Cost Accounting Standards for Determining Transportation Costs

Understanding the importance of transportation costs in procurement and distribution, this guide outlines the standards for determining average costs, separation of transportation costs in accounting records, objectives for maintaining cost uniformity, components of transportation costs, and treatme

0 views • 11 slides

Low Pay Household Estimates in Rural India

Analysis of data from the Periodic Labour Force Survey reveals estimates of households with monthly per capita earnings below a threshold in Rural India. The study, presented by Vasavi Bhatt, focuses on the characteristics of low earnings households and highlights the importance of decent work and i

1 views • 8 slides

Understanding Excess Costs in Special Education

Excess costs in special education refer to additional expenses incurred by Local Educational Agencies to provide services to children with disabilities. These costs go beyond the average per-student expenditure on general education. The calculation of excess costs ensures that federal IDEA Part B fu

0 views • 11 slides

Understanding Economic Development: Concepts and Measures

Economic development goes beyond just economic growth and encompasses social and monetary progress. It involves factors like job creation, technological advancements, standard of living, per capita income, and more. Measurements include GNP, GNP per capita, welfare, and social indicators. Developmen

0 views • 8 slides

Grant Management Flexibility under Horizon 2020 During COVID-19

Grant management under Horizon 2020 during COVID-19 requires maximum flexibility with eligibility of costs incurred, force majeure clause usage, and flexibility in actual personnel costs. Teleworking costs are eligible, and personnel costs can be adjusted for exceptional circumstances. Travel costs

1 views • 12 slides

Understanding Administrative Costs in Grant Management

Administrative costs are essential for managing grants effectively. Learn about the difference between direct and indirect costs, and why tracking and reporting accurately is crucial to avoid disallowed costs. Explore the definition, classification, and significance of administrative costs in grant

0 views • 22 slides

Understanding Global Economic Disparities and Growth Trends

Explore the significant differences in living standards and economic growth rates across countries, from advanced economies like the UK to middle-income nations like Mexico and low-income countries like Mali. Real GDP per capita, life expectancy, literacy rates, and growth data provide insights into

0 views • 27 slides

Understanding Activities Delivery Costs and Program Administrative Costs in CDBG Programs

Exploring the allocation of staff costs between Activities Delivery Costs (ADCs) and Program Administrative Costs (PACs) in Community Development Block Grant (CDBG) programs. ADCs cover non-profit staff expenses for carrying out eligible activities, while PACs include costs for planning, general adm

1 views • 10 slides

Understanding the Costs of Inflation and Its Impact on Purchasing Power

Inflation is a crucial economic phenomenon with both winners and losers. While inflation itself doesn't necessarily reduce real purchasing power, it leads to various costs such as shoeleather costs, menu costs, and unit of account costs. These costs emerge due to the changing dynamics of prices, wag

0 views • 16 slides

Understanding Costs for Defendants in Legal Proceedings

This article provides detailed information on the costs involved for defendants in legal cases, including the starting point for cost allocation, costs at different stages of the legal process, and considerations for recovery of costs. It covers aspects such as costs at the pre-action stage, costs a

2 views • 54 slides

Understanding GDP and Economic Indicators

Evaluating the economy involves analyzing total income per person, comparing revenue and spending, and examining GDP per capita. GDP, a key economic indicator, reflects the total market value of goods and services produced in a country. Rich data sources like World Bank provide insights into various

0 views • 27 slides

Overview of New Civil Procedure Rules on Costs: CPR Parts 58 & 59

The new Civil Procedure Rules (CPR) Parts 58 & 59 introduce changes in the assessment and taxation of costs in legal proceedings. Detailed assessment replaces taxation, standard basis, fixed costs, and more defined, with new definitions and procedures outlined. Order 59 expands the powers to tax cos

0 views • 22 slides

International Economic Indicators Comparison

The data presented includes GDP per capita rankings for various countries in 2015, showcasing the economic status of nations like Qatar, Norway, and the United States. It also illustrates the growth in GDP per capita from 2006 to 2015, with countries like China and India showing significant progress

2 views • 21 slides

Understanding Engineering Costs and Estimation Methods

This informative content delves into the concept of engineering costs and estimations, covering important aspects such as fixed costs, variable costs, semi-variable costs, total costs, average costs, marginal costs, and profit-loss breakeven charts. It provides clear explanations and examples to hel

0 views • 33 slides

Understanding Budget Basics for Comprehensive Budget Development

Components necessary for comprehensive budget development include categories of spending like direct costs, personnel costs, and facilities & administrative costs. Budget construction may vary by sponsor, but a detailed budget is required at submission. Personnel costs cover various types of employe

