Company Reconstruction and Capital Alteration Overview

Company reconstruction involves internal and external methods to reorganize the financial structure without liquidation or by forming a new company after liquidating the existing one. Objectives include writing off losses, adjusting share values, ensuring fair returns, and enhancing goodwill. Capita

1 views • 8 slides

Cost Accounting Standards for Determining Transportation Costs

Understanding the importance of transportation costs in procurement and distribution, this guide outlines the standards for determining average costs, separation of transportation costs in accounting records, objectives for maintaining cost uniformity, components of transportation costs, and treatme

0 views • 11 slides

EANS-I Grant Deadlines and Requirements Overview

Understanding the EANS-I grant deadlines is crucial for proper utilization of funds. Learn about the obligation, performance, and liquidation deadlines, including flexibility and requirements for reimbursement and direct payments. Stay informed to ensure compliance with the grant program guidelines.

2 views • 14 slides

Premier Liquidation Warehouse in Arizona

Find amazing deals on top brands at Vendorsoutlet.com, the ultimate liquidation warehouse in Arizona. Shop now and save big on your favorite items!\n\n\/\/ \/

4 views • 1 slides

Types of Shares: Ordinary and Preference Shares in Equity Investments

Equity capital in a company is comprised of ordinary and preference shares. Ordinary shares represent full risk and reward for shareholders, who can vote on resolutions and receive dividends. Preference shares offer specific features like cumulative or participating dividends, non-voting rights, and

0 views • 4 slides

Liquidation of Companies: Procedures as per IBC 2016

The process of liquidating a company involves collecting and selling its assets to pay off debts, with remaining funds distributed to shareholders. Under the Insolvency and Bankruptcy Code (IBC) 2016, specific procedures must be followed, including initiation by either creditors or debtors within se

0 views • 16 slides

Understanding Internal Reconstruction in Companies

Internal reconstruction in companies involves reorganizing the financial position without liquidation or forming a new entity. It aims to enhance profitability by aligning assets with true values. Methods include altering share capital, changing shareholder rights, and compromising with creditors. N

0 views • 19 slides

Grant Management Flexibility under Horizon 2020 During COVID-19

Grant management under Horizon 2020 during COVID-19 requires maximum flexibility with eligibility of costs incurred, force majeure clause usage, and flexibility in actual personnel costs. Teleworking costs are eligible, and personnel costs can be adjusted for exceptional circumstances. Travel costs

1 views • 12 slides

Understanding Administrative Costs in Grant Management

Administrative costs are essential for managing grants effectively. Learn about the difference between direct and indirect costs, and why tracking and reporting accurately is crucial to avoid disallowed costs. Explore the definition, classification, and significance of administrative costs in grant

0 views • 22 slides

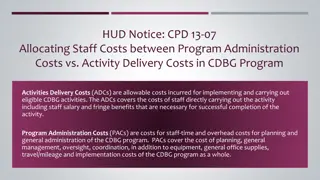

Understanding Activities Delivery Costs and Program Administrative Costs in CDBG Programs

Exploring the allocation of staff costs between Activities Delivery Costs (ADCs) and Program Administrative Costs (PACs) in Community Development Block Grant (CDBG) programs. ADCs cover non-profit staff expenses for carrying out eligible activities, while PACs include costs for planning, general adm

1 views • 10 slides

Understanding Insolvency Accounts and Laws in Financial Accounting

Insolvency in financial accounting refers to the inability to pay debts when they fall due. This article covers the meaning of insolvency, the criteria for being declared insolvent, the Insolvency Act in India, and its applicability to individuals, firms, and Hindu Undivided Families. It distinguish

1 views • 10 slides

Understanding the Costs of Inflation and Its Impact on Purchasing Power

Inflation is a crucial economic phenomenon with both winners and losers. While inflation itself doesn't necessarily reduce real purchasing power, it leads to various costs such as shoeleather costs, menu costs, and unit of account costs. These costs emerge due to the changing dynamics of prices, wag

0 views • 16 slides

Understanding Redemption of Preference Shares in Companies

Preference shares in companies offer preferential rights in dividend payments and capital repayment during liquidation. Redemption of preference shares involves returning the preference share capital to the shareholders. This process requires adherence to specific provisions under the Companies Act,

