Renewing Richmond's Conservation Reserve Fund

Richmond's Conservation Reserve Fund has a successful 18-year track record in protecting water and air quality, biodiversity, working farms and forests, outdoor recreation, historic resources, and education. Established in 2005 and last renewed by voters in 2023, the fund has brought in over $2.0 mi

0 views • 9 slides

Work Group meeting

This review project aims to assess the need for a special industry rule for trucking companies given the shift to market-based sourcing by the MTC. Factors prompting the review include distortion in applying the mileage approach, differences in revenue per mile among states, and the nature of taxpay

0 views • 21 slides

Advanced Analytics in Indirect Taxation by Central Board of Indirect Taxes & Customs

The Central Board of Indirect Taxes & Customs in India leverages technology through ADVAIT to provide near real-time data capture, predictive analytics, and fraud detection in the realm of indirect taxation. This initiative enhances taxpayer service with cutting-edge data visualization, mobile acces

2 views • 28 slides

San Francisco Business Tax Revenue Forecast Update Fall 2023

San Francisco is facing a significant loss in business tax revenue compared to budget projections, with estimates ranging from $40M to $55M in annual losses for current and future fiscal years. The Homelessness Gross Receipts Tax (HGR) is a key source of revenue, but its revenue has been volatile an

0 views • 7 slides

Ohio's New Tax System Overview May 2023

Ohio is launching a new tax system in May 2023 aiming to improve taxpayer service, modernize technical systems, enhance user experience, and ensure secure taxpayer information. The project scope includes Individual Income Tax and School District Tax, with key dates set for testing in August 2023 and

5 views • 11 slides

Enhancing Tax Compliance: Factors, Audit, and Investigation" (56 characters)

Exploring factors influencing taxpayer behavior towards tax compliance, this study delves into the impact of tax audit and investigation procedures on adherence to tax laws at both corporate and individual levels. Previous research gaps are identified and addressed to provide a comprehensive underst

1 views • 20 slides

Understanding Acceptance of Construction Works

The process of acceptance of construction works involves rescission of contracts, different types of acceptance such as partial, final, and definitive, and the obligations of investors and contractors. It also includes details on partial acceptance according to Art. 654 CC and FIDIC regulations for

4 views • 33 slides

Issuance of notice in Form GST ASMT-10

Form GST ASMT-10 is a scrutiny notice issued to intimate the discrepancies observed by the officer while verifying the GST returns filed by the taxpayer.\n\nUpon scrutiny of GST returns by GST authorities, if any discrepancy is noticed, he may issue a notice in Form GST ASMT-10. In the said notice t

1 views • 6 slides

For Tax Filing - Analyze the Tax Regime

As the financial year closes, taxpayers would need to ensure that their books of accounts, pay slips, bank statements and other important documents are in place such that the details are available at the time of audit and filing the return of income. While filing the return of income, a taxpayer mu

0 views • 3 slides

Conference Cost Submission, Approval, and Reporting Guidelines for DOJ Programs

This policy outlines the requirements and procedures for managing conference costs within the Department of Justice (DOJ). It covers planning, approval, attendance, and reporting of conferences while ensuring efficient and responsible use of federal funds. The guidelines aim to promote cost-effectiv

3 views • 48 slides

Nevada Department of Taxation Compliance Division Audit Process Overview

Responsible for ensuring taxpayer compliance with various taxes, the Nevada Department of Taxation Compliance Division conducts audits locally and nationwide. From refund verification to audit selection criteria, learn about the audit process, taxes audited, time periods, initial contact procedures,

5 views • 18 slides

Understanding Autism Acceptance vs. Awareness & Why It Matters

Trainings led by Emily Whaland, LPC, highlight the shift from awareness to acceptance in understanding autism. The sessions focus on fostering diversity, enhancing transition planning, and empowering autistic voices. Rejecting stigma and stereotypes, the agenda encourages active involvement and supp

2 views • 23 slides

Understanding Acceptance and Commitment Therapy (ACT)

Acceptance and Commitment Therapy (ACT) is a therapeutic approach that focuses on psychological flexibility, emphasizing acceptance of thoughts and feelings, commitment to values, and behavioral changes. It aims to help individuals develop skills to navigate life's challenges effectively, promoting

4 views • 20 slides

Community Programs and Service Fund (Fund 80) Overview

The Community Programs and Service Fund (Fund 80) is a local taxpayer-funded initiative that allows school boards to provide community education, training, recreational, cultural, and athletic programs and services. This fund is separate from the regular school curriculum and operates under specific

