Understanding 95% Confidence Intervals in Statistics

Confidence intervals are a key concept in statistics that provide a range within which the true value of an estimate is likely to fall. This video series explores the interpretation of 95% CIs, compares them to standard error and standard deviation, and explains how sample size and standard deviatio

2 views • 8 slides

Understanding Deductions in Personal Finance

In Lesson 2 of "Deductions: What You See Is Not What You Get," the content delves into concepts central to financial literacy. Covering topics like gross and net income, types of deductions, compound interest for retirement planning, and the workings of insurance (including health insurance), this l

1 views • 24 slides

Understanding Amendment in Section 43B for MSME Presented by CA Naman Maloo

The recent amendment in Section 43B of the Income Tax Act introduces a new clause (h) focusing on payments to Micro and Small Enterprises (MSMEs). Payments to MSMEs must adhere to the time limits prescribed in the MSMED Act of 2006 for deductions to be allowed. This change emphasizes timely payments

0 views • 29 slides

Ohio Collaborative Standard for Vehicular Pursuit Certification Program 2023

The Ohio Collaborative Community-Police Advisory Board adopted the State of Ohio Standard for Vehicular Pursuit in 2020 to address the risks and dangers associated with vehicle pursuits. This standard aims to govern law enforcement agencies in defining pursuits, criteria for initiation, evaluating c

3 views • 46 slides

Ohio Collaborative Standard for Body-Worn Cameras

The Ohio Collaborative Standard for Body-Worn Cameras outlines guidelines for law enforcement agencies regarding the use of body-worn cameras. It emphasizes the importance of clear policies, accountability, and privacy considerations. Adopted in 2016, this standard aims to enhance trust between poli

0 views • 29 slides

Ohio Collaborative Standard: Investigation of Employee Misconduct

Ohio Collaborative Standard focuses on the investigation of employee misconduct in law enforcement agencies, emphasizing the importance of procedural justice, public respect, and comprehensive investigation processes. It outlines the purpose, learning objectives, and the establishment of written pol

0 views • 29 slides

The Role of the Indian Government in Lowering Tax Deductions for NRIs

The Indian government assumes a crucial role in enabling reduced tax deductions for Non-Resident Indians (NRIs). By implementing diverse policies and initiatives, it strives to entice investments from NRIs while ensuring equitable taxation. These endeavors encompass tax treaties, specific provisions

0 views • 11 slides

Understanding Standard Form and Numbers Conversion

Explore the concept of standard form, learn how to write numbers concisely, and practice converting numbers to and from standard form through helpful examples and exercises. Enhance your skills in dealing with big and small numbers efficiently.

2 views • 16 slides

Solving Money Problems with Arithmetic

This chapter focuses on applied arithmetic concepts such as calculating mark-up, margin, compound interest, income tax, and net pay. It covers topics like percentages, income, deductions, and income tax rates in Ireland. Detailed examples on calculating tax payable, deductions, and net pay are provi

0 views • 12 slides

Standard Costing: Understanding Variances in Actual vs. Budgeted Costs

Explore the concept of standard costs, variance analysis, and the importance of investigating variances in actual vs. budgeted costs. Learn to calculate and interpret material and labor variances, overhead variances, and participate in a case study to apply learned concepts. Understand the developme

2 views • 52 slides

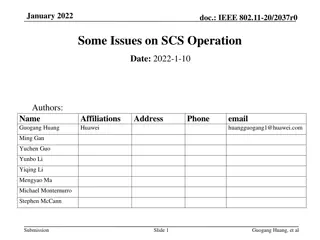

Issues with SCS Operation in IEEE 802.11be Standard

The document discusses technical issues related to the SCS (Spatial Channel Sharing) operation in the IEEE 802.11be standard. It highlights inconsistencies in the standard regarding parameterized QoS requirements, mixing of traffic streams with different QoS needs, and challenges in prioritizing SCS

0 views • 15 slides

Understanding Motion and Measurement of Distances in Science at Sainik School Gopalganj

Explore the concepts of motion and measurement of distances in science as taught by Dr. A.K. Choubey at Sainik School Gopalganj. Discover the development of means of transport, different measurement methods like non-standard and standard measures, the significance of measurement, and the Internation

1 views • 16 slides

Understanding Deductions in Taxation

Explore the essentials of tax deductions in Module 5, including how to calculate taxable income, lower taxable income plus income taxes, differentiate between Standard and Itemized Deductions, select the appropriate deduction for a client's return, and identify expenses covered by Itemized Deduction