1 views • 19 slides

Understanding Marginal Costing in Cost Accounting

Marginal Costing is a cost analysis technique that helps management control costs and make informed decisions. It involves dividing total costs into fixed and variable components, with fixed costs remaining constant and variable costs changing per unit of output. In Marginal Costing, only variable c

1 views • 7 slides

CSU Travel Policy: Per Diem Implementation Guidelines

In this detailed guide, learn about the implementation of per diem in CSU Travel Policy, reasons for moving from actuals to per diem, coverage areas, GSA rates, and the benefits of per diem over receipts. Get insights into complying with federal guidelines, avoiding tax implications, and the per die

0 views • 23 slides

Pricing Strategy for Martha's Macadamia Milk Product

Martha's Macadamia Milk product pricing strategy involves analyzing raw nut costs, competition pricing, assumptions for US market pricing, and per carton costs for different variants like Sweetened, Unsweetened, and Chocolate. The strategy includes factors like additional costs, production costs, ma

0 views • 8 slides

Understanding Overhead Costs and Their Importance in Business

Overhead costs play a crucial role in cost allocation and management within an organization. These costs, which include indirect expenses such as labor, materials, and services, cannot be directly linked to specific units of production. Instead, overhead costs are apportioned and absorbed using vari

0 views • 16 slides

Evolution of Public Policies and Income Patterns: Insights from India

Comprehensive analysis of changing intergenerational support for elderly in India from 2004-05 to 2011-12, alongside initiatives like the Unorganized Sector Workers Social Security Act, the National Rural Employment Guarantee Act, and the National Rural Health Mission. The shift in per capita income

0 views • 15 slides

Insights into Retirement Plans in the Regulated Sector

Explore the dynamics of Defined Benefit (DB) and Defined Contribution (DC) retirement plans in the regulated sector, focusing on trends, key considerations, per capita costs, and the complexities of managing DB costs. Learn about the shift from DB to DC plans, derisking strategies, and the impact on

0 views • 20 slides

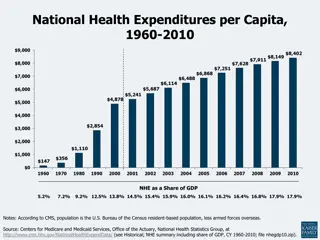

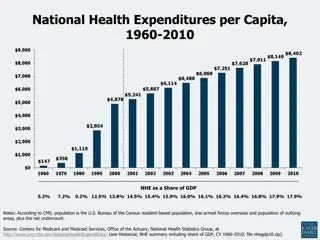

Trends in National Health Expenditures and Care Costs, 1960-2010

National health expenditures per capita and as a share of GDP from 1960 to 2010, along with average annual growth rates, show the evolving landscape of healthcare spending in the U.S. The data reveals changing patterns in healthcare expenditure and outlines the concentration of health care spending

0 views • 20 slides

Overview of U.S. Health Care Expenditure Trends

Analysis of U.S. health care expenditure trends from 1960 to 2010, including per capita spending, share of GDP, concentration of spending in different income brackets, growth rates compared to GDP, and impact of cost on access to care. Data reveals the increasing financial burden on individuals, dis

0 views • 6 slides

Analysis of Police Services Consolidation Potential in Beacon, Fishkill Town, and Fishkill Village

Through extensive research and investigation, a study was conducted to explore the possibility of consolidating police departments in Beacon, Fishkill Town, and Fishkill Village. Recommendations were made to consolidate the Town and Village departments based on operational efficiencies. Crime statis

1 views • 25 slides

The Impact of Retiree Health Costs on Medicare and Medicaid Programs

This content discusses how retiree health costs affect individuals and government programs, specifically focusing on the rising Medicare and Medicaid spending projections. It highlights the challenges posed by out-of-pocket expenses for retirees and the gaps in Medicare coverage that contribute to h

0 views • 11 slides

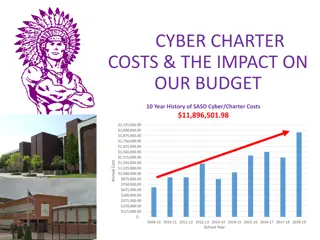

Impact of Cyber/Charter Costs on School Budgets Over 10 Years

The 10-year history of SASD Cyber/Charter Costs reveals a significant increase, with total charter school tuition payments exceeding $2.0 billion in 2018-19 alone. This amount could cover the salaries of 29,700 teachers and surpasses spending on career and technical education programs. The costs ass

0 views • 8 slides

Mean Per Capita Harvest and 95th Percentile Per Capita Use for Fish and Seafood in Alaska

This document provides information on the mean per capita harvest and 95th percentile per capita use for fish and seafood in Port Graham, Nanwalek, Tyonek, and Sleetmute, Alaska. The data is from a technical workgroup report dated September 30, 2015, and includes details on a meal of salmon, salmonb

