karolyn Ladas Grant Thornton Gwen Mazzola HoganTaylor LLP

Topics ERISA Section 103(a)(3)(C) Audits vs. Non-Section 103(a)(3)(C) Audits Reporting and financial statement disclosures Current topics Including DOL proposed changes, 2023 special considerations, SECURE 2.0 Act of 2022, Form 5500, pooled employer plans (PEPs), EBPAQC resources, and more Open Q&A 4

Topics discussed on parts 1, 2, and 3 ERISA rules Types of plans & key parties Planning and risk assessment Internal controls Plan document, SSAE 18, and payroll testing Participant data testing Contribution testing Parties in interest and prohibited transactions Benefit payments and notes receivable Investments Concluding an audit 5

ERISA Section 103(a)(3)(C) audits vs. Non-Section 103(a)(3)(C) audits

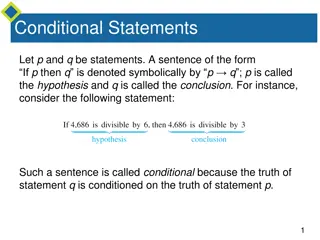

Statutory and regulatory basis Section 103(a)(3)(C) of ERISA Allows plan administrators to instruct the auditor not to perform any additional procedures with respect to the investment information prepared and certified by a qualified institution The election is implemented by Title 29 U.S. Code of Federal Regulations (CFR) Parts 2520.103-8 and 103-12, which outline the Department of Labor s (DOL) Rules and Regulations for Reporting and Disclosure under ERISA 7

ERISA Section 103(a)(3)(C) audit decision tree (from the EBP Guide) 8

Non-Section 103(a)(3)(C) audit The plan auditor should be engaged to perform additional audit procedures where There are certification issues i.e. assets are not held by a qualified institution, the investment information is not prepared and certified by a qualified institution, or the certification is not reliable The plan administrator does not request an ERISA Section 103(a)(3)(c) audit SEC Form 11-K filers *Be aware that it is possible that some assets will not be in the custody of the Plan s custodian and will fall outside of the certification. 9

DOL Regulations 2520.103 Provides sample certification language to be used by the certifying institution The XYZ Bank (insurance carrier) hereby certifies that the foregoing statement furnished pursuant to 29 CFR 2520.103- 5(c) is complete and accurate. Indicates that the certification extends to ordinary business records of the certifying institution The certification must be signed by a person authorized to represent the insurance carrier or bank 10

Who is qualified to certify investment information? Bank or similar institution or by an insurance carrier that is regulated, supervised, and subject to periodic examination by a state or federal agency who acts as trustee or custodian Bank Trust company (or similar institution) Insurance carrier Agent can certify on behalf of qualified institution Modify report language ABC as agent for XYZ Trust Company Broker/dealers and investment companies are not qualified to certify 11

Certification Stipulations Not every certification is acceptable Unqualified institutions try to certify Qualified institutions provide certifications based on their ordinary books and records that may not be fair value Watch for agency relationships Certification of transferred assets and/or change in trustee/custodians 12

Questions to consider when reviewing a certification Is the ENTIRE period under audit certified? Are all investments covered by the certification? Are notes receivable from participants covered by the certification? Was there a change in trustee/custodian during the year? Changes in custodians/trustees are common but can increase risk if not managed properly Plan sponsors have a fiduciary responsibility to ensure that the change is monitored and performed properly Must make sure transfer was complete and accurate at the plan and the participant level 13

Investments ERISA Section 103(a)(3)(C) audits vs. Non-Section 103(a)(3)(C) audits Audit Procedures ERISA Section 103(a)(3)(C) Non-Section 103(a)(3)(C) Confirm assets directly with custodian X Agree the certified investment information to the Plan s financial statement X Year-end market value testing X Investment transaction testing X Test investment income allocation to participants X X X X Determine that the Plan s financial statement and disclosures are in compliance with GAAP Other audit procedures, such as testing of contributions, distributions, etc. X X 14

Testing Technicalities Limited testing only applies to investment information Does not extend to participant data, contributions, benefit payments, required financial statement disclosures, etc. Plan investments not held by a qualifying institution, such as real estate, should be subjected to non-Section 103(a)(3)(C) audit procedures. Investment income allocation at the participant level and investment elections should be subjected to the same audit procedures as a non-Section 103(a)(3)(C) audit. 15

AU-C section 703 (eff. for periods ending on or after 12/15/21) SAS 136 + amendments: SAS 138 (materiality) SAS 140 (supplementary information) SAS 141 (effective date) = https://us.aicpa.org/content/dam/aicpa/research/standards/auditattest/downloadabledocuments/au-c-00703.pdf 16