0 views • 20 slides

Taxpayer Information for Direct Fee Payments - Guidelines and Forms

Guidelines and procedures for providing taxpayer information to the IRS for direct fee payments made to representatives of claimants for Social Security and Supplemental Security Income benefits. Learn how to register, complete required forms, and request direct payment online. Find information on e

0 views • 30 slides

Insights into Post-Award Challenges in NIH Grants Administration

Explore the complexities and issues in post-award management of NIH grants through case studies and real-life examples. Key aspects discussed include changes in recipient organizations, research team delays, large balances, and unexpected changes post-award. Gain perspectives on federal policies, ta

0 views • 41 slides

Understanding Self-Acceptance Through the Big I, Little i Exercise

Explore the concept of self-acceptance through the Big I, Little i exercise. Discover how the Big I represents your totality, while the little i symbolizes various aspects of yourself. Reflect on your positive, negative, and neutral traits with guidance on filling in the Big I to gain a deeper under

0 views • 5 slides

Challenges of Kenyan Taxation System and Solutions

The Kenyan taxation system faces complexities in terms of the ITax system, low taxpayer acceptance, capacity issues at the Kenya Revenue Authority (KRA), and lack of political will. Simplifying the filing process, increasing taxpayer education on the importance of taxes, enhancing KRA capacity, and

1 views • 13 slides

Legal Professional Privilege in the Protection of Taxpayer Rights: South African Perspective

Legal professional privilege plays a crucial role in safeguarding taxpayer rights in South Africa. This privilege ensures that communications between a legal advisor and client remain confidential, promoting fairness in litigation and enabling a proper functioning adversarial system of justice. The

0 views • 16 slides

Enhancing Taxpayer Education for Voluntary Compliance

Liberian taxes operate on a self-assessment system, where taxpayers must assess, submit returns, and pay taxes. Taxpayer education is crucial in promoting voluntary compliance. The Liberia Revenue Authority's Taxpayer Service Division conducts extensive educational programs covering tax types, respo

0 views • 21 slides

Understanding Acceptance Sampling in Quality Engineering

Acceptance sampling is a decision-making tool used to accept or reject products based on sample inspections. It involves determining sample size and allowable defects. Attributes and variables play crucial roles in this process, ensuring representative samples are inspected randomly. Homogeneity and

0 views • 48 slides

Public Opinion and Stakeholder Expectations in EU Project HYACINTH

The EU project HYACINTH focused on public and stakeholder acceptance of hydrogen technologies in the transition phase. Led by Prof. Paul Upham from Leuphana University, the project involved surveying participants across European countries to gauge awareness, acceptance, and support for Fuel Cell and

0 views • 20 slides

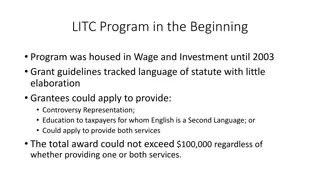

Evolution of Low Income Taxpayer Clinics (LITC) Program

The Low Income Taxpayer Clinics (LITC) Program has evolved over the years to ensure fairness and integrity in the tax system for low-income taxpayers and those who speak English as a second language. Initially housed in Wage and Investment, the program now reports to the National Taxpayer Advocate.

0 views • 10 slides

Understanding Acceptance Sampling in Quality Control

Acceptance sampling plays a crucial role in quality control by determining whether a lot of goods should be accepted or rejected based on a sample inspection. This method helps manage defects while keeping appraisal costs reasonable. The process involves defining lot and sample sizes, acceptance cri

0 views • 18 slides

Assessing Technology Acceptance Model (TAM) Impact on Customer Satisfaction: A GCC Student Case Study

This research project aims to evaluate the influence of the Technology Acceptance Model (TAM) on customer satisfaction, specifically focusing on GCC students using a book rental system on a mobile platform. The study addresses the lack of research on students' preferences for obtaining textbooks and

0 views • 13 slides

Principles of Effective Client-Worker Relationship in Social Work

Understanding the principles of acceptance, communication, individualization, participation, confidentiality, self-awareness, and self-discipline is vital in establishing a positive client-worker relationship in social work. The initial interaction between the client and worker sets the tone for mut

0 views • 11 slides

Understanding the Enforceability of Taxpayer Bill of Rights (TBOR)

Explore the enforceability of the Taxpayer Bill of Rights (TBOR) as outlined in IRC 7803(a)(3), delving into its history, statutory interpretation, the question of remedy, and enforcement issues. Discover the evolution of TBOR, statutory text, and challenges surrounding its enforcement.

