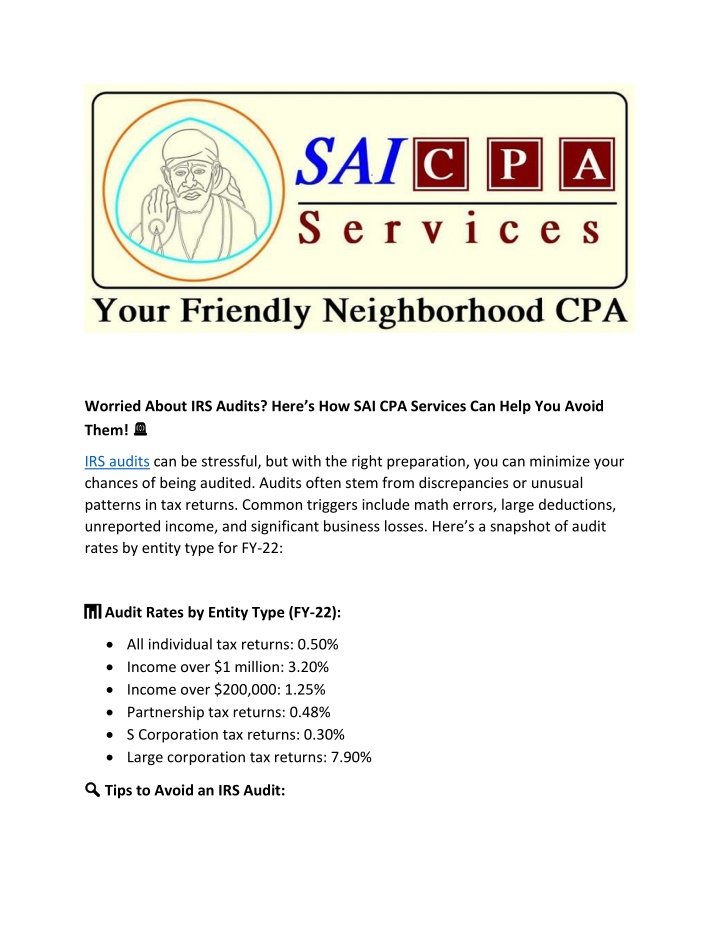

Worried About IRS Audits? Here’s How SAI CPA Services Can Help You Avoid Them!

IRS audits can be stressful, but with the right preparation, you can minimize your chances of being audited. Audits often stem from discrepancies or unusual patterns in tax returns. Common triggers include math errors, large deductions, unreported in

Uploaded on | 8 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Worried About IRS Audits? Heres How SAI CPA Services Can Help You Avoid Them! ? ? IRS audits can be stressful, but with the right preparation, you can minimize your chances of being audited. Audits often stem from discrepancies or unusual patterns in tax returns. Common triggers include math errors, large deductions, unreported income, and significant business losses. Here s a snapshot of audit rates by entity type for FY-22: ? ? Audit Rates by Entity Type (FY-22): All individual tax returns: 0.50% Income over $1 million: 3.20% Income over $200,000: 1.25% Partnership tax returns: 0.48% S Corporation tax returns: 0.30% Large corporation tax returns: 7.90% ? ? Tips to Avoid an IRS Audit:

Report All Income: Ensure all your W-2s, 1099s, and cash earnings are accurately reported. Avoid Excessive Deductions: Be cautious with high home office or charitable deductions that could raise red flags. Double-Check Your Math: Simple math errors can lead to audits. File on Time: Late filings can attract unnecessary scrutiny. Keep Detailed Records: Itemize your expenses and explain any significant changes in your return. Avoid Frequent Amendments: Regularly amending returns can increase your chances of being audited. Use Exact Figures: Avoid rounding numbers on your tax return. Complete Every Section: Don t leave any questions unanswered. Sign Your Return: Make sure your tax return is signed before submission. ? ?If You re Audited: Be transparent and honest with the IRS auditor. Gather and provide documentation to support your claims. Respond promptly to any requests for documents. Seek professional help if needed. Pay any amounts owed in a timely manner. By following these tips and relying on the expertise of SAI CPA Services, you can reduce the likelihood of an audit and handle the process smoothly if one occurs. Stay informed, stay prepared, and let us guide you through your tax journey with confidence! ??