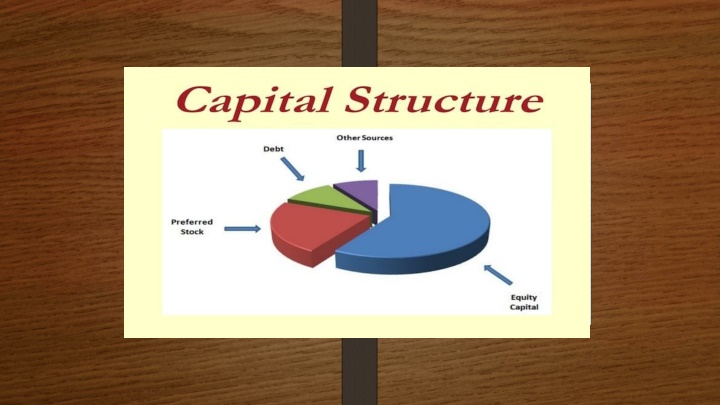

Capital Structure

An appropriate capital structure aims to maximize shareholder return, minimize financial risk, provide flexibility, ensure debt capacity is not exceeded, and maintain shareholder control. The optimum capital structure achieves a balance of equity and debt to maximize firm value.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Features of an Appropriate Features of an Appropriate Capital Structure Capital Structure While developing an appropriate capital structure for his company, the financial manager should aim at maximizing the long-term market price of equity shares. An appropriate capital structure should have the following features- Return-The capital structure of the company should give maximum return to the shareholders. Within the constraints, maximum use of the leverage at a minimum cost should be made, so as to obtain maximum advantage of trading on equity at minimum cost.

Risk-The capital structure should involve minimum risk of financial insolvency. The use of excessive debt threatens the solvency of the company. Since, use of debt adds to the risk of the company and shareholders, it should be used cautiously with equity. Flexibility-The company should be able to change the proportion of debt and equity in the capital structure, if required depending on changing conditions. The capital structure should be flexible to meet the changing conditions. It should also be possible for the company to provide funds whenever needed to finance its profitable activities.

Capacity-The company should have capacity to pay the fixed periodic charges and the installments of principal sum. The debt capacity of the company should not be exceeded. The debt capacity of a company depends on its ability to generate cash flows. Control-The capital structure should not involve loss of control of the shareholders. If there is too much debt, then shareholders are likely to loss control to debenture holders.

Optimum Capital Structure Optimum Capital Structure One of the basic objective of financial management is to maximize the value or wealth of the firm. Capital structure is optimum, where the firm has a combination of equity and debt, so that the wealth of the firm is maximum. At this level, cost of capital is minimum and market price per share is maximum.