E-QIP Instructions for IRS Applicants

Complete guide for IRS applicants on how to navigate and complete the electronic questionnaires for investigation processing (E-QIP) system. Includes helpful tips and definitions.

2 views • 10 slides

Understanding IRS Reporting Requirements for Supplier Payments

This document covers important reminders related to 1099 corrections, choosing the right location and address when entering vouchers, reasons for reporting to the IRS, and guidelines on which suppliers are reportable. It also provides examples of reportable payments, such as rents, awards, medical s

2 views • 23 slides

Theories of Intelligence: Monarchie vs. Spearman's Two-Factor Theory

The Monarchie Theory of Intelligence posits a single factor of intelligence, while Spearman's Two-Factor Theory divides intelligence into a general ability (G-factor) and specific abilities (S-factors). The implications of these theories on educational practices are discussed, shedding light on the

11 views • 25 slides

Understanding Blood Clotting Factors in the Human Body

Blood clotting factors play a crucial role in the coagulation process to prevent excessive bleeding. Factors such as Fibrinogen (Factor-I), Prothrombin (Factor-II), Thromboplastin (Factor-III), Calcium Ions (Factor-IV), Labile Factor (Factor-V), and Stable Factor (Factor-VII) are essential for the c

7 views • 14 slides

The Fitz Factor: Your Ultimate Fitness Guide

Discover the power of personalized fitness with The Fitz Factor, where expert advice meets real-life results. Our brand is dedicated to providing you with top-notch fitness tips, innovative workout strategies, and comprehensive wellness guidance. Whether you're looking to kickstart your fitness jour

2 views • 4 slides

The Fitz Factor: Your Ultimate Fitness Guide

Discover the power of personalized fitness with The Fitz Factor, where expert advice meets real-life results. Our brand is dedicated to providing you with top-notch fitness tips, innovative workout strategies, and comprehensive wellness guidance. Whether you're looking to kickstart your fitness jour

0 views • 4 slides

The Fitz Factor: Your Ultimate Fitness Guide

Discover the power of personalized fitness with The Fitz Factor, where expert advice meets real-life results. Our brand is dedicated to providing you with top-notch fitness tips, innovative workout strategies, and comprehensive wellness guidance. Whether you're looking to kickstart your fitness jour

0 views • 4 slides

The Fitz Factor: Your Ultimate Fitness Guide

Discover the power of personalized fitness with The Fitz Factor, where expert advice meets real-life results. Our brand is dedicated to providing you with top-notch fitness tips, innovative workout strategies, and comprehensive wellness guidance. Whether you're looking to kickstart your fitness jour

0 views • 4 slides

The Fitz Factor: Your Ultimate Fitness Guide

Discover the power of personalized fitness with The Fitz Factor, where expert advice meets real-life results. Our brand is dedicated to providing you with top-notch fitness tips, innovative workout strategies, and comprehensive wellness guidance. Whether you're looking to kickstart your fitness jour

0 views • 4 slides

Understanding the Concept of Return to Factor in Production Economics

Return to Factor is a key concept in production economics that explains the relationship between variable inputs like labor and total production output. The concept is based on the three stages of production - increasing returns, diminishing returns, and negative returns. By analyzing the behavior o

0 views • 7 slides

Effective Strategies for Overcoming Test Anxiety

Learn practical methods to combat test anxiety in this 1-hour workshop by CCAMPIS Kayla Taylor. Topics covered include avoiding test anxiety, preparing effectively for tests, identifying and reducing sources of anxiety, quelling anxiety, test-taking strategies, and stress management. The PASS method

0 views • 13 slides

Areas Requiring Deeper Scrutiny in Taxation - Saravanan B., IRS

Explore the various areas necessitating closer examination in taxation, such as adjustments in income, capital gains computation, liabilities, and more. Saravanan B., an IRS official from Chennai, highlights key points for scrutiny in financial statements and profit-loss accounts.

