Course Registration for SPRING 2023

Attention AUCA freshmen! Online course registration for Spring 2023 is from November 21 to December 2. Make sure to complete the Anti-Harassment Training to be eligible for registration. Watch the registration tutorial and follow your department's checklist for a smooth registration process. Underst

2 views • 37 slides

REGISTRATION OF SHIPS UNDER MALTESE LAW

Explore the comprehensive process and legal framework for the registration of ships under Maltese law explained by Christian Farrugia, LL.M, LL.D. Learn about the registration of assets, ship nationality, ownership requirements, eligible vessels, and the registration process. Understand the signific

2 views • 21 slides

PM Vishwakarma Registration Process Flow

The process flow for registering applicants for PM Vishwakarma involves gathering necessary information, accessing the PM Vishwakarma portal, and completing registration via the CSC/VLEs. Applicants need to provide Aadhaar details, ration details, savings account details, and other key information t

0 views • 13 slides

SACE Presentation on Registration Requirements

The presentation by Ms. Yvonne Lechaba, Head of Registration & Teacher Professionalisation at SACE, focuses on the registration requirements for educators in South Africa according to the SACE Act. It outlines the vision, mission, and values of SACE, as well as the professional registration value ch

6 views • 13 slides

Voter Registration Process in New York State: A Comprehensive Guide

Learn how to run a successful voter registration drive in New York State with this detailed guide. Explore who qualifies to register, how New Yorkers can register online, in-person, or by mail, what is needed for registration, and the mandatory questions on the registration form. Get insights into o

1 views • 19 slides

Challenges and Solutions in VAT Registration for Dubai-based Businesses

Discover the challenges of VAT registration in Dubai, UAE, and learn effective solutions to navigate the process smoothly. Ensure compliance with UAE tax regulations with these expert tips and strategies.

1 views • 11 slides

Understanding GST Registration Essentials

Dive into the intricacies of GST registration with a focus on different types of registration, eligibility criteria, exemptions, and aggregate turnover calculations. Gain insights from expert CA Indranil Das on key topics and practical issues related to GST registration. Unravel examples, explore pe

4 views • 42 slides

Voter Registration Process in Colorado

Learn about voter registration in Colorado, including eligibility requirements, automatic voter registration process, new registration statistics, and online voter registration. Discover who is eligible to register, how automatic registration works, and the options available to voters in the state.

2 views • 35 slides

Afghanistan Revenue Department Implements Value Added Tax

The Afghanistan Revenue Department has introduced Value Added Tax (VAT) as a step towards self-reliance and economic stability. The program aims to inform taxpayers about VAT, its purpose, implementation process, and impact on domestic revenues. By adopting VAT, Afghanistan aims to decrease reliance

0 views • 35 slides

Tatmeen Users Training - User Registration Process Overview

This document provides an overview of the user registration process for Tatmeen users, focusing on the registration of Single Point of Contact (SPOC) and non-SPOC users. It includes details on how users receive registration invitations, the different user types, steps for SPOC registration, data flo

2 views • 20 slides

Strategies for Accelerated Death Registration in Kenya: Insights from Janet Mucheru

The Civil Registration Services in Kenya faces challenges in death registration, but through lessons learned, best practices are recommended for accelerated progress. The department's core functions, purpose of civil registration, and death registration processes in Kenya are outlined, shedding ligh

3 views • 12 slides

Enhancing VAT Revenue in Zambia through Electronic Fiscal Devices

Analyzing the impact of Electronic Fiscal Devices (EFDs) on VAT remittances in Zambia and exploring policies to complement their implementation. The study discusses the design, distribution, and effects of EFDs, highlighting a reduction in remittances post-registration. The research also examines se

0 views • 16 slides

A Guide to Making Tax Digital (MTD) for VAT Regulations

The new Making Tax Digital (MTD) for VAT regulations came into effect from April 1, 2019. Businesses with a taxable turnover over £85,000 must keep digital records and file VAT returns using HMRC-approved software. The Government Gateway for VAT returns will be disabled, and businesses need to regi

0 views • 10 slides

Overview of TRAIN Revenue Regulations No. 13-2018 on Value-Added Tax

These regulations under the Tax Reform for Acceleration and Inclusion (TRAIN) Act (RA 10963) focus on Value-Added Tax provisions, amending Revenue Regulations No. 16-2005. They cover zero-rated sales, VAT-exempt transactions, claims for input tax, refund procedures, and more. Conditions for VAT appl

