The SDG Accelerator Fund

The SDG Accelerator Fund aims to establish a replicable financial facility that links key actors and utilizes blockchain technology to support SMEs in achieving the Sustainable Development Goals. With investments between $100,000 to $2.5 million per venture, the fund promotes cost-effectiveness, tra

1 views • 9 slides

Historic Investments in Climate Action: Inflation Reduction Act May 2023

The Inflation Reduction Act (IRA) of May 2023 focuses on making significant investments in climate action to reduce U.S. emissions by an estimated 40% by 2030. This act supports disadvantaged communities, the clean energy industry, and aims to drive emissions reductions over the next decade while pa

5 views • 14 slides

Understanding Personal Investment Accounting Standards (AS-13)

Introduction to Accounting Standard -13 (AS-13) for personal investment accounting, covering types of investments, factors to consider while holding investments, formats for investment accounting, handling face value and interest columns, as well as cum-interest and ex-interest calculations.

0 views • 11 slides

ELENA Grants: Supporting Sustainable Investments for a Greener Future

ELENA grants provide support for various sustainable investments, including sustainable energy projects, residential renovations, sustainable urban transport initiatives, and more. With a minimum investment requirement of 30 million, ELENA focuses on mature projects with investment returns within 3/

0 views • 30 slides

Understanding Investments in the Illinois Bookkeepers Conference

Explore the informative presentation on accounting for investments at the 2023 Bookkeepers Conference in Rolling Meadows, Illinois. The session covers allowable investments, including money market funds, treasury securities, certificates of deposit, and more. Gain insights on investment policies, di

2 views • 24 slides

Enhancing Research Competitiveness through EPSCoR Program

The EPSCoR Program aims to enhance research competitiveness by investing in STEM capacity and capability in targeted jurisdictions. It prioritizes sustainable growth, infrastructure investments, scholarships, partnerships, and capacity building activities. EPSCoR institutions receive a percentage of

1 views • 34 slides

EU Climate Investment Deficit Report Launch Event

The launch event of the first edition of the EU Climate Investment Deficit Report highlights the importance of climate investments in shaping Europe's future. The report focuses on tracking public and private investments to assess the EU's progress towards the 2030 targets set by the European Green

4 views • 19 slides

Investment Incentives in Katsina: Federal and State Offerings

Investment incentives in Katsina state, Nigeria, aim to support direct investments in priority sectors through tax waivers, land allocation, and other benefits at both federal and state levels. The Nigeria Investment Promotion Commission plays a key role in promoting investments. Federal incentives

2 views • 13 slides

California Forest Improvement Program (CFIP) Overview

The California Forest Improvement Program (CFIP) aims to promote investments in forestlands to ensure timber supplies, employment, and economic benefits while enhancing the forest resource. Funding sources, program objectives, eligibility requirements, and reimbursement details are covered in the pr

1 views • 22 slides

Investment Responses to Biophysical Climate Impacts on Water, Energy, and Land in SDGs and Climate Policies

Investment assessments using Integrated Assessment Models (IAMs) are evolving to include biophysical climate impacts, assessing climate uncertainty on investments. The approach involves the MESSAGEix-GLOBIOM IAM, considering climate policy, SDG measures, and impacts under different scenarios. Climat

6 views • 32 slides

Insights into Investments and Convergence in Central Eastern Europe

Explore the dynamics of investments, convergence, and capital inflows in Central Eastern Europe, delving into the role of investment capital in the convergence process, the impact of foreign capital, and the heterogeneity across various countries in the region. Discover how savings, investments, GDP

0 views • 11 slides

Strategic Platform for Sustainable Landscapes in Lao PDR

The Lao PDR Landscapes and Livelihoods Project aims to establish a strategic platform for sustainable landscapes to address the fragmentation of investments, institutions, incentives, and information. By enhancing coordination and efficiency, the project aligns with key government priorities related

3 views • 9 slides

Foreign Investments in India: Legal Framework and Investment Routes

Key statutes applicable for foreign investors in India include FEMA, SEBI regulations, and legislations governing securities markets. Foreign investments avenues in India include FDI, FVCI, FPI, NRI investments through SEBI approval or automatic approval route. Foreign Portfolio Investors (FPIs) and

1 views • 54 slides

Understanding Investments: A Comprehensive Overview by Mr. Vinoth Kumar J, Assistant Professor