1 views • 10 slides

Understanding Migration Costs in Low-skilled Labor Migration

This content delves into the work of KNOMAD and The World Bank in measuring migration costs for low-skilled labor migration. It outlines the objectives, phases, and methodologies used to assess various costs incurred throughout the migration cycle, such as compliance costs, transportation expenses,

1 views • 21 slides

Summary Data on California Dual Eligibles

Summary data for California dual eligibles compiled by Special Needs Consulting Services (SNCS) reveals key information about full duals in the state. With approximately 1.1 million full duals, the annual costs total around $300 billion, averaging $50,000 per person per year. A significant portion o

0 views • 5 slides

Resource Analysis Summary Report for Instructional Costs

This Resource Analysis Summary Report analyzes instructional costs for different campuses based on subject code and course level. It outlines how model costs used in the State Share of Instruction (SSI) are calculated by dividing the sum of unrestricted costs by Full-Time Equivalents (FTE). The repo

0 views • 9 slides

Understanding the Victorian Regulatory Change Measurement (RCM)

The Victorian Regulatory Change Measurement (RCM) methodology introduced in June 2010 aims to measure reductions in regulatory burden through different categories such as administrative costs, substantive compliance costs, delay costs, and more. The RCM formula helps in calculating the total regulat

0 views • 63 slides

Understanding GDP and its Limitations in Global Economics

The Gross Domestic Product (GDP) measures the monetary value of goods and services produced within a country, reflecting its economic development. However, simply comparing GDP figures may not provide a complete picture. GDP per capita is a better indicator, showing the average wealth per person. De

0 views • 7 slides

Understanding Tariff of Electricity and Principles of Calculation

Electrical energy production involves costs that are shared by consumers based on the amount and nature of electricity consumed. This includes fixed costs for setting up power plants and variable costs for generating electricity, which covers fuel expenses. The calculation of electricity costs is ba

0 views • 18 slides

Understanding Accounting for Borrowing Costs in Financial Management

Borrowing costs in financial management refer to interest and other expenses incurred when borrowing funds. These costs are crucial to account for correctly to ensure accurate financial reporting. Borrowing costs directly attributable to acquiring, constructing, or producing a qualifying asset are c

0 views • 8 slides

Indian Housing Block Grant 2023 Competitive Priorities

The Fiscal Year 2023 Indian Housing Block Grant (IHBG) Competitive NOFO Training focuses on Soundness of Approach with a maximum of 42 points. Subfactor 3.1 emphasizes IHBG Competitive Priorities, including new housing construction projects, housing rehabilitation projects, acquisition of units, and

0 views • 23 slides

Insights on the Canadian Charity Sector 2010-2018: A Blumberg Snapshot Analysis

Analysis of the Canadian charity sector from 2010 to 2018 based on Blumberg's Snapshot. The report covers data on the number of charities filing T3010s, charities with websites, charities per capita in Canada, charity assets and liabilities, and inflation trends during the period. Key findings inclu

0 views • 16 slides

Financials and Cost Verification for Twinning Manual Updates

The Financials and Cost Verification section of the Twinning Manual focuses on Commission Decision-defined types of costs, unit costs, flat rates, and the process of verifying actually incurred costs. It delves into unit costs related to RTA, method of calculating compensation, per diem rates, and p

0 views • 24 slides

Analysis of Manufacturing Costs for Trunnion Speaker Production

This analysis breaks down the manufacturing costs for producing Trunnion Speakers, including variable costs, fixed costs, overhead costs, total costs, mark-up values, and break-even points. The detailed breakdown provides insight into cost per unit and helps in pricing decisions for achieving profit

0 views • 8 slides

Understanding Relevant Revenues and Costs in Decision-Making

Explore the concepts of relevant revenues and costs in decision-making, including differential costs, avoidable costs, sunk costs, opportunity costs, and relevant costs. Learn how to analyze costs, make add or drop decisions, and apply these principles through an example scenario with Recovery Sanda

0 views • 16 slides

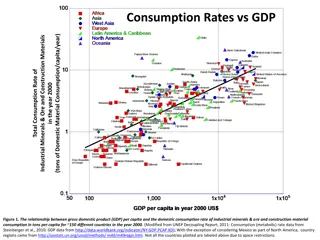

Global Relationship Between GDP per Capita and Mineral Resource Consumption Rates in 2000

The images depict the relationship between GDP per capita and domestic consumption rates of industrial minerals, ore, and construction materials in various countries in the year 2000. The data highlights the varying consumption patterns and their correlation with economic prosperity. Additionally, s

2 views • 10 slides