0 views • 25 slides

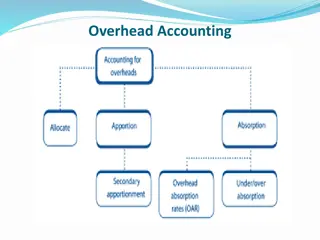

Understanding Overhead Accounting and Allocation Process

Overhead accounting involves allocating and apportioning overhead costs to different departments or cost centers in a company. This process includes dividing cost centers into production and service departments, assigning overhead costs accurately, and distributing common overhead costs proportionat

0 views • 18 slides

Understanding Costs for Defendants in Legal Proceedings

This article provides detailed information on the costs involved for defendants in legal cases, including the starting point for cost allocation, costs at different stages of the legal process, and considerations for recovery of costs. It covers aspects such as costs at the pre-action stage, costs a

2 views • 54 slides

Overview of New Civil Procedure Rules on Costs: CPR Parts 58 & 59

The new Civil Procedure Rules (CPR) Parts 58 & 59 introduce changes in the assessment and taxation of costs in legal proceedings. Detailed assessment replaces taxation, standard basis, fixed costs, and more defined, with new definitions and procedures outlined. Order 59 expands the powers to tax cos

0 views • 22 slides

Understanding Engineering Costs and Estimation Methods

This informative content delves into the concept of engineering costs and estimations, covering important aspects such as fixed costs, variable costs, semi-variable costs, total costs, average costs, marginal costs, and profit-loss breakeven charts. It provides clear explanations and examples to hel

0 views • 33 slides

Understanding the Insolvency and Bankruptcy Code of 2016 in India

The Insolvency and Bankruptcy Code of 2016 in India replaced various existing laws to streamline the process of corporate restructuring, insolvency, and liquidation. Enacted to resolve bad debts efficiently, attract investors, and strengthen the economy, the code offers benefits like quicker resolut

0 views • 31 slides

Comprehensive Guide to Post-Confirmation Trusts and Plan Agents

Learn about the importance and necessity of post-confirmation trusts and plan agents in bankruptcy cases, the selection process for trustees/fiduciaries, choosing the right post-confirmation vehicle, creating trusts through agreements, and understanding the role of litigation/liquidation trusts in m

0 views • 32 slides

Understanding Budget Basics for Comprehensive Budget Development

Components necessary for comprehensive budget development include categories of spending like direct costs, personnel costs, and facilities & administrative costs. Budget construction may vary by sponsor, but a detailed budget is required at submission. Personnel costs cover various types of employe

1 views • 19 slides

Understanding Liquidation Estate and Key Asset Components

In the process of liquidation, the liquidator forms an estate comprising various assets of the corporate debtor for the benefit of creditors. These assets include ownership rights, tangible and intangible assets, proceeds of liquidation, and more. However, certain assets owned by third parties or he

0 views • 39 slides

Liquidation Process and Costs under Insolvency and Bankruptcy Code

The process of passing a liquidation order under the Insolvency and Bankruptcy Code is detailed, including scenarios for passing the order and the steps involved in the liquidation process. The costs associated with liquidation, as defined under Section 5 and Regulation 2(ea), cover various expenses

0 views • 28 slides

Understanding Costs in Business: Types and Significance

Costs in business play a crucial role in determining profitability and decision-making. This article explores various types of costs such as direct, indirect, fixed, and variable costs, along with their definitions, uses, and impact on business operations. Understanding these costs is essential for

0 views • 13 slides

Understanding Marginal Costing in Cost Accounting

Marginal Costing is a cost analysis technique that helps management control costs and make informed decisions. It involves dividing total costs into fixed and variable components, with fixed costs remaining constant and variable costs changing per unit of output. In Marginal Costing, only variable c

1 views • 7 slides

Overview of Insolvency Procedures in Business and Individual Cases

Explore the different insolvency procedures such as bankruptcy, Individual Voluntary Arrangement (IVA), Company Voluntary Arrangement, Compulsory Liquidation, and Creditors Voluntary Liquidation. Understand the key aspects of each process, from initiating petitions to the appointment of IPs and the

0 views • 19 slides

Liquidating a Small Business in Dubai: Challenges and Solutions

Discover the challenges and solutions involved in company liquidation in Dubai, UAE. Learn how to navigate legal requirements, settle debts, and ensure tax compliance for a smooth business closure.