AU-C section 703 (SAS 136, as amended) Engagement acceptance preconditions (.15-.17) Risk assessment and response (.18-.26) Communications with those charged with governance (TCWG) (.27-.28) ERISA Section 103(a)(3)(C) procedures (.29-.35) Written representations (.36) Forming an opinion and form of opinions (.37-.46) Form 5500 filings (.47-.59) Auditor s reports (.60-.135) Non-Section 103(a)(3)(C) (.60-.84) ERISA Section 103(a)(3)(C) (.98-.126) ERISA required schedules (129-.135) 17

Key Provisions Engagement Acceptance Risk Assessment and Response Performance Procedures Evaluation and Documentation Review of Draft Form 5500 prior to dating auditor s report Management Representations Communications with Those Charged with Governance Reporting 18

Engagement Acceptance - Auditor responsibilities Follow AU-C section 210 Terms of Engagement and 703 Preconditions: obtain an agreement from management that it acknowledges and understands its responsibility for: Maintaining a current plan instrument Administering the plan properly If electing an ERISA Section 103(a)(3)(C) audit Whether that is permissible under the circumstances, Investment information is prepared and certified by a qualified institution Certification meets the requirements of U.S. Code of Federal Regulations (CFR) 2520.103-5 Certified investment information is appropriately measured, presented, and disclosed 19

Engagement Acceptance - Auditor responsibilities (Cont.) If electing an ERISA Section 103(a)(3)(C) audit Auditor needs to inquire of management how they determined that the certification is from a qualified institution Obtain the agreement of management or TCWG to provide a substantially complete draft of the From 5500 prior to the dating of the auditor s report 20

Engagement Acceptance - Managements responsibilities Maintain a current plan document and amendments (collectively, the plan instrument) Administer the plan, which extends to maintaining sufficient participant records Provide the auditor with a substantially complete draft Form 5500 prior to the date of the auditor s report Determine whether an ERISA Section 103(a)(3)(C) audit (formerly known as a limited- scope audit) is appropriate Evaluate the plan s investment certification and financial information associated with that certification Determine whether the certified investment information is appropriately measured, presented, and disclosed Understand how transactions and amounts relating to the certified investment information are processed and reported 21

Risk Assessment and Response Obtain and read the plan documents, including amendments Consider relevant plan provisions when designing and performing audit procedures Participation and eligibility requirements Types of contributions and distributions allowed Definition of compensation Distribution eligibility rules Reference AICPA Technical Questions and Answers (TQA) 6933.13 - .17 on relevant plan provisions 22

Performing Procedures Perform procedures necessary to become satisfied that amounts received or disbursed were determined in accordance with plan provisions Rare to not test any relevant plan provisions Evaluate whether prohibited transactions are reported appropriately in supplemental schedules Tax status has management performed compliance testing and corrected any failures? 23

Procedures for Certification in an ERISA Section 103(a)(3)(C) Audit Obtain and read a copy of the certification Identify which investment information is certified Perform procedures on investments not covered by the certification Evaluate management s assessment of whether the entity issuing the certification is a qualifying institution under DOL regulations Compare the investment information certified to the plan s financial statements If certified investment information is determined to be incomplete or inaccurate, discuss with management and perform additional procedures 24

Procedures for Certification in an ERISA Section 103(a)(3)(C) Audit (Cont.) Determine whether the form and content of the financial statement disclosures related to the investment information prepared and certified by the plan s custodian are in conformity with the applicable financial reporting framework Perform necessary procedures to become satisfied that any received or disbursed amounts reported by the custodian were determined in accordance with the plan provisions [applicable for all audits!] 25

Evaluation and Documentation If the auditor determines it is not necessary to test any relevant plan provisions as part of risk assessment, they are required to document their considerations When work performed results in items that are not in accordance with the plan instrument, evaluate whether the items are reportable findings Noncompliance with laws or regulations (AU-C 250) Significant to TCWG (AU-C 260) Internal control deficiencies (AU-C 265) 26

Form 5500 Responsibilities Substantially complete = contains all forms and schedules that could have a material effect (qualitatively or quantitatively) Review for inconsistencies and determine materiality Audit and Accounting Guide Chapter 13 presents different situations where information is missing from schedules and whether the overall form would be substantially complete e.g. Schedule C, Service Provider Information is missing. If service provider fees are immaterial, it might not be an issue, but if they are, auditor would need to further evaluate 27

Management Representations Provided the most current plan instrument Acknowledge responsibility for administering the plan Maintaining sufficient participant records to determine benefits due or which may become due ERISA Section 103(a)(3)(C) audit Election of this type of audit does not affect management s responsibility for the financial statements Responsibility to determine whether the audit is permissible Whether the investment information is prepared and certified by a qualified institution Certification meets the requirements in 29 CFR 2520.103-5 Certified investment information is appropriately measured, presented, and disclosed 28

