For Tax Filing - Analyze the Tax Regime

As the financial year closes, taxpayers would need to ensure that their books of accounts, pay slips, bank statements and other important documents are in place such that the details are available at the time of audit and filing the return of income. While filing the return of income, a taxpayer mu

0 views • 3 slides

Navigating Hart-Scott Act Filing Requirements (2024)

This guide provides an overview of the HSR filing process, including reportable transaction thresholds, exemptions, and filing requirements. It explains the key aspects like size-of-the-transaction test, size-of-the-persons test, types of transactions involved, and the valuation of voting securities

4 views • 60 slides

Setting and Collecting Fees in Immigration Law

Becki Young and Jill Wayland from Hammond Young Immigration Law provide insights on setting fees for immigration cases, discussing hourly versus flat fees, reasons to charge each, and guidelines for setting flat fees for specific case types. They highlight the importance of transparency, efficiency,

1 views • 13 slides

What is The Process JetBlue Flight Change?

JetBlue allows flight changes with different policies based on fare type. Changes to Blue Basic fares incur fees ($100 for North America, Central America, and Caribbean; $200 for other routes). Other fare types can be changed without fees, but fare differences may apply. Cancellations within 24 hour

0 views • 5 slides

Process for Filing a Petition for Divorce in India

Filing a Petition for Divorce in India\n\nFiling a Petition: The divorce process in India begins with the crucial step of filing a petition. This is the formal action taken by one spouse, known as the petitioner, to initiate the legal proceedings for divorce. The petition is filed in the appropriate

0 views • 4 slides

Explore BDS, MDS Nursing courses at Maitri Dental College, Durg

BDS ADMISSION 2024\nEligibility Criteria : NEET Qualified Tuition Fees: 2 Lac Annually\nHostel Fees: 60,000\/- Annually\n\nMDS ADMISSION 2024\nEligibility : PG-NEET Qualified\n5Clinical & 3Non-Clinical Branches\nHostel Fees: 1,00,000\/- Annual\n\nBSC NURSING\nDuration : 4 years\nTuition Fees: 70,000

0 views • 12 slides

Simplifying Income Tax Filing_ A Friendly Guide

Get expert income tax return filing service providers in Punjagutta, Begumpet, Banjara Hills, Hyderabad. We offer online tax filing, ITR filing and tax preparation services.

1 views • 2 slides

Understanding Service & Activity Fees in Business Affairs Commission

Service & Activity (S&A) fees are charges applied to students registering at community colleges, distinct from tuition fees, to fund student activities and programs. Restrictions govern the use of these fees, ensuring compliance with statutory and constitutional limitations. Expenditures must align

0 views • 19 slides

Understanding the Importance of Filing Income Tax Returns

Filing income tax returns is crucial as it involves declaring total income and tax payable. Deadlines are specified based on the type of assessee, with penalties for late filing. The process allows for claiming refunds, showing financial worth for visas, and ensuring eligibility for tenders. Failing

0 views • 26 slides

Annual Filing Requirements for Knights of Columbus Councils

Learn about the IRS annual filing requirements for Knights of Columbus Councils, including the need to file Form 990, obtain an EIN, and maintain tax-exempt status. Failure to comply can result in the revocation of tax-exempt status and reinstatement fees. Find detailed guidance on applying for an E

0 views • 23 slides

Guide to Filing for Conservatorship in Fresno, CA Probate Court

Comprehensive guide on filing for conservatorship in Fresno, CA Probate Court, covering basics, costs, required forms, service procedures, and due diligence efforts. Detailed information on the process including filing location, fees, required documents, and serving requirements. Includes tips on du

0 views • 22 slides

Late Renewals and Reinstatements Process for ASEP and CSEP Certifications

Late renewals and reinstatements process for ASEP and CSEP certifications include specific requirements, fees, and steps to follow for renewing late. The process involves submitting PDUs, renewal fees, reactivation fees, and documents to the Certification Office. Additionally, individuals have the o

0 views • 8 slides

Tax Filing, Payment, and Penalties Overview for LRA Practitioners in Monrovia 2021

Comprehensive training module covering income tax, excise tax, goods and services tax filing requirements, due dates for tax returns, and more for taxpayers in Monrovia. Learn about the responsibilities of taxpayers, due dates for filing tax returns, and specific requirements for various types of ta

0 views • 43 slides

ESFA Funding Guidance for Young People 2022-2024

ESFA has released funding guidance for academic years 2022-2023 and 2023-2024, covering student eligibility rules, fees, and the relationship between fees and eligibility. The presentation aims to clarify the SEG rules and help institutions understand the guidelines. Updates for the new funding cycl

1 views • 57 slides

Understanding Budgeted Costs and Fees in Legal Proceedings

Budgeted costs and fees in legal proceedings play a crucial role in determining the financial aspects of a case. Parties can set cost budgets, which, when approved by the court, cap the overall cost exposure. This approach helps in effective cost management, especially in cases involving complex iss

0 views • 11 slides

Comprehensive Guide to Filing in Business Organizations

Filing is essential for maintaining records in business organizations. It involves systematic arrangement of documents for easy access and reference. The objectives, functions, and importance of filing are discussed in this informative guide.

