Understanding Foreign Capital and Its Impact on Development

Foreign capital encompasses investments from foreign governments, private individuals, and international organizations in a country, including aid, commercial borrowings, and foreign investments. It plays a crucial role in capital formation, technology utilization, and development across various sectors. However, it also poses challenges such as increased foreign dependence, debt burden, and hindrances in adopting independent economic policies. Private foreign investments bring benefits like the creation of new technology, entrepreneurial skills, and market facilities. Foreign portfolio investments involve the purchase of stocks and bonds in foreign companies, contributing to capital flows and economic growth.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Foreign Capital. Problems of Foreign Capital. Private Foreign Investment. Public Foreign Investment. Foreign Aid.

Meaning: the investment of capital by a foreign government , institution, private individual and international organisation in a country. Foreign capital includes foreign aid , commercial borrowings and foreign investment , grants, commercial loans etc. Foreign capital is invested in the form of foreign machines and foreign technical know-how. Foreign capital refers to

Capital Formation. Technology. Utilisation of Resources. Development of Non-Traditional Sectors. Infrastructure. Basic and Key Industries. Generation of Employment Opportunities. Balance of Payments Problems. Human Resources.

Hindrance in Adopting Independent Economic Policy. Increase in Foreign Dependence. More Burden of External Debt. Uncertainty. Harmful for Domestic Producers. Unbalanced Development. Mors Project Aid. Problem of Debt Servicing.

Meaning: an investment made by a private individual or a private entity in a foreign country. This type of investment differs from other investments made by a foreign public or government entity in another country in that it is made by an individual or a private entity. A private foreign investment is

Creation of New Technology , Entrepreneurial Skill and New Ideas. Encourage to Local Investment and Enterprise. Lead to the Training of Labour in Skills. Useful for Capital Investment. More Productive. Risk Taking. Technical Know-how. High Standard. Market Facilities.

Foreign Portfolio Investment: type of capital flow under which foreign institutions such as banks , insurance companies , companies managing mutual funds and pension funds purchase stocks and bonds of companies of other countries in the secondary market. The adoption of policy of liberalisation the flow of portfolio capital was permitted in 1991. Foreign portfolio come to India in large amounts in the last ten years (1991-2001). This is important

Foreign Direct Investment: on the foreign flow of capital for development. India is a developing country facing the problems of raising funds for business expansion. For the growth of economic development , the flow of capital from other developed countries is very essential. Government of India to get foreign exchange in the form of equity capital. India took necessary steps to liberalise the economy and invite flow of foreign capital. Every country has to rely

Meaning: lending to our industries. Such investment is in the form of equities or lending. Foreign direct investment leads to the control of foreign investors in the management of the concerned organisation in which investment is done. The foreign investment may not only be in the form of net foreign capital but there may be flow of new technology also. It helps the economic development of the country. Foreign direct investment is the flow of

To Supplement to the Domestic Savings. Exchange of Technical Know-how. To Benefit from Experience of Developed Countries. To Off-set the gap in Balance of Payment. To Increase the Pace of Development.

Gives Ready Capital. Large Enterprise and Global Size. Nucleus of Growth. Generates Healthy Competition. Pushes Domestic Investment. Boots Economy. Green Field Investments. Growth of Market.

Bilateral Loans: developed country to a developing countries under bilateral contract. The loan is given for a specified period and act a certain rate of interest in lender country s currency. Bilateral Soft Loans: The poverty of the developing countries does not allow adequate borrowing at commercial rate of interest. The borrowing capacity is greatly restricted due to low repayment capability. Considering this difficulty the developed countries lend at concessional rate of interest for longer period and easier terms. These loans are given by a

Multilateral Loans: International financial institutions such as World Bank , Asian Development Bank , International Financial Corporation have been established. Under multilateral loans the developed countries make financial resources available to above institutions for providing development finance to developing countries. Grants: developed countries to the developing countries. The recipient country has no obligation what s over to repay the grants made by the donor country. In the post world war period Grants are unilateral payments made by

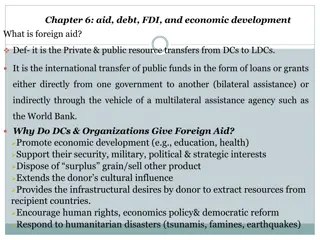

Foreign aid the international transfer of capital goods , or services from a country or international organisation for the benefit of the recipient country or its population. Aid can be economic , military , or emergency humanitarian. Aid: Tied Aid. Untied Aid. There are two types of foreign

Tied Aid: spent in the country providing the aid or in a group of selected countries. A developed country will provide a bilateral loan or grant to a developing country , but mandate that the money be spent on goods or services produced in the selected country. Untied Aid: developing countries which can be used to purchase goods and services in virtually all countries. Tied Aid is foreign aid that must be Untied aid is assistance given to

Foreign Loan Bridges Saving Gap and Balance of Payments. Development Requirement are met. Level of Technological Increases. Meeting Emergencies. Defence Modernisation. Increase in Tax Revenue.

A Small Portion of Investment. Aid Dependence and Aid Fatigue. Misuse of Aid. Economic Sovereignty. Uncertainty. Capital Intensity. Inflationary Pressures. Aims and Aid Givers. External Indebtedness.

THANK YOU You