The Specific Role of Employees as a Stakeholder

The importance of employees as stakeholders in a business and how their actions and well-being impact the success of the company. It also discusses how to treat employees as valuable assets and shares relevant stakeholders in a corporation.

1 views • 11 slides

Redundancy Masterclass: 8 Tricky Issues and How to Deal with Them

How to handle challenging aspects of redundancy, including employees on maternity leave, discriminatory selection criteria, targeting expensive employees, scoring adjustments for disabled employees, employee disputes, disabled employees at risk, and persuading the board.

0 views • 21 slides

Overview of Government Employees Pension Fund (GEPF) in South Africa

Africa's largest pension fund, GEPF was established in 1996, with over 1.2 million members and assets under management. It provides pensions and related benefits to government employees in South Africa, managing investments and administering payouts. The fund's governance involves a Board of Trustee

0 views • 17 slides

Federal Employees Retirement System Errors Overview

Federal Employees Retirement System (FERS) encompasses various retirement plans with different contribution rates for federal employees. Recent discoveries of coding errors have led to a department-wide review to identify and rectify potential errors affecting thousands of employees. The errors rang

0 views • 14 slides

Comprehensive Telecommuting Training for Employees

Introduction to telecommuting training for employees, covering topics such as defining telecommuting, benefits to employees and employers, criteria for selecting telecommuting employees, application process, and tips for effective telecommuting. The content emphasizes the advantages of telecommuting

2 views • 21 slides

UCR Shared Service Centers COBRA Training

COBRA, under the Consolidated Omnibus Budget Reconciliation Act of 1985, allows employees to continue health coverage under certain circumstances like job loss, reduced hours, divorce, or reaching age 26. The coverage can last up to 18 or 36 months, depending on the event. Notification and enrollmen

1 views • 13 slides

Revising ETSI Standard for License-Exempt Operation in 6 GHz Band

Work has commenced on revising the ETSI standard EN 303.687 for license-exempt operation in the 6 GHz band to expedite completion. This revision project outlines the history, New Work Item approval, ETSI processes, and the upcoming steps. It traces back to 2017 when Switzerland and ECC administratio

0 views • 10 slides

Understanding IRB Review Levels and Exempt Determinations

Explore the levels of IRB review for human participant research, including Exempt, Expedited, and Full Board reviews. Learn about the categories of Exempt Determinations and the criteria for Limited IRB Review. Understand if your study requires IRB review based on research and human subject involvem

1 views • 12 slides

Workplace Adjustments and Employee Lifecycle Overview

This content discusses the key stages in the employee lifecycle where workplace adjustments may be necessary to support employees effectively. It emphasizes the importance of providing reasonable adjustments as required under the Equality Act 2010, especially during recruitment, induction, performan

3 views • 4 slides

Employee Rights in Colorado State Classified System

The State Personnel System in Colorado provides certain rights and protections for employees in state classified positions, including appeal and grievance rights. Classified employees must adhere to employment laws and are safeguarded against discrimination, retaliation, and harassment. Various fede

0 views • 72 slides

Understanding H-1B Visa Program for Professional Employees

The H-1B visa is a popular choice for professional employees in specialty occupations, requiring at least a Bachelor's degree. It has a validity period of up to six years, with exceptions, and an annual cap of 65,000 visas. Certain institutions are exempt from the cap. Employers need to follow speci

3 views • 20 slides

Understanding the Hatch Act: Guidelines for Federal Employees

The Hatch Act regulates federal employees' participation in partisan political activities. It categorizes employees into two groups: Less Restricted and Further Restricted, each with specific limitations. Certain intelligence and enforcement agencies, specific positions, and all employees have varyi

0 views • 30 slides

Annual Filing Requirements for Knights of Columbus Councils

Learn about the IRS annual filing requirements for Knights of Columbus Councils, including the need to file Form 990, obtain an EIN, and maintain tax-exempt status. Failure to comply can result in the revocation of tax-exempt status and reinstatement fees. Find detailed guidance on applying for an E

0 views • 23 slides

Exempt Employee LoboTime Navigation and Common Tasks Guide

This job aid provides an overview for exempt employees on navigating and performing common tasks in the LoboTime system. It covers logging on and off, accessing different workspaces, managing widgets, requesting time off, and retracting time off requests. Visual aids accompany detailed step-by-step