0 views • 16 slides

Rising Container Park Fees - Increases Since Inception

Container park fees under Container Chain have been continuously increasing, with mammoth hikes recorded across various parks. The fees have surged by an average of 61%, with some parks experiencing up to an 856% increase since their inception. The relentless increases show no signs of slowing down,

0 views • 5 slides

Understanding the Costs of Buying a Home

When purchasing a home, it's crucial to consider all the costs involved beyond the mortgage payment. These additional expenses include property taxes, homeowners insurance, maintenance fees, and more. One-time costs like down payments, realtor fees, and title fees must also be factored in. This cont

0 views • 10 slides

Understanding GST Returns: Types, Benefits, and Mechanisms

GST returns play a crucial role in the tax system by providing necessary information to the government in a specific format. They include details of outward and inward supplies, ITC availed, tax payable, and more. Filing returns ensures timely transfer of information, aids in tax liability determina

4 views • 38 slides

Security and Authentication in Electronic Filing Systems: Arkansas Subcommittee Report

Explore the subcommittee report on security and authentication in electronic filing systems for campaign and finance reports in Arkansas. Learn about user authentication, risks, mitigation strategies, and approaches used in other states. Discover the filing processes in both paper and electronic for

0 views • 24 slides

Understanding the Impact of the Tenants Fee Ban on Landlords and Agents

The Tenants Fees Act bans all fees from letting agents and landlords to tenants, impacting the rental market significantly. This article explores what can be charged to tenants, reasons for using an agent, services provided by agents, and insights from landlords on the changing landscape post-ban. A

0 views • 13 slides

Restructuring Fees Inventory File: Updates and Changes Overview

The restructuring of the Fees Inventory File includes the reclassification of fees to streamline the collection of tuition and fee information. Expertise from financial professionals like David Cummins and Frederick Church guided the process. The goal is to enhance institutional benchmarking, elimin

0 views • 16 slides

Understanding NPDES Permit Application and Fees in Michigan

NPDES permits in Michigan regulate the discharge of municipal, industrial, and commercial wastewater, as well as stormwater, into state surface waters under Act 451. The permit fees vary based on the type of discharge, with separate fees for stormwater and non-stormwater discharges. Industrial storm

1 views • 13 slides

Project Management Fees and Escalation Challenges Analysis

In the analysis of project management fees and escalation challenges, key findings include low fee percentages, inconsistent reporting practices, and high escalation rates. Proposals suggest revising fee structures, monitoring design/management fees, and addressing code and practice escalation. Reco

2 views • 12 slides

University Fees and Authority Guidelines in California

The document outlines the definition, authority, and processes related to university fees in California, including classification, purpose, and administration. It covers payments due to the university, legislative bodies involved, fee establishment processes, and requirements effective from July 22,

1 views • 13 slides

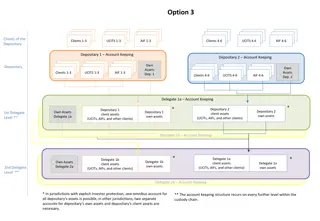

Account Structure and Cost Components for Depositaries

The content discusses the account structure within depositaries, including client assets segregation and the necessity for separate accounts. It also delves into cost components for segregated accounts, such as account opening/maintenance fees, custody fees, transaction fees, and reconciliation cost

0 views • 4 slides

Guidelines for Attorney Fees Assessment in Georgia State Court

Understanding the principles and statutes governing attorney fees in Georgia State Court, including O.C.G.A. codes 13-6-11, 13-1-11, and 9-15-14. Details on expert testimony requirements, allocation issues, and evidentiary basis for fee assessments. Tips on establishing the evidentiary basis, value,

0 views • 33 slides

Virginia ACA Filing Season 2022 Carrier Teleconference: Important Updates

Explore key topics discussed during the Virginia ACA filing season teleconference, including important dates, rate filing template changes, health care savings programs, mental health parity compliance, and more. Stay informed about crucial deadlines and regulatory requirements for carriers in Virgi

0 views • 19 slides

Election Filing Deadlines and Procedures for 2024

Detailed information on candidate filing deadlines and procedures for the 2024 election season, covering key dates for filing, deadlines for petitions, withdrawals, challenges, and ballot vacancies for Democratic, Republican, and Libertarian parties in Indiana.

