Understanding Risk Management in Environmental Geography and Disaster Management

Risk management in environmental geography and disaster management involves assessing the potential losses from hazards, evaluating vulnerability and exposure, and implementing strategies to mitigate risks. It includes calculating risk, dealing with risk through acceptance, avoidance, reduction, or

1 views • 10 slides

Understanding Investments in the Illinois Bookkeepers Conference

Explore the informative presentation on accounting for investments at the 2023 Bookkeepers Conference in Rolling Meadows, Illinois. The session covers allowable investments, including money market funds, treasury securities, certificates of deposit, and more. Gain insights on investment policies, di

2 views • 24 slides

Introduction to Flood Risk Assessment with HEC-FDA Overview

This presentation delves into flood risk assessment using HEC-FDA software, covering topics such as defining flood risk, components of uncertainty, consequences of flood risk, and methods to assess flood risk including hydrology, hydraulics, geotechnical, and economics. It explores the intersection

6 views • 39 slides

EU Climate Investment Deficit Report Launch Event

The launch event of the first edition of the EU Climate Investment Deficit Report highlights the importance of climate investments in shaping Europe's future. The report focuses on tracking public and private investments to assess the EU's progress towards the 2030 targets set by the European Green

4 views • 19 slides

Investment Responses to Biophysical Climate Impacts on Water, Energy, and Land in SDGs and Climate Policies

Investment assessments using Integrated Assessment Models (IAMs) are evolving to include biophysical climate impacts, assessing climate uncertainty on investments. The approach involves the MESSAGEix-GLOBIOM IAM, considering climate policy, SDG measures, and impacts under different scenarios. Climat

6 views • 32 slides

Insights into Investments and Convergence in Central Eastern Europe

Explore the dynamics of investments, convergence, and capital inflows in Central Eastern Europe, delving into the role of investment capital in the convergence process, the impact of foreign capital, and the heterogeneity across various countries in the region. Discover how savings, investments, GDP

0 views • 11 slides

Foreign Investments in India: Legal Framework and Investment Routes

Key statutes applicable for foreign investors in India include FEMA, SEBI regulations, and legislations governing securities markets. Foreign investments avenues in India include FDI, FVCI, FPI, NRI investments through SEBI approval or automatic approval route. Foreign Portfolio Investors (FPIs) and

1 views • 54 slides

Understanding Country Risk Analysis in International Business

Country risk analysis is crucial for multinational corporations (MNCs) to assess the potential impact of a country's environment on their financial outcomes. It includes evaluations of political and economic risks in foreign operations. Sovereign risk, political risk characteristics, and factors are

0 views • 61 slides

Understanding Investments: A Comprehensive Overview by Mr. Vinoth Kumar J, Assistant Professor

Mr. Vinoth Kumar J, an Assistant Professor at St. Joseph's College, dives into the world of investments, explaining the meaning, definition, and classification of investments. He covers financial products like equities, mutual funds, real estate, and more, providing insights into both financial and

0 views • 21 slides

Academic Senate Resolutions and Low-Cost Thresholds in Higher Education

The Academic Senate addresses the adoption of open educational resources (OER) and low-cost materials to support academic freedom and compliance with legislative requirements. The resolution discusses the definition of low-cost resources and the variability among California Community Colleges in set

2 views • 9 slides

Project Risk Management Fundamentals: A Comprehensive Overview

Project risk management involves minimizing potential risks and maximizing opportunities through processes such as risk management planning, risk identification, qualitative and quantitative risk analysis, risk response planning, and risk monitoring and control. Quantitative risk analysis assesses t

0 views • 41 slides

Understanding Foreign Capital and Its Implications on Development

Foreign capital plays a significant role in the development of a country through investments from foreign governments, institutions, and individuals. It encompasses various forms such as foreign aid, commercial borrowings, and investments that contribute to capital formation, technology utilization,

0 views • 19 slides

Understanding Foreign Capital and Its Impact on Development

Foreign capital encompasses investments from foreign governments, private individuals, and international organizations in a country, including aid, commercial borrowings, and foreign investments. It plays a crucial role in capital formation, technology utilization, and development across various sec

0 views • 19 slides

Understanding Syndicated Mortgage Investments: Key Information and Regulations

Syndicated Mortgage Investments (SMIs) involve multiple lenders participating in a mortgage, with distinctions between Qualified SMIs (QSMIs) and Non-Qualified SMIs (NQSMIs). The presentation covers the definition of SMIs, requirements for QSMIs, registration processes, compliance obligations, and c

