Is the U.S Approaching Another Regional Bank Crisis

The U.S. Regional Bank Sector is under scrutiny amid concerns of a potential crisis, notably highlighted by New York Community Bancorp's (NYCB) recent challenges. NYCB's stock hit a 27-year low following revelations of undisclosed credit loss provisions, leading to shareholder lawsuits.

2 views • 7 slides

Capital Structure

An appropriate capital structure aims to maximize shareholder return, minimize financial risk, provide flexibility, ensure debt capacity is not exceeded, and maintain shareholder control. The optimum capital structure achieves a balance of equity and debt to maximize firm value.

1 views • 5 slides

Understanding Piecemeal Distribution of Cash in Partnership Dissolution

Piecemeal distribution of cash in partnership dissolution involves systematically distributing cash over stages as assets are realized and liabilities settled. Realization expenses, contingent liabilities, outside liabilities, partners' loans, and partners' capitals are settled in a specific order.

0 views • 6 slides

Rights and Liabilities of Minors in Partnership according to Sec. 30 by Dr. Satyendra Kumar Singh

Minors can be admitted to the benefits of partnership with the consent of all partners. They have rights to share property and profits, access firm accounts, and sue for accounts. However, minors have liabilities and limitations in partnership, where their share is initially liable for firm acts but

0 views • 9 slides

Introduction to Principles of Accounts Level 1: Basics of Accounting and Bookkeeping

Understanding the fundamentals of accounting including bookkeeping, classification of data, users of accounting information, assets, liabilities, and capital. Practice exercises to classify items and review concepts of assets, liabilities, and equity.

0 views • 24 slides

Accounting for Foreign Branches: Converting Trial Balances and Exchange Rates

A foreign branch maintains its accounts in a foreign currency, requiring the head office to convert the trial balance into its own currency before finalizing accounts. Fixed and fluctuating exchange rates impact the conversion process, with specific rules for fixed assets, liabilities, and current a

0 views • 7 slides

FPC Annual General Meeting & Shareholder Information Session Summary

The FPC Annual General Meeting featured introductory remarks by Chairman Mr. Michael Gallagher, followed by formal business resolutions and a shareholder information session by Mr. Angus Geddes. Key resolutions included the adoption of the Remuneration Report and the re-election of Director Mr. Mich

0 views • 26 slides

Understanding Dividend Policy and Share Repurchase in Corporate Finance

Firms in corporate finance make decisions on dividend payouts and share repurchases, impacting company value and shareholder returns. Dividends are payments to shareholders, while share repurchases involve buying back company stock. Companies can choose between these methods based on various factors

1 views • 29 slides

Understanding IAS 39: Financial Instruments Recognition and Measurement

This content provides an overview of an IFRS seminar on IAS 39, focusing on key concepts such as the classification and measurement of financial assets, impairment, reclassification, and more. It covers definitions of financial instruments, financial assets, equity instruments, and financial liabili

1 views • 43 slides

Understanding Provisions, Contingent Liabilities, and Assets in Accounting

This content covers the concept of provisions, contingent liabilities, and contingent assets in accounting, highlighting the criteria for recognizing a liability as a provision. It explains the types of obligations, the importance of a reliable estimate, and specific applications such as onerous con

0 views • 13 slides

Working Capital and Current Ratio in Accounting

Understanding indicators like net current assets (working capital) and current ratio is crucial in accounting. Net current assets reflect the ability to settle current liabilities and the capital required for operational functions. Managing working capital effectively involves factors like stock man

0 views • 12 slides

Guide to Filling Out Parent's Financial Statement Section 4: Assets and Liabilities

Learn how to accurately complete Section 4 - Assets and Liabilities of the Parent's Financial Statement. This section covers details on rental payments, homeownership information, bank accounts, investments, retirement savings, and education funds. Follow the instructions provided to showcase the fa

0 views • 8 slides

Sustainability in Supply Chain Management: Key Considerations and Benefits

Sustainable supply chain management is crucial for meeting sustainability criteria while staying competitive and addressing customer needs. It encompasses activities from raw materials to end-users, impacting aspects like product design, recycling, risk management, and shareholder value. By promotin

0 views • 20 slides

Practical Tips for ESG Litigation Strategies: Claimants and Defendants

Learn about constructing effective ESG litigation strategies with practical tips for both claimants and defendants. Explore topics such as what ESG litigation entails, jurisdiction issues, and examples of ESG litigation cases. Understand the formats for group actions and shareholder actions, along w

