E-QIP Instructions for IRS Applicants

Complete guide for IRS applicants on how to navigate and complete the electronic questionnaires for investigation processing (E-QIP) system. Includes helpful tips and definitions.

2 views • 10 slides

Understanding IRS Reporting Requirements for Supplier Payments

This document covers important reminders related to 1099 corrections, choosing the right location and address when entering vouchers, reasons for reporting to the IRS, and guidelines on which suppliers are reportable. It also provides examples of reportable payments, such as rents, awards, medical s

2 views • 23 slides

Areas Requiring Deeper Scrutiny in Taxation - Saravanan B., IRS

Explore the various areas necessitating closer examination in taxation, such as adjustments in income, capital gains computation, liabilities, and more. Saravanan B., an IRS official from Chennai, highlights key points for scrutiny in financial statements and profit-loss accounts.

0 views • 28 slides

Annual Filing Requirements for Knights of Columbus Councils

Learn about the IRS annual filing requirements for Knights of Columbus Councils, including the need to file Form 990, obtain an EIN, and maintain tax-exempt status. Failure to comply can result in the revocation of tax-exempt status and reinstatement fees. Find detailed guidance on applying for an E

0 views • 23 slides

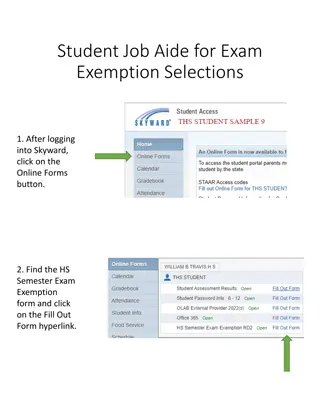

Guide for Submitting HS Semester Exam Exemption Requests in Skyward

Learn how to submit your High School Semester Exam Exemption requests in Skyward by following a step-by-step guide. Understand the process of filling out the form, submitting your requests, making changes if needed, and checking for updates on your exam exemptions. Images provided for visual referen

3 views • 6 slides

IRS Bankruptcy Issues in Subchapter V of Chapter 11 Explained

This content discusses the IRS bankruptcy issues in Subchapter V of Chapter 11, focusing on tax return filing requirements and payment of post-petition taxes under both standard Chapter 11 and Subchapter V. The responsibilities of debtors, trustees, and governmental units, as well as the compliance

2 views • 7 slides

DIDD Staff Training on Policy 30.1.6 Exemption Process

This content provides information for DIDD staff regarding Policy 30.1.6 Exemption Process. It covers permissible and prohibited exemptions, requirements, and duration of approved exemptions. The training agenda includes discussions on background check exemptions, examples of dispositions, and vario

0 views • 56 slides

Overview of 1099 Reporting Systems

The 1099 Reporting Systems consist of MINC, EARN, and SPPS, which are used for IRS 1099 reporting purposes. These systems handle transactions and generate Form 1099 for recipients based on predefined criteria. Taxpayers are responsible for accurate reporting to the IRS, with reporting thresholds set

0 views • 15 slides

Update on IDoW Process in Built Environment Professions

Presentation on the current status of the Identification of Work (IDoW) process as per the professions Acts and the Council for the Built Environment Act. It includes details on the reasons for rejecting exemption applications, consultation processes, scope of work identification, and international

6 views • 16 slides

Understanding Sanctioning in Edmond Public Schools

Sanctioning in Edmond Public Schools allows organizations to operate for the benefit of students by permitting fundraising on school property and providing financial exemption from certain laws. However, it does not equate to control as organizations manage their own funds and must comply with relev

0 views • 44 slides

Understanding Health Status Indicators and Measurements

Health status indicators play a crucial role in assessing overall health status at individual, group, and population levels. These measurements, such as self-assessed health status and life expectancy, provide valuable insights for governments to identify trends, enact appropriate interventions, and

2 views • 18 slides

Worried About IRS Audits? Here’s How SAI CPA Services Can Help You Avoid Them!

