Behavioral Life-Cycle of Saving and Spending in Finance

Explore the behavioral aspects of saving and spending in the life-cycle theory of finance. Learn how individuals reconcile conflicts between saving and spending desires through mental accounting, self-control, and framing. Discover the various sources and uses of spending, including luxury items and discretionary expenses, within the context of wealth accumulation.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Finance for Normal People Chapter 9: Behavioral life-cycle of saving and spending

Behavioral life-cycle of saving and spending Portfolio theory is about the production of portfolios Life-cycle theory is about accumulation of assets into portfolios and decumulation from them

Behavioral life-cycle of saving and spending 1. Standard life-cycle theory Our sole reason for saving is spending We wants smoothed spending during our life-cycle (More precisely, we want smoothed marginal utility of consumption and leisure during our life-cycle)

Behavioral life-cycle of saving and spending 1. Behavioral life-cycle theory Our reasons for saving consist of wants for the full range of utilitarian, expressive, and emotional benefits of wealth (Wealth owning, rather than spending, also yields expressive and emotional benefits)

Behavioral life-cycle of saving and spending 2. Standard life-cycle theory People need no tools and no help in resolving conflicts between wants for saving and spending

Behavioral life-cycle of saving and spending 2. Behavioral life-cycle theory People reconcile the conflict between wants by: Framing Mental accounting Self-control Public policy also helps reconcile conflicts between wants

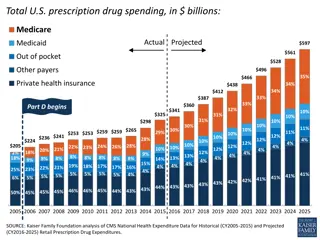

Behavioral life-cycle of saving and spending The spending-sources and spending-uses pyramids

Behavioral life-cycle of saving and spending Figure 9-1a Spending-sources pyramid

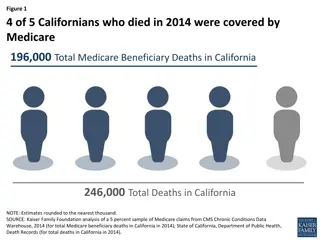

Behavioral life-cycle of saving and spending Figure 9-1b Spending-uses pyramid Major luxury and status items, such as luxury cars and jewelry Discretionary items such as recreation and travel Necessities, such as food and shelter

Behavioral life-cycle of saving and spending Self-control Wants for spending can overwhelm wants for saving when self-control is weak

Behavioral life-cycle of saving and spending Genetics account for approximately 1/3 of differences in saving behavior The effect of parents on their children s saving behavior is strongest when children are in their 20s but disappears by middle age

Behavioral life-cycle of saving and spending Personal Saving Orientation (PSO) is a measure of saving habit People with high PSO tend to agree with statements such as: Putting money into personal savings is a habit for me I usually save money without having a specific goal in mind People with high PSO find it difficult to break their saving habit

Behavioral life-cycle of saving and spending Self-control Conscientiousness is closely associated with self-control Poverty undermines self-control Self-control is bolstered by commitment

Behavioral life-cycle of saving and spending Evidence about standard and behavioral life-cycle theories The financial advising industry Government saving and spending plans Corporate saving and spending plans Distinctions between capital and income

Behavioral life-cycle of saving and spending Prescriptions of standard and behavioral life-cycle theories Social security Defined-benefit pension plans Defined-contribution retirement saving plans Annuities (and the annuity puzzle) Information about sustainable withdrawals

Behavioral life-cycle of saving and spending Financial literacy Financial comprehension Financial behavior

Behavioral life-cycle of saving and spending Standard and behavioral life-cycle theories in public policy Libertarian hands-off Libertarian-paternalistic nudges (Voluntary) Paternalistic shoves (Mandatory)

Behavioral life-cycle of saving and spending Retirement income for the wealthy, middle-income, and poor Wealthy Steady-middle Precarious middle (low-earners and high-spenders) Poor