Driving Low-Carbon Investments Through EU ETS Reform

Introducing a price floor in the EU ETS to address persistently low carbon prices and regulatory uncertainties, ultimately aiming to stimulate low-carbon investments. Mechanisms distorting EUA price formation, concerns over self-fulfilling prophecies, and the impact of external demand shocks are discussed, indicating the need for policy adjustments. Empirical evidence highlights the influence of market myopia, regulatory uncertainties, and political commitments on EUA price dynamics.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Decarbonization and EU ETS Reform: Introducing a price floor to drive low-carbon investments AHEAD Workshop Berkeley, 2 October 2017 Prof. Dr. Ottmar Edenhofer

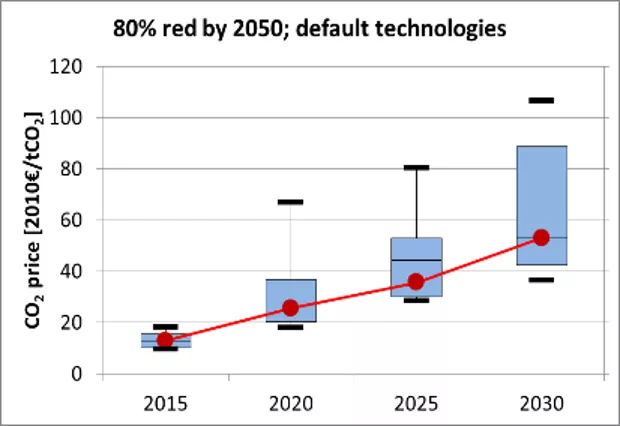

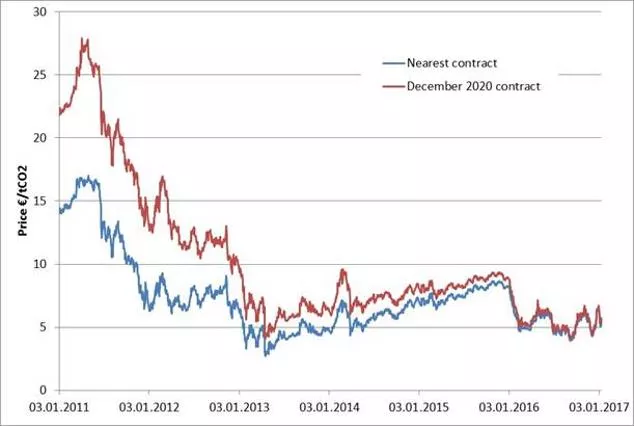

EUA price below economic benchmark level Carbon price with efficient investment and technology R&D in 12 energy-economy models Observed EUA price ICE 2017 Knopf et al. 2013 2

Reason for concern inefficient /tCO2 efficient time Persistently low EUA price might lead to hockey stick price curve Escalating price will induce future downward adjustment of the cap Concern over self-fulfilling prophecy (Salant 2016, Koch et al. 2016, Acworth et al. 2017, Fuss et al. 2017) 3

Low EUA price: External demand shocks? Are external demand shocks the reason for low EUA price? according to empirical evidence, they explain only 10% of price slide indicates relevance of regulatory and market failures (Koch et al. 2014) 4

Mechanisms distorting EUA price formation 1) 1) Market myopia (short Market myopia (short- -sightedness) lower than socially optimal sightedness): time horizon of market participants Liquid EUA futures market only until 2021 Limited hedging time horizons of utilities Anecdotal evidence for thin long term EUA market, little capacity for speculating on rising price 2) 2) Regulatory uncertainty (lack of political credibility): Regulatory uncertainty (lack of political credibility): low credibility of political commitment to long-term targets affects expectations over future cap Economic theory and empirical evidence indicate downward pressure of policy events on EUA price (Salant 2016, Koch et al. 2016, Fuss et al. 2017) 3) 3) Waterbed effect (heterogeneous preferences): Waterbed effect (heterogeneous preferences): unilateral emission reductions lower EUA price, shift emissions in space and time, no additional emission reductions Well-established in economic literature (Goulder and Stavins 2011, IPCC 2014, Edenhofer et al. 2017) Empirical evidence for only very limited effect in EU ETS so far (Koch et al. 2014) 5

Empirical evidence: Regulatory uncertainty Event Event study contributed to EUA price decline study: : Policy announcements related to cap-setting have systematically 9 of 14 backloading- announcements have led to EUA price declines Proposal EC: -23% Refutation EP: -31% Adoption EP: -9% Koch et al. 2016 6

Mechanisms distorting EUA price formation 1) 1) Market myopia (short Market myopia (short- -sightedness) lower than socially optimal sightedness): time horizon of market participants Liquid EUA futures market only until 2021 Limited hedging time horizons of utilities Anecdotal evidence for thin long term EUA market, little capacity for speculating on rising price 2) 2) Regulatory Regulatory uncertainty (lack of political credibility): uncertainty (lack of political credibility): low credibility of political commitment to long-term targets affects expectations over future cap Economic theory and empirical evidence indicate downward pressure of policy events on EUA price (Salant 2016, Koch et al. 2016, Fuss et al. 2017) 3) 3) Waterbed effect (heterogeneous preferences): Waterbed effect (heterogeneous preferences): unilateral emission reductions lower EUA price, shift emissions in space and time, no additional emission reductions Well-established in economic literature (Goulder and Stavins 2011, IPCC 2014, Edenhofer et al. 2017) Empirical evidence for only very limited effect in EU ETS so far (Koch et al. 2014) 7

