Scheme of Arrangement under the Companies Act, 1956

The changes introduced in the existing procedures for stock exchanges and listed companies regarding the scheme of arrangement under the Companies Act, 1956. It covers the submission of draft schemes, display on websites, changes in internal procedures, court process, approval of shareholders, and i

4 views • 16 slides

Important Provisions of Companies Act Regarding Audit

The Companies Act mandates specific provisions related to audit, including the appointment of auditors, consent, certificates, and rotation requirements. Companies need to appoint auditors timely, obtain consent and eligibility certificates before appointment, and adhere to mandatory auditor rotatio

2 views • 22 slides

Blog 2- Unveiling the Top RPO Companies in the USA_ Elevate Your Recruitment Strategy

In the competitive landscape of talent acquisition, companies are increasingly turning to Recruitment Process Outsourcing (RPO) providers to streamline their hiring processes and gain access to top talent. With a myriad of RPO companies in the USA, it can be challenging to identify the best partners

6 views • 2 slides

Challenges in Asset Valuation Using CAPM

Analysis of the Capital Asset Pricing Model (CAPM) for listed companies demonstrates significant discrepancies between the model's results and actual returns. Various factors contributing to this deviation are discussed, including the limitations of the model and potential modifications to enhance i

0 views • 21 slides

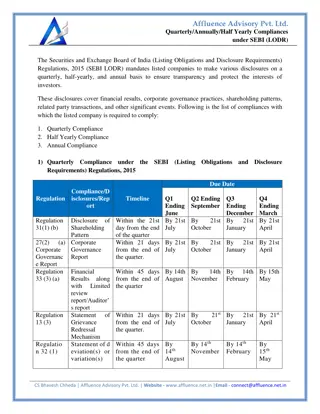

Quarterly-Annually-Half Yearly Compliances under SEBI LODR

The SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 mandate that listed companies must adhere to a strict schedule of disclosures on a quarterly, half-yearly, and annual basis. These requirements include financial results, corporate governance reports, shareholding patterns,

0 views • 4 slides

Understanding Corporate Bonds: Issuance, Trading, and Security Features

Corporate bonds are long-term debt instruments issued by listed companies to fund expansion and investment. They are traded primarily in the over-the-counter market, offering security to investors through various asset types. Different types include fixed rate bonds with fixed maturity dates.

0 views • 10 slides

New Risk Management and Internal Audit Framework for Local Councils in NSW

This framework outlines the importance of audit, risk, and improvement committees (ARIC), internal audit (IA), and risk management (RM) in local councils in NSW under the Local Government Act 1993. It defines key terms, such as Audit Committee, Internal Audit, Risk Management, and the three lines of

1 views • 31 slides

Understanding Different Types of Companies in Business

Explore the various kinds of companies in the business world, including statutory companies, registered companies, private companies, public companies, and more. Learn about the differences between private and public companies, statutory company examples like LIC and RBI, and the characteristics of

0 views • 25 slides

Employee Stock Option Plan Presentation and Guide

This presentation and guide cover the Employee Stock Option Plan, including Black-Scholes Model, practical challenges, market research, and relevant standards like Ind AS 102. It provides an in-depth overview of share-based payments, recognition, measurement, and disclosure requirements, along with

0 views • 71 slides

Stunning Apartment Listed at $325,000 - Fully Furnished and Move-In Ready

Explore this exquisite apartment listed at $325,000, featuring modern amenities and stylish decor. With a spacious layout and prime location, this property offers a comfortable and luxurious living experience. Don't miss the opportunity to make this stunning apartment your new home.

0 views • 4 slides

Rising Auditor Resignations in Listed Entities: Shocking Trends Revealed

Amidst a surge in auditor resignations at listed firms, a total of 204 companies saw auditors stepping down between January 1, 2018, and July 17, 2018. The trend continued with 32 auditors resigning in the last 5 months, shaping an alarming pattern in the financial sector. Key players like Price Wat

0 views • 33 slides

Modern Apartment for Sale - Listed at $315,000

Stunning apartment listed for sale at $315,000. This modern property offers a contemporary design and luxurious amenities. Check out the images and envision your new lifestyle in this beautiful space.