0 views • 22 slides

The Five Stages of Investing Explained

In the journey of investing, there are five stages to progress through. The stages involve understanding the types of investments, assessing risk levels, setting up financial accounts, and gradually moving towards higher-risk investments. Starting with a put-and-take account for daily expenses, tran

0 views • 10 slides

Implementing STarT Back for Stratified Care in Low Back Pain Management

Helen Duffy and Kay Stevenson discuss the implementation of STarT Back, a screening tool designed to stratify low back pain patients for matched treatments based on modifiable risk factors. The tool is quick, validated, and helps clinicians identify high, medium, and low-risk patients for tailored p

0 views • 21 slides

Smarter Europe: Cohesion Policy for Innovation and Economic Transformation

The Cohesion Policy aims to create a smarter Europe by promoting innovative economic transformation through digitization, enhancing R&I capacities, and supporting the growth and competitiveness of SMEs. It focuses on developing skills, fostering interregional innovation investments, and enabling sma

0 views • 5 slides

The Case for Private Credit Investments in the Global Market

Private credit investments are gaining significance in the global market, offering innovative financing solutions outside traditional avenues like public markets. With a focus on innovation, independence, and integrity, private credit investments cater to diverse sectors such as real estate, natural

1 views • 9 slides

Understanding Markowitz Risk-Return Optimization

Modern portfolio theory, introduced by Harry Markowitz, aims to maximize expected return while managing risk. Efficient portfolios are represented by points on the efficient frontier, diversifying investments for optimal risk-return trade-offs. The risk-expected return relationship is depicted graph

0 views • 16 slides

Understanding Risk Concepts and Management Strategies in Finance

Explore the essential concepts of risk in finance, such as risk definition, risk profiles, financial exposure, and types of financial risks. Learn about risk vs. reward trade-offs, identifying risk profiles, and tools to control financial risk. Understand the balance between risk and return, and the

0 views • 18 slides

Risk Management Instruments to Mobilize Private Finance

Risk is a critical factor hindering projects from attracting financial investors and preventing investors from achieving desired returns. Different types of risk such as political, technical, and market risks impact investment decisions. Mitigation instruments are essential to address these risks an

0 views • 19 slides

Risk and Return Assessment in Financial Management

This comprehensive presentation explores the intricacies of risk and return assessment in the realm of financial management. Delve into understanding risk concepts, measuring risk and return, major risk categories, and the impact of risk aversion on investment decisions. Gain insights into the manag

0 views • 62 slides

Risk Management and Security Controls in Research Computing

The European Grid Infrastructure (EGI) Foundation conducts risk assessments and implements security controls in collaboration with the EOSC-hub project. The risk assessments involve evaluating threats, determining likelihood and impact, and recommending treatment for high-risk threats. Results from

0 views • 13 slides

Risk Management & MPTF Portfolio Analysis at Programme Level for UN Somalia

This session delves into the world of risk management and portfolio analysis at the programme/project level, specifically focusing on the Risk Management Unit of the United Nations Somalia. It covers enterprise risk management standards, planned risk management actions, the role of RMU, joint risk m

0 views • 30 slides

Alcohol and Cancer Risk: Understanding the Links

Alcohol consumption is linked to an increased risk of various cancers, including mouth, throat, esophagus, breast, liver, and colorectal cancers. Factors such as ethanol, acetaldehyde, nutrient absorption, estrogen levels, and liver cirrhosis play a role in this risk. Even light drinking can elevate

0 views • 17 slides

Understanding Risk Concepts in the Mathematics Classroom

Risk is a concept integral to decision-making in various aspects of life. This resource explores how risk is defined in the real world, its relevance in the classroom, and strategies for teaching risk literacy to students. It delves into the multiple definitions of risk, risk analysis, and the emoti

0 views • 62 slides

High-Risk Newborn Nursing Care and Factors

Maternal and neonatal nursing specialties focus on providing care for high-risk newborns and their families, who face conditions endangering the neonate's survival. Factors contributing to high-risk newborns include high-risk pregnancies, maternal medical illnesses like diabetes, labor complications