Heterogeneous Member State preferences are essential! Based on Chichilnisky and Heal (1994) and Edenhofer et al. (2017) Emissions trading Emissions trading equalizes marg. abatement costs for all Member States i=1, ,N. Thus: If the income level in Member State income level in Member State i i is lower Member State j, then: is lower than in Requirement for 1 Requirement for 1st stbest allocative efficiency with ETS best allocative efficiency with ETS Equalization of marg. social valuations of private Equalization of marg. social valuations of private consumption, consumption, Via optimal transfers Via optimal transfers from rich to poor countries, such that: E.g. by initial allocation of allowances or redistribution of auction revenues.

Current response in EU ETS: Market Stability Reserve (MSR) MSR already adopted: aims at limiting allowances in circulation Currently discussed MSR reforms: Change removal rate, delete allowances Starts in 2019 9

Will the ongoing reform remedy the 3 challenges? MSR reform proposals apparantly rely on unspecified theory of surplus-price relationship Unclear how they would address 3 underlying EU ETS challenges Models by market analysts lack transparency and peer-review (Jones 2017) Scientific study finds limited effect on price (Perino & Willner 2017) 10

Proposal: EUA floor price Level of price floor o Available EU modeling indicates 20 20- -40 2020, rising over time (Knopf et al. 2013) 40 /t /t in /tCO2 Potentially complemented by price ceiling o Stern-Stiglitz Commission global 40-80$/t by 2020 50-100$/t by 2030 o Set up expert commission commission to propose EU ETS price floor levels, governance mechanism Significant and rising carbon price floor expert time 11

Price floor implementation options b) b) Auction Auction reserve reserve price price (California) (California) a) a) Current Current EU ETS EU ETS /tCO2 supply demand p p allowances withheld tCO2 c) Price c) Price support support (UK) (UK) d d) ) Emissions Emissions Containment Reserve (RGGI) Containment Reserve (RGGI) pCCR pECR Puni support rate PEUA pres allowances withheld 12

UK experience: Effects of Carbon Price Support Mechanism IEA 2016 13

One Europe or multiple speeds? EU EU- -wide preferable Contain waterbed effect Common decarbonization effort no one left behind Role-model for global approach wide implementation implementation of significant auction reserve price or ECR clearly If not feasible a coalition Germany is essential, but has so far not displayed required political will Coalition with France, possibly Scandinavian countries, and Benelux to minimize power market leakage (WWF 2014) Move towards EU-wide approach over time coalition of of the the willing willing 14

Carbon pricing and companion policies Regulatory policies including technology important complements but not substitutes! technology subsidies subsidies and and standards standards can be Substituting Substituting carbon price floor Is ineffective due to waterbed effect Signals lack of political commitment Is costly no incentive for some mitigation options (e.g. demand reduction) Increases wedge between leaders (Germany) and laggards (Poland) Complementing Complementing carbon price floor Signals political commitment Reduces reliance on politically uncertain future carbon price and related uncertainty in expected profitability of investments Sequencing: Politically feasible regulation in early decarbonization stage can prepare acceptance of more significant carbon pricing at later stage (Pahle et al. 2017) Other Other policies policies with with equivalent equivalent level level of of ambition ambition face face equivalent equivalent political political challenges challenges! ! 15

Conclusion - the way forward Introduce EU ETS carbon Heterogeneous preferences Regulatory uncertainty Myopia carbon price price floor floor + + transfers transfers to adress three core challenges: Proposal: Set up expert Price levels Implementation options Governance framework balancing flexibility and commitment expert commission commission on EU ETS price floor implementation Next German German government Joint EU-initiative with Macron government needs to make carbon price floor a reform priority Macron, and others Embed carbon price floor discussion in broader energy fiscal fiscal reform reform (Agora 2017) energy and and environmental environmental 16