0 views • 4 slides

Understanding Internal Financial Controls and Regulatory Mandates

This content provides insights into Internal Financial Controls (IFC) and its significance in ensuring efficiency, fraud prevention, accuracy in accounting, and timely financial reporting. It also delves into regulatory mandates under the Companies Act of 2013, specifying requirements for auditors'

0 views • 19 slides

Understanding REITs and InvITs in the Securities Market

REITs, or Real Estate Investment Trusts, offer investors the opportunity to own and invest in income-generating real estate assets. They are listed on stock exchanges and must distribute a significant portion of their cash flows to investors. REITs are structured with sponsor and investor ownership,

0 views • 24 slides

Insights into the Biotech Industry: Companies, Key Players, and Career Pathways

Keith Ho's career journey from a scientist to a digital health expert at Biogen is highlighted. The overview covers the definition of biotech, the concentration of biotech companies in the US, and the global distribution of such companies. Additionally, key insights into the top biopharma companies

0 views • 9 slides

Audit Quality Maturity Model (AQMM) - Overview and Implementation Guidelines

The Audit Quality Maturity Model (AQMM) is a self-evaluation tool designed for audit firms to assess their level of maturity, identify strengths and weaknesses, and enhance their audit practices. The model covers various operational aspects such as revenue budgeting, technology adoption, and human r

1 views • 14 slides

An Overview of Different Types of Companies and Their Characteristics

Explore the various kinds of companies based on mode of incorporation, number of members, liability of members, and more. Learn about statutory companies, registered companies, private companies, and the distinctions between different types of companies in the business world.

0 views • 25 slides

Ensuring Sustainability in Trade of Newly Listed Sharks and Manta Rays

Parties involved in the trade of newly listed sharks and manta rays must adhere to specific guidelines outlined by CITES Scientific Authorities to ensure the survival of the species. This includes obtaining non-detriment findings (NDFs) through scientific assessments, monitoring export permits, sett

2 views • 12 slides

Capital Market Committee Updates: 2nd Quarter Meeting Highlights

The Capital Market Committee addressed updates on the consolidation of accounts, progress reports submitted by members, and strategies for awareness campaigns through various channels including PEBEC platform, banking halls, and social media. The active engagement of stakeholders like registrars, st

0 views • 8 slides

Characteristics of Companies in the Care Sector

Companies operating in the care sector exhibit distinct characteristics, such as financial prioritization, control by financial experts, and reliance on technology. Large care chains engage in takeovers and have offshore accounts, while smaller companies face asset stripping and profit maximization

0 views • 5 slides

Overview of IFRS Implementation in Japan

The overview of IFRS implementation in Japan includes the voluntary and mandatory phases, benefits for companies, challenges faced during implementation, and future plans for mandatory adoption. The process involves transitioning from Japanese standards to IFRS, with a focus on reducing funding cost

1 views • 16 slides

Analysis of Kidney Transplant Trends in End-Stage Renal Disease Patients (1996-2013)

This report delves into the trends surrounding kidney transplants in end-stage renal disease (ESRD) patients from 1996 to 2013. It looks at the percentage of dialysis patients wait-listed, unadjusted kidney transplant rates, number of patients wait-listed for kidney transplants, transplant counts, p

0 views • 33 slides

Understanding Listed Companies and Financial Reporting

Listed companies are publicly traded entities whose shares are available on stock markets. They are required to submit annual accounts and reports, including key financial statements like the balance sheet and profit and loss account. The annual report provides insights into the company's financial

0 views • 28 slides

Practical Aspects of Strike Off and Restoration of Companies by CS Ashish O. Lalpuria

This presentation discusses the practical aspects of striking off and restoring companies based on analysis of case laws from NCLT and NCLAT. It covers types of strike off, companies that cannot be struck off by ROC, and the process of strike off by the Registrar of Companies. Various scenarios and

0 views • 44 slides

Influence of Corporate Governance on Earnings Management in Bahrain Bourse

The study explores the impact of Corporate Governance (CG) on Earnings Management (EM) in listed companies in Bahrain Bourse. It delves into the importance of CG in maintaining investor interests, transparency, and accountability, especially in the wake of corporate scandals. The research aims to in

0 views • 25 slides

Overview of Limited Liability Companies under Polish Company Law

Explore the legal aspects of limited liability companies under the Polish Commercial Companies Code, detailing formation, share capital requirements, shareholder liabilities, and powers granted to these entities. Learn about the two main types of companies in Polish law, their characteristics, and k

0 views • 13 slides

The Foundations of the Separation of Powers in Companies

The separation of powers in companies is based on the dualism of organs: the Board and General Meeting. The actual situation in companies diverges between large public companies with autonomous management and smaller private companies with owner-operators. The search for the foundations of the separ

