Iowa League of Cities Membership Webinar June 28, 2023

The key highlights of HF 718 Property Tax Legislation discussed in the Iowa League of Cities Membership Webinar. Division II covers city rate consolidation and mechanisms for levy reduction based on growth triggers. The legislation also introduces homestead credit and exemption provisions for indivi

0 views • 24 slides

Important Dates and Information for Class of 2024

Stay updated on key dates and requirements for the Class of 2024, including graduation details, community service cord eligibility, exemption guidelines, tardy policies, and more. Ensure seniors sign up for Remind alerts and complete necessary tasks to prepare for the upcoming events. Don't miss out

3 views • 31 slides

DPI Auditor Insights and State Audit Guidelines Overview

This collection of images and descriptions provides insights into DPI Auditor activities, state audit guidelines, and updates related to state major program determinations. The State Single Audit Guidelines for Wisconsin School Districts are highlighted, along with the State Audit Manual overview an

3 views • 36 slides

Understanding FDA Regulations and Medical Device Classification

The Food and Drug Administration (FDA) plays a crucial role in regulating research, manufacturing, marketing, and distribution of medical devices. Medical devices are classified based on risk and intended use, with three main categories determining regulatory pathways. The classification system help

2 views • 27 slides

Insights into the Globalized Sports Industry - Law, Strategy, and Competition

Explore the intricate legal and strategic aspects of the global sports industry, including topics such as labor exemption, antitrust issues, and competition design. Delve into key concepts like intellectual property rights in broadcasting and the challenges faced in bargaining within club-run league

1 views • 15 slides

Analysis of GST Provisions in the Banking Industry

The Goods and Services Tax (GST) regime replaced the old service tax regime on July 1, 2017. In the context of the banking industry, the provisions governing GST for services provided by Cooperative Banks and Banking Cooperative Societies are similar to those of the service tax regime. While interes

1 views • 13 slides

GST Implications in case of Accommodation service in 53rd GST Council meeting

Notification No. 4\/2024 amends the GST exemption rules for accommodation services effective 15 July 2024. Heading 9963 is removed from Notification 12\/2017, and a new explanation excludes certain accommodations like hostels from exemptions. A new e

1 views • 2 slides

Comprehensive Guide to Hazlewood Act for Texas Veterans

Detailed overview of the Hazlewood Act provided by the Texas Veterans Commission, including eligibility requirements, supporting documents needed, the role of TVC in administering the exemption program, and information on educational benefits for veterans and dependents. Learn how to start helping v

0 views • 33 slides

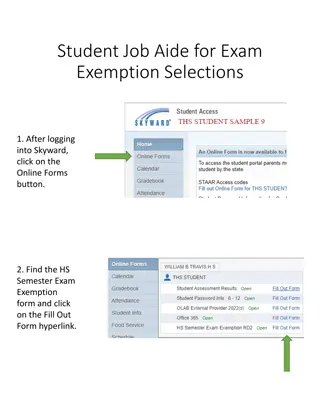

Guide for Submitting HS Semester Exam Exemption Requests in Skyward

Learn how to submit your High School Semester Exam Exemption requests in Skyward by following a step-by-step guide. Understand the process of filling out the form, submitting your requests, making changes if needed, and checking for updates on your exam exemptions. Images provided for visual referen

1 views • 6 slides

Overview of Finance Act 2019 and Its Business Implications

The Finance Act 2019, signed into law in January 2020, aims to promote fiscal equity, align tax laws with global practices, introduce tax incentives, support small businesses, and raise revenue. It made significant changes to tax laws affecting companies, VAT, personal income tax, capital gains tax,

0 views • 22 slides

Understanding Conditional Duty Exemptions and the Harmonized System

This information delves into the concept of conditional duty exemptions associated with the Common External Tariff (CET) and the Harmonized System (HS). It explains the structure of the Schedule of Rates based on the HS, the application of duty rates in CARICOM, and the lists of items ineligible for

0 views • 16 slides

Finance Training Event Overview

The Finance Training event held on Wednesday, October 23rd, 2019 at Faculty Club covered various topics including purchasing, P-Card, budget management, and Chrome River. The agenda included sessions on finance overview, travel and invoices, accepting payments on campus, and financial security. Spea

0 views • 30 slides

DIDD Staff Training on Policy 30.1.6 Exemption Process

This content provides information for DIDD staff regarding Policy 30.1.6 Exemption Process. It covers permissible and prohibited exemptions, requirements, and duration of approved exemptions. The training agenda includes discussions on background check exemptions, examples of dispositions, and vario