0 views • 25 slides

Northamptonshire Pension Fund Investments Overview

The Northamptonshire Pension Fund Investments, managed by Richard Perry, follows regulations like the Local Government Pension Scheme Regulations. The fund structure includes investments in equities, bonds, diversified growth funds, private equity, and property. Investments are managed by profession

0 views • 10 slides

Understanding Investments of Dental Materials

Dental investments are ceramic materials used to create molds for casting metal alloys in dentistry. These investments must accurately reproduce wax patterns, have suitable setting times, withstand high temperatures, and exhibit controlled expansion. Components include refractory materials, binder m

0 views • 30 slides

Understanding Investments: Objectives, Decision Making, and Goals

Investments involve committing money for future benefits, balancing risk and return. The nature, scope, and objectives of investments guide decision-making processes, considering factors like time, risk, and diversification. Investment goals range from short-term to long-term priorities, aiming to i

0 views • 35 slides

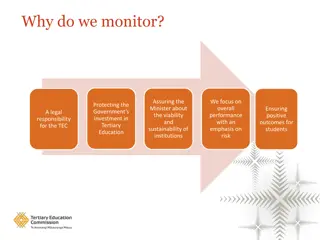

Effective Monitoring and Investment Relationship in Tertiary Education Institutions

Assurance of viability and sustainability of institutions, focusing on overall performance and risk assessment, safeguarding government investments in tertiary education, ensuring positive student outcomes, and fulfilling legal responsibilities for the Tertiary Education Commission. Monitoring activ

0 views • 6 slides

Critical Review of TAVR in Low-Risk Bicuspid Patients

TAVR has shown promising outcomes in tricuspid aortic stenosis but has not been extensively studied in low-risk bicuspid patients. The Low Risk Bicuspid Trial aims to evaluate the procedural and short-term outcomes of TAVR in this patient population through a prospective study involving 25 centers.

0 views • 21 slides

Understanding Organizational Risk Appetite and Tolerance

Explore the development of market risk appetite goals and how to define and establish organizational risk tolerance. Learn about the Classic Simplified View of Risk Tolerance and different methods to determine risk appetite. Discover the importance of assessing market risk impact and aligning risk t

0 views • 8 slides

Developing a Risk Appetite Culture: Importance and Framework

Risk management plays a critical role in the success of corporations, with strategy and risk being intertwined. This presentation delves into definitions of key terms such as risk appetite, the Risk Appetite Cycle, characteristics of a well-defined risk appetite, and the importance of expressing ris

0 views • 31 slides

Security Planning and Risk Management Overview

This content provides an in-depth exploration of managing risk, security planning, and risk appetite in the context of cybersecurity. It covers essential concepts such as risk management process, threat types, risk analysis strategies, vulnerability assessment, and risk mitigation techniques. The ma

0 views • 73 slides

Risk Factors Analysis: Identifying At-Risk Students Before They Reach Campus

Risk Factors Analysis aims to identify students at risk of attrition before they even arrive on campus by evaluating academic, financial, minority, and first-generation factors. The method involves choosing specific risk factors, tracking historical prevalence, calculating relative risk, and predict

0 views • 15 slides

Driving Low-Carbon Investments Through EU ETS Reform

Introducing a price floor in the EU ETS to address persistently low carbon prices and regulatory uncertainties, ultimately aiming to stimulate low-carbon investments. Mechanisms distorting EUA price formation, concerns over self-fulfilling prophecies, and the impact of external demand shocks are dis

0 views • 18 slides

Conflict in VGI Themes: Advancing VGI vs Future-Proofing Utility Investments

Conflicting themes within VGI Working Group include advancing VGI in California and future-proofing utility investments. The clash lies in risk-taking versus risk-minimizing approaches, highlighting the importance of value and connection to EV adoption. Recommendations focus on defining long-term ob

0 views • 7 slides

Understanding Risk and Masculinity in Social Psychology Experiments

This experimental setting explores the impact of testosterone levels on risk-taking behaviors, using digit ratio as a proxy measure for testosterone. The Balloon Analogue Risk Task (BART) is employed to assess risk-taking tendencies in individuals with high and low testosterone levels. The measureme

0 views • 7 slides

Comprehensive Risk Assessment Training Overview

In this risk assessment training session held on November 23, participants reviewed the process of writing and reviewing risk assessments to enhance the quality of assessments for safer scouting experiences. The training aimed to improve leaders' skills and confidence in risk assessment practices wh

0 views • 37 slides