Understanding IRB Review Process for Research Studies

The content provides an overview of the IRB review process for research studies, including what necessitates IRB review, the levels of IRB review (exempt, expedited, full board), examples of full board research, and criteria for an Investigational New Drug.

1 views • 17 slides

Challenges of EU Foreign Subsidies Regulation in Public Procurement

The EU Foreign Subsidies Regulation (FSR) imposes EU State aid rules on foreign vendors in EU Member States, creating disclosure requirements and review processes. This regulation poses administrative burdens and strategic challenges for vendors, particularly impacting EU-based vendors purchasing fr

2 views • 7 slides

Tax Considerations for Incentive, Recognition & Safety Programs

This presentation provides guidelines on tax implications, exemptions, and reporting obligations related to incentive, recognition, and safety programs. It emphasizes the importance of understanding tax considerations for program sponsors and participants to ensure compliance with applicable laws an

3 views • 14 slides

Understanding GST Nuances in Real Estate

The realm of GST in real estate, particularly works contracts and property sales, is intricate and crucial to the country's GDP growth. This includes transactions like leases, constructions, and sales, all of which have specific provisions under the CGST Act. While some real estate transactions are

2 views • 36 slides

Revising ETSI Standard for License-Exempt Operation in 6 GHz Band

Work has commenced on revising the ETSI standard EN 303.687 for license-exempt operation in the 6 GHz band to expedite completion. This revision project outlines the history, New Work Item approval, ETSI processes, and the upcoming steps. It traces back to 2017 when Switzerland and ECC administratio

0 views • 10 slides

Understanding IRB Review Levels and Exempt Determinations

Explore the levels of IRB review for human participant research, including Exempt, Expedited, and Full Board reviews. Learn about the categories of Exempt Determinations and the criteria for Limited IRB Review. Understand if your study requires IRB review based on research and human subject involvem

1 views • 12 slides

Oklahoma Department of Public Safety Driver Compliance Division: Information on Suspensions and Withdrawals under the Bail Bond Procedure Act 2021

This information provides details on driver license suspensions for failure to appear, contact information for assistance, and guidelines to follow when filling out suspension notices. Certain violations are not eligible for failure to appear actions, and the document outlines what to remember about

0 views • 28 slides

Understanding H-1B Visa Program for Professional Employees

The H-1B visa is a popular choice for professional employees in specialty occupations, requiring at least a Bachelor's degree. It has a validity period of up to six years, with exceptions, and an annual cap of 65,000 visas. Certain institutions are exempt from the cap. Employers need to follow speci

3 views • 20 slides

Analysis of GST Provisions in the Banking Industry

The Goods and Services Tax (GST) regime replaced the old service tax regime on July 1, 2017. In the context of the banking industry, the provisions governing GST for services provided by Cooperative Banks and Banking Cooperative Societies are similar to those of the service tax regime. While interes

1 views • 13 slides

Tax Benefits and Double Tax Treaties in Cyprus

Cyprus offers an attractive tax regime, with a corporate tax rate of 12.5%, exempt capital gains, and favorable personal tax rates for residents. Additionally, Cyprus has double tax treaties with numerous countries, making it an ideal location for individuals and businesses seeking tax efficiency.

0 views • 21 slides

NIMH Clinical Research Education and Monitoring Program Overview

NIMH's Clinical Monitoring and Clinical Research Education, Support, and Training Program (CREST) aims to ensure the proper conduct, recording, and reporting of clinical trials. This program includes clinical monitoring plans, guidelines for site monitoring activities, and independent clinical monit

1 views • 29 slides

Annual Filing Requirements for Knights of Columbus Councils

Learn about the IRS annual filing requirements for Knights of Columbus Councils, including the need to file Form 990, obtain an EIN, and maintain tax-exempt status. Failure to comply can result in the revocation of tax-exempt status and reinstatement fees. Find detailed guidance on applying for an E

0 views • 23 slides

Exempt Employee LoboTime Navigation and Common Tasks Guide

This job aid provides an overview for exempt employees on navigating and performing common tasks in the LoboTime system. It covers logging on and off, accessing different workspaces, managing widgets, requesting time off, and retracting time off requests. Visual aids accompany detailed step-by-step

0 views • 7 slides

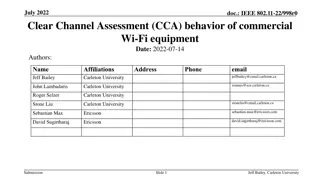

Clear Channel Assessment (CCA) Behavior of Commercial Wi-Fi Equipment

This document, dated July 2022, delves into the Clear Channel Assessment (CCA) behavior of commercial Wi-Fi equipment in response to Narrowband Frequency Hopping (NB FH) signals. It explores the regulatory framework around license-exempt frequency bands in the USA and Europe, highlighting the specif