IRS audits can be stressful, but with the right preparation, you can minimize your chances of being audited. Audits often stem from discrepancies or unusual patterns in tax returns. Common triggers include math errors, large deductions, unreported in

3 views • 2 slides

Enhancing Code Status Discussions in End-of-Life Care: A Quality Improvement Project

This project led by Dr. John Rutkowski aims to reduce inappropriate interventions for patients with DNR or Modified Code Status by implementing an improved code status documentation system. Data analysis reveals a need for better documentation practices, and survey responses highlight various challe

0 views • 18 slides

Efficient Team Management with Integrated Reporting Service (IRS)

Streamline team management processes using Integrated Reporting Service (IRS), allowing different operators and authorities to efficiently manage teams, assign roles, and grant user privileges. Learn about the roles, responsibilities, and how to set up and manage teams effectively through IRS platfo

0 views • 4 slides

Striking the Proper Balance: Compensation Package Tips for Rebbis and IRS

In this presentation, you will learn about creating a compensation package that satisfies both Rebbis and the IRS. It covers topics such as Qualified Tuition Reductions (QTR), tax implications, wage basics, and legal disclaimers. Understanding the delicate balance between salary and benefits is cruc

0 views • 27 slides

Understanding Financial Best Practices for NC 4-H Clubs

The article discusses the transition of tax-exempt status for 4-H groups in North Carolina, detailing the importance of Group Exemption Numbers (GEN) and the implications of changes in federal income tax regulations. It explores the history of tax exemptions for 4-H clubs, highlighting the IRS rulin

0 views • 41 slides

Legal Issues and Compliance for Charter Holders in Texas Education

This content covers essential legal information for entities holding charters in the education sector in Texas. It addresses governance, applicable laws and regulations, eligibility criteria, and compliance requirements related to IRS 501(c)(3) exemption status. Key topics include organizational str

0 views • 50 slides

Guide to IRS Tax Exempt Status Application for Non-Profit Organizations

This comprehensive guide provides essential information on applying for tax-exempt status with the IRS for non-profit organizations. It covers the benefits, application procedures, responsibilities, and tools needed for a successful application process. From determining eligibility to understanding

0 views • 14 slides

Seattle City Council - Multifamily Housing Property Tax Exemption Program Renewal Overview

The Multifamily Housing Property Tax Exemption Program in Seattle, initiated in 1995 and renewed thrice since, requires buildings to allocate 20% of units as affordable for up to 12 years. This program provides tax exemptions for residential improvements and is applicable to new constructions and re

0 views • 12 slides

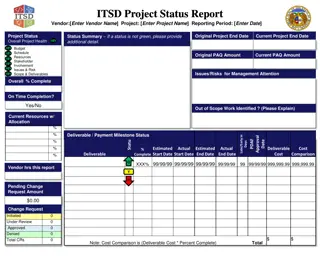

ITSD Project Status Report - Vendor & Project Overview

This ITSD Project Status Report provides a comprehensive update on the current status of a specific project, including health, scope, deliverables, budget, schedule, resources, stakeholder involvement, issues, risks, completion percentage, on-time completion status, out-of-scope work, milestone stat

0 views • 10 slides

Minimizing or Avoiding IRS Penalties on 1098-T Filing

Learn how to respond to IRS penalties on 1098-T filings, understand 972CG notices, reasons for reporting errors, steps for appealing penalties, and what to do after submitting an appeal. Take action within the 45-day window to avoid fines and potential interest charges.

0 views • 16 slides

IRS 8823 Guide and OHCS LIHTC Compliance Training Overview

In this comprehensive training, the IRS 8823 Guide and OHCS LIHTC Compliance process are discussed by Jennifer Marchand, a technical advisor. The training covers the basics of tax credits, 8823 process, compliance tips, and more. Participants learn about reporting requirements, IRS processing, corre

0 views • 58 slides

House Privileges and Elections Meeting Agenda for July 20, 2020 - Property Tax Exemption Proposal for Disabled Veterans

The House Privileges and Elections meeting agenda includes discussions on proposed constitutional amendments related to property tax exemption for disabled veterans and the Virginia Redistricting Commission. The meeting will review explanations and ballot questions, such as HJ.103 which proposes a t

0 views • 9 slides

Understanding OHCS Inspection Rating Process at AHMA Conference Summer 2019

Learn about the OHCS inspection rating process discussed at the AHMA Conference Summer 2019. The process includes different types of inspections, steps involved in the inspection process, common findings, tips to improve rating, consequences of non-compliance, and the new IRS requirements. Understan

0 views • 21 slides

Dealing with IRS Assessments: Options for Challenging Unfair Tax Claims

Learn how to address erroneous IRS assessments through various options like audit reconsideration, doubt-as-to-liability, offers in compromise, refund litigation, and bankruptcy. Make an informed choice based on factors like refund eligibility, ability to pay, receipt of the Notice of Deficiency, an

0 views • 5 slides

CAS Exemption SmartForm Application Process Update

Update in the CAS Exemption application process requires entries via SmartForm and approval in UFIRST by the Project Manager and Unit Fiscal Authority. This process change eliminates the physical signing and scanning of applications. Instructions are provided on how to request exemptions for adminis

0 views • 9 slides

Common Compliance Findings in IRS Form 8823 Compliance Continuum

Tina Clary provides insights into ten common compliance findings related to IRS Form 8823, focusing on issues such as VAWA policies, incorrect forms, targeted set-asides, and more. State findings that may not necessarily lead to 8823 violations are highlighted, with recommendations for addressing ea

0 views • 14 slides

Energy Efficiency Exemption: Rules and Research Considerations

Explore the guidelines and requirements for implementing energy efficiency projects under an exemption to the revenue limit in school districts. Learn about due diligence, cost-saving analysis, and the importance of performance contracts to ensure sustainable savings over time.

