Accounting and Taxation of Securities Organized by Belgaum Branch of ICAI

Explore the accounting treatment and taxation of securities in a seminar organized by the Belgaum branch of ICAI. Learn about various types of securities, their accounting principles, taxation rules, and important points through case studies and insightful discussions led by CA Kinjal Shah. Gain val

4 views • 74 slides

Lusaka Securities Exchange Q1 2024 Market Performance Overview

The Lusaka Securities Exchange (LuSE) in Q1 2024 witnessed notable market performance with Equity Market Capitalization at K97.76 billion, a 10.20% YTD increase. Quarterly media engagements support market transparency and investor confidence. Sector-wise, Retail Trading leads with 36% market capital

0 views • 18 slides

Demat of Securities -Navigating the Process and Laisoning with RTA

Dematerialization converts physical securities into electronic form, stored in a Demat account managed by a Depository Participant (DP). This process, facilitated by Registrars and Share Transfer Agents (RTAs), ensures streamlined trading and ownership. All public companies and certain private compa

0 views • 4 slides

Dematerialization of Securities -Navigating the Process and Laisoning with RTA

Dematerialization converts physical securities into electronic form, stored in a Demat account managed by a Depository Participant (DP). This process, facilitated by Registrars and Share Transfer Agents (RTAs), ensures streamlined trading and ownership. All public companies and certain private compa

0 views • 4 slides

Securitization – From Relationship to Transaction

Securitization allows originators to convert illiquid assets into marketable securities, offering significant benefits like reduced borrowing costs and diversified funding sources. It provides issuers with flexibility to create securities with distin

0 views • 9 slides

Understanding Mortgage Derivatives and Risk Management

Mortgage derivatives such as Interest Only (IO) and Principal Only (PO) strips, as well as Collateralized Mortgage Obligations (CMOs), offer investors a way to manage risk more precisely than traditional mortgage-backed securities. By allowing control over interest rate and default risks, these soph

0 views • 80 slides

Understanding Primary Market Rights Issue in Securities Market

Rights issue in the primary market allows existing shareholders to purchase additional securities at a discounted price. This presentation covers the overview, types of securities offered, key terms, key documents, application processes, and allotment status. It is intended for educational purposes

0 views • 35 slides

Understanding Valuation of Fixed Income Securities

Explore the valuation process for fixed income securities like bonds with a focus on characteristics, capitalization of cash flows, and bond yields. Learn about the features of fixed income securities and how to calculate their present value based on cash flows and discount rates.

0 views • 9 slides

Overview of Indian Securities Market and SEBI

Explore the Indian Securities Market and the role of SEBI in regulating it. Learn about key concepts such as primary and secondary markets, investor rights, mutual funds, and investor grievance redressal. Understand the structure of the market and the prerequisites for buying and selling shares. Dis

0 views • 56 slides

Understanding the Significance of Capital Market in Finance

Capital Market plays a crucial role in facilitating long-term finance for companies and governments, offering avenues for investors, promoting economic growth, and ensuring stability in securities. It encompasses functions like fund mobilization, capital formation, and technological advancement. Wit

0 views • 11 slides

Accounting Treatment of Casual Incomes and Interest on Securities in Income Tax

This content discusses the accounting treatment of casual incomes and interest on securities in income tax, presented through two problems with solutions. The first problem involves computing income from other sources based on lottery winnings and betting amounts. The second problem deals with calcu

0 views • 13 slides

Understanding Marshalling of Securities in Mortgage Law

Marshalling of Securities, as per Section 81 of the Transfer of Property Act, addresses the scenario where a property owner mortgages properties to different individuals. This doctrine ensures subsequent mortgagees are entitled to have debts satisfied from properties not mortgaged to them while prot

0 views • 20 slides

Understanding Syndicated Mortgage Investments: Key Information and Regulations

Syndicated Mortgage Investments (SMIs) involve multiple lenders participating in a mortgage, with distinctions between Qualified SMIs (QSMIs) and Non-Qualified SMIs (NQSMIs). The presentation covers the definition of SMIs, requirements for QSMIs, registration processes, compliance obligations, and c