0 views • 56 slides

Highlights of the Employment Code Act No. 3 of 2019 by the Ministry of Labour and Social Security

The Employment Code Act No. 3 of 2019, implemented by the Ministry of Labour and Social Security, has made significant changes in Zambia's employment regulations. This act has repealed and replaced older employment acts to address gaps in labor laws and adapt to the evolving labor market dynamics. I

0 views • 25 slides

ISQ Program Overview and Requirements

ISQ (Institute of Bankers Pakistan) offers programs like ISQ Awareness Session, IBP Superior Qualification, and more. Eligibility includes banking professionals, graduates, and students. Program fees vary per subject. Exemption policy, passing criteria, and time limitations apply. Candidates can ava

0 views • 14 slides

Update on IDoW Process in Built Environment Professions

Presentation on the current status of the Identification of Work (IDoW) process as per the professions Acts and the Council for the Built Environment Act. It includes details on the reasons for rejecting exemption applications, consultation processes, scope of work identification, and international

6 views • 16 slides

Understanding Sanctioning in Edmond Public Schools

Sanctioning in Edmond Public Schools allows organizations to operate for the benefit of students by permitting fundraising on school property and providing financial exemption from certain laws. However, it does not equate to control as organizations manage their own funds and must comply with relev

0 views • 44 slides

Mainstreaming HIV and AIDS in Uganda: Guidelines and Initiatives

The presentation by Quinto Rwotoyera from Uganda AIDS Commission discusses the national guidelines for mainstreaming HIV and AIDS in all sectors in Uganda. The content covers the existing policy and guidelines, overview of the presidential FastTrack initiative, objectives of the guidelines, users of

0 views • 28 slides

Understanding Exempt Research Categories and Requirements

Exploring the concept of exempt research in the context of the Common Rule and VA guidelines, this workshop series delves into the obligations and responsibilities of key entities involved in the initial review and approval process. It clarifies what it means to be exempt, outlines the categories of

0 views • 28 slides

Device-as-a-Service Lunch and Learn Event Overview

Explore the latest device models, leasing benefits, exemption processes, and device disposition options in this comprehensive lunch and learn event. Discover the updated 55xx and 74xx Latitude series laptops, 72xx 2-in-1 tablet, and 7080 OptiPlex desktop. Learn why leasing is a cost-effective soluti

0 views • 26 slides

Revised Common Rule and Proposed VHA Directive 1200.05 Update

Update on the significant changes in the Revised Common Rule and Proposed VHA Directive 1200.05, focusing on the impact on the IRB, membership, functions, and review of research. Details provided on the status of the Revised Common Rule, VHA Handbook 1200.05, and applicability of pre-2018 and 2018 r

0 views • 38 slides

Understanding Cover Crops and Weed Management

This detailed content provides insights into cover crop seed regulations, exceptions, and conditions. It also discusses weed seeds in cover crops, including issues with locally grown rye seed. Learn about the farmer exemption, weed species like rye, and seed sample terminology from an official persp

0 views • 17 slides

Workshop on Sales Tax Laws on Services Part 1: Provincial Withholding Sales Tax on Services

This workshop conducted by Asif S. Kasbati covers topics such as Provincial Withholding Sales Tax in Sindh and Punjab, exemption and reduced rates in SST and PST, federal withholding sales tax, withholding agents, and the mechanism of withholding sales tax under SST and PST for different categories

0 views • 68 slides

Competition Commission Comments on the National Health Insurance Bill

The Competition Commission supports the overall objectives of the NHI Bill but raises concerns about the potential exemption from the Competition Act for the National Health Insurance Fund. The Commission emphasizes the need for clarity and careful consideration to prevent anti-competitive behavior

0 views • 15 slides

Understanding Financial Best Practices for NC 4-H Clubs

The article discusses the transition of tax-exempt status for 4-H groups in North Carolina, detailing the importance of Group Exemption Numbers (GEN) and the implications of changes in federal income tax regulations. It explores the history of tax exemptions for 4-H clubs, highlighting the IRS rulin

0 views • 41 slides

Indiana IREAD-3 Reading Evaluation Program

The Indiana IREAD-3 program, mandated by Public Law 109, evaluates grade three students' reading skills to ensure proficiency before advancing to fourth grade. The assessment aligns with Indiana Academic Standards and provides specific testing details and good cause exemptions for students. Retentio