1 views • 54 slides

Brexit VAT Treatment of Goods and Services Overview

The Brexit VAT treatment of goods and services impacts cross-border supplies to the UK, VAT refunds for goods, separation provisions under the Withdrawal Agreement, and the Ireland/Northern Ireland Protocol. Changes in VAT regulations and protocols are outlined for businesses and traders within the

3 views • 10 slides

Student Planning Self-Registration Guide for Term 2: Important Dates and Steps

Understand the process of self-registration using Student Planning for Term 2, access registration dates, find where to locate Student Planning in HUB, and follow essential instructions provided via email for successful registration. Learn about planning courses, schedules, electives, and registrati

0 views • 15 slides

Comprehensive Overview of Divine IT Limited and PrismVAT

Divine IT Limited is a pioneering IT consultancy firm offering ERP solutions and web applications since its inception in 2005. With a strong focus on innovation and customer retention, the company has garnered several accolades and certifications. One of its flagship products, PrismVAT, is a web-bas

0 views • 20 slides

Understanding Value Added Tax (VAT) and Unemployment Insurance in Mathematical Literacy NQF Level 3

Dive into the realm of Value Added Tax (VAT) in South Africa, distinguishing between VAT-inclusive and VAT-exclusive pricing, and exploring the Unemployment Insurance Fund. Learn how to calculate VAT on exclusive prices and decipher payslips to enhance your mathematical literacy skills at NQF Level

0 views • 23 slides

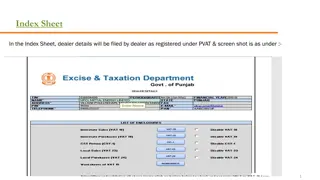

Overview of Dealer Details Filing Procedures Under Different Forms

This content outlines the process for dealers to file various details under different forms such as Index Sheet, VAT-18, VAT-19, CST Form, VAT-23, VAT-24, Worksheet-4, Worksheet-5, and Worksheet-6. With the arrival of GST, changes in the filing requirements have been highlighted, emphasizing the imp

0 views • 10 slides

European Islands VAT and Taxation Policy Overview

European islands have unique VAT and taxation policies. Various islands in Europe have different approaches to VAT, including special rates and exemptions. For example, in Greece, certain islands have lower VAT rates compared to the mainland. Countries like Germany and Spain exclude specific territo

0 views • 8 slides

CSM.ASLP Registration Guidance for Implementing Users

This guidance provides detailed instructions on the registration process for users implementing the CSM.ASLP requirements. It covers the importance of registration, preparing for quality registration, entity contacts, filling out registration templates, and contacting ERA. Key points include the pur

0 views • 16 slides

Voter Registration Responsibilities and Procedures at MVD Offices

Presented by Raul Alvarez at the 2010 Managers Conference, this information outlines the key responsibilities for Voter Registration Contacts at MVD offices. It includes details on the importance of having designated contacts, handling voter registration forms, and adhering to procedures to offer vo

0 views • 21 slides

Vehicle Inspection and Registration System Overview

This information highlights the changes in vehicle inspection and registration processes, particularly focusing on the transition to a registration-based enforcement system starting March 1, 2015. It explains the importance of the Vehicle Inspection Report (VIR) and how the new system affects regist

0 views • 21 slides

PhytClean.V2 Citrus 2022/2023 Special Market Registration Update

This update covers the changes in the Citrus 2022/2023 Special Market Registration process using PhytClean.V2. It includes a walkthrough of the registration system, information on registration periods, costs, available markets, dashboard features, and document requirements. Seasonal registration rem

0 views • 9 slides

Step-by-Step Guide for Connect & Canvas Student Registration

Step 1: Enter your Canvas username and password, then click Login to start the registration process. Step 2: Navigate to Courses and select a course name. Step 3: Access Assignments from the course home page. Step 4: Click on the Connect assignment. Step 5: Begin the assignment. Step 6: Register as

1 views • 13 slides

Towards a Modern VAT System for Intra-Union Trade

The European Commission aims to replace the current fragmented and complex VAT system for intra-Union trade with a definitive system. This new system, based on taxation at the destination, seeks to reduce VAT fraud, enhance compliance, and bring uniformity to EU supplies. The two-step legislative ap

