Challenges and Progress in Chilean Infrastructure Development

The challenges of Public-Private Partnerships (PPPs) in Chile within the framework of best practices and international standards are discussed, highlighting the need for long-term infrastructure planning and enhanced governance. The 2017 OECD Infrastructure Governance Review identified deficiencies

4 views • 40 slides

Infrastructure Programme Implementation Plan (IPIP) - Module 7 Overview

Module 7 of the Infrastructure Delivery Management System (IDMS) focuses on the Infrastructure Programme Implementation Plan (IPIP). It provides guidance to programme managers on applying management principles for effective planning and management of infrastructure projects. The module emphasizes sy

3 views • 33 slides

Understanding Investments in the Illinois Bookkeepers Conference

Explore the informative presentation on accounting for investments at the 2023 Bookkeepers Conference in Rolling Meadows, Illinois. The session covers allowable investments, including money market funds, treasury securities, certificates of deposit, and more. Gain insights on investment policies, di

2 views • 24 slides

Enhancing Research Competitiveness through EPSCoR Program

The EPSCoR Program aims to enhance research competitiveness by investing in STEM capacity and capability in targeted jurisdictions. It prioritizes sustainable growth, infrastructure investments, scholarships, partnerships, and capacity building activities. EPSCoR institutions receive a percentage of

1 views • 34 slides

EU Climate Investment Deficit Report Launch Event

The launch event of the first edition of the EU Climate Investment Deficit Report highlights the importance of climate investments in shaping Europe's future. The report focuses on tracking public and private investments to assess the EU's progress towards the 2030 targets set by the European Green

4 views • 19 slides

Investment Responses to Biophysical Climate Impacts on Water, Energy, and Land in SDGs and Climate Policies

Investment assessments using Integrated Assessment Models (IAMs) are evolving to include biophysical climate impacts, assessing climate uncertainty on investments. The approach involves the MESSAGEix-GLOBIOM IAM, considering climate policy, SDG measures, and impacts under different scenarios. Climat

6 views • 32 slides

Insights into Investments and Convergence in Central Eastern Europe

Explore the dynamics of investments, convergence, and capital inflows in Central Eastern Europe, delving into the role of investment capital in the convergence process, the impact of foreign capital, and the heterogeneity across various countries in the region. Discover how savings, investments, GDP

0 views • 11 slides

Infrastructure Development Bank of Zimbabwe (IDBZ) - Financing Zimbabwe's Infrastructure Needs

The presentation by the Infrastructure Development Bank of Zimbabwe (IDBZ) at the CIFOZ Congress 2018 outlines the critical infrastructure sectors, funding requirements, and the funding gap faced by Zimbabwe. IDBZ is mandated to facilitate infrastructure development in key sectors like ICT, housing,

4 views • 20 slides

Foreign Investments in India: Legal Framework and Investment Routes

Key statutes applicable for foreign investors in India include FEMA, SEBI regulations, and legislations governing securities markets. Foreign investments avenues in India include FDI, FVCI, FPI, NRI investments through SEBI approval or automatic approval route. Foreign Portfolio Investors (FPIs) and

1 views • 54 slides

Addressing Infrastructure Investment Disparity: Challenges and Solutions

The disparities in infrastructure investment pose significant challenges, with the nation facing an aging infrastructure that requires substantial funding for maintenance and upgrades. Despite the positive economic impacts of infrastructure investments, many communities struggle to access the necess

0 views • 12 slides

Understanding Infrastructure Financing Options and Principles

This presentation discusses the various tools and principles of infrastructure financing, including project finance, corporate finance, public finance, and blended finance. It covers the differences between financing and funding in infrastructure provision, the challenges faced by infrastructure ser

0 views • 32 slides

Understanding Investments: A Comprehensive Overview by Mr. Vinoth Kumar J, Assistant Professor

Mr. Vinoth Kumar J, an Assistant Professor at St. Joseph's College, dives into the world of investments, explaining the meaning, definition, and classification of investments. He covers financial products like equities, mutual funds, real estate, and more, providing insights into both financial and

0 views • 21 slides

Alberta Infrastructure Overview

Alberta's infrastructure development initiatives include a multi-billion dollar capital plan, various projects in health and education sectors, investments in the Canada Infrastructure Program, and a comprehensive recovery plan focusing on workforce, resources, and economy diversification. The provi

