Filing a Candidate’s Statement of Organization

The process of filing a Candidate's Statement of Organization (CFA-1) in Indiana. Understand the deadlines based on the salary for the elected office and the campaign finance committee requirements.

1 views • 10 slides

RBI Directions on Filings of Supervisory Returns

RBI issues new Master Directions on 'Filing of Supervisory Returns,' emphasizing NBFCs. Timelines, revised applicability, and online portals introduced for streamlined filing. Physical submission required for Form A Certificate.

1 views • 5 slides

Overview of Enforcement Initiatives and Outcomes at National Conference of Enforcement Officers

Delve into the insights shared at the National Conference of Enforcement Officers on 4th March 2024, focusing on enforcement initiatives such as National Special Drive, actions by the Centre and State, technology interventions, and policy changes. Uncover details on fake billing structures, motives

3 views • 32 slides

Climate Action Strategy for Decarbonising Inland Transport by 2050

The Inland Transport Committee (ITC) has adopted a strategy to reduce greenhouse gas emissions from inland transport, aligning with the goal of achieving net-zero emissions by 2050. This strategy includes a focus on reducing GHG emissions, setting strategic objectives, implementing climate actions,

1 views • 19 slides

For Tax Filing - Analyze the Tax Regime

As the financial year closes, taxpayers would need to ensure that their books of accounts, pay slips, bank statements and other important documents are in place such that the details are available at the time of audit and filing the return of income. While filing the return of income, a taxpayer mu

0 views • 3 slides

Changes in ITC for 2025: Exam Structure, Competency Framework, and More

Exciting changes are coming to the Initial Test of Competence (ITC) in 2025, including adjustments to the exam structure, mark allocation, number of papers, competency framework, and more. The new competency framework emphasizes six competency areas, with a focus on an even spread over three papers.

18 views • 4 slides

Navigating Hart-Scott Act Filing Requirements (2024)

This guide provides an overview of the HSR filing process, including reportable transaction thresholds, exemptions, and filing requirements. It explains the key aspects like size-of-the-transaction test, size-of-the-persons test, types of transactions involved, and the valuation of voting securities

4 views • 60 slides

Understanding FAFSA Simplification: Campus-wide Impact

The FAFSA simplification aims to streamline the financial aid process for students through recent legislative changes, with implications including increased Pell grant recipients and changes in aid eligibility criteria. The shift towards simplification benefits access to postsecondary education, pro

4 views • 8 slides

Process for Filing a Petition for Divorce in India

Filing a Petition for Divorce in India\n\nFiling a Petition: The divorce process in India begins with the crucial step of filing a petition. This is the formal action taken by one spouse, known as the petitioner, to initiate the legal proceedings for divorce. The petition is filed in the appropriate

0 views • 4 slides

Simplifying Income Tax Filing_ A Friendly Guide

Get expert income tax return filing service providers in Punjagutta, Begumpet, Banjara Hills, Hyderabad. We offer online tax filing, ITR filing and tax preparation services.

1 views • 2 slides

Understanding the Importance of Filing Income Tax Returns

Filing income tax returns is crucial as it involves declaring total income and tax payable. Deadlines are specified based on the type of assessee, with penalties for late filing. The process allows for claiming refunds, showing financial worth for visas, and ensuring eligibility for tenders. Failing

0 views • 26 slides

The Art of Work Simplification

Work simplification is the conscious effort to find the simplest and most efficient ways of doing work to eliminate waste of time, energy, and resources. This involves techniques like time and motion studies, Mundel's classes change, and focusing on body mechanics. The approach includes eliminating

0 views • 34 slides

Annual Filing Requirements for Knights of Columbus Councils

Learn about the IRS annual filing requirements for Knights of Columbus Councils, including the need to file Form 990, obtain an EIN, and maintain tax-exempt status. Failure to comply can result in the revocation of tax-exempt status and reinstatement fees. Find detailed guidance on applying for an E

0 views • 23 slides

Guide to Filing for Conservatorship in Fresno, CA Probate Court

Comprehensive guide on filing for conservatorship in Fresno, CA Probate Court, covering basics, costs, required forms, service procedures, and due diligence efforts. Detailed information on the process including filing location, fees, required documents, and serving requirements. Includes tips on du