0 views • 15 slides

Types of Companies in Corporate Administration

This article discusses the various kinds of companies in corporate administration, including incorporated, chartered, statutory, and registered companies. It covers the definition of a company, different types of legal entities, and examples of each type. The classification of companies based on inc

0 views • 17 slides

Ruhunu Putra Energy Group of Companies Overview

Ruhunu Putra Energy Group of Companies, led by Chairman/CEO Mr. Sanath Jayamuni, operates in auto air conditioning, energy, supermarkets, tea manufacturing, and leisure sectors. Established in 2002 and listed on the Colombo Stock Exchange in 2009, RPE aims to be a trusted Sri Lankan multinational im

0 views • 34 slides

Efic: Specialist Financing Solutions for Australian Companies

Efic is a specialist financier owned by the Australian Government, providing creative financing solutions to help Australian companies succeed globally. They offer various financial instruments like bonds, guarantees, and loans to assist companies in winning contracts and expanding internationally.

0 views • 11 slides

Corporate Transparency Act (CTA) Beneficial Ownership Reporting Requirements

The Corporate Transparency Act (CTA) mandates companies to report information about their beneficial owners to FinCEN starting January 1, 2024, to combat illicit activities. Reporting companies include U.S.-based corporations, LLCs, and foreign companies registered to do business in the U.S. Exempt

0 views • 10 slides

Understanding Borrowing Powers of Companies under Companies Act, 2013

The term "Borrowing" in the Companies Act, 2013, pertains to the power granted in Section 180(1)(c) for companies to borrow money with the consent of the company by a special resolution. This includes provisions on limits, definitions of temporary loans, necessary board resolutions, and validity of

1 views • 8 slides

Corporate Governance and Business Ethics in Listed Companies: Regulations and Perspectives

Corporate governance and business ethics are integral to the success of listed companies, with a focus on internalized values, self-governance, and adherence to moral principles. Key areas include code of conduct, compliance, dealings with related parties, and vigil mechanisms. The Companies Act, 20

0 views • 18 slides

Companies (Cost Records and Audit) Amendment Rules 2014 Overview

The Companies (Cost Records and Audit) Amendment Rules 2014, presented by CMA Harshad S. Deshpande, cover the applicability of cost records and cost audit for companies in regulated and non-regulated sectors. The rules specify the class of companies engaged in production or services that must mainta

1 views • 41 slides

Understanding Clause 41 of Listing Agreement

Listing Agreement outlines the terms for securities to be traded on a stock exchange. Clause 41 mandates listed companies to provide detailed financial results periodically, promoting transparency for investors' informed decisions and safeguarding their interests. The results must adhere to accrual

0 views • 15 slides

Listing Requirements for Companies on the GEM of the Stock Exchange of Hong Kong Limited

The GEM of the Stock Exchange of Hong Kong Limited has specific listing requirements for companies aiming to be listed, including positive cash flow, market capitalization, mandatory public offering, minimum public float, number of shareholders, and management ownership criteria. Unsuitable applican

0 views • 12 slides

Technical Committee Update on Attraction of New Listings Initiatives

The Technical Committee on Attraction of New Listings provides an update on initiatives aiming to increase the number of listed companies on exchanges. The mandate includes proposing strategies, undertaking advocacy, and implementing various activities. Specific initiatives involve engaging with ind

0 views • 7 slides

Technical Committee Update on New Listings Initiatives to Capital Market Committee (CMC)

The presentation by Jalo Waziri, Chairman, highlighted the Technical Committee's mandate to drive advocacy for increasing listed companies. Initiatives include creating industry groups, sensitization timelines, engaging with high-value issuers, and identifying MDAs for listing incentives. Ongoing ef

0 views • 10 slides

Impact of Political Stability on Equity Trading Costs of Cross-Listed Firms

The research explores the relationship between political stability and equity trading costs of cross-listed firms, highlighting the impact of political institutions, liquidity, and investor protection. It delves into the importance of factors like quality of political institutions, transparency, and

0 views • 24 slides

Understanding Growth Companies and Growth Stocks

Differentiating between good companies and good investments, this content delves into the intrinsic value versus market value of stocks, the characteristics of growth companies and growth stocks, and how stock prices can be undervalued or overvalued in the market due to incomplete information. It em

0 views • 38 slides