Dual Credit Options at Champion High School

Champion High School offers Advanced Placement (AP) and Dual Credit programs in partnership with various institutions like Northwest Vista College, Angelo State University, UT On-Ramps, and Tarleton Today. Students can earn college credit by meeting testing requirements, with some classes being free

1 views • 14 slides

Best Mortgages in Manly

Are you looking for the Best Mortgages in Manly? Then contact Ever After Home Loans. They offer include Home Loans, Residential Lending, Refinances, Car Loans, Asset Finance. Although they are located in Wellington Point, they service clients from areas such as Thorneside, Birkdale, Ormiston, Wellin

0 views • 6 slides

Low Credit Score Mortgages | bcreditkings.com

With bcreditkings.com, you can get accepted for a mortgage even if your credit score is low. Our team of professionals can assist you in realizing your goal of becoming a homeowner.

2 views • 1 slides

Understanding Home Ownership and Mortgages

Exploring the fundamental concepts of buying a house, the cost of living, renting vs. buying, mortgages, and reasons why not everyone owns a home. The content covers essential financial aspects and practical considerations involved in homeownership, making it insightful for individuals navigating th

1 views • 20 slides

Resolving Financial Abuse: Legal Issues and Consumer Credit Law

Learn about resolving legal issues related to financial abuse, consumer credit law, crafting financial hardship requests, negotiating with creditors, getting specialist legal advice, and testing your knowledge on financial matters. Gain insights into consumer credit law, the National Consumer Credit

0 views • 67 slides

Understanding Credit Reports and Scores: A Comprehensive Overview

Explore the importance of credit reports and scores in financial empowerment through modules on reviewing credit reports, understanding credit scores, and mastering credit basics. Learn how good credit can impact your ability to obtain loans, credit cards, secure rentals, insurance coverage, and emp

3 views • 35 slides

Mastering Credit and Debt in Head Start Program

Understand the complexities of credit and debt to make informed financial decisions. Learn about different types of credit, pros and cons of credit cards, debit cards, prepaid cards, and secured credit cards. Gain insights on how to manage your finances effectively and build a strong credit history

0 views • 29 slides

How to Check Your Company Credit Report? Maintaining Financial Control

CreditQ, a leading business, recognizes that its company credit report and Credit Score for Company significantly impact its financial credibility and access to market support. A positive report and credit score reflect responsible financial manageme

1 views • 8 slides

Understanding Credit Reporting and Credit Scores in CARE Presentation

Explore the essential concepts of credit reporting and credit scores in the context of Credit Abuse Resistance Education (CARE). Learn about credit history, its impact on financial decisions, ways to establish credit, the significance of credit reports, and how credit behaviors affect one's financia

0 views • 21 slides

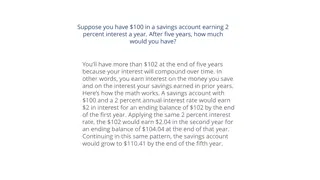

Understanding Financial Concepts: Savings, Inflation, Bond Prices, Mortgages, and Investments

Savings accounts earn interest over time, impacted by inflation rates. Bond prices fall when interest rates rise. Shorter mortgages result in lower total interest payments. Investing in stock mutual funds offers diversification for lower risk compared to single stock investments.

0 views • 6 slides

Understanding Credit Cards: A Beginner's Guide

Explore the basics of credit cards, including how they work, differences from debit and prepaid cards, obtaining one, and building credit. Learn about credit character, revolving credit, and tips for getting approved for a credit card. Discover the importance of good credit and income when applying

0 views • 20 slides

Understanding Credit Reports and Building Credit in 2017

Understanding credit reports is essential for financial well-being. A credit report is a record of your payment history on loans and credit cards. This report is used to calculate your credit score, which determines your creditworthiness. Building and maintaining credit involves making payments on t

5 views • 22 slides

Dual Credit Reporting Guidelines for College Courses

Dual Credit Reporting provides definitions, guidelines, and validation rules for reporting college courses that allow students to earn both high school and college credit. Key elements covered include credit indicators, college credit hours, course sequencing, and validation rules to avoid overrepor