0 views • 28 slides

Annual Filing Requirements for Knights of Columbus Councils

Learn about the IRS annual filing requirements for Knights of Columbus Councils, including the need to file Form 990, obtain an EIN, and maintain tax-exempt status. Failure to comply can result in the revocation of tax-exempt status and reinstatement fees. Find detailed guidance on applying for an E

0 views • 23 slides

Understanding Software Testing: Test Cases, Selection, and Execution

Software testing plays a crucial role in identifying and resolving issues within software products. Test cases, selection, and execution are fundamental aspects of the testing process. Test cases define conditions for testing software functionality, with a focus on repeatability and data specificity

2 views • 36 slides

IRS Bankruptcy Issues in Subchapter V of Chapter 11 Explained

This content discusses the IRS bankruptcy issues in Subchapter V of Chapter 11, focusing on tax return filing requirements and payment of post-petition taxes under both standard Chapter 11 and Subchapter V. The responsibilities of debtors, trustees, and governmental units, as well as the compliance

2 views • 7 slides

Understanding Spearman's Two-Factor Theory

Spearman's Two-Factor Theory posits a general mental energy factor (g) and specific abilities factors (s), determining individual intelligence. The g factor is innate and crucial in various activities, while the s factor is acquired and varies per task. Despite criticisms regarding the oversimplific

0 views • 9 slides

Overview of 1099 Reporting Systems

The 1099 Reporting Systems consist of MINC, EARN, and SPPS, which are used for IRS 1099 reporting purposes. These systems handle transactions and generate Form 1099 for recipients based on predefined criteria. Taxpayers are responsible for accurate reporting to the IRS, with reporting thresholds set

0 views • 15 slides

Worried About IRS Audits? Here’s How SAI CPA Services Can Help You Avoid Them!

IRS audits can be stressful, but with the right preparation, you can minimize your chances of being audited. Audits often stem from discrepancies or unusual patterns in tax returns. Common triggers include math errors, large deductions, unreported in

3 views • 2 slides

Efficient Team Management with Integrated Reporting Service (IRS)

Streamline team management processes using Integrated Reporting Service (IRS), allowing different operators and authorities to efficiently manage teams, assign roles, and grant user privileges. Learn about the roles, responsibilities, and how to set up and manage teams effectively through IRS platfo

0 views • 4 slides

Understanding Analytic Rotation in Factor Analysis

Factor analysis involves rotation of the factor loading matrix to enhance interpretability. This process was originally done manually but is now performed analytically with computers. Factors can be orthogonal or oblique, impacting the interpretation of factor loadings. Understanding rotation simpli

0 views • 42 slides

Striking the Proper Balance: Compensation Package Tips for Rebbis and IRS

In this presentation, you will learn about creating a compensation package that satisfies both Rebbis and the IRS. It covers topics such as Qualified Tuition Reductions (QTR), tax implications, wage basics, and legal disclaimers. Understanding the delicate balance between salary and benefits is cruc

0 views • 27 slides

Analyzing Experimental Design with One-Factor and Two-Factor GLMs

Comparing the experimental designs of one-factor (1-way ANOVA) and two-factor GLMs, this content explores biological questions that can be answered through the analysis of multiple factors simultaneously in experiments. It discusses sample sizes, drug treatments, factor levels, and concentration var

1 views • 13 slides

Legal Issues and Compliance for Charter Holders in Texas Education

This content covers essential legal information for entities holding charters in the education sector in Texas. It addresses governance, applicable laws and regulations, eligibility criteria, and compliance requirements related to IRS 501(c)(3) exemption status. Key topics include organizational str

0 views • 50 slides

Mastering SAS for Data Analytics - Factor Analysis Essentials

Factor analysis is a dimension reduction technique used to identify latent variables from observed data. Exploratory factor analysis involves steps like computing correlations, extracting factors, rotating factors for interpretation, and computing factor scores. SAS PROC FACTOR is commonly used for

1 views • 34 slides

Guide to IRS Tax Exempt Status Application for Non-Profit Organizations

This comprehensive guide provides essential information on applying for tax-exempt status with the IRS for non-profit organizations. It covers the benefits, application procedures, responsibilities, and tools needed for a successful application process. From determining eligibility to understanding

0 views • 14 slides

Treatment Strategies for Recurrent Venous Thromboembolism in Factor V Leiden Patients

This presentation discusses the treatment options for recurrent venous thromboembolism in patients with Factor V Leiden mutation. It explores the pathophysiology, epidemiology, and diagnosis criteria for Factor V Leiden, reviews failed anticoagulation history, and suggests outpatient anticoagulation

0 views • 31 slides

Minimizing or Avoiding IRS Penalties on 1098-T Filing

Learn how to respond to IRS penalties on 1098-T filings, understand 972CG notices, reasons for reporting errors, steps for appealing penalties, and what to do after submitting an appeal. Take action within the 45-day window to avoid fines and potential interest charges.