0 views • 30 slides

Understanding the Use of Interest Rate Swaps in Insurance Industry

This presentation delves into the world of interest rate swaps (IRS), their types, regulations, and market overview in the insurance sector. It explores why the IRS market is not growing despite its potential benefits. The content covers IRS basics, variations in types, regulatory guidelines, and ke

0 views • 21 slides

Managing Distribution Lists in Integrated Reporting Service (IRS)

Integrated Reporting Service (IRS) allows users with Notification Submitter privileges to create distribution lists to inform interested parties about notifications submitted. Creating distribution lists saves time by eliminating the need to repeatedly enter email addresses, ensuring all relevant pa

0 views • 5 slides

Request for Exemption from 14 CFR 119.1(e)(6) for American Aviation

Information provided by ATK Launch Systems Inc., prime contractor for LUU Flares, outlines the history of LUU flares and the need for an exemption from aviation regulations to continue using a test site for Lot Acceptance Testing (LAT). The test site, located 45 statute miles from the nearest town,

0 views • 5 slides

Machine Status Update Meeting with Rob Ainsworth on 31st March 2017

Update on machine status meeting with Rob Ainsworth at 9 o'clock on 31st March 2017 includes various topics such as RR activities, downtime, MI machine status, Numi power status, issues, and upcoming tasks. Multiple images show detailed information regarding RR machine status updates, downtime repor

0 views • 7 slides

Legislative Update: Statutory Issues in Tax for Affordable Housing Solutions

In 1997, the Texas Legislature enacted Tax Code Sec. 11.182, providing a 100% property tax exemption for affordable housing. The exemption was later expanded to include Low Income Housing Tax Credit (LIHTC) projects, with additional terms added in 2001. To qualify for this exemption, organizations m

0 views • 6 slides

MODIS and VIIRS Product Status Overview - May 2023

The MODIS and VIIRS Product Status for May 2023 discusses the current processing status of MODIS and VIIRS data, reprocessing plans, algorithm changes, geolocation updates, and upcoming activities of the science team meetings. Key points include the forward processing status, C7 reprocessing plan, V

0 views • 6 slides

Washington State Overtime Exemption Changes 2021 Overview

Washington State has outlined overtime exemption changes for 2021, including minimum wage act requirements, exemptions from overtime pay requirements, qualifying criteria for exemptions, new salary thresholds effective January 1, 2021, phased-in salary thresholds, and application of the salary thres

0 views • 11 slides

Efficient UL Buffer Status Reporting in IEEE 802.11 Networks

IEEE 802.11-16/0856r1 discusses the importance of UL buffer status reporting in 11ax for efficient resource allocation. The document addresses managing unmanaged P2P flows to enhance buffer status reporting accuracy. It proposes solutions to prevent misallocation of resources due to large data amoun

0 views • 11 slides

Understanding IRS Guidelines on Tip Reporting

Explore the history of tax rules on tip income and delve into the new IRS guidance regarding tips versus service charges. Learn about the distinctions, employer responsibilities, and the impact on FICA taxes and Federal income tax withholding. Gain insights into key factors that differentiate tips f

0 views • 30 slides

IRS Audit Survival- gnsaccountancy

IRS Audit Survival | NGO Ready for the Public Support\nNGO for an IRS audit with expert guidance. Ensure public support compliance and audit readiness with our tailored services for nonprofits.

1 views • 5 slides

Expert Help Negotiating with the IRS

Need help negotiating with the IRS? Mike, a seasoned negotiator based in Minnesota, assists clients nationwide with IRS negotiations, business-to-business issues, and internal business matters. With proven expertise, Mike builds relationships, listen

1 views • 5 slides

Enhanced Functionality of Integrated Reporting Service (IRS)

Explore the additional features of IRS allowing users to run reports, search for notifications, and view notification summaries on the OPRED website. Easily access and download relevant notifications while tracking your organization's involvement. Enhance your reporting capabilities with user-friend

0 views • 5 slides