0 views • 10 slides

Louisiana Department of Revenue Electronic Filing Guidelines

This content provides a comprehensive overview of the electronic filing process for individual income tax returns with the Louisiana Department of Revenue. It covers important details such as filing requirements, third-party filings, ERO application procedures, retention of paper documents, and more

0 views • 30 slides

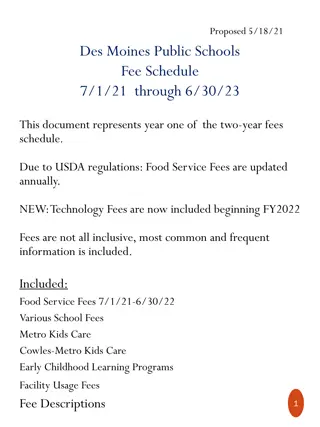

Des Moines Public Schools Fee Schedule FY2022-2023

Proposed Des Moines Public Schools Fee Schedule for the period of July 1, 2021, to June 30, 2023 including Food Service Fees, Technology Fees, various School Fees, Metro Kids Care, and Facility Usage Fees. Detailed breakdown of Food and Nutrition Fee Schedule, School Activities/Sports Fees, and Text

0 views • 11 slides

Proposed Updates to Street Use Hourly Rates and Permit Fees Effective January 1st, 2022

Changes are coming to the street use hourly rates and permit fees starting January 1st, 2022. The updates aim to ensure full cost recovery, align with policy goals, and support various stakeholders. Hourly rates and permit fees will be adjusted to maintain service levels and reduce reliance on use f

0 views • 7 slides

Tax Rates and Standard Deductions for Different Filing Statuses

This content provides information on tax rates and standard deductions for various filing statuses for tax years 2010 and 2011. It includes details on taxable income brackets and corresponding tax rates for single filers, all filers, and married filing jointly, along with standard deductions for dif

0 views • 10 slides

Colorado Recreation Resource Advisory Committee Presentation Overview

The presentation highlights the Colorado Recreation Resource Advisory Committee's role in providing fee recommendations and reviewing fees under the Recreation Enhancement Act. It explains the purpose of the Colorado Recreation RAC (RRAC) and its differences from other advisory committees, emphasizi

0 views • 27 slides

Guide to Filing 2015 Federal Tax Return with 1040NR-EZ Form

Learn about filing your 2015 Federal Tax Return using the 1040NR-EZ form, including guidance on completing the form, using tax preparation software, and determining eligibility. Understand the criteria for completing the 1040NR-EZ form and find resources to help you navigate through the tax filing p

0 views • 78 slides

Understanding UCC Article 9 Filing System

The UCC Article 9 filing system plays a crucial role in perfecting security interests and providing public notice for creditors' rights adjustments. It emphasizes the importance of proper filing, searchers' due diligence, and the neutral role of the filing office in maintaining accurate records. Key

0 views • 40 slides

Amendments and Changes in Lobbyist Registration Requirements

Amendments to the definition of legislative persons, inclusion of certain individuals and organizations in the definition, changes in registration fees, and shifts in the registration year timeline for lobbyists in Indiana starting from July 1, 2013. The process for filing annual registration statem

1 views • 24 slides

Proposed Water Pollution Control Fee Updates Workshop

The Bureau of Water Pollution Control is proposing fee increases for permits and application fees to support its programs and address budgetary needs. The updates aim to sustain the existing staff, meet permittee requirements, and adhere to EPA audit findings. The proposed increases will impact disc

0 views • 22 slides

Understanding the E-Filing Process for Guardianship/Probate

Explore the e-filing procedure and process for guardianship/probate cases, covering document formats, form/template modifications, and designations of emails for pro se parties and unrepresented individuals. Learn about acceptable document formats, necessary modifications, and recommendations for em

0 views • 17 slides

Eliminating Transaction Fees on Water Utility Bill Payments

Assembly Bill 1180 aims to eliminate transaction fees on water utility bill payments made through credit and debit cards. The bill allows participating water utilities to waive these fees during their General Rate Case cycle, collecting information on payment methods, costs, customer utilization, ex

0 views • 9 slides