0 views • 22 slides

Understanding Dematerialisation in Securities Market

Dematerialisation is the conversion of physical securities into electronic form, making it convenient and secure for investors. This presentation covers the process, prerequisites, and steps involved in dematerialising securities, along with examples of securities that can be dematerialised. It also

1 views • 39 slides

Listing of Securities in Stock Exchange: Requirements and Obligations

Understanding the process of listing securities in a stock exchange involves fulfilling specific conditions before listing, such as offering shares to the public and having a broad-based capital structure. Obligations post-listing include paying annual listing fees, complying with exchange regulatio

1 views • 12 slides

Understanding Buyback of Securities and Open Offer of Shares

Buyback of securities is a corporate action where a company repurchases its own shares from existing shareholders, opposite of a public issue. Common reasons include returning surplus cash to shareholders, improving return on equity, and enhancing earnings per share. Conditions for buy-back include

0 views • 32 slides

Understanding the Importance of Money Markets and Bond Markets

Money markets play a crucial role in the financial system by providing short-term, low-risk, and liquid investment options. Participants include institutional investors and dealers who engage in large transactions. Money market securities have specific characteristics, such as large denominations, l

0 views • 23 slides

Understanding Gas Laws: Boyle's, Charles', Gay-Lussac's, and Avogadro's Laws

Gas laws such as Boyle's Law, Charles' Law, Gay-Lussac's Law, and Avogadro's Law govern the behavior of gases under different conditions. Boyle's Law relates pressure and volume at constant temperature, Charles' Law relates volume and temperature at constant pressure, Gay-Lussac's Law relates pressu

1 views • 19 slides

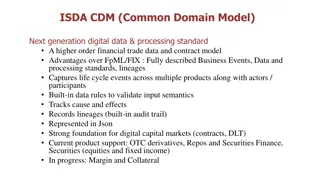

Next Generation Digital Data and Processing Standard in Financial Trade

ISDA CDM (Common Domain Model) presents a higher-order financial trade data and contract model with advantages over FpML/FIX. It offers fully described business events, data, and processing standards, capturing life cycle events across various products along with participants. The model includes bui

0 views • 4 slides

Overview of Indian Capital Market and Financial Institutions

The Indian Capital Market comprises securities market and financial institutions, facilitating the trading of government securities, industrial securities, and providing medium to long-term funds. Financial intermediaries like merchant bankers, mutual funds, and venture capital companies contribute

0 views • 5 slides

Role of Securities Firms and Investment Banks in Financial Markets

Securities firms and investment banks play a vital role in facilitating the transfer of funds between suppliers and users in financial markets with efficiency and low costs. Investment banks assist businesses and governments in raising funds through securities issuance, while securities firms aid in

0 views • 26 slides

Key Changes in Securities Investment Business Law, 2019 for Investment Managers

Amendments to the Securities Investment Business Law in 2019 introduce important changes for Excluded Persons, requiring registration and compliance with regulatory frameworks. Registered Persons face stricter information requests, director appointment rules, and fit and proper person assessments un

0 views • 8 slides

Understanding Capital Market and Its Significance

Capital market refers to the market for long-term finance where financial assets like Shares, Debentures, and Bonds are traded. It plays a vital role in mobilizing funds for companies and governments, facilitating capital formation, and promoting economic growth. The classification includes Industri

0 views • 11 slides

Understanding the Primary Market and Its Functions

The primary market, also known as the new issue market, is where industrial securities are issued for the first time to the public. It plays a crucial role in mobilizing savings and channelizing them for productive purposes. Through processes like IPOs and FPOs, companies raise capital for various n

0 views • 7 slides

Private Placement of Securities: Overview and Methods to Raise Capital

Private placement of securities involves offering securities to a select group of investors by a company, excluding public offering. This presentation covers the meaning of private placement, provisions of law, methods to raise capital through private placement, and understanding the Private Placeme

3 views • 16 slides

Understanding Delta Hedging Techniques in Finance

Explore the concept of delta hedging as a premier technique in finance, illustrated through examples of long and short stock positions, profit curves, and the process of manually hedging a position by counterbalancing price changes with options. Learn how delta hedging helps in determining the right

0 views • 18 slides

Contrasting Legal Systems Around the World

Explore the diverse legal families globally, such as Civil Law (Romano-Germanic) and Common Law (Anglo-American), along with their historical backgrounds, sources of law, and dominant ideologies. Delve into the distinctions between Civil Law and Common Law, their origins, development, and practical