1 views • 9 slides

Understanding Foreign Capital and Its Implications on Development

Foreign capital plays a significant role in the development of a country through investments from foreign governments, institutions, and individuals. It encompasses various forms such as foreign aid, commercial borrowings, and investments that contribute to capital formation, technology utilization,

0 views • 19 slides

Understanding Foreign Capital and Its Impact on Development

Foreign capital encompasses investments from foreign governments, private individuals, and international organizations in a country, including aid, commercial borrowings, and foreign investments. It plays a crucial role in capital formation, technology utilization, and development across various sec

0 views • 19 slides

Understanding Syndicated Mortgage Investments: Key Information and Regulations

Syndicated Mortgage Investments (SMIs) involve multiple lenders participating in a mortgage, with distinctions between Qualified SMIs (QSMIs) and Non-Qualified SMIs (NQSMIs). The presentation covers the definition of SMIs, requirements for QSMIs, registration processes, compliance obligations, and c

0 views • 22 slides

Challenges and Importance of Infrastructure in Indian Economy

Infrastructure is crucial for economic growth in India, encompassing services like transport, power, communication, and more. The differing roles of social and economic infrastructure are outlined, highlighting their impact on human and economic resources. The significance of infrastructure lies in

0 views • 16 slides

The Five Stages of Investing Explained

In the journey of investing, there are five stages to progress through. The stages involve understanding the types of investments, assessing risk levels, setting up financial accounts, and gradually moving towards higher-risk investments. Starting with a put-and-take account for daily expenses, tran

0 views • 10 slides

Infrastructure Prioritization Framework and Challenges

The Infrastructure Prioritization Framework (IPF) is a tool designed to support the infrastructure planning process, aiming to address challenges such as infrastructure gaps, limited resources, and technical capacity constraints. The tool integrates social, environmental, and financial criteria to h

2 views • 25 slides

Smarter Europe: Cohesion Policy for Innovation and Economic Transformation

The Cohesion Policy aims to create a smarter Europe by promoting innovative economic transformation through digitization, enhancing R&I capacities, and supporting the growth and competitiveness of SMEs. It focuses on developing skills, fostering interregional innovation investments, and enabling sma

0 views • 5 slides

The Case for Private Credit Investments in the Global Market

Private credit investments are gaining significance in the global market, offering innovative financing solutions outside traditional avenues like public markets. With a focus on innovation, independence, and integrity, private credit investments cater to diverse sectors such as real estate, natural

1 views • 9 slides

Introducing the New Governor's AFID Infrastructure Grant Program

The Governor's Agriculture and Forestry Industry Development (AFID) Infrastructure Grant Program is a new initiative to support community infrastructure projects that promote local food production and sustainable agriculture. Through this program, local governments can access funding to enhance thei

0 views • 24 slides

Bridging the Global Infrastructure Gap: A Framework for Distinction

This paper introduces a Dual-Hurdle Framework to differentiate poor countries where the World Bank's claims on infrastructure investments are feasible from those where they are not. By assessing domestic efficiency and foreign profitability, the framework offers a practical approach to prioritize in

0 views • 13 slides

Understanding Internal Rate of Return (IRR) in Investments

Internal Rate of Return (IRR) is a method used to assess the profitability of potential investments by calculating the discount rate that makes the net present value of an investment zero. It considers the time value of money and helps in comparing projects based on their returns relative to costs.

0 views • 5 slides

Nuancing Narratives on Large-Scale Agriculture Investments' Labor Market Effects in Sub-Saharan Africa

Exploring the impacts of Large Scale Agriculture Investments (LAI) on job creation in Sub-Saharan Africa, focusing on labor market dynamics, supply and demand sides analysis, and case studies from Kenya, Mozambique, and Madagascar. The research delves into the quantity and quality of jobs created, i

0 views • 17 slides

Introduction to Terraform for Infrastructure Automation

Terraform is a powerful tool used for building, changing, and versioning infrastructure efficiently and safely. It operates based on Infrastructure as Code principles, allowing for versioning of infrastructure configurations like any other code. With features like Execution Plans, Resource Graph, an

0 views • 27 slides

President Trump's $1.5 Trillion Infrastructure Plan: Key Points for Counties

President Trump introduced a $1.5 trillion federal infrastructure package with a focus on regulatory reform, aiming to stimulate new investment, shorten project approval times, and address rural infrastructure needs. The plan includes $200 billion in new federal spending, leveraging funds for projec

