DEPARTMENT OF HEALTH AND SOCIAL SERVICES

An overview of the benchmark trend in health care spending in Delaware for the year 2021. It includes data collected from various sources and highlights changes in total health care expenditures, COVID-19 relief payments, per capita spending, quality benchmarks, and more.

5 views • 14 slides

How We Hooked Big-Spending Whales for a Cruise Line

Curious about how a cruise brand reeled in big-spending customers for direct bookings? Discover how we navigated through data chaos to unlock insights and propel growth.

2 views • 6 slides

2024 Health Benefits Enrollment Information for Commonwealth of Virginia

The 2024 Open Enrollment for Health Benefits and Flexible Spending Accounts in the Commonwealth of Virginia is scheduled from May 1 to May 15. This period allows individuals to make decisions regarding health plans, flexible spending accounts, and other benefit options. Changes made during this time

0 views • 39 slides

Get pr newswire Coverage Without Spending a Fortune in US

Our PDF document, \"Get PR Newswire Coverage Without Spending a Fortune in US,\" serves as a comprehensive guide to affordable PR solutions for businesses. This document covers key topics such as the importance of press release distribution, the benefits of leveraging PR Newswire, and strategies for

1 views • 13 slides

Get pr newswire Coverage Without Spending a Fortune in US

Our PowerPoint presentation titled \"Get PR Newswire Coverage Without Spending a Fortune in US\" offers valuable insights into affordable solutions for press release distribution. With a focus on maximizing visibility and reach without breaking the bank, this presentation provides practical tips, ca

0 views • 13 slides

How much healthcare spending is expected to grow in the US?

The CMS Office of the Actuary predicts US health spending to reach a staggering $7.7 trillion by 2032, up from $4.8 trillion in 2023 (7.5% annual growth).

2 views • 6 slides

Reaganomics Impact on Income Disparities and Economic Policies

Reaganomics, introduced during the 1980s by President Reagan, aimed to address economic challenges through tax cuts, decreased social spending, increased military spending, and deregulation. While the top tax rates were significantly reduced, disparities emerged as lower and middle-income groups fac

1 views • 20 slides

Principles Governing Public Expenditure: Canons of Public Spending

Public expenditure refers to expenses incurred by government authorities for maintaining governance and societal well-being. The canons of public expenditure guide governmental spending by emphasizing social benefits, efficiency, proper sanctioning, and fiscal prudence to avoid deficits.

3 views • 26 slides

2022 Tusla-Funded Family Support Services Spending Review

The Spending Review 2022 focuses on tracking and assessing Tusla's investments in Family Support Services (FSS) and its collaboration with the Community & Voluntary sector. Key findings include an 18.6% increase in total FSS spend from 2018-2021, with notable growth in funding for C&V sector FSS. Th

0 views • 6 slides

Understanding Taxes and Government Spending: A Comprehensive Overview

This comprehensive overview delves into the fundamental concepts of taxes and government spending. It covers topics such as the definition of taxes, the power of Congress to tax, limits on taxation, tax structures, characteristics of a good tax, and the burden of taxes. Exploring these concepts prov

1 views • 29 slides

Insights on Borrowing and Spending Among the Economically Vulnerable

Discussion by David Low from CFPB on consumer finance challenges, borrower behaviors regarding borrowing and repayment, and the impact of overdraft fees on financial inclusion. Key insights on payday loans, borrower amortization, and daily spending modeling are explored. Recommendations are made to

0 views • 13 slides

Evidence-Based Public Investment Prioritization for Rwanda's Inclusive Agricultural Transformation

Explore the contributions of public spending on agriculture in Rwanda to economic growth, employment, poverty reduction, and diet quality improvements under the PSTA 4 allocations. Understand the impact of different types of investments on development outcomes, and identify opportunities for optimiz

0 views • 23 slides

Importance of Moderation in Spending and Consumption

The content emphasizes the significance of moderation in spending, as highlighted by a Noble Hadith, encouraging controlled spending and rationalized consumption. It warns against extravagance and advocates for balanced use of resources. By practicing moderation in food, drink, and clothing, individ

2 views • 19 slides

Save Money on Healthcare Costs and Take Control of Your Finances

Understand your out-of-pocket healthcare costs, learn how to calculate FSA tax savings, identify qualified expenses, and access resources to manage healthcare finances effectively. Explore the benefits of a Flexible Spending Account (FSA) to save money on eligible medical, dental, and vision expense

