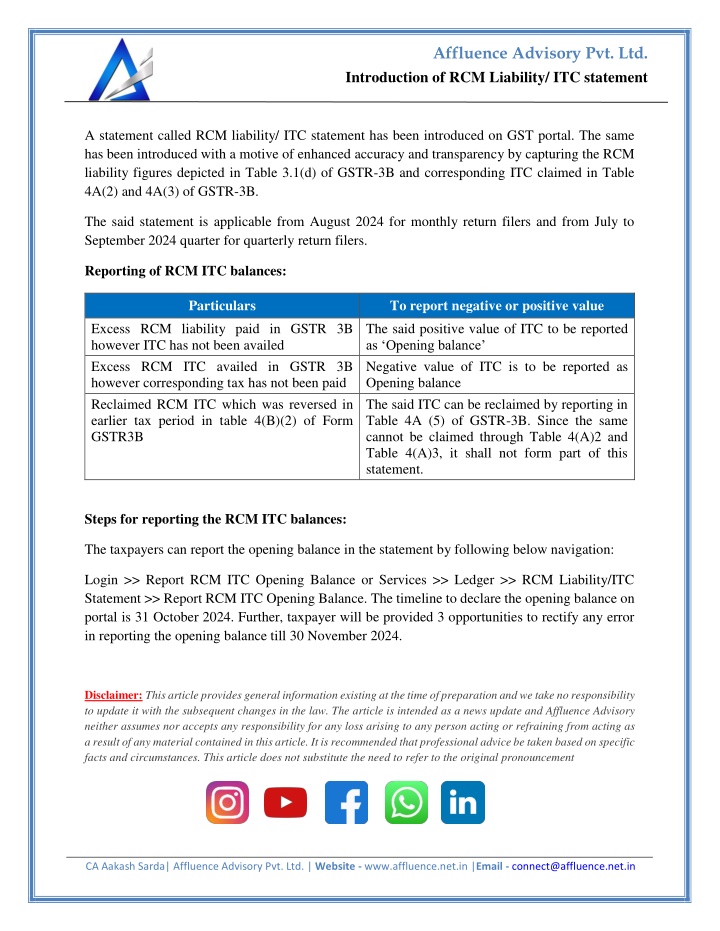

Introduction of RCM Liability - ITC statement

The GST portal now features a new RCM liability/ITC statement, effective August 2024. Taxpayers must declare their opening balance by October 31, 2024, with three opportunities to correct errors by November 30, 2024. This update aims to enhance accu

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Affluence Advisory Pvt. Ltd. Introduction of RCM Liability/ ITC statement A statement called RCM liability/ ITC statement has been introduced on GST portal. The same has been introduced with a motive of enhanced accuracy and transparency by capturing the RCM liability figures depicted in Table 3.1(d) of GSTR-3B and corresponding ITC claimed in Table 4A(2) and 4A(3) of GSTR-3B. The said statement is applicable from August 2024 for monthly return filers and from July to September 2024 quarter for quarterly return filers. Reporting of RCM ITC balances: Particulars To report negative or positive value The said positive value of ITC to be reported as Opening balance Negative value of ITC is to be reported as Opening balance The said ITC can be reclaimed by reporting in Table 4A (5) of GSTR-3B. Since the same cannot be claimed through Table 4(A)2 and Table 4(A)3, it shall not form part of this statement. Excess RCM liability paid in GSTR 3B however ITC has not been availed Excess RCM ITC availed in GSTR 3B however corresponding tax has not been paid Reclaimed RCM ITC which was reversed in earlier tax period in table 4(B)(2) of Form GSTR3B Steps for reporting the RCM ITC balances: The taxpayers can report the opening balance in the statement by following below navigation: Login >> Report RCM ITC Opening Balance or Services >> Ledger >> RCM Liability/ITC Statement >> Report RCM ITC Opening Balance. The timeline to declare the opening balance on portal is 31 October 2024. Further, taxpayer will be provided 3 opportunities to rectify any error in reporting the opening balance till 30 November 2024. Disclaimer:This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement CA Aakash Sarda| Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in