0 views • 20 slides

Indian Accounting Standard 2: Inventories Overview

This article provides an overview of Indian Accounting Standard 2 (IAS 2) on inventories. It covers the objectives, scope, definitions, and measurement of inventories at the lower of net realizable value or cost of purchase. The standard applies to all inventories except financial instruments and bi

2 views • 17 slides

Evolution of DICOM Standard for Radiation Therapy

The DICOM Standard has evolved significantly over the years to address the complex needs of radiation therapy in cancer treatment. The 2nd Generation DICOM RT introduces key principles, design approaches, and workflow improvements to enhance efficiency and safety in radiotherapy. Stakeholders in the

0 views • 26 slides

Understanding Standard Deviation, Variance, and Z-Scores

Explore the importance of variation in interpreting data distributions, learn how to calculate standard deviation, understand z-scores, and become familiar with Greek letters for mean and standard deviation. Discover the significance of standard deviation in statistical analysis and the difference b

1 views • 18 slides

Understanding the Standard Normal Distribution in Statistics

Exploring the significance of normal distributions in statistics, this lesson covers the 68-95-99.7 rule, using Table A to find probabilities and z-scores, properties of normal curves, and the standard normal distribution. Key concepts include the mean, standard deviation, and how to standardize var

4 views • 9 slides

Understanding Normal Distribution in Probability

Explore the properties and characteristics of the normal distribution, including the mode, symmetry, inflection points, and the standard normal distribution. Learn how to use standard normal tables to find probabilities and areas under the curve. Practice using examples to calculate probabilities ba

1 views • 35 slides

Workplace Exposure Standard for Silica Dust in Stone Benchtop Fabrication

Reduction in workplace exposure standard for respirable crystalline silica dust has been implemented, halving the national standard to 0.05 mg/m3. The new standard aims to protect workers in stone benchtop fabrication businesses from serious lung diseases caused by breathing in silica dust. Employer

1 views • 8 slides

Health and Disability Services Standard NZS 8134:2021 Update Overview

The session discusses the updated Health and Disability Services Standard NZS 8134:2021, highlighting changes from the 2008 edition, implementation details, and criteria application. The standard aims to enhance service quality and features key sections addressing rights, workforce, wellbeing pathwa

5 views • 20 slides

Impact of 2018 Tax Act: Key Changes Explained

Explore how the new 2018 tax act impacts taxpayers, including changes to deductions, tax brackets, and the SALT deduction. Learn about the standard deduction increase, personal exemptions elimination, new tax brackets, and more insights from a CPA.

0 views • 34 slides

Understanding Payslips and Overtime Calculations

Explore the world of payslips and overtime calculations with examples involving basic pay, overtime rates, gross pay, and net pay. Follow along as we calculate earnings for different scenarios like Joe the worker, Mark the joiner, Louise the admin assistant, and Zoe the nursery nurse. Understand how

0 views • 11 slides

Arizona Health Care Cost Updates Effective 04/01/2018

In these updates shared by Tara Lockner, the Deputy Assistant Director at the Programs Division of Member Services, changes regarding Share of Cost (SOC) deductions in medical expenses are highlighted. The proposed modifications will now allow SOC deductions for medical services that would have been

1 views • 6 slides

Understanding Income Tax Issues in the Ratemaking Process

This content explores various aspects related to income tax issues in the ratemaking process, including Accumulated Deferred Income Taxes (ADIT), Net Operating Losses (NOLs), Tax Normalization, Repair Deductions, and more. It provides insights on how ADIT is calculated, the significance of NOLs, dif

0 views • 24 slides

Linking BIM and GIS Standard Ontologies with Linked Data

Introduction to the need for seamless data interpretation between Building Information Model (BIM) and Geographic Information System (GIS), focusing on aligning BIM and GIS standard ontologies for semantic interoperability. Addressing the challenges of data interoperability layers and the characteri

0 views • 15 slides

Understanding Guardianship Fees and Participation Under Medicaid

This session delves into how DSHS utilizes Medicaid State Plan and Home & Community-Based Waiver rules for deductions related to guardianship fees. Topics covered include personal needs allowance arrangements, cost of care rules, participation distinctions, and specific guidelines for deductions. A

0 views • 67 slides

Comparing Before-Tax and After-Tax Deductions in Paychecks

Exploring the differences between before-tax and after-tax deductions in January and February paychecks, highlighting deductions with double premium amounts. Visual comparisons and analysis help understand the financial impact on income.