0 views • 10 slides

Legal Issues and Compliance for Charter Holders in Texas Education

This content covers essential legal information for entities holding charters in the education sector in Texas. It addresses governance, applicable laws and regulations, eligibility criteria, and compliance requirements related to IRS 501(c)(3) exemption status. Key topics include organizational str

0 views • 50 slides

Navigating IRB Submission Forms & Resources with Dr. Kelly Quesnelle

Explore the essential criteria for human subjects research, the process of applying to the IRB for determinations, understanding regulated research, and common errors in exemption submissions. Delve into expedited vs. full board reviews and different categories of research review, in this detailed g

0 views • 52 slides

Wisconsin Sales and Use Tax Training for Grocers - Audit Preparation and Record Keeping

This resource provides guidance on preparing for a sales tax audit as a grocer in Wisconsin. It covers important topics such as record-keeping requirements, taxable and exempt products, and necessary documentation. Maintaining detailed records, including sales tax returns, invoices, and exemption ce

0 views • 30 slides

Important Guidelines for Using Purchasing Cards at Salt Lake Community College

Understand the basic rules and card limits when using purchasing cards at Salt Lake Community College. Ensure compliance with sales tax exemption, SLCCBuy usage, and shipping instructions. Remember monthly and single purchase limits, and follow procedures for tax-exempt purchases in Utah.

0 views • 25 slides

Academic Professional Positions Review 2019: SUCSS Changes

Recent changes to the State University Civil Service System (SUCSS) procedures require public universities in Illinois to review positions designated as Principal Administrative Appointments (Academic Professionals at UIS) to determine Civil Service exemption eligibility. This session covers new req

0 views • 30 slides

Seattle City Council - Multifamily Housing Property Tax Exemption Program Renewal Overview

The Multifamily Housing Property Tax Exemption Program in Seattle, initiated in 1995 and renewed thrice since, requires buildings to allocate 20% of units as affordable for up to 12 years. This program provides tax exemptions for residential improvements and is applicable to new constructions and re

0 views • 12 slides

House Privileges and Elections Meeting Agenda for July 20, 2020 - Property Tax Exemption Proposal for Disabled Veterans

The House Privileges and Elections meeting agenda includes discussions on proposed constitutional amendments related to property tax exemption for disabled veterans and the Virginia Redistricting Commission. The meeting will review explanations and ballot questions, such as HJ.103 which proposes a t

0 views • 9 slides

CAS Exemption SmartForm Application Process Update

Update in the CAS Exemption application process requires entries via SmartForm and approval in UFIRST by the Project Manager and Unit Fiscal Authority. This process change eliminates the physical signing and scanning of applications. Instructions are provided on how to request exemptions for adminis

0 views • 9 slides

Energy Efficiency Exemption: Rules and Research Considerations

Explore the guidelines and requirements for implementing energy efficiency projects under an exemption to the revenue limit in school districts. Learn about due diligence, cost-saving analysis, and the importance of performance contracts to ensure sustainable savings over time.

0 views • 30 slides

Request for Exemption from 14 CFR 119.1(e)(6) for American Aviation

Information provided by ATK Launch Systems Inc., prime contractor for LUU Flares, outlines the history of LUU flares and the need for an exemption from aviation regulations to continue using a test site for Lot Acceptance Testing (LAT). The test site, located 45 statute miles from the nearest town,

0 views • 5 slides

Legislative Update: Statutory Issues in Tax for Affordable Housing Solutions

In 1997, the Texas Legislature enacted Tax Code Sec. 11.182, providing a 100% property tax exemption for affordable housing. The exemption was later expanded to include Low Income Housing Tax Credit (LIHTC) projects, with additional terms added in 2001. To qualify for this exemption, organizations m

0 views • 6 slides

Understanding Air Quality Permitting Regulations for Generators

Exploring the complexities of air quality permitting for generators, focusing on regulations in Pinal County for insignificant units and federal rules governing different types of engines. The regulations cover exemption criteria, compliance requirements, and specific guidelines for emergency genera

0 views • 21 slides

Washington State Overtime Exemption Changes 2021 Overview

Washington State has outlined overtime exemption changes for 2021, including minimum wage act requirements, exemptions from overtime pay requirements, qualifying criteria for exemptions, new salary thresholds effective January 1, 2021, phased-in salary thresholds, and application of the salary thres

0 views • 11 slides

Bridging Programme for International Students at UTM: Overview and Pathway

The Bridging Programme at UTM aims to prepare international students for enrollment in undergraduate programs and provide a solid foundation in Science and Mathematics. The program includes foundation subjects in Engineering & Science, Computer Science, Business, and more. Students are guided throug

0 views • 21 slides