0 views • 14 slides

Union Stewardship in Shareholder Engagement

Janet Williamson, TUC Senior Policy Officer and Trustee of the TUC Pension Fund, emphasizes the importance of stewardship in public debate and policy. The Stewardship Code principles include public disclosure, conflict management, monitoring investee companies, and collective action. Increased union

0 views • 13 slides

Understanding Liabilities of Directors under Companies Act, 2013

Director's liabilities under the Companies Act, 2013 include definitions of directors, shadow directors, officers, and those in default. Responsibility for default and potential prosecutions for wrongful actions are discussed. Changes in definitions and concepts are highlighted to illustrate the leg

0 views • 37 slides

Understanding Final Accounts: Key Concepts and Definitions

Explore the essential key words related to final accounts such as Debtors, Creditors, Assets, Liabilities, Fixed Assets, Current Assets, Current Liabilities, Long-term Liabilities, Purchases, Sales, and Gains. These images provide a visual representation of the concepts to help you grasp the fundame

0 views • 12 slides

Understanding Net Worth: Integers and Financial Assets

Learn about net worth, liabilities, and assets by exploring how integers are used to determine the financial standing of individuals. Discover the concepts of liabilities, responsibilities, and assets through real-life examples of notable personalities. Dive into calculations and understand how net

0 views • 18 slides

Recent Developments in Shareholder Claims and Legal Issues

Explore the latest insights on shareholder claims and legal issues in the banking and financial services sector, including significant litigation cases and key considerations regarding causes of action, reflective loss, procedural routes, and privilege challenges. Stay informed about important judgm

1 views • 86 slides

Legal Provisions Regarding Affidavits and Liabilities in Financial Matters

The ARAA 2003 mandates that all plights must be supported by affidavits and payment of court fees. Affidavits are considered substantive evidence in court proceedings, allowing for judgment without witness deposition. Financial liabilities for mortgagees and guarantors are joint and several, with a

0 views • 14 slides

Legal Rights and Obligations Regarding Shareholder Meetings

This content discusses the rights and obligations related to shareholder meetings in a legal context. It covers topics such as the chairman's authority to call special meetings, shareholders' voting rights, and the secretary's obligation to provide notice for meetings. The comparison between optiona

0 views • 28 slides

Understanding Reformulated Balance Sheets in Financial Analysis

Reformulated balance sheets in financial analysis involve categorizing assets and liabilities into operating and financial components for a more detailed credit analysis. This process helps differentiate between assets and liabilities used in business operations versus financing activities, providin

0 views • 17 slides

Liability of the Mediator in Mediation Processes: A Comparative Perspective

Exploring the liability aspects of mediators in various jurisdictions, this academic session discusses different types of liabilities, submitting liability claims, and scenarios where mediators may face liability issues. It delves into contractual, tortious, and criminal liabilities, examining the n

0 views • 11 slides

Understanding Directors and Officers Liability Insurance

Explore the intricacies of Directors and Officers Liability Insurance, including coverage scope, directors' duties, potential liabilities, recent cases, and Employment Practices Liability. Learn about the evolution of D&O insurance, claims trends, and premium trends. Understand wrongful acts, Compan

0 views • 21 slides

Maximizing Shareholder Value Creation Through Strategic Business Practices

Explore the concept of shareholder value creation, the importance of generating revenues exceeding economic costs, and meeting shareholders' expectations. Learn about Economic Value Added (EVA), key value drivers, aligning strategy with value creation, and essential factors for overall business succ

0 views • 11 slides

Overview of Limited Liability Companies under Polish Company Law

Explore the legal aspects of limited liability companies under the Polish Commercial Companies Code, detailing formation, share capital requirements, shareholder liabilities, and powers granted to these entities. Learn about the two main types of companies in Polish law, their characteristics, and k

0 views • 13 slides

Rethinking Firm Governance Through Property Rights and Stakeholder Theory

Challenging the traditional shareholder-centric view, this study explores how property rights theory and stakeholder theory can offer a more comprehensive perspective on firm governance. It delves into the complexities of value creation, contractual relationships, and diverse stakeholder interests,

0 views • 10 slides

Understanding the New Jersey Oppressed Shareholder Statute

The New Jersey Oppressed Shareholder Statute, N.J.S.A. 14A:12-7, outlines the grounds for oppression in a corporation and the process for a buyout. It allows the Superior Court to appoint a custodian, provisional director, order stock sale, or dissolve the company. Key provisions include shareholder

0 views • 12 slides

India Fellowship Seminar on Participating vs. Non-participating Products

The seminar delved into the role of participating and non-participating insurance products in premium growth, risk management, and creating shareholder value in the long term. It discussed market trends, historical data, and key drivers influencing shareholder value in the Indian insurance industry.