0 views • 17 slides

Overview of Insider Trading Laws and Notorious Cases

Insider trading, involving the trading of securities based on confidential information, is prohibited under various statutes such as Section 10(b) of the Securities Exchange Act of 1934 and SEC Rule 10b-5. The Insider Trading Sanctions Act of 1984 and the Insider Trading and Fraud Act of 1988 provid

0 views • 24 slides

Overview of UK Law: Statute Law, Common Law, Criminal Law, Civil Law

Statute Law is written law created through the parliamentary process, forming the basis of the legal system. Common Law, on the other hand, is unwritten law based on judicial decisions and precedents. They govern different aspects such as civil and criminal matters, each with its unique characterist

0 views • 15 slides

Overview of the Securities and Exchange Board of India (SEBI)

The Securities and Exchange Board of India (SEBI) was established in 1992 to regulate and promote the development of the securities market. SEBI aims to protect investor interests, prevent malpractices, and ensure a fair and transparent market. Through its objectives, SEBI plays a crucial role in re

0 views • 5 slides

The Rise and Fall of Bernard Madoff and His Securities Firm

Bernard Lawrence Madoff, a former prominent figure in high finance, founded Madoff Securities and revolutionized the securities market. However, his firm's success was built on a fraudulent scheme that collapsed in 2008, causing immense losses to investors.

0 views • 20 slides

Understanding Issuer Considerations for Bank Loans in Municipal Finance

Exploring the considerations and challenges faced by issuers and advisors in the realm of bank loans and securities within the municipal finance sector. The discussion covers regulatory structures, terminology, key players, and the differences in regulatory frameworks between loans and securities.

0 views • 19 slides

Understanding Fixed Income Securities: Bonds Overview

Learn about fixed income securities in week 2 of the Fundamentals of Investment course, focusing on bond characteristics, types, and risks. Bonds are vital debt instruments issued by organizations to raise funds, with features like fixed maturity dates and interest rates. Explore various bond types

0 views • 20 slides

The Role and Purpose of Securities and Exchange Board of India (SEBI)

Established in 1988 by the Government of India, Securities and Exchange Board of India (SEBI) plays a crucial role in regulating the securities market. SEBI aims to promote investor protection, ensure fair practices, and facilitate efficient resource mobilization. By monitoring and enforcing regulat

0 views • 15 slides

Classification of Law: Understanding Different Types and Functions

Exploring the classification of law is essential for understanding the diverse nature of legal systems. This overview delves into domestic law vs. public international law, public law vs. private law, and the sub-divisions within public law, such as constitutional, administrative, and criminal law.

0 views • 19 slides

Introduction to Security Types in Financial Markets

This chapter provides an overview of different types of securities traded in financial markets worldwide. It covers classifications of financial assets, including money market instruments, fixed-income securities, equities, futures, and options. The focus is on interest-bearing assets, such as Treas

0 views • 21 slides

Understanding Fixed-Income Securities for Investment

Fixed-income securities offer fixed returns up to a redemption date or indefinitely, comprising long-term debt securities and preferred stocks. These investments involve various risk factors, including default risk. Long-term debt securities, such as bonds, provide a safe asset but require careful c

0 views • 47 slides

Overview of Legal Systems and Roman Law Development

Legal systems play a crucial role in governing societies, with Roman Law, Common Law, Civil Law, and Religious Law being some of the major types worldwide. Roman Law, focusing on private law, has influenced legal traditions in various regions, especially in Europe. Contrasting Common Law and Civil L

0 views • 26 slides

Comprehensive Guide to Global Securities Operations

Explore the world of global securities operations through this detailed guide, covering topics such as course outlines, study plans, exam preparation, taking the exam, securities investment, and ordinary shares. Gain insights into how securities investment firms operate, the role of investment banks

0 views • 102 slides

2-Year LLM Degree Program in Juridical Sciences at JIS University

Explore the 2-year LLM degree program offered by the Department of Juridical Sciences at JIS University, specializing in Corporate Law, Criminal Law, and Constitutional Law. The program covers a range of specializations such as Comparative Criminal Law, Human Rights, Corporate Law, Competition Law,

0 views • 7 slides