0 views • 21 slides

Transportation Infrastructure Initiatives in Dauphin County

The County and State Transportation Infrastructure Initiatives in Dauphin County include the PennDOT Bridge Bundling Program, Dauphin County Infrastructure Bank, PennDOT Agility Program, and Next Generation Transit Revitalization Investment Districts. The Bridge Bundling Program aims to save time an

0 views • 26 slides

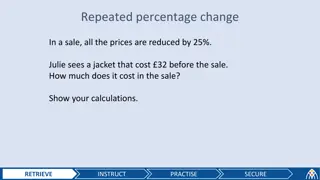

Understanding Repeated Percentage Changes in Sales and Investments

This content covers examples and calculations related to repeated percentage changes in sales and compound interest investments. It explains how prices are affected when all items are reduced by a certain percentage in sales, as well as scenarios involving compound interest investments over multiple

0 views • 17 slides

Northamptonshire Pension Fund Investments Overview

The Northamptonshire Pension Fund Investments, managed by Richard Perry, follows regulations like the Local Government Pension Scheme Regulations. The fund structure includes investments in equities, bonds, diversified growth funds, private equity, and property. Investments are managed by profession

0 views • 10 slides

Understanding Investments of Dental Materials

Dental investments are ceramic materials used to create molds for casting metal alloys in dentistry. These investments must accurately reproduce wax patterns, have suitable setting times, withstand high temperatures, and exhibit controlled expansion. Components include refractory materials, binder m

0 views • 30 slides

Understanding Buy America Requirements in Federal Infrastructure Projects

This presentation provides an overview of the Buy America requirements as mandated by the Federal Highway Administration (FHWA) and outlined in the Bipartisan Infrastructure Law. The Buy America regulations apply to iron, steel, manufactured products, and construction materials, requiring that these

1 views • 20 slides

Understanding Investments: Objectives, Decision Making, and Goals

Investments involve committing money for future benefits, balancing risk and return. The nature, scope, and objectives of investments guide decision-making processes, considering factors like time, risk, and diversification. Investment goals range from short-term to long-term priorities, aiming to i

0 views • 35 slides

Improving First Nation Infrastructure and Housing through Fiscal Management Act Model

The presentation at the AFN National Housing and Infrastructure Forum in October 2017 highlighted the challenges faced by First Nation communities in developing sustainable infrastructure. The current system is inefficient, prompting the exploration of alternatives like the First Nations Fiscal Mana

1 views • 9 slides

Infrastructure Funding Framework and Delivery Plan

This document outlines the mechanisms for funding community infrastructure through tools such as Community Infrastructure Levy (CIL) and Section 106 agreements. It also details financial contributions received since 2010/11, setting spending priorities, and the LBWF Infrastructure Delivery Plan. The

0 views • 13 slides

Opportunities to Mobilize Institutional Investment in Capital Markets

Aligning trillions of dollars managed by OECD institutional investors towards green infrastructure investments presents a significant opportunity. Currently, only a small percentage of large pension fund assets are directed towards infrastructure, with an even smaller fraction allocated to green pro

0 views • 4 slides

Indian Private Equity Landscape 2016: Insights and Trends

The state of Indian private equity in 2016 reflected significant activity and growth across various industries. Key highlights include the dominance of PE/VC over IPOs, consistent PE investments over 2 years, industry-wise distribution of deals, investment stages, and top PE investments centered aro

0 views • 27 slides

Conflict in VGI Themes: Advancing VGI vs Future-Proofing Utility Investments

Conflicting themes within VGI Working Group include advancing VGI in California and future-proofing utility investments. The clash lies in risk-taking versus risk-minimizing approaches, highlighting the importance of value and connection to EV adoption. Recommendations focus on defining long-term ob

0 views • 7 slides

Digital Infrastructure in India: Creating Pathways for Economic Growth

Digital infrastructure in India plays a crucial role in driving economic growth and development. The focus on creating a national digital grid and catalyzing investments in digital infrastructure is essential for the country's digital transformation. Improving digital infrastructure can unlock signi

12 views • 10 slides

Understanding State and Local Public Infrastructure Finance

Exploring the significance of state and local public infrastructure finance, this lecture discusses the need for investment in long-lived public assets like roads, bridges, water systems, and energy production. It highlights the urgency to address the deteriorating infrastructure in the US and the i

0 views • 33 slides