0 views • 21 slides

Understanding Offers and Acceptance in Contract Law

Exploring the fundamental concepts of offers and acceptance in contract law, this content dives into various types of offers, legal rules surrounding offers, and the significance of acceptance in forming a binding agreement. From express and implied offers to specific and standing offers, learn abou

0 views • 14 slides

Exploring Inner Growth and Acceptance Journey Through Step Four

Dive deep into the transformative process of Step Four, where fearless moral inventory leads to self-awareness and acceptance. Discover the power of examining oneself honestly and forgiving the past to find peace in the present. Embrace the wisdom that acceptance is the key to personal happiness and

0 views • 18 slides

Exploring Awareness, Acceptance, and Courage in Talking About Sex

Dive into a transformative workshop focusing on awareness, acceptance, courage, and love when discussing sex. Discover the power of vulnerability, self-care, and the importance of creating a safe space for exploring personal perspectives on sexual topics. Embrace the paradox of acceptance leading to

0 views • 16 slides

Understanding TABOR: Taxpayer's Bill of Rights Overview

The Taxpayer's Bill of Rights (TABOR) is a crucial constitutional amendment in Colorado that limits government spending and empowers citizens to vote on expenditure increases. TABOR aims to secure individual freedoms and prevent excessive government control through financial accountability. This bri

0 views • 10 slides

MQXFA10 Coils Acceptance Review Summary

Overview of the MQXFA10 Coils Acceptance Review for QXFA131 and QXFA132 conducted on September 8, 2021. The review process includes discrepancy reports against specific steps in the traveler, adherence to production specifications and design reports, and addressing critical and noncritical DRs. The

0 views • 33 slides

Development and Evaluation of Harm Reduction Acceptance Scales

Development of scales to measure the acceptance of harm reduction is crucial for understanding public attitudes towards harm reduction strategies. This project focuses on creating valid and reliable scales through a systematic process involving item development, data collection, analysis, and refine

0 views • 15 slides

The Path to Self-Acceptance and Understanding Through Artwork and Reflection

Explore the importance of self-acceptance in discovering one's true identity and the impact of emotions on our well-being. Reflect on images, artist statements, and articles to analyze universal themes and the role of adversity in self-acceptance. Engage in self-exploration through writing and discu

0 views • 24 slides

Understanding Self-Acceptance and Overcoming Stigma

Self-esteem and self-acceptance are distinct concepts, with self-acceptance focusing on embracing all facets of oneself unconditionally. Developing self-acceptance involves stages like aversion, curiosity, tolerance, and allowing. Overcoming avoidance and resistance can lead to self-compassion and g

0 views • 10 slides

ILC Damping Ring Specifications and Recommendations

Specifications and recommendations for the ILC Damping Rings include nominal parameters for injected and extracted beams, positron acceptance criteria, longitudinal acceptance guidelines, energy acceptance with quantum lifetime considerations, and layout components for injection/extraction systems.

0 views • 13 slides

Understanding Acceptance Levels Towards Intimate Behaviors

Explore the varying levels of acceptance towards different intimate behaviors such as holding hands, kissing, and hugging in different scenarios. Factors influencing acceptance levels, including age, relationship, environment, culture, and more, are examined to promote healthy values towards sexuali

0 views • 23 slides

Understanding Silence as Acceptance in Contract Law

Explore the concept of silence as acceptance in contract law through real cases like Cole-McIntyre-Norfleet Co. v. Holloway and Day v. Caton. Learn how silence can sometimes be legally interpreted as acceptance in certain circumstances, leading to implications for contract formation and legal action

0 views • 8 slides

Understanding Income Taxes and Contributions in Canada

This content provides an overview of income taxes and contributions in Canada, covering topics such as tax facts, tax basics, taxpayer rights and responsibilities, types of taxes, government revenues, and key messages for Canadian taxpayers. It emphasizes the importance of filing tax returns accurat

0 views • 43 slides

Key Concepts in Polish Contract Law Explained

Explore the essentials of valid contracts under Polish law, including legal capacity, free consent, plurality of parties, proposal, acceptance, and enforcement. Delve into important aspects such as offer, counter-offer, rejection, and acceptance, with real-life case scenarios demonstrating the appli

0 views • 33 slides