0 views • 21 slides

Overview of Redomiciliation Transactions and Section 7874 Implications

Section 7874 imposes restrictions on domestic corporations becoming owned by foreign entities with the same or similar shareholder base. It outlines tests triggering adverse consequences and discusses self-inversion transactions, tax considerations, and cross-border combinations. Notably, substantia

0 views • 8 slides

Understanding the Role and Liabilities of Promoters in Company Formation

Promotion in the formation of a company involves the initial groundwork by a promoter, who assembles funds, property, and managerial expertise. Promoters have a fiduciary duty towards the company and original shareholders, necessitating full disclosure of all material facts. They can be held liable

0 views • 20 slides

Understanding Financial Instruments in IFRS: Key Concepts and Overview

This content provides an overview of financial instruments under IFRS, focusing on their classification as assets, liabilities, or equity. It explains the presentation of compound financial instruments and outlines key concepts related to financial assets, financial liabilities, and equity instrumen

0 views • 28 slides

Understanding Best Practices for Managing Personnel Files

Benjamin P. Glass, a Shareholder at Ogletree, Deakins, shares insights on the purpose, contents, confidentiality, and liabilities associated with personnel files. He emphasizes best practices to mitigate risks and maintain compliance with employment laws.

1 views • 16 slides

Understanding Dividend Policy in Financial Management

Dividend policy plays a critical role in balancing long-term financing and shareholder wealth. It involves determining the distribution of profits among shareholders while retaining earnings for company growth. Approaches like Long Term Financing and Wealth Maximisation influence dividend decisions,

0 views • 24 slides

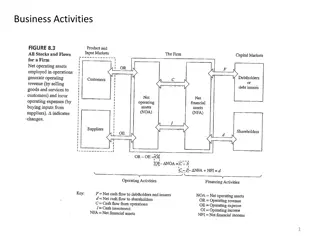

Understanding Balance Sheets and Income Statements in Financial Reporting

Balance sheets provide a snapshot of a company's assets, liabilities, and shareholders' equity at a specific point in time, with assets listed on the left and liabilities and equity on the right. Current assets are those expected to be converted into cash within a year, while non-current assets are

0 views • 34 slides

Understanding Debt Capital in Chapter 8 of Accounting for Managers

Explore the concept of debt capital and liabilities in Chapter 8 of Accounting for Managers by Professor Zhou Ning from Beihang University. Learn about the nature of liabilities, legal obligations, contingencies, and levels of likelihood in financial reporting. Discover how to differentiate between

0 views • 21 slides

Managing Corporate Finance: Insights from Fiji Institute of Accountants Symposium

Explore how companies organize corporate finance, including new provisions regarding shares, liabilities of members, and winding up processes as discussed by Peter Fulcher at the Fiji Institute of Accountants Symposium on the Companies Act 2015. The presentation delves into important aspects such as

0 views • 54 slides

Understanding Balance Sheets in Financial Management

A balance sheet is a crucial financial statement that reflects the assets, liabilities, and owner's equity of a business at a specific point in time. It provides a snapshot of the financial health of a company, helping stakeholders assess its overall standing. Assets are items of value owned by the

0 views • 9 slides

India Fellowship Seminar: Product Contributions to Growth, Risk Management, and Shareholder Value

India Fellowship Seminar discussed the contributions of participating and non-participating products to premium growth, risk management, and shareholder value. Key topics included market trends, drivers of shareholder value, PAR vs NPAR attractions, creating shareholder value, and risk management st

0 views • 21 slides

Understanding Corporate Governance: Principles, Objectives, and Duties

Corporate governance is a system of principles and practices used to manage conflicts of interest in corporations. It ensures managers act in the best interest of shareholders. Key aspects include objectives to mitigate conflicts, ensure efficient asset use, and common sources of conflict like manag

0 views • 10 slides