0 views • 11 slides

How to Fill Out a Nursing Assistant Certification Reimbursement Request Form

Detailed instructions on filling out Form 06-123 for Nursing Assistant Certification (NAC) reimbursement requests. Sections covered include Provider Information, Direct Care Costs, Operating Costs, Total Costs, and Provider Authorization. The form requires manual entry of some totals and provides au

0 views • 16 slides

Analysis of 2021 Marginal Generation Costs for San Diego Gas & Electric

The analysis presents the 2021 Marginal Generation Costs methodology filed by San Diego Gas & Electric in April 2016 for the Time-of-Use (TOU) OIR Workshop. It includes forecasts for Marginal Energy Costs (MEC) and Marginal Generation Capacity Costs (MGCC) for the calendar year 2021, based on market

0 views • 6 slides

Understanding Overhead Costs and Their Importance in Business

Overhead costs play a crucial role in cost allocation and management within an organization. These costs, which include indirect expenses such as labor, materials, and services, cannot be directly linked to specific units of production. Instead, overhead costs are apportioned and absorbed using vari

0 views • 16 slides

Project Cost Estimation for Microgrid Equipment and Installation

This module delves into estimating project costs for microgrid equipment, including procurement, installation, design, and engineering. It covers categories such as installation costs, design and engineering costs, overhead costs, and contingency costs, to provide a comprehensive understanding of es

0 views • 18 slides

Understanding Migration Costs in Low-skilled Labor Migration

This content delves into the work of KNOMAD and The World Bank in measuring migration costs for low-skilled labor migration. It outlines the objectives, phases, and methodologies used to assess various costs incurred throughout the migration cycle, such as compliance costs, transportation expenses,

1 views • 21 slides

Guidelines on Allowable Costs and Related Parties in Long-term Debt Training

Explore guidelines on allowable costs and transactions with related parties in long-term debt training programs. Learn about costs paid to other agencies, examples of allowed costs, and costs not allowed. Gain insights into the XI-Q Bond Agency Guide and upcoming training sessions. Have questions? F

0 views • 6 slides

Resource Analysis Summary Report for Instructional Costs

This Resource Analysis Summary Report analyzes instructional costs for different campuses based on subject code and course level. It outlines how model costs used in the State Share of Instruction (SSI) are calculated by dividing the sum of unrestricted costs by Full-Time Equivalents (FTE). The repo

0 views • 9 slides

Understanding Tariff of Electricity and Principles of Calculation

Electrical energy production involves costs that are shared by consumers based on the amount and nature of electricity consumed. This includes fixed costs for setting up power plants and variable costs for generating electricity, which covers fuel expenses. The calculation of electricity costs is ba

0 views • 18 slides

Understanding Accounting for Borrowing Costs in Financial Management

Borrowing costs in financial management refer to interest and other expenses incurred when borrowing funds. These costs are crucial to account for correctly to ensure accurate financial reporting. Borrowing costs directly attributable to acquiring, constructing, or producing a qualifying asset are c

0 views • 8 slides

Sri Lanka Accounting Standards LKAS 23: Borrowing Cost Overview

This document provides an overview of Sri Lanka Accounting Standards LKAS 23 on borrowing costs, covering its introduction, scope, definition, and accounting treatment. It explains how borrowing costs are recognized, the scope of the standard, and the classification of borrowing costs. Additionally,

0 views • 12 slides

Financial Guidelines Overview for Collaborative Projects

Introduction to the financial framework for collaborative projects, including budget formats, budget lines, and principles of alignment in accordance with partner universities. Details on budget limits, implementation periods, activity year breakdown, and justification requirements are provided. Key

0 views • 27 slides

Analysis of Manufacturing Costs for Trunnion Speaker Production

This analysis breaks down the manufacturing costs for producing Trunnion Speakers, including variable costs, fixed costs, overhead costs, total costs, mark-up values, and break-even points. The detailed breakdown provides insight into cost per unit and helps in pricing decisions for achieving profit

0 views • 8 slides

Understanding Costs in Power Sector Decision-Making

Operational, decommissioning, and investment decisions in the power sector are influenced by different categories of costs. Operational decisions focus on variable costs like fuel and CO2 expenses, while decommissioning decisions consider both variable and fixed costs. Investment decisions require a

0 views • 6 slides

Understanding Relevant Revenues and Costs in Decision-Making

Explore the concepts of relevant revenues and costs in decision-making, including differential costs, avoidable costs, sunk costs, opportunity costs, and relevant costs. Learn how to analyze costs, make add or drop decisions, and apply these principles through an example scenario with Recovery Sanda

0 views • 16 slides