0 views • 22 slides

Tax Filing, Payment, and Penalties Overview for LRA Practitioners in Monrovia 2021

Comprehensive training module covering income tax, excise tax, goods and services tax filing requirements, due dates for tax returns, and more for taxpayers in Monrovia. Learn about the responsibilities of taxpayers, due dates for filing tax returns, and specific requirements for various types of ta

0 views • 43 slides

Cold Storage Nutan Rajumani Transport (P) Ltd - Logistics Service Provider Since 1965

Cold Storage Nutan Rajumani Transport (P) Ltd has been a leading logistics service provider in India since 1965, celebrating 50 glorious years. Their motto is to create opportunities and their vision is to be the best in India. With a strong clientele including ITC Ltd, Asian Paints, and others, NRT

0 views • 12 slides

Comprehensive Guide to Filing in Business Organizations

Filing is essential for maintaining records in business organizations. It involves systematic arrangement of documents for easy access and reference. The objectives, functions, and importance of filing are discussed in this informative guide.

0 views • 16 slides

Mastering BODMAS Rule for Simplification in Mathematics

Learn all about the BODMAS rule, simplification techniques, and numerical expressions involving whole numbers, decimal numbers, and fractional numbers. Discover the importance of understanding brackets and how to apply the rule effectively to solve math problems. Enhance your math skills with brain

2 views • 30 slides

Understanding Full Adder and Full Subtractor Circuits

Full Adder and Full Subtractor are essential combinational circuits used in digital electronics for addition and subtraction operations. A Full Adder calculates the sum of three bits, while a Full Subtractor performs subtraction considering borrow operations. They consist of input and output variabl

0 views • 23 slides

Understanding GST Returns: Types, Benefits, and Mechanisms

GST returns play a crucial role in the tax system by providing necessary information to the government in a specific format. They include details of outward and inward supplies, ITC availed, tax payable, and more. Filing returns ensures timely transfer of information, aids in tax liability determina

4 views • 38 slides

Security and Authentication in Electronic Filing Systems: Arkansas Subcommittee Report

Explore the subcommittee report on security and authentication in electronic filing systems for campaign and finance reports in Arkansas. Learn about user authentication, risks, mitigation strategies, and approaches used in other states. Discover the filing processes in both paper and electronic for

0 views • 24 slides

Introduction of RCM Liability - ITC statement

The GST portal now features a new RCM liability\/ITC statement, effective August 2024. Taxpayers must declare their opening balance by October 31, 2024, with three opportunities to correct errors by November 30, 2024. This update aims to enhance accu

5 views • 1 slides

International Trade Centre: Empowering Small Businesses Through Trade

The International Trade Centre, a joint agency of the United Nations and World Trade Organization, supports small businesses globally in engaging in international trade. With a vision of creating inclusive, sustainable economies, ITC focuses on areas like regional integration, resilient value chains

0 views • 16 slides

IEEE Internet Technical Committee Meeting 2013 Summary

The IEEE Internet Technical Committee (ITC) met in December 2013 in Atlanta, USA. The meeting included various agenda items such as introductions, award announcements, conference updates, and discussions on roles and recertification. It highlighted the officers, community members, and past chairs of

0 views • 42 slides

Virginia ACA Filing Season 2022 Carrier Teleconference: Important Updates

Explore key topics discussed during the Virginia ACA filing season teleconference, including important dates, rate filing template changes, health care savings programs, mental health parity compliance, and more. Stay informed about crucial deadlines and regulatory requirements for carriers in Virgi

0 views • 19 slides

Election Filing Deadlines and Procedures for 2024

Detailed information on candidate filing deadlines and procedures for the 2024 election season, covering key dates for filing, deadlines for petitions, withdrawals, challenges, and ballot vacancies for Democratic, Republican, and Libertarian parties in Indiana.

