Quarterly-Annually-Half Yearly Compliances under SEBI LODR

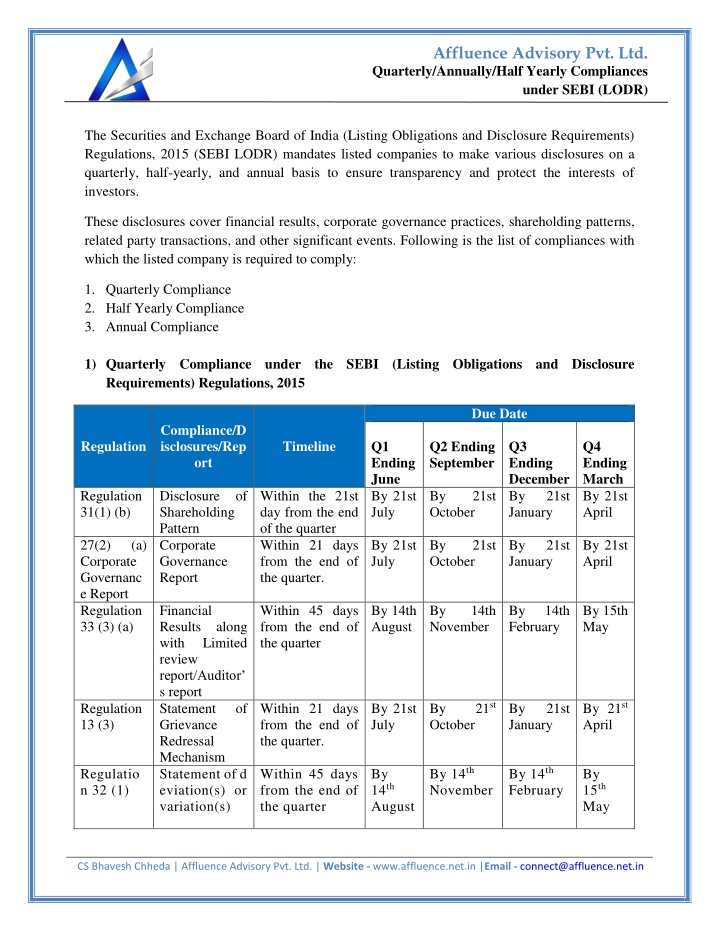

The SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 mandate that listed companies must adhere to a strict schedule of disclosures on a quarterly, half-yearly, and annual basis. These requirements include financial results, corporate governance reports, shareholding patterns, and related party transactions, ensuring transparency and protecting investor interests.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Affluence Advisory Pvt. Ltd. Quarterly/Annually/Half Yearly Compliances under SEBI (LODR) The Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (SEBI LODR) mandates listed companies to make various disclosures on a quarterly, half-yearly, and annual basis to ensure transparency and protect the interests of investors. These disclosures cover financial results, corporate governance practices, shareholding patterns, related party transactions, and other significant events. Following is the list of compliances with which the listed company is required to comply: 1.Quarterly Compliance 2.Half Yearly Compliance 3.Annual Compliance 1)Quarterly Compliance under the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 Due Date Compliance/D isclosures/Rep ort Q1 Ending June By 21st July Q2 Ending September Q3 Ending December By January Q4 Ending March By 21st April Regulation Timeline Regulation 31(1) (b) Disclosure of Shareholding Pattern Corporate Governance Report Within the 21st day from the end of the quarter Within 21 days from the end of the quarter. By October 21st 21st 27(2) Corporate Governanc e Report Regulation 33 (3) (a) (a) By 21st July By October 21st By January 21st By 21st April Financial Results along with Limited review report/Auditor s report Statement Grievance Redressal Mechanism Statement of d eviation(s) or variation(s) Within 45 days from the end of the quarter By 14th August By November 14th By February 14th By 15th May 21st By 21st April Regulation 13 (3) of Within 21 days from the end of the quarter. By 21st July By October By January 21st By 14th November By 14th February Regulatio n 32 (1) Within 45 days from the end of the quarter By 14th August By 15th May CS Bhavesh Chheda | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. Quarterly/Annually/Half Yearly Compliances under SEBI (LODR) By 30th October By 30th January By 30th April Reconciliation of share capital audit report Within 30 days from the end of the quarter. By 30th July 2)Half Yearly Compliance under the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 Due Date Half-yearly Ending September Half- yearly Ending March By 29th June Compliance/Disclosures/ Report Regulation Timeline Regulation 2 3 (9) Disclosures party transactions of related 30 days from the date publication its standalone and consolidated financial results. By 14th December of of 3)Annual Compliance under the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 Regulation Regulation 24 A Compliance/Disclosures/Report Secretarial Compliance Report Timeline within 60 days of the end of the financial year At the 1st BM in every Financial Year Due Date By every year 30th May Regulation 26 (3) Annual compliance with code of conduct affirmations for At 1st Board Meeting every Financial Year By 30th April the in Share Transfer Agent Regulation 7 (3) Within 30 days from the end of the financial year. CS Bhavesh Chheda | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. Quarterly/Annually/Half Yearly Compliances under SEBI (LODR) By 30th April Regulation 14Payment of listing fees & Other charges Within 1 month of the end of 31st March every year Within 60 days from the end of the financial year Not later than the day commencement of dispatch to its shareholders. Within 30 days from the end of the financial year Within 30 days from beginning of the FY 30th May Regulation 33 (3) (d) Financial Results along with Aud itor s Report By every year Annual Report Regulation 34 (1) Not less than 21 days before the AGM of By 30th April Regulation 40 (10) Transfer transposition of securities or transmission or By 30th April Circular No. S EBI/HO/DDH S/CIR/P/2018 /144 Initial Disclosure requirements for large entities the By 15th May Circular No. SEBI/HO/DD HS/CIR/P/201 8/144 Annual Disclosure requirements for large entities Within 45 days of the end of the FY By 30th April Regulation 40 (9) Certificate Practicing Company Secretary. from Within month of the end of the financial year. Within two working days of the conclusion of General Meeting one Regulation 44 (3) Submission of Voting Results to Stock Exchange Conclusion: In conclusion, adherence to SEBI regulations is imperative for maintaining the integrity, transparency, and efficiency of the Indian capital markets. The quarterly, half-yearly, and yearly SEBI listed compliance reports serve as vital tools for ensuring that listed entities operate within the bounds of regulatory requirements and uphold investor confidence. CS Bhavesh Chheda | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. Quarterly/Annually/Half Yearly Compliances under SEBI (LODR) Through meticulous monitoring and reporting of financial statements, corporate governance practices, and disclosure norms, companies demonstrate their commitment to regulatory compliance and stakeholder trust. Moreover, these compliance mechanisms foster greater accountability, helping to mitigate risks and safeguard investor interests. As we navigate an increasingly dynamic and complex business environment, the significance of regulatory compliance cannot be overstated. By embracing a culture of compliance and implementing robust internal controls, companies can not only mitigate regulatory risks but also enhance their corporate reputation and long-term sustainability. In essence, the quarterly, half-yearly, and yearly SEBI listed compliance reports serve as vital checkpoints in the regulatory landscape, ensuring that listed entities operate ethically, Transparently, and in accordance with the highest standards of corporate governance. By upholding these standards, companies contribute to the overall health and resilience of the Indian capital markets, fostering trust and confidence among investors, regulators, and stakeholders alike. Disclaimer:This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement CS Bhavesh Chheda | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in