0 views • 7 slides

Comprehensive Guide to Retirement Process for EACS Employees in 2022-2023

Detailed information about the retirement process for EACS employees in the upcoming years, including steps to retirement, what employees can expect to receive, and current retiree monthly insurance premium amounts for 2023. The guide covers essential aspects such as submitting a retirement letter,

1 views • 15 slides

Understanding Compensation, Overtime, and Time Reporting Policies

This content discusses important topics such as compensation, overtime, exempt vs. non-exempt classification, and salary thresholds. It aims to provide a comprehensive understanding of the rules and regulations surrounding time reporting and compensation for staff and academic employees. Topics cove

0 views • 39 slides

Understanding 18 U.S.C. 209 and Its Impact on VA Research Personnel

DOJ guidance has clarified the application of 18 U.S.C. 209 to VA employees receiving compensation from non-Federal entities for research. This law prohibits Federal employees from receiving any form of compensation from non-Federal entities for services expected as Government employees. The webinar

0 views • 20 slides

Impact of New Minimum Wage and Semi-Monthly Pay on Charter Schools

Presentation by Kari Wallace at the CCSA Conference on how the progressive increase in California's minimum wage affects exempt/non-exempt classifications and the introduction of semi-monthly payrolls. The presentation discusses key details, including Delta Managed Solutions' experience, labor code

0 views • 33 slides

Parental Leave and Employment Protection Act 1987 Overview

The Parental Leave and Employment Protection Act 1987 provides minimum entitlements for parental leave, protects employees during pregnancy and parental leave, and allows for up to 22 weeks of parental leave payments. Eligibility criteria include female employees with a baby, their spouses or partne

1 views • 42 slides

Efficient Timesheet Reporting Guidelines for Non-Exempt Employees

Comprehensive guide detailing requirements and procedures for reporting hours on timesheets, including minimum hours, overtime, and how to record additional hours. Key points include reporting a minimum of 40 hours per week, differentiating between regular and additional hours, and considering pay p

5 views • 11 slides

Understanding Exempt Research Categories and Requirements

Exploring the concept of exempt research in the context of the Common Rule and VA guidelines, this workshop series delves into the obligations and responsibilities of key entities involved in the initial review and approval process. It clarifies what it means to be exempt, outlines the categories of

0 views • 28 slides

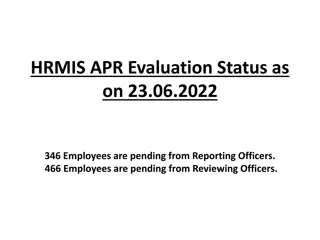

HRMIS APR Evaluation Status Summary as of 23.06.2022

A total of 346 employees are pending evaluation from Reporting Officers and 466 employees are pending from Reviewing Officers as of 23.06.2022. The list of employees includes various designations across different healthcare settings like hospitals, subcenters, and community health roles. The status

0 views • 4 slides

Policies, Procedures, and Supervisor Responsibilities Overview

This content covers important policies and procedures related to supervisor eligibility, time sheet/payroll policies, EEO and FERPA training requirements, and on-boarding/training for student employees at Collin County Community College. Supervisors must closely monitor student employees' work hours

1 views • 10 slides

Montana Incumbent Worker Training Program

The Montana Incumbent Worker Training (IWT) Program is designed to assist small businesses in Montana by providing training grants to qualifying full-time and part-time employees. The program aims to help retain workers, enhance their skills, and boost wages, ultimately benefiting local businesses a

0 views • 19 slides

Executime Automated Time & Attendance Policy Overview

Executime is an automated system for capturing employee time, streamlining processes for salary exempt, non-exempt, and hourly employees. The policy highlights clock-in rules, time-off procedures, and steps for entering and approving time. Employees are required to adhere to the guidelines outlined

0 views • 8 slides

University of California PPSM-30: Student Life & Leadership Compensation Guidelines

University of California PPSM-30 outlines guidelines regarding meal periods, rest breaks, overtime approval, and compensation for non-exempt employees. It specifies the meal period duration, rest break allocation for full-time and part-time employees, and the process for seeking advance approval for

0 views • 9 slides

Understanding UW-Madison Salary and Activities Guidelines

This document covers the guidelines and policies related to salary, compensation, and activities for faculty members at UW-Madison. It explores topics such as institutional base salary, total UW effort components, exempt employee salaries, and overload policies. It emphasizes the importance of follo

0 views • 19 slides

Guide to IRS Tax Exempt Status Application for Non-Profit Organizations

This comprehensive guide provides essential information on applying for tax-exempt status with the IRS for non-profit organizations. It covers the benefits, application procedures, responsibilities, and tools needed for a successful application process. From determining eligibility to understanding