Communication with Those Charged with Governance Communicate reportable findings in writing to those charged with governance Include: A description of the reportable finding Sufficient information to provide the context Explanation of the potential effects If there are no reportable findings found during the audit, the auditor should not issue a written communication stating that 29

Auditors Report Express an unmodified opinion when the ERISA plan financial statements are presented fairly Two-pronged opinion: Whether the information not covered by certification is presented fairly Whether the certified information agrees to or is derived from the certification 30

ERISA Section 103(a)(3)(C) report The ERISA section 103(a)(3)(C) report contains the following sections: Scope and Nature of the ERISA Section 103(a)(3)(C) Audit (required to be placed first) Opinion (required to follow the scope and nature section) Basis for Opinion (required to follow the opinion section) Going concern (if applicable) Key Audit Matters (if applicable) Responsibilities of Management for the Financial Statements Auditor s Responsibilities for the Audit of the Financial Statements ERISA-Required Supplemental Schedules 31

EBPAQC ERISA Section 103(a)(3)(C) Audits Resource Center Primer, ERISA Section 103(a)(3)(C) audits of employee benefit plans Tool, Common deficiencies in ERISA Section 103(a)(3)(C) audit certifications Tool, Conditions for plan management to elect an ERISA Section 103(a)(3)(C) audit Tool, Documentation of the auditor s evaluation of management s assessment of an ERISA Section 103(a)(3)(C) audit certification https://www.aicpa.org/interestareas/employeebenefitplanauditquality/r esources/accountingandauditingresourcecenters/erisa-section-103-a- 3-c-audits.html 32

Reporting and financial statement disclosures

Illustrative example: ERISA Section 103(a)(3)(C) Report versus a Non-Section 103(a)(3)(C) Report Title and addressee Responsibilities of management for the financial statements Auditor s responsibilities for the audit of the financial statement ERISA-required supplemental schedules Other reporting Signature of the auditor and auditor s address Date of the auditor s report Scope and nature of the ERISA Section 103(a)(3)(C) audit Auditor s opinion Basis for opinion Going concern Key audit matters 34

Year 1 vs. year 2 unmodified ERISA Section 103(a)(3)(C) Current year Unmodified ERISA Section 103(a)(3)(C) Report; Prior year Limited Scope Disclaimer (Year 1) Current and prior year Unmodified ERISA Section 103(a)(3)(C) Report (Year 2) Scope and Nature of the ERISA Section 103(a)(3)(C) Audit of the 2021 Financial Statements Opinion on the 2021 Financial Statements Scope and Nature of the ERISA Section 103(a)(3)(C) Audit Opinion Basis for Opinion on the 2021 Financial Statements Basis for Opinion Going Concern (when applicable) Going Concern (when applicable) Key Audit Matters (when applicable) Key Audit Matters (when applicable) Responsibilities of Management for the 2021 Financial Statements Responsibilities of Management for the Financial Statements Auditor s Responsibilities for the Audit of the 2021 Financial Statements Auditor s Responsibilities for the Audit of the Financial Statements Other Matter 2021 Supplemental Schedule(s) Required by ERISA paragraph Other Matter Supplemental Schedule(s) Required by ERISA paragraph Other Matter Report on 2020 Financial Statements paragraph

Year 2 ERISA Section vs. Non-Section 103(a)(3)(C) ERISA Section 103(a)(3)(C) report Non-Section 103(a)(3)(C) report N/A Scope and Nature of the ERISA Section 103(a)(3)(C) Audit Opinion Opinion Basis for Opinion Going Concern (when applicable) Basis for Opinion Going Concern (when applicable) Key Audit Matters (when applicable) Key Audit Matters (when applicable) Responsibilities of Management for the Financial Statements Responsibilities of Management for the Financial Statements Auditor s Responsibilities for the Audit of the Financial Statements Auditor s Responsibilities for the Audit of the Financial Statements Other Matter Supplemental Schedule(s) Required by ERISA paragraph Separate section Report on Supplemental Schedule(s) required by ERISA

Year 1 vs. year 2 ERISA Section 103(a)(3)(C) disclaimer Current year Disclaimer on ERISA Section 103(a)(3)(C) Report; Prior year Limited Scope Disclaimer (Year 1) Current and prior year Disclaimer on ERISA Section 103(a)(3)(C) Report (Year 2) Scope and Nature of the ERISA Section 103(a)(3)(C) Audit of the 2021 Financial Statements Disclaimer of Opinion on the 2021 Financial Statements Scope and Nature of the ERISA Section 103(a)(3)(C) Audit Disclaimer of Opinion Basis for Disclaimer of Opinion on the 2021 Financial Statements Basis for Disclaimer of Opinion Going Concern (when applicable) Going Concern (when applicable) Key Audit Matters (when applicable) Key Audit Matters (when applicable) Responsibilities of Management for the 2021 Financial Statements Responsibilities of Management for the Financial Statements Auditor s Responsibilities for the Audit of the 2021 Financial Statements Auditor s Responsibilities for the Audit of the Financial Statements Other Matter 2021 Supplemental Schedule(s) Required by ERISA paragraph Other Matter Supplemental Schedule(s) Required by ERISA paragraph Other Matter Report on 2020 Financial Statements paragraph

