HR Manager Guidelines for Supporting Employees During Challenging Times

HR Managers should prioritize clear communication, employee protection, and creating a caring culture. They need to inform employees about company updates, provide necessary resources like face masks and flexible scheduling, and assist in accessing government support programs like reemployment assistance and pandemic unemployment benefits. Additionally, they should ensure remote employees are supported and connected, and help employees individually based on their unique needs.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

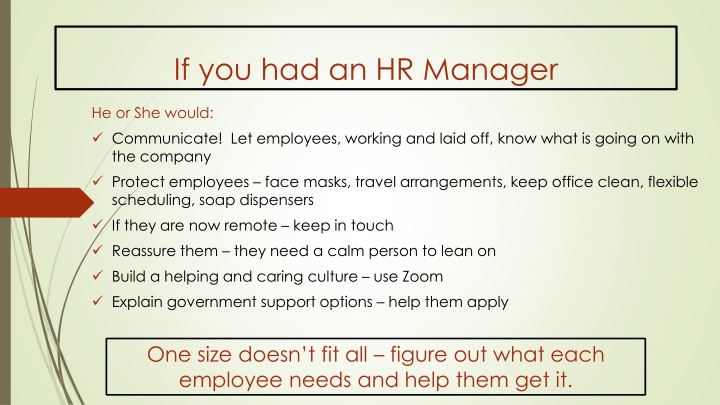

If you had an HR Manager He or She would: Communicate! Let employees, working and laid off, know what is going on with the company Protect employees face masks, travel arrangements, keep office clean, flexible scheduling, soap dispensers If they are now remote keep in touch Reassure them they need a calm person to lean on Build a helping and caring culture use Zoom Explain government support options help them apply One size doesn t fit all figure out what each employee needs and help them get it.

FOR YOUR EMPLOYEES Available Programs Florida s Reemployment Assistance Pandemic Unemployment Assistance Florida Short Term CompensationProgram Family First Act (FFCRA) Sick Leave Caring for others Dependent Care FSA

Floridas Reemployment Assistance Eligibility You must have lost your job through no fault of your own. You must be totally or partially unemployed. Partially unemployed means your hours were reduced or you re a part-time worker who can t find additional work. You must have earned at least $3,400 before taxes in what is called the "base period," which is the first four complete quarters beginning 18 months prior to your claim. You must be able to work, available to work, and actively seeking work. This includes being able to get to a job and have child care if necessary. You can apply online at CONNECT The weekly payment will vary from person to person. The only way to be sure of the amount is to submit a claim. Your weekly payment from the State is based on your previous earnings. In 2020, you can receive a maximum of $275 per week for 12 weeks. You are entitled to a maximum benefit amount of $3,300. When you secure a job, the payments will stop. However, working part-time or temporarily does not necessarily end the benefits.

Low-Income Home Energy Assistance Program The Low-Income Home Energy Assistance Program (LIHEAP) is a federally funded program that helps low-income households cover heating and cooling costs. You can request assistance up to three times per year. The funds are paid directly to the energy company, not the household. Visit the Contact Your Local LIHEAP Provider For Help web page. Contact that agency by phone or online. http://www.floridajobs.org/community-planning-and-development/community-services/low-income- home-energy-assistance-program

Pandemic Unemployment Assistance: PUA PUA Program A temporary unemployment program for: Self-Employed Independent contractors People with limited work history $600/week in addition to state Unemployment Insurance payments thru July Additional 13 weeks of Unemployment Insurance after Florida UI expires. (39 weeks total) Will cover the usual 1-week state waiting period Effective 1/27/20 12/31/20 http://floridajobs.org/ReemploymentAssistance-Service- Center/reemploymentassistance/claimants/apply-for-benefits

Florida Short Time Compensation Program The Short Time Compensation program helps employers retain their workforce in times of temporary slowdown by encouraging work sharing as an alternative to layoff. The program permits prorated reemployment assistance to employees whose work hours and earnings are reduced to avoid total layoff of some employees. Eligibility Requirements Reduced hours must be used as a temporary solution to avoid a layoff. Participating employees must be full-time (at least 32 hours per week), permanent employees (not seasonal) With a set number of hours (excluding overtime) that they work each week (not piece rate) Short Time Compensation benefits are payable when normal hours of work are reduced from 10-40 percent. If normal work hours exceed 40, the percentage will be based on 40 hours. Each week that Short Time Compensation benefits are claimed, at least 10% of the employees from the total staff or within a particular unit must be working reduced hours. Two employees is the minimum for a staff or unit of less than 20 employees http://www.floridajobs.org/office-directory/division-of-workforce-services/reemployment-assistance-programs/short-time- compensation-program-for-employers

Florida Short Time Compensation Program (continued) Benefits: The amount of Unemployment Compensation paid to individuals filing for Short Time Compensation is a pro-rated portion of the Unemployment Compensation payment they would have received if they were totally unemployed. Example: An employee normally works a 40 hour work week. The employee s work week is reduced by eight hours or 20 %. If the employee had been laid off and totally unemployed and determined eligible for Unemployment Compensation, the individual would have received a weekly benefit amount of $270.00. The employer submits an Short Time Compensation plan and the plan is approved. Under the STC plan, the employee would receive $54.00 of benefits (or 20 percent of $270) in addition to the 32 hours of wages earned from the employer.

Family First Coronavirus Response Act (FFCRA) Emergency Paid Sick Leave Act Emergency Family & Medical Leave Expansion Act Tax Credits for Paid Sick & Family Medical Leave Act Sole proprietors can qualify for some of the tax credits Employers with under 50 employees need to ask for exemption if they cannot front the cost of paying employees on leave Some programs may have limited funding so do not be last in line https://www.gibsondunn.com/department-of-labor-issues-guidance-on-families-first-coronavirus-response-act/ The Secretary is also empowered to exempt small businesses with fewer than 50 employees from the paid leave requirements if compliance would jeopardize the viability of the business as a going concern. The guidance issued by the Division directs businesses wishing to utilize this small business exemption to document why the business meets the criteria set forth by the Department, which will be addressed in more detail in forthcoming regulations. However, businesses are not supposed to send any of this documentation to the Division at the current time.