0 views • 10 slides

Simplifying Learning: Strategies for Effective Education

Emphasizing the importance of simplification in education, this workshop explores techniques such as simplifying, changing, and arranging to enhance learning outcomes. It delves into the Magenta Principles, the significance of language in thinking, and the magic words of simplifying, changing, and a

0 views • 37 slides

Louisiana Department of Revenue Electronic Filing Guidelines

This content provides a comprehensive overview of the electronic filing process for individual income tax returns with the Louisiana Department of Revenue. It covers important details such as filing requirements, third-party filings, ERO application procedures, retention of paper documents, and more

0 views • 30 slides

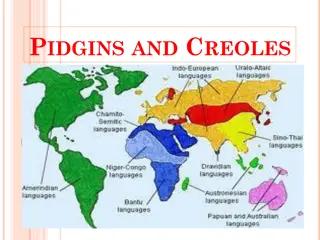

Understanding Language Simplification, Mixing, and Reduction in Adult Learners

Adolescents and adults face challenges in learning foreign languages, often leading to simplification, mixing, and reduction in their speech. These processes involve regularization, loss of redundancy, and the introduction of elements from their native language. This pidginization occurs when langua

0 views • 40 slides

Small Company Disclosure Simplification Act: H.R. 4164 Overview

The Small Company Disclosure Simplification Act, also known as H.R. 4164, aims to exempt small companies with less than $250 million in revenue from certain reporting requirements. The bill directs the SEC to analyze the costs and benefits of XBRL reporting and provide updates to congressional commi

0 views • 4 slides

Tax Rates and Standard Deductions for Different Filing Statuses

This content provides information on tax rates and standard deductions for various filing statuses for tax years 2010 and 2011. It includes details on taxable income brackets and corresponding tax rates for single filers, all filers, and married filing jointly, along with standard deductions for dif

0 views • 10 slides

Understanding Input Tax Credit (ITC) Law: Provisions and Issues

Dive into the world of Input Tax Credit (ITC) with a focus on basic provisions, eligibility criteria, conditions, apportionment of credit, and blocked credit as outlined in Sec-16, Sec 17 (1) to (4), and Sec 17 (5) of tax laws. Gain insights into how businesses can effectively utilize ITC while navi

0 views • 109 slides

Logical Circuit Simplification Techniques and Boolean Expressions Overview

Exploring logic circuit simplification methods such as Karnaugh Maps, minimal Boolean expressions, and variable cases (two and three). These techniques aid in reducing complexity and optimizing logic circuits for efficient operation.

0 views • 9 slides

Computation for Real Estate Sector in Bangalore Branch of ICAI

Practical overview of GST computation for real estate transactions in Bangalore, with details on old rates with ITC and new rate regime effective from April 1, 2019. The content discusses different transactions, conditions for new rates without ITC, and provides insights on the 80:20 computation met

0 views • 39 slides

Guide to Filing 2015 Federal Tax Return with 1040NR-EZ Form

Learn about filing your 2015 Federal Tax Return using the 1040NR-EZ form, including guidance on completing the form, using tax preparation software, and determining eligibility. Understand the criteria for completing the 1040NR-EZ form and find resources to help you navigate through the tax filing p

0 views • 78 slides

Understanding Input Tax Credit Provisions in Taxation

This content provides a comprehensive overview of Input Tax Credit (ITC) provisions in taxation, covering eligibility criteria, conditions for claiming ITC, issues related to excess or wrong tax charged by vendors, receipt of goods/services, blocked credits, apportioned credits, and more. It discuss

0 views • 16 slides

Evaluation of Text Simplification Systems using Machine Translation Techniques

This research paper presents a method to evaluate text simplification systems using machine translation evaluation techniques. It focuses on assessing the quality of simplification output based on properties like grammaticality, meaning preservation, and simplicity. The study aims to develop evaluat

0 views • 30 slides

Understanding UCC Article 9 Filing System

The UCC Article 9 filing system plays a crucial role in perfecting security interests and providing public notice for creditors' rights adjustments. It emphasizes the importance of proper filing, searchers' due diligence, and the neutral role of the filing office in maintaining accurate records. Key

0 views • 40 slides

GST Refund Procedure and Guidelines

Introduction to GST refunds focusing on refund of accumulated credit under GST for zero-rated supplies, the procedure for claiming refund of accumulated ITC, and filing and obtaining GST refund. It covers the eligibility criteria, required documents, formula for calculating refund amount, and step-b

0 views • 7 slides

Understanding the E-Filing Process for Guardianship/Probate

Explore the e-filing procedure and process for guardianship/probate cases, covering document formats, form/template modifications, and designations of emails for pro se parties and unrepresented individuals. Learn about acceptable document formats, necessary modifications, and recommendations for em

0 views • 17 slides