ERISA Section 103(a)(3)(C) Reports versus Non-Section 103(a)(3)(C) Reports Differences mainly due to clarification that the ERISA Section 103(a)(3)(C) audit did not extend to investment information. As with the auditor s reports under AU-C section 700A, the report must be tailored to reflect the financial statements for different types of plans, such as defined benefit plans and health and welfare plans. 38

Illustrative Auditors Report Non-Section 103(a)(3)(C) Audit (EBP Guide para. 14.29) 401(k) plan unmodified opinion For an employee benefit plan that is filing Form 11-K with the SEC Omitted information in a schedule required under DOL regulations Omitted schedule required under DOL regulations Qualified report on supplementary information omitted information 39

Illustrative Auditors Report Non-Section 103(a)(3)(C) Audit (EBP Guide para. 14.29) (continued) Qualified report disclosure of material prohibited transaction with party in interest omitted Disclosure of immaterial prohibited transaction with party in interest omitted Prohibited transaction with party in interest that is also considered a related-party transaction 40

Illustrative auditors report ERISA Section 103(a)(3)(C) audit (EBP Guide para. 14.73) Standard ERISA Section 103(a)(3)(C) audit report ERISA Section 103(a)(3)(C) audit in prior year ERISA Section 103(a)(3)(C) audit in current year ERISA Section 103(a)(3)(C) audit in current year, prior year ERISA Section 103(a)(3)(C) audit performed by other auditors Change in trustee Standard ERISA Section 103(a)(3)(C) audit reports with omitted schedule required under DOL regulations Modified opinion on supplemental schedules omitted information required under DOL regulation in an ERISA Section 103(a)(3)(C) audit engagement 41

Common financial statement disclosures Description of the plan General description Eligibility Contributions Participant accounts Vesting Investment options Participant loans Payment of benefits Forfeited accounts Administrative expenses 42

Common financial statement disclosures (cont.) Summary of accounting policies Basis of accounting Use of estimates Investment valuation Payment of benefits Investments Trustee certification, mentioning the certifying entity Fair value disclosures (Level 1, 2, 3 table) Investments using NAV as a practical expedient Investment contracts with insurance companies Risks and uncertainties Parties in interest Plan termination Tax status, including uncertain tax positions 43

Common financial statement disclosures (cont.) Prohibited transactions Reconciliation to Form 5500 Management statement on subsequent events 44

FinREC recommendations all plans Dividends and Distributions--reinvested Dividends be considered investment income and shown separately from changes in fair value Capital gain distributions may be considered either investment income and shown separately from changes in fair value or included as part of the net change in fair value Cash Balances Interest bearing cash be shown as an investment Since no cash flow statement is required, there is no need to classify short term investments as cash equivalents 45

FinREC recommendations all plans types Separate disclosure of employer contributions relating to the correction of operational defects or other nonrecurring items Additional disclosures and discussion Benefits paid Other income Other employer contributions Expense offset arrangements Transfers of assets to or from other plans Frozen or merged plans Full or partial terminations Changes in service providers 46

FinREC recommendations defined contribution plans Excess contributions/corrective contributions Amounts may be netted against contributions received in the statement of changes with additional footnote disclosure Include refund or payment as a payable to participant Contributions receivable Additional guidance added to include the factors that are to be reviewed in determining whether a receivable should be recognized and the relationship between employer and employees as compared to a DB plan Participant loans classified as a note receivable with additional disclosures for valuation, interest income, etc. 47

FinREC recommendations defined contribution plans Forfeitures Added more discussion about forfeitures and use of forfeitures with recommended disclosures Rollover Contributions Significant rollovers be shown as a separate line item on the statement of changes in net assets available for benefits Discussion as to when a rollover is really a plan transfer Employee Stock Ownership Plans How a leveraged ESOP plan works ESOP financial statements for leveraged ESOPs FinREC recommends columnar format 48

Form 11-K Filings Do not file PCAOB auditor s report with the Form 5500 Preparing the financial statements may violate auditor s independence Auditors should not provide typing and word processing services nor financial statement templates that are not publicly available to audit clients (See Dec 2014 EBPAQC E-Alert) Archived annual webinar on 11-K Audits on website https://bcove.video/3G94I9p 49