0 views • 13 slides

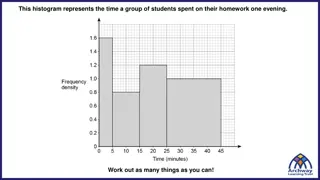

Analysis of Students' Homework Time Distribution

The histogram illustrates the time distribution of students spent on homework. The analysis includes determining the number of participants, proportion spending less than 5 minutes, percentage spending more than 30 minutes, mean time estimation, modal class identification, interquartile range calcul

0 views • 8 slides

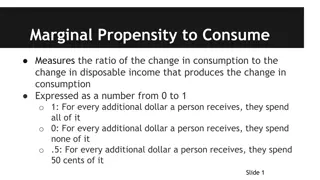

Understanding Marginal Propensity to Consume and Save

Marginal Propensity to Consume (MPC) and Marginal Propensity to Save (MPS) measure the ratios of change in consumption and saving to change in disposable income respectively. The relationship between MPC and MPS shows that they equal 1 when combined, with the remainder being saved. The multiplier ef

7 views • 5 slides

Behavioral Life-Cycle of Saving and Spending in Finance

Explore the behavioral aspects of saving and spending in the life-cycle theory of finance. Learn how individuals reconcile conflicts between saving and spending desires through mental accounting, self-control, and framing. Discover the various sources and uses of spending, including luxury items and

0 views • 18 slides

Updates on Tourism Electronic Card Transactions (TECTs) and Spending Trends

Changes to the Tourism Electronic Card Transactions (TECTs) have been made, including the reinstatement of the international category and implementation adjustments for domestic spend. The Australian market has been split out within the international category. Caution is advised when interpreting TE

0 views • 10 slides

Overview of American Rescue Plan Act Implementation at Niagara Falls City School District

The Niagara Falls City School District is prioritizing the health and safety of students and staff through the utilization of American Rescue Plan (ARP) funds. The Superintendent, in coordination with various stakeholders, is ensuring a safe return to in-person instruction and continuity of services

0 views • 21 slides

Managing Finances in the United States: Creating a Spending Plan

Explore the importance of creating a spending plan to cover basic living needs, care for family, purchase desired items, and manage financial obligations or debts. Learn about different types of expenses, frequency of occurrence, and how to start creating a personalized spending plan based on your i

0 views • 14 slides

Financial Overview of IARC-ERDC Spending and Project Plan by Michael Geelhoed

Delve into the detailed breakdown of spending, challenges, progress, and future steps outlined in the IARC-ERDC Spending and Project Plan presented by Michael Geelhoed. The plan includes cost allocations for various components like RF Coupler, SRF Gun, Cryostat, and more, as well as projections and

0 views • 5 slides

Overview of U.S. Prescription Drug Spending and Medicare Part D

U.S. prescription drug spending data from 2005 to 2025 shows trends in various payer contributions, with predictions for future years. Medicare Part D's drug spending is broken down, revealing top drugs and rebate percentages. The total Medicare spending in 2015 and average annual growth in Medicare

0 views • 10 slides

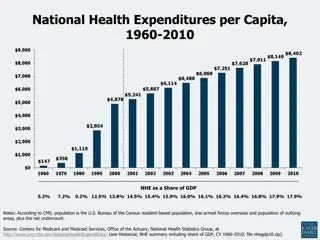

Overview of U.S. Health Care Expenditure Trends

Analysis of U.S. health care expenditure trends from 1960 to 2010, including per capita spending, share of GDP, concentration of spending in different income brackets, growth rates compared to GDP, and impact of cost on access to care. Data reveals the increasing financial burden on individuals, dis

0 views • 6 slides

Proposed Equipment Acquisition Plan FY2012 Overview

The Proposed Equipment Acquisition Plan FY2012 for the Finance Department covers three main components: Rolling Stock Equipment, Technology Investment Plan, and Other Equipment Acquisitions. This plan outlines the funding sources, appropriations for FY12, and the process for creating the Rolling Sto

0 views • 11 slides

Municipality 2015 Financial Plan Overview

The 2015 financial plan for municipalities involved discussions, resolutions, and increases in property taxes, user rates, and specific service areas. The plan also detailed revenue increases, fund allocations, expense reallocations, and discretionary spending for various projects. Key focus areas i

0 views • 9 slides

Maryland Pandemic Relief Spending Summary May 2021

Maryland Department of Budget & Management's report reveals a pandemic relief spending of over $60 billion, comprising Federal Non-Grant Funding of $36.2 billion and Federal Grant Funding of $23.8 billion. The funds were allocated for various purposes such as state tax relief, state grant funding, a

0 views • 16 slides

Wheatland-Chili's Federal COVID Relief Funds Spending Plan

Wheatland-Chili School District has outlined its spending plan for Federal COVID relief funds, including details on CRRSA and ARP allocations. The plan focuses on addressing various needs such as COVID safety measures, educational resources and support, staff professional development, mental health