0 views • 19 slides

Juvenile Sex Offender Registration and Mandatory Offenses

The content details the requirements and processes related to juvenile sex offender registration, including discretionary removal from the registry, comprehensive evaluations, and mandatory registration for specific offenses. It also lists the mandatory offenses that require registration for juvenil

1 views • 21 slides

Civil Registration System in Uganda: Legal Framework and Responsibilities

The civil registration system in Uganda is governed by a legal framework including the Constitution, Registration Services Bureau Act, Children Act, and other laws. The Uganda Registration Services Bureau oversees the registration of vital events such as births, deaths, marriages, and adoptions. Reg

0 views • 23 slides

Understanding Vat Dyes: Properties, Dyeing Process, and Limitations

Vat dyes are known for providing excellent color and fastness properties to textile materials, especially natural and manmade fibers. The dyeing process involves steps like aqueous dispersion, vatting, absorption by fibers, re-oxidation, and soaping off to ensure colorfastness. However, there are ce

0 views • 25 slides

Understanding the Reduced Rate of VAT in the Hospitality Industry

Delve into the intricacies of the Reduced Rate of VAT in the hospitality sector through this upcoming live webinar presented by Richard Taylor, VAT Manager at Albert Goodman. The webinar covers various aspects including catering, hotel and holiday accommodation, admission to attractions, and account

0 views • 16 slides

Reform Efforts in Civil Registration and Vital Statistics System in Tanzania

The Registration Insolvency and Trusteeship Agency (RITA) in Tanzania is responsible for vital event registration, insolvency services, and trusteeship services. The history of birth registration in Tanzania dates back to the colonial era, with separate systems for Mainland Tanzania and Zanzibar. La

0 views • 9 slides

VAT in Worcester

JRMA offers comprehensive VAT services in Kidderminster, ensuring businesses comply with tax regulations while maximizing savings. With meticulous attention to detail, they handle VAT registration, returns, and advisory, easing the burden for clients

2 views • 1 slides

Streamlining Registration and Enrollment Process Overview

This detailed guide provides essential information on registration and enrollment procedures, emphasizing the importance of training multiple personnel at each school. Key topics covered include new student registration, returning student registration, Parent Portal access, system differences betwee

0 views • 21 slides

Understanding Time and Value of Supply in VAT Webinar Series

This course note covers the essential aspects of time and value of supply in relation to VAT rules. It explains key rules that determine when VAT must be accounted for and paid, focusing on important regulations impacting vendors. Topics include general time of supply rules, rules for connected pers

0 views • 44 slides

Comparative Study of Sales Tax on Services in Various Countries

This content provides information on the scope and implementation of sales tax on services in different countries like Pakistan, India, Australia, Canada, France, Japan, and Malaysia. It highlights the VAT/GST regimes across the globe, the number of countries implementing VAT/GST by region, and coun

0 views • 55 slides

Dispute over VAT Liability in Car Purchase Case

Cartrader A bought cars from B Ltd., paid VAT, but B Ltd. didn't remit VAT. C involved in evasion. A held liable initially, successful appeal against VAT evasion assessment. Dispute over A's knowledge of C's intentions.

0 views • 10 slides

Amendments and Changes in Lobbyist Registration Requirements

Amendments to the definition of legislative persons, inclusion of certain individuals and organizations in the definition, changes in registration fees, and shifts in the registration year timeline for lobbyists in Indiana starting from July 1, 2013. The process for filing annual registration statem

1 views • 24 slides

VAT Registration for Startups: What Startups Need to Know in Dubai

Learn the essentials of VAT Registration in Dubai, UAE for startups. Discover when to register, steps involved, and the benefits of compliance to boost your business growth.

0 views • 9 slides

Customs Investor Facilitation Center's INFAC Scheme Details

The INFAC Scheme, offered by the Customs Investor Facilitation Center, aims to implement import duty concessions for the textile and garment industry in Sri Lanka. Registered manufacturers, exporters, and service providers in the industry can benefit from this scheme by availing duty concessions on

0 views • 18 slides

Preparing for Brexit Customs Declarations VAT and Duty Webinar Overview

Detailed webinar presented by Richard Taylor, VAT Manager at Albert Goodman, discussing changes in import procedures for EU movements, duties, VAT, customs declarations, and more post-Brexit transition period.

0 views • 24 slides