0 views • 16 slides

An Introduction to Factor Analysis: Course Logistics for PSY544

This course in PSY544 introduces students to factor analysis with a focus on understanding the statistical theory behind the model. Taught in English, the course covers lecture times, prerequisites, math requirements, and grading criteria. Emphasizing the inner workings of factor analysis, it aims t

0 views • 16 slides

Relief Veterinarians: Employee or Independent Contractor Classification

Relief veterinarians' classification as employees or independent contractors is determined by various factors, including state and federal laws. Key considerations include the IRS Twenty Factor Test, state laws like the Tennessee Employment Security Act, and the nature of the veterinarian's work arr

0 views • 26 slides

IRS 8823 Guide and OHCS LIHTC Compliance Training Overview

In this comprehensive training, the IRS 8823 Guide and OHCS LIHTC Compliance process are discussed by Jennifer Marchand, a technical advisor. The training covers the basics of tax credits, 8823 process, compliance tips, and more. Participants learn about reporting requirements, IRS processing, corre

0 views • 58 slides

Understanding OHCS Inspection Rating Process at AHMA Conference Summer 2019

Learn about the OHCS inspection rating process discussed at the AHMA Conference Summer 2019. The process includes different types of inspections, steps involved in the inspection process, common findings, tips to improve rating, consequences of non-compliance, and the new IRS requirements. Understan

0 views • 21 slides

Dealing with IRS Assessments: Options for Challenging Unfair Tax Claims

Learn how to address erroneous IRS assessments through various options like audit reconsideration, doubt-as-to-liability, offers in compromise, refund litigation, and bankruptcy. Make an informed choice based on factors like refund eligibility, ability to pay, receipt of the Notice of Deficiency, an

0 views • 5 slides

Common Compliance Findings in IRS Form 8823 Compliance Continuum

Tina Clary provides insights into ten common compliance findings related to IRS Form 8823, focusing on issues such as VAWA policies, incorrect forms, targeted set-asides, and more. State findings that may not necessarily lead to 8823 violations are highlighted, with recommendations for addressing ea

0 views • 14 slides

Understanding the Use of Interest Rate Swaps in Insurance Industry

This presentation delves into the world of interest rate swaps (IRS), their types, regulations, and market overview in the insurance sector. It explores why the IRS market is not growing despite its potential benefits. The content covers IRS basics, variations in types, regulatory guidelines, and ke

0 views • 21 slides

Managing Distribution Lists in Integrated Reporting Service (IRS)

Integrated Reporting Service (IRS) allows users with Notification Submitter privileges to create distribution lists to inform interested parties about notifications submitted. Creating distribution lists saves time by eliminating the need to repeatedly enter email addresses, ensuring all relevant pa

0 views • 5 slides

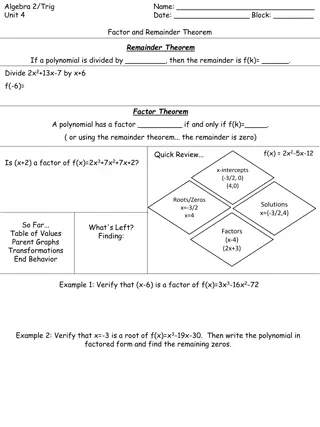

Understanding Polynomial Factor and Remainder Theorems

Exploring the Factor and Remainder Theorems in algebra, including examples on verifying factors, finding roots, applying the Rational Root Test, and determining zeros of polynomials. Learn how to factor polynomials, find remaining zeros, and analyze coefficients to uncover the complete factorization

0 views • 6 slides

Understanding IRS Guidelines on Tip Reporting

Explore the history of tax rules on tip income and delve into the new IRS guidance regarding tips versus service charges. Learn about the distinctions, employer responsibilities, and the impact on FICA taxes and Federal income tax withholding. Gain insights into key factors that differentiate tips f

0 views • 30 slides

IRS Audit Survival- gnsaccountancy

IRS Audit Survival | NGO Ready for the Public Support\nNGO for an IRS audit with expert guidance. Ensure public support compliance and audit readiness with our tailored services for nonprofits.

1 views • 5 slides

Expert Help Negotiating with the IRS

Need help negotiating with the IRS? Mike, a seasoned negotiator based in Minnesota, assists clients nationwide with IRS negotiations, business-to-business issues, and internal business matters. With proven expertise, Mike builds relationships, listen

1 views • 5 slides

Enhanced Functionality of Integrated Reporting Service (IRS)

Explore the additional features of IRS allowing users to run reports, search for notifications, and view notification summaries on the OPRED website. Easily access and download relevant notifications while tracking your organization's involvement. Enhance your reporting capabilities with user-friend

0 views • 5 slides