0 views • 14 slides

Employee Feedback Survey Analysis and Insights

This detailed report outlines the process and findings of an employee feedback survey conducted in July and August 2012. The survey aimed to gather feedback from classified and exempt employees, with a focus on assessing satisfaction levels and identifying top priorities across various aspects such

0 views • 14 slides

Understanding the New FLSA Overtime Rules: Implementation Guidelines

The Fair Labor Standards Act (FLSA) has introduced new overtime rules effective December 1, 2016, impacting employees previously exempt. The changes include raising the salary threshold for overtime eligibility and creating new job class codes. This summary highlights key aspects such as the backgro

0 views • 19 slides

Understanding Overtime Regulations for Salaried Employees and Independent Contractors

Explore the complexities of paying overtime to salaried employees and distinguishing independent contractors from employees. Uncover the proposed revisions by the US Department of Labor regarding salary requirements for overtime exemptions, and learn about the potential impact on white-collar exempt

0 views • 58 slides

Southern Connecticut State University Core-CT Time and Labor Employee Self Service Overview

Employee Entering Time & Labor Self Service at Southern Connecticut State University allows employees to enter their own time into Core-CT. Employees can access Core-CT using their login and password to enter time on a Positive or Exception basis. Training tools are available to help employees learn

0 views • 23 slides

South Carolina Public Service Authority Revenue Obligations Investor Presentation

This investor presentation provides details on South Carolina Public Service Authority Revenue Obligations for 2024, including Tax-Exempt Improvement Series A, Tax-Exempt Refunding Series B, and Taxable Improvement Series C. It emphasizes the preliminary nature of the information and the need for ca

0 views • 24 slides

Addressing Issues in Supported Housing: Exempt Accommodation Oversight Act of 2023

A comprehensive overview of the Supported Housing Regulatory Oversight Act of 2023 and the challenges faced in the exempt accommodation sector. The narrative delves into the need for increased regulations, concerns about exploitation, and the positive impact of recent pilot programs on improving res

0 views • 15 slides

Understanding IRB and IRBNet Processes at Lehman College

Explore the different types of IRB review processes, including exempt, expedited, and full/convened reviews. Learn about human subjects research, not human subjects research, and exempt categories. Discover the importance of obtaining informed consent and navigating IRBNet for research compliance at

0 views • 74 slides

Significant Challenges in Wage and Hour Lawsuits

Continued increase in class action wage and hour litigation poses personal liability risks for employers. Recent amendments to New York minimum wage laws and white collar exemptions, along with issues like worker misclassification, create compensation pitfalls for non-exempt employees. The surge in

0 views • 89 slides

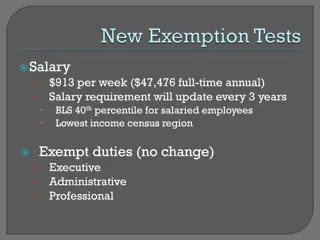

Overview of Salary Requirement Update Process in the Lowest-Income Census Region

This detailed process outlines the updating of salary requirements every 3 years to comply with BLS 40th percentile standards for salaried employees in the lowest-income census region. It involves reviewing job classifications, determining potential non-exempt positions, and seeking approvals before

0 views • 7 slides

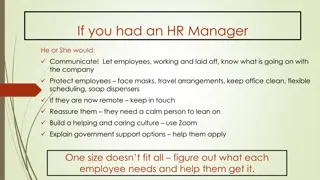

HR Manager Guidelines for Supporting Employees During Challenging Times

HR Managers should prioritize clear communication, employee protection, and creating a caring culture. They need to inform employees about company updates, provide necessary resources like face masks and flexible scheduling, and assist in accessing government support programs like reemployment assis

0 views • 12 slides

Navigating Payroll Expenses: Furloughs vs. Layoffs in Your Workplace

Understand the options for reducing HR costs without layoffs, such as work-sharing, reduced pay, benefits adjustments, and furloughs. Learn the differences between layoffs and furloughs, their impact on employees, and compliance with regulations. Differentiate between exempt and nonexempt employees

0 views • 28 slides

Social Protection of Employees in EU: Historical Backgrounds and Directives

In this informative content, JUDr. Jana Komendov, Ph.D., delves into the social protection of employees in the European Union. Topics covered include historical backgrounds, laws for safeguarding employees in case of company transfers or insolvency, and the scope of application. Key directives such

0 views • 16 slides