0 views • 6 slides

Understanding Child and Dependent Care Expenses Credit

The Child and Dependent Care Expenses Credit allows taxpayers to reduce their tax liability by a portion of expenses incurred for caring for qualifying persons. Qualifying persons include children under 13, incapacitated spouses or dependents, and certain criteria must be met to claim the credit. Th

8 views • 10 slides

Understanding Recovery of Willful Default in Mortgages through NAB

This content discusses the National Accountability Ordinance (NAO) of 1999 and the concept of willful default in the context of mortgages. It covers the need for recovery, the definition of default, and key definitions outlined in NAO. The focus is on eradicating corruption and holding individuals a

0 views • 40 slides

Company Credit Score: What Is It, Why It Is Important, & How to Improve It?

Maintaining healthy credit is crucial for financial growth. A dependable scoring model, like CreditQ, aids in making informed decisions regarding a company credit score: prioritizing credit management with CreditQ yields various benefits, emphasizing

1 views • 7 slides

Financial Literacy: Handling Money Matters at 18 Years

Exploring financial independence at 18 involves understanding credit, getting a credit card, managing payments, and maintaining a good credit score. This journey includes crucial aspects like limiting credit cards, responsible spending, and repercussions of missed payments. Embracing financial liter

0 views • 50 slides

Take Control of Your Credit Report: A Comprehensive Guide

Learn how to take control of your credit report, understand why it matters, spot credit repair scams, and fix mistakes. Discover why your credit history is important and how to get your free credit reports. Explore the significance of your credit score, review your credit reports, and know how to ha

0 views • 16 slides

If you are looking for Mortgages in Orini

If you are looking for Mortgages in Orini, Welcome to Lauren Hunter - Vega Mortgages. Our mission is to guide you through the journey of property ownership with expertise and care. Lauren is a mortgage broker and adviser with nearly a decade of exper

3 views • 6 slides

Credit Score: What Factors Can Negatively Affect Credit Scores

With help from CreditQ, keep your credit score high and attain financial ease. Take charge of your financial health with CreditQ's expert guidance. With a primary focus on resolving financial concerns to assist clients in establishing and preserving

2 views • 8 slides

GLMHC/SCORE Jail Program: Providing Services for City of Tacoma Residents

GLMHC/SCORE Jail Program offers court-ordered assessments and transition services for City of Tacoma residents sent to the SCORE jail. Learn about its background, the purpose of SCORE, mental health services provided, and the collaboration efforts to address gaps in service provision.

0 views • 21 slides

Strategies for Reaching Hard-to-Count Communities Using Low-Response Score

Explore how to leverage a low-response score to engage with hard-to-count communities effectively. Learn about ROAM mapping tool, the 2020 Census goal, and the significance of Low Response Score (LRS) in identifying areas for targeted outreach. Discover hard-to-count variables and how to utilize dat

0 views • 14 slides

Understanding Charges and Mortgages in Property Transactions

According to the Transfer of Property Act and Companies Act, charges and mortgages play significant roles in property transactions. This content explains the definitions of charges and mortgages, their distinctions, registration requirements, and the duty of companies to register charges. It covers

0 views • 22 slides

Overview of Residential Mortgage Types and Borrower Decisions

This content delves into various types of residential mortgages and borrower decisions, covering topics such as the primary and secondary mortgage markets, 30-year fixed-rate mortgages, prime conventional mortgage loans, FHA mortgages, and other types like purchase money mortgages, piggyback loans,

0 views • 12 slides

Empirical Credit Risk Management at FMB Group Credit Union

Empirical Credit-Risk Management (ECM) presentation to FMB Group Credit Union by Financial Analytics Ltd discusses the background, traditional forecasting methods, income and risk recognition, provisioning approaches, and benefits for credit unions. ECM offers expert retail credit risk management th

0 views • 25 slides

Community SCORE - Outcomes Reporting Webinar

Explore the Community SCORE outcomes reporting tool in this insightful webinar. Learn how to effectively utilize Community SCORE for reporting client outcomes and satisfaction, benefiting individuals, groups, and communities. Discover the importance of measuring client outcomes and how it can enhanc

0 views • 30 slides

Understanding Credit Derivatives and Managing Credit Risk

This chapter delves into credit derivatives, exploring their purpose, types such as credit default swaps and total return swaps, and the development of the market over the years. It discusses credit risk, problems associated with it, methods for estimating credit risk, and the role of credit derivat

0 views • 35 slides

YBS Commercial Mortgages May 2021 Updates: New HMO Product and Criteria

YBS Commercial Mortgages introduces a new 5-year fixed-rate HMO product along with updated landlord experience criteria and maximum customer exposure details. Learn about the expansion of services, key contacts, and growth achievements since the relaunch as YBS Commercial Mortgages.