Mr. Vinoth Kumar J, an Assistant Professor at St. Joseph's College, dives into the world of investments, explaining the meaning, definition, and classification of investments. He covers financial products like equities, mutual funds, real estate, and more, providing insights into both financial and

0 views • 21 slides

Financial Strategy for National Strategy on Climate Change and Vegetation Resources

The Financial Strategy for the ENCCRV encompasses three phases - Preparation, Implementation, and Payment based on results, with a focus on addressing deforestation, forest degradation, and promoting sustainable vegetation management. Funding sources include international funds, private sector inves

0 views • 9 slides

Understanding Foreign Capital and Its Implications on Development

Foreign capital plays a significant role in the development of a country through investments from foreign governments, institutions, and individuals. It encompasses various forms such as foreign aid, commercial borrowings, and investments that contribute to capital formation, technology utilization,

0 views • 19 slides

Understanding Foreign Capital and Its Impact on Development

Foreign capital encompasses investments from foreign governments, private individuals, and international organizations in a country, including aid, commercial borrowings, and foreign investments. It plays a crucial role in capital formation, technology utilization, and development across various sec

0 views • 19 slides

Understanding Syndicated Mortgage Investments: Key Information and Regulations

Syndicated Mortgage Investments (SMIs) involve multiple lenders participating in a mortgage, with distinctions between Qualified SMIs (QSMIs) and Non-Qualified SMIs (NQSMIs). The presentation covers the definition of SMIs, requirements for QSMIs, registration processes, compliance obligations, and c

0 views • 22 slides

The Five Stages of Investing Explained

In the journey of investing, there are five stages to progress through. The stages involve understanding the types of investments, assessing risk levels, setting up financial accounts, and gradually moving towards higher-risk investments. Starting with a put-and-take account for daily expenses, tran

0 views • 10 slides

Regional Integrated Coastal Management and Island Water Resources Resilience Program

The program focuses on strengthening national and local capacities for integrated coastal management and island water resources resilience, incorporating climate change adaptation. It involves investments in human capital, mainstreaming approaches into development planning, establishing regional and

0 views • 8 slides

Enhancing Coastal Spatial Systems and Database Management for R2R Investments

This presentation delves into the enhancement and training of national GIS/Data Practitioners on R2R coastal spatial systems, governance, and socioeconomic baseline assessments. It explores the use of EGS and DPSIR approaches, along with the integration of existing databases for future R2R investmen

0 views • 4 slides

Smarter Europe: Cohesion Policy for Innovation and Economic Transformation

The Cohesion Policy aims to create a smarter Europe by promoting innovative economic transformation through digitization, enhancing R&I capacities, and supporting the growth and competitiveness of SMEs. It focuses on developing skills, fostering interregional innovation investments, and enabling sma

0 views • 5 slides

The Case for Private Credit Investments in the Global Market

Private credit investments are gaining significance in the global market, offering innovative financing solutions outside traditional avenues like public markets. With a focus on innovation, independence, and integrity, private credit investments cater to diverse sectors such as real estate, natural

1 views • 9 slides

Busy Angels: A Successful Journey in the Startup Ecosystem

Busy Angels, founded in Lisbon in 2013, has made significant strides in the business angel investment space. With a focus on co-investments, leveraging capital smartly, and engaging with national and international investors, they have built a diverse portfolio across various industries. Committed to

8 views • 10 slides

Re-Investing in Supported Employment: Turning Tides and Future Perspectives

Initial investments in supported employment in the 1980s and 1990s paved the way for positive outcomes and policy developments, yet there remains uneven implementation across states. The journey from impossible to required standards for integrated employment highlights the need for renewed national

0 views • 27 slides

Supporting National Planning for Action on SLCPs - SNAP Initiative Overview

The Supporting National Planning for Action on SLCPs (SNAP) Initiative aims to develop capacity in partner countries for effective national action planning on Short-Lived Climate Pollutants (SLCPs). Key objectives include supporting national SLCP planning processes, enhancing tools for emission scen

0 views • 12 slides

Understanding Internal Rate of Return (IRR) in Investments

Internal Rate of Return (IRR) is a method used to assess the profitability of potential investments by calculating the discount rate that makes the net present value of an investment zero. It considers the time value of money and helps in comparing projects based on their returns relative to costs.