References Chichilnisky Chichilnisky, , G., and G. Heal ( G., and G. Heal (1994 1994): ): Who should abate carbon emissions. Economics Letters 44, pp. 443 449. Dorsch Dorsch, M., Flachsland, C. and Kornek, U. ( , M., Flachsland, C. and Kornek, U. (2017 Revenue Spending in the EU ETS. Mimeo. 2017) ): Enhancing Climate Policy Ambition Using Strategic Transfers: Allowance Allocation and Edenhofer, O., Roolfs, C., Gaitan, B., Nahmacher, P Edenhofer, O., Roolfs, C., Gaitan, B., Nahmacher, P. . and subsidiarity and efficiency in the EU, in: Parry, I., Pittel, K., Vollebergh, H. (Eds.), Energy Tax and Regulatory Policy in Europe: Reform Priorities. MIT Press, Cambridge, Massachusetts. and Flachsland Flachsland, C. ( , C. (2017 2017). ). Agreeing on an EU ETS minimum price to foster solidarity, EEX EEX ( (2017 2017). ). https://www.eex.com/de/ (accessed 29 August 2017). Fuss Fuss, S., Flachsland, C., Koch, N., Kornek, U., Knopf, B. , S., Flachsland, C., Koch, N., Kornek, U., Knopf, B. and performance of cap-and-trade systems: lessons from the EU-ETS. Review of Environmental Economics and Policy, accepted. and Edenhofer, O. ( Edenhofer, O. (2017 2017). ). An assessment framework for intertemporal economic Goulder GoulderL. H. and Stavins, R.N. ( L. H. and Stavins, R.N. (2011 Review 101: 253 57. 2011). ). Challenges from State-Federal Interactions in US Climate Change Policy. American Economic ICE ICE ( (2017 2017) ): The ICE Futures Europe. www.theice.com. IEA IEA International Energy Agency ( International Energy Agency (2016 2016) ): Energy, Environment and Climate Change: 2016 Insights. Paris. IPCC IPCC ( (2014 the Intergovernmental Panel on Climate Change [Edenhofer, O., R. Pichs-Madruga, Y. Sokona, E. Farahani, S. Kadner, K. Seyboth, A. Adler, I. Baum, S. Brunner, P. Eickemeier, B. Kriemann, J. Savolainen, S. Schl mer, C. von Stechow, T. Zwickel and J.C. Minx (eds.)]. Cambridge University Press, Cambridge, United Kingdom and New York, NY, USA. 2014). ). Climate Change 2014: Mitigation of Climate Change. Contribution of Working Group III to the Fifth Assessment Report of Jaffe, A.B., Newell, R.G. and Jaffe, A.B., Newell, R.G. and Stavins Economics 54: 164 174. Stavins, R.N. ( , R.N. (2005 2005): ): A tale of two market failures: Technology and environmental policy. Ecological Jones, D. ( Jones, D. (2017 2017). ). Pricing ETS reforms. Talk at EU ETS Dialogue Forum, 27 March 2017, Berlin. Kalkuhl M., Edenhofer, O. and Lessmann, K. ( Kalkuhl M., Edenhofer, O. and Lessmann, K. (2013 Resource and Energy Economics 35, 217 234. 2013). ).Renewable energy subsidies: Second-best policy or fatal aberration for mitigation? . 17

References Klenert, D., Mattauch, L., Klenert, D., Mattauch, L., Combet Paper No. 80943, https://mpra.ub.uni-muenchen.de/80943/1/MPRA_paper_80943.pdf Combet, E., Edenhofer, O., Hepburn, C., , E., Edenhofer, O., Hepburn, C., Rafaty Rafaty, R. , R. and and Stern, N. ( Stern, N. (2017 2017). ). Making Carbon Pricing Work. MPRA Knopf Knopf, B., Chen, Y. H. H., De Cian, E., , B., Chen, Y. H. H., De Cian, E., F rster costs for transforming the European energy system. Climate Change Economics 4 (1) DOI: 10.1142/S2010007813400010. F rster, H., , H., Kanudia Kanudia, A., , A., Karkatsouli Karkatsouli, I., , I., and Van and Van Vuuren Vuuren, D. P. ( , D. P. (2013 2013). ). Beyond 2020 Strategies and Koch Koch, N.T., Fuss, S., Grosjean, G. , N.T., Fuss, S., Grosjean, G. and Edenhofer of everything? New evidence. Energy Policy 73: 676 685. and Edenhofer, O. ( , O. (2014 2014). ). Causes of the EU ETS price drop: Recession, CDM, renewable policies or a bit Koch, N., Koch, N., Grosjean and-trade. Journal of Environmental Economics and Management 8: 121 139. Grosjean, G., Fuss, S. and , G., Fuss, S. and Edenhofer Edenhofer, O. ( , O. (2016 2016). ).Politics matters: Regulatory events as catalysts for price formation under cap- Perino, G. and Perino, G. and Willner DOI: 10.1080/14693062.2017.1360173. 2016). ). What ails the European Union s emissions trading system? Journal of Environmental Economics and Management, 80, 6-19. Willner, M. ( , M. (2017 2017) ). EU-ETS Phase IV: allowance prices, design choices and the market stability reserve, Climate Policy Salant Salant, S. W. ( , S. W. (2016 Stiglitz Stiglitz, J.E., Stern, N., , J.E., Stern, N., Duan Winkler, H. ( Winkler, H. (2017 2017). ). Report of the High-Level Commission on Carbon Prices. Carbon Pricing Leadership Coalition. Duan, M., , M., Edenhofer Edenhofer, O., Giraud, G., Heal, G., , O., Giraud, G., Heal, G., Rovere Rovere, E.L. la, Moyer, E., , E.L. la, Moyer, E., Pangestu Pangestu, M., Shukla, P.R., , M., Shukla, P.R., Sokona Sokona, Y. and , Y. and von Butler, B. ( von Butler, B. (2017 2017): ): Carbon Pricing Aspects from a Trader s Perspective. Talk at EU ETS Dialogue Forum, 15 May 2017, Berlin 18