0 views • 12 slides

Understanding the HEART Score for Risk Stratification in Patients with Chest Pain

The HEART score is a valuable tool for stratifying patients presenting with chest pain in the emergency department. It helps in distinguishing between low, intermediate, and high-risk individuals and guides further management decisions. By incorporating factors like history, ECG findings, age, risk

0 views • 30 slides

Understanding Debt, Interest, and Borrowing Money

Explore the concepts of debt, interest, and borrowing money in this informative presentation. Learn about the types of debt, reasons people borrow money, average debt per person in various countries, costs of personal loans, the time value of money, and how interest rates affect the value of debt ov

0 views • 19 slides

Understanding the Importance of Credit Policies in Business Operations

A credit policy/manual serves as a comprehensive guide detailing rules, regulations, and procedures within a company. It helps new employees understand the company's credit processes and establishes clear guidelines for decision-making. Without a credit policy, conflicts may arise in approving credi

0 views • 9 slides

Understanding Mortgages and Capital Market Instruments

Mortgages play a crucial role in lending for real estate properties, classified into categories such as home, commercial, and farm mortgages. They can be backed by specific property, offering security to lenders in case of defaults. On the other hand, capital market instruments involve contracts bet

0 views • 54 slides

Understanding the Mortgage Market: Key Concepts and Trends

The mortgage market is a critical component of the financial system, providing long-term loans secured by real estate. This comprehensive overview covers topics such as mortgages types, loan characteristics, lending institutions, and the history of mortgages. It explores the evolution of mortgage fi

0 views • 42 slides

Understanding High School Articulated Credit: Benefits, Transferability & Responsibilities

High school articulated credit allows students to earn college credit by aligning high school CTE classes with college-level courses. This collaboration between high school teachers and college professors can save students time and money by reducing the need to repeat coursework in college. Students

0 views • 8 slides

All About Credit Cards: A Comprehensive Guide

Explore the world of credit cards, from understanding the basics to managing credit wisely. Delve into the advantages and disadvantages, learn about different types of credit cards, and discover how to use credit cards responsibly. Discuss whether high school students, college students, and adults s

0 views • 36 slides

Negative Credit Score Factors: Understanding Credit Scores and Their Impacts

Investigate the various options that CreditQ offers to improve your credit score and see if any of them meet your needs. Individuals are strongly encouraged to investigate the possibility of obtaining expert assistance to effectively improve their cr

0 views • 8 slides

4 Tips to Improve Your Business Credit Score

To improve your company's credit score, visit CreditQ to track it regularly. With CreditQ, businesses can make informed financial decisions, fostering long-term stability. Regular monitoring identifies potential issues, ensuring companies stay well-i

6 views • 8 slides

Comprehensive Information on ESL Department's Fall 2020 Offerings

Explore ESL class options starting Fall 2020, including credit vs. non-credit courses, new course offerings, course numbering system, differences between credit and non-credit classes, and more. Discover details on certificates, financial aid, graduation, and transfer information, with insights on c

0 views • 12 slides

Evolution of Credit Reporting and Consumer Awareness

Credit access is crucial for consumers, yet inaccurate credit reporting can have significant impacts on credit scores. Studies show that errors in credit reports are common, with many consumers disputing inaccurate information. The regulatory landscape has evolved since the 2012 FTC study, with incr

0 views • 10 slides

Best Mortgages in Ormiston

Are you looking for the Best Mortgages in Ormiston? Then contact Auckland Financial Solutions. With over 10 years\u2019 experience in the areas of international business, finance, insurance, and accounting, Auckland Financial Solutions brings a wealt

0 views • 6 slides