0 views • 10 slides

Tax Rates and Standard Deductions for Different Filing Statuses

This content provides information on tax rates and standard deductions for various filing statuses for tax years 2010 and 2011. It includes details on taxable income brackets and corresponding tax rates for single filers, all filers, and married filing jointly, along with standard deductions for dif

0 views • 10 slides

Basic Educational Series on Income Tax: Salaries and Income from House Property

This educational series covers the essentials of income tax related to salaries and income from house property. It delves into topics like charging sections, definitions, deductions, and responsibilities in employer-employee relationships. The content explains the basis of charge, annual value, admi

0 views • 43 slides

Understanding Gross Receipts Taxation for Health Care Practitioners in New Mexico

New Mexico imposes gross receipts tax on individuals and businesses conducting business in the state. This presentation discusses the basic principles of the tax, exemptions for non-profits, and deductions available for health care practitioners. It outlines the specific deductions under Sections 7-

0 views • 10 slides

Arithmetic II Practice Questions Solutions

In this set of practice questions, various scenarios involving income tax calculations are discussed and solved step-by-step. The examples cover different income levels, tax rates, tax credits, and standard rate cut-off points. From calculating gross tax to determining the tax paid and net income af

0 views • 34 slides

Money Management in Applied Arithmetic

This chapter focuses on practical applications of arithmetic related to money, including solving problems involving mark-up, margin, compound interest, income tax, and net pay calculations. Topics covered include percentages, income and deductions, income tax rates, and example scenarios to calculat

0 views • 12 slides

Physical Education Grading Policy and Procedures at CDHS

Physical Education at CDHS follows a detailed grading policy where each class is worth 10 points. Points are earned based on participation, effort, behavior, and adherence to rules. Deductions can occur for violations such as tardiness, inappropriate behavior, lack of participation, and disrespect o

0 views • 22 slides

Understanding IRC 280E in the Cannabis Industry

Explore the implications of IRC 280E on cannabis businesses, highlighting tax practitioner considerations, deductions limitations, and the history behind the enactment of this tax code. Learn about the impact of federal and state laws on deductions for businesses involved in the sale of controlled s

0 views • 19 slides

Aerobic Gymnastics Competition Guidelines and Rules

The guidelines for aerobic gymnastics competitions include compulsory elements, categories, competition spaces, deductions, and specific rules for different age groups. The competitions have specific parameters for elements allowed, lifting, floor elements, music length, maximum difficulty elements,

0 views • 17 slides

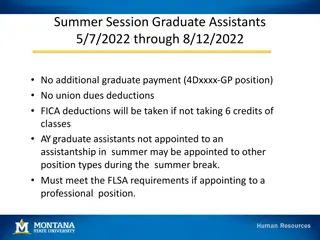

Guidelines for Summer Session Graduate Assistants 2022

Detailed guidelines for Summer Session Graduate Assistants from May 7, 2022, to August 12, 2022, regarding payment, deductions, appointment types, payroll dates, and EPAF instructions for teaching and research positions. The document also covers information on student workers during the summer sessi

0 views • 5 slides

Understanding Standard Molar Enthalpies of Formation

Formation reactions involve substances being created from elements in their standard states, with the enthalpy change known as the standard molar enthalpy of formation (Hf). This enthalpy represents the energy released or absorbed when one mole of a compound is formed from its elements in their stan

0 views • 13 slides

Rainbow-Inclusive Workplaces Standard: Promoting Diversity in Employment

The Rainbow-Inclusive Workplaces Standard (NZS 8200:2015) is a groundbreaking initiative in New Zealand, setting guidelines for organizations to create inclusive and safe workplaces for individuals of diverse sexual orientations and gender identities. The standard aims to address discrimination and

0 views • 30 slides

Understanding Standard Deviation and Standard Error of the Means

Standard deviation measures the variability or spread of measurements in a data set, while standard error of the means quantifies the precision of the mean of a set of means from replicated experiments. Variability is indicated by the range of data values, with low standard deviation corresponding t

0 views • 7 slides

Understanding Work-from-Home Expense Deductions for Employees in the 2022-23 Financial Year

Explore the revised fixed cost method and actual cost method for claiming work-from-home expenses as a typical employee in the 2022-23 financial year. Learn about eligibility criteria, claimable expenses, calculation methods, necessary records to keep, and more. Take advantage of deductions while fu

0 views • 14 slides