0 views • 5 slides

Nuancing Narratives on Large-Scale Agriculture Investments' Labor Market Effects in Sub-Saharan Africa

Exploring the impacts of Large Scale Agriculture Investments (LAI) on job creation in Sub-Saharan Africa, focusing on labor market dynamics, supply and demand sides analysis, and case studies from Kenya, Mozambique, and Madagascar. The research delves into the quantity and quality of jobs created, i

0 views • 17 slides

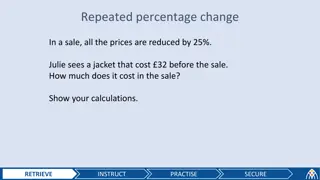

Understanding Repeated Percentage Changes in Sales and Investments

This content covers examples and calculations related to repeated percentage changes in sales and compound interest investments. It explains how prices are affected when all items are reduced by a certain percentage in sales, as well as scenarios involving compound interest investments over multiple

0 views • 17 slides

Northamptonshire Pension Fund Investments Overview

The Northamptonshire Pension Fund Investments, managed by Richard Perry, follows regulations like the Local Government Pension Scheme Regulations. The fund structure includes investments in equities, bonds, diversified growth funds, private equity, and property. Investments are managed by profession

0 views • 10 slides

FY23 DoD Space Budget Overview and Investments

The FY23 Department of Defense (DoD) budget continues to prioritize investments in national security space capabilities, with a $1.6B increase in funding for DoD space programs. The United States Space Force receives significant appropriations exceeding the request, emphasizing oversight and managem

0 views • 16 slides

Understanding Alternative Investments and Equity Compensation

Explore the world of alternative investments including private equity, venture capital, and hedge funds with a focus on equity compensation. Learn about complex income calculations, vesting, timing, and tax considerations. Discover how these unconventional assets with high return potential differ fr

0 views • 61 slides

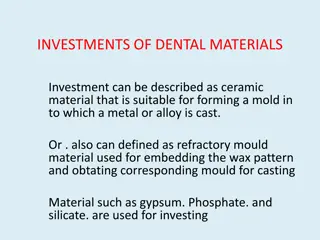

Understanding Investments of Dental Materials

Dental investments are ceramic materials used to create molds for casting metal alloys in dentistry. These investments must accurately reproduce wax patterns, have suitable setting times, withstand high temperatures, and exhibit controlled expansion. Components include refractory materials, binder m

0 views • 30 slides

Understanding Investments: Objectives, Decision Making, and Goals

Investments involve committing money for future benefits, balancing risk and return. The nature, scope, and objectives of investments guide decision-making processes, considering factors like time, risk, and diversification. Investment goals range from short-term to long-term priorities, aiming to i

0 views • 35 slides

Snapshot of Chinese Overseas Investments: Trends and Insights

China's non-financial overseas direct investment (ODI) reached $77.2 billion in 2012, showing impressive growth despite global financial crises. A significant portion was allocated to acquiring mineral resources for domestic economic expansion. The geographical distribution of investments by Chinese

0 views • 11 slides

Understanding FEMA Regulations for Foreign Investments

This presentation by CA Sunil Jain provides a comprehensive overview of the Foreign Exchange Management Act (FEMA) including topics such as overseas direct investments, immovable property transactions, commercial borrowings, and regulations governing investments in Joint Ventures/Wholly Owned Subsid

0 views • 73 slides

Indian Private Equity Landscape 2016: Insights and Trends

The state of Indian private equity in 2016 reflected significant activity and growth across various industries. Key highlights include the dominance of PE/VC over IPOs, consistent PE investments over 2 years, industry-wise distribution of deals, investment stages, and top PE investments centered aro

0 views • 27 slides

Conflict in VGI Themes: Advancing VGI vs Future-Proofing Utility Investments

Conflicting themes within VGI Working Group include advancing VGI in California and future-proofing utility investments. The clash lies in risk-taking versus risk-minimizing approaches, highlighting the importance of value and connection to EV adoption. Recommendations focus on defining long-term ob

0 views • 7 slides

Navigating Governance Structures for Specific Investments

This study delves into the role of governance structures in incentivizing specific investments in interfirm relationships. It explores how contractual price terms affect suppliers' motivations to undertake investments, considering factors like haggling and risks of appropriation. The research highli

0 views • 14 slides

Optima Nutrition: Maximizing Efficiency of Nutrition Investments in Tajikistan

Preliminary analysis on the allocative efficiency of nutrition investments in Tajikistan reveals the potential impact of Optima Nutrition in optimizing resource allocation for various interventions. The tool aims to enhance the cost-effectiveness and effectiveness of public health investments in nut

0 views • 23 slides