Account Structure and Cost Components for Depositaries

The content discusses the account structure within depositaries, including client assets segregation and the necessity for separate accounts. It also delves into cost components for segregated accounts, such as account opening/maintenance fees, custody fees, transaction fees, and reconciliation costs, with insights on cost drivers like the number of clients, custodians, and trading/settlement frequency.

Uploaded on Sep 12, 2024 | 3 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

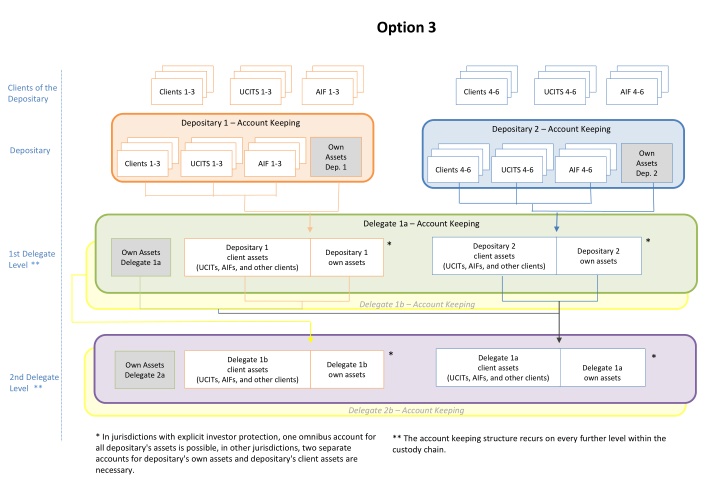

Option 3 Clients of the Depositary Clients 1-3 UCITS 1-3 AIF 1-3 Clients 4-6 UCITS 4-6 AIF 4-6 Depositary 1 Account Keeping Depositary 2 Account Keeping Own Assets Dep. 1 Depositary Own Assets Dep. 2 Clients 1-3 UCITS 1-3 AIF 1-3 Clients 4-6 UCITS 4-6 AIF 4-6 Delegate 1a Account Keeping * * Depositary 2 client assets Depositary 1 client assets Depositary 2 own assets Own Assets Delegate 1a Depositary 1 own assets 1st Delegate Level ** (UCITs, AIFs, and other clients) (UCITs, AIFs, and other clients) Delegate 1b Account Keeping * * Delegate 1a client assets Delegate 1b client assets Delegate 1b own assets Own Assets Delegate 2a Delegate 1a own assets 2nd Delegate Level ** (UCITs, AIFs, and other clients) (UCITs, AIFs, and other clients) Delegate 2b Account Keeping * In jurisdictions with explicit investor protection, one omnibus account for all depositary's assets is possible, in other jurisdictions, two separate accounts for depositary's own assets and depositary's client assets are necessary. ** The account keeping structure recurs on every further level within the custody chain.

Clients of the Depositary Clients 1-3 UCITS 1-3 AIF 1-3 Clients 4-6 UCITS 4-6 AIF 4-6 Depositary 1 Account Keeping Depositary 2 Account Keeping Depositary Own Assets Dep. 1 Own Assets Dep. 2 Clients 1-3 UCITS 1-3 AIF 1-3 Clients 4-6 UCITS 4-6 AIF 4-6 Delegate 1 Account Keeping 1st Delegate Level Depositary 1 other client assets (UCITs and other clients) Depositary 1 AIF client assets Depositary 2 client assets (UCITs and other clients) Depositary 2 AIF client assets Own Assets Delegate 1 Depositary 1 own assets Depositary 2 own assets Issuer CSD Account Keeping Delegate 1 other client assets (UCITs and other clients) Delegate 1 AIF s from Dep. 1 Delegate 1 AIF s from Dep. 2 Own Assets Delegate 2 Delegate 1 own assets 2nd Delegate Level Own Assets Issuer CSD Delegate 1 own assets Delegate 1 client assets Delegate 2a (including ICSDs) Account Keeping Multiple Delegates (2b,2c, etc.) * Since Issuer CSDs are not delegates; client omnibus accounts could be applied on 2nd Level if Delegate 1 is direct at Issuer CSD Delegate 3a Account Keeping Delegate 2 other client assets (UCITs and other clients) Delegate 2 / D1 -AIF s from Dep. 1 Delegate 2 / D1- AIF s from Dep. 2 3rd Delegate Level Own Assets Delegate 3 Delegate 2 own assets ** Where ICSDs utilizes commercial banks as sub-custodians rather than CSD-Links, they cannot be treated as delegates, therefore segregation applies. Multiple Delegates (3b, 3c, etc.) Client omnibus accounts could only be applied on 3rd Level if Delegate 3 is direct at Issuer CSD. Issuer CSD Account Keeping 4th Delegate Level Own Assets Issuer CSD Delegate 3 own assets Delegate 3 client assets

Cost Components for Segregated Accounts Cost Type / Cost Driver Explanations Multipliers Number of local markets Account Opening / Account Maintenance Fee Custody Fees are typically a basis point fee on Assets under Custody and can differ significantly per market. Custodians typically charge a minimum fee per account. The number of necessary accounts to comply with the different models is therefore a significant cost driver for depositaries on an on-going basis. Number of Custodians throughout the sub- custody chain. Typically custody-chains may involve 3-6 layers before assets are held in the Issuer CSD. Number of Custodians throughout the sub- custody chain Number of clients Trading / Settlement Frequency of clients Activity between other clients of the Depositary and AIF clients of the Depositary; e.g. Collateral management activity increases the number of settlements Transaction Fees per settlement Custodians will charge a nominal fee per settlement transaction. The more segregated the account setup is, the more settlement transactions will occur externally as segregation reduces the internalisation of settlement. Number of accounts drives reconciliation costs Reconciliation Fees A reconcilation between the books and records of the Depositary and the Delegate is required. The number of segregated accounts increases the reconciliation effort and the likelihood of reconciliation breaks.

Cost Components for Segregated Accounts Cost Type / Cost Driver Explanations Multipliers Number of settlement transactions SWIFT Costs External settlement instructions will be sent via SWIFT Network. A fee per SWIFT transaction will apply (depending on the Depositaries SWIFT contract). A higher frequency for SWIFT traffic will increase the costs for maintenance of the SWIFT messaging infrastructure. Number of accounts Implementation Fees The connectivity for additional accounts must be tested prior to go-live (assuming the existing system technology would support more segregated accounts). the number of satellite systems to be adapted and the variety of products depending on the account structure Implementation Fees Existing systems of depositaries, custodians and CSDs must be upgraded to support segregated account structures. Not all systems are designed to support sufficient granularity, which will require a major system upgrade and implementation project. Reporting tools have to be adapted in order to reflect the required additional segregation.