0 views • 30 slides

Integrating Spending Reviews into the Budget Cycle: Best Practices and Recommendations

To integrate spending reviews effectively into the budget cycle, align the process with the budget calendar, ensure consistency with medium-term frameworks, and incorporate outcomes into budget decisions. Countries like Australia, the UK, Ukraine, Italy, and Slovakia have institutionalized spending

0 views • 11 slides

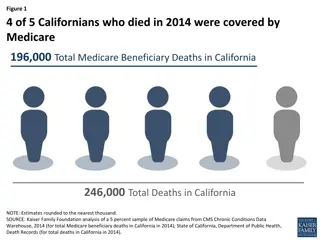

Medicare Trends in End-of-Life Care for Californians

Californians who died in 2014 were analyzed in terms of Medicare coverage, spending at the end of life, and hospice care utilization. The data shows a decrease in the share of total Medicare spending, variations in spending with age, and an increase in hospice use and spending over the years. Furthe

0 views • 6 slides

Amended Spending Plan and Grant Application for ESSER III 2021-2024

The spending plan and grant application for the ESSER III program spanning from 2021 to 2024 at Bremond ISD includes prioritizing mental health support for students and staff, addressing school operations, and facilities needs. Extensive data analysis and input from various stakeholders were used to

0 views • 14 slides

Understanding Government Tools for Economic Stability

The government uses fiscal and monetary policies to stabilize the economy. Fiscal policy involves Congress's actions through government spending or taxation changes, while monetary policy is driven by the Federal Reserve Bank. Discretionary fiscal policy involves new bills designed to adjust aggrega

0 views • 36 slides

Comprehensive Overview of Medical Spending Accounts for 2024

Explore the details of Medical Spending Accounts (MSA) and Limited-use Medical Spending Accounts for the year 2024, including eligibility, contribution limits, eligible expenses, carryover options, deadlines, and administration fees. Learn how these accounts can help you manage your healthcare expen

0 views • 9 slides

Budget 2023 Summary: Political, Economic, and Fiscal Highlights

The Budget 2023 by Craig Renney in May covers a range of critical areas including Political Background, Economic Outlook, Fiscal Outlook, and Spending Highlights. It reflects the challenges faced by the government amidst an impending election and economic uncertainties. The economic forecast is more

0 views • 11 slides

ctcLink Steering Committee Peer Review Discussion & Recommendation for Gate 2 Implementation

Discussion and recommendation report for the ctcLink Steering Committee regarding Gate 2 implementation, including milestones, peer review participants, and peer evaluation rubrics summarizing the project deliverables' ratings on various aspects such as project charter, resource plan, schedule, OCM

0 views • 16 slides

Cancer Types Spending in Europe

Learn about the spending on various types of cancer in Europe including breast cancer, colorectal cancer, prostate cancer, lung cancer, ovary cancer, and pancreatic cancer. The information is based on the Comparator Report on Cancer in Europe 2019, which covers disease burden, costs, and access to m

2 views • 7 slides

Sustainable Health Care Cost Growth Trends in Oregon, 2020-2021

The Sustainable Health Care Cost Growth Target Program in Oregon aims to regulate the annual per person growth rate of total health care spending. Reports show a 3.5% increase in total health care expenditures per person in 2020-2021. The link between Medicaid enrollment and spending is highlighted,

0 views • 31 slides

Flexible Spending Account Options for 2024

Explore the various Flexible Spending Account options available for 2024, including Medical Spending Account, Limited-use Medical Spending Account, Dependent Care Spending Account, and Pretax Group Insurance Premium feature. Learn about contribution limits, reimbursement deadlines, and enrollment re

0 views • 9 slides

Future Health Spending Trends in Latin America

The content explores the increasing public spending on social sectors, particularly health, in countries like Brazil, Chile, and Mexico. It discusses the growth in health expenditure since 1995 and predicts future trends in health spending based on economic development. The analysis highlights the i

0 views • 17 slides

MoneyPlus Insurance Benefits Training Overview

This overview provides information about the MoneyPlus insurance benefits training for 2024, including details about the IRS Section 125 Plan, flexible spending accounts, enrollment process, and qualified status changes. The content highlights how employees can save money on eligible medical and dep

0 views • 21 slides

Analysis of Solar Energy Program Spending and State Allocation Trends

This analysis delves into the spending patterns of state energy programs on solar initiatives, particularly under the American Recovery and Reinvestment Act. It explores the amount of funding invested in solar projects, identifies the top states allocating funds to solar energy, and assesses the ava

0 views • 13 slides