0 views • 22 slides

Understanding Plea Bargaining in Criminal Cases

Plea bargaining is a negotiation process where the accused admits guilt in exchange for a reduced punishment. It helps in resolving cases faster and reducing court congestion. The concept is applicable to cases with a maximum sentence of 7 years, not involving women or children under 14, and not imp

2 views • 14 slides

United States Food Safety and Inspection Service: Ensuring Meat and Poultry Products' Safety

The United States Department of Agriculture's Food Safety and Inspection Service (FSIS) oversees the federal inspection of meat and poultry products to ensure their safety for human consumption. The statutes governing this process include the Federal Meat Inspection Act, the Poultry Products Inspect

0 views • 23 slides

Nonpoint Source Categories: The Wagon Wheel Tool Training Agenda

Delve into the comprehensive training agenda for the Wagon Wheel Tool focusing on nonpoint source categories. Explore options for submitting data to EPA, templates for inputting data, and interactive demonstrations. Understand the staggered development plan of different source categories and learn a

0 views • 16 slides

Understanding Compensation, Overtime, and Time Reporting Policies

This content discusses important topics such as compensation, overtime, exempt vs. non-exempt classification, and salary thresholds. It aims to provide a comprehensive understanding of the rules and regulations surrounding time reporting and compensation for staff and academic employees. Topics cove

0 views • 39 slides

Understanding Disposition of Assets for Less Than Fair Market Value in Affordable Housing

In affordable housing, applicants are required to disclose if any family member disposed of assets for less than fair market value within two years of certification or recertification. This requirement, mandated by HUD, aims to prevent asset divestment for housing eligibility. Involuntary dispositio

0 views • 8 slides

Impact of New Minimum Wage and Semi-Monthly Pay on Charter Schools

Presentation by Kari Wallace at the CCSA Conference on how the progressive increase in California's minimum wage affects exempt/non-exempt classifications and the introduction of semi-monthly payrolls. The presentation discusses key details, including Delta Managed Solutions' experience, labor code

0 views • 33 slides

Understanding Municipal Management Districts (MMDs) in Texas

Municipal Management Districts (MMDs) in Texas are special districts that are self-governed but require approval from the host municipality. They have the authority to provide infrastructure and approved service plans. MMDs can issue tax-exempt bonds, levy taxes, assessments, and impact fees, and pr

7 views • 21 slides

UNR WLTP: Regulations Update for Vehicle Type Approval

This document details the transposition of GTR15 (WLTP) and GTR19 (Evap) into UN Regulations, focusing on the scope, definitions, and application for approval of vehicle categories M1, M2, N1, and N2. It outlines requirements for emissions testing, carbon dioxide, fuel consumption, electric energy c

0 views • 38 slides

Understanding Alternative Investment Funds (AIFs) and Their Categories

Explore the world of Alternative Investment Funds (AIFs), including their introduction, categories, regulations, and taxation. Discover the benefits of AIFs, such as flexibility, diversification, and potential for higher returns. Learn about the entry of AIFs in the investment domain and the various

0 views • 30 slides

Introduction to Builders Law: Industry Context, Purpose, Administration, and Registration Categories

Over 600 companies in the Contractor Development Industry contribute significantly to the Cayman Islands' GDP. The Builders Law aims to protect consumers and businesses, enhance industry competency, and establish registration categories for different types of contractors. The Builders Board oversees

0 views • 15 slides

Understanding Exempt Research Categories and Requirements

Exploring the concept of exempt research in the context of the Common Rule and VA guidelines, this workshop series delves into the obligations and responsibilities of key entities involved in the initial review and approval process. It clarifies what it means to be exempt, outlines the categories of

0 views • 28 slides

Understanding Methodological Choice and Key Categories Analysis in Greenhouse Gas Inventory Management

Methodological choice and key categories analysis play a crucial role in managing uncertainties in greenhouse gas inventories. By prioritizing key categories and applying rigorous methods where necessary, countries can improve the accuracy and reliability of their emissions estimates. Key categories

0 views • 24 slides

Comprehensive Review of Drugs, Categories, and Drug Influence Evaluation

This mid-course review covers key aspects such as defining drugs, naming drug categories and subcategories, identifying drug categories for specific drugs, components of drug influence evaluation, and examinations conducted as part of the evaluation process. The content also includes identifying dru

0 views • 28 slides

Understanding Multiclass Logistic Regression in Data Science

Multiclass logistic regression extends standard logistic regression to predict outcomes with more than two categories. It includes ordinal logistic regression for hierarchical categories and multinomial logistic regression for non-ordered categories. By fitting separate models for each category, suc

0 views • 23 slides

Executime Automated Time & Attendance Policy Overview

Executime is an automated system for capturing employee time, streamlining processes for salary exempt, non-exempt, and hourly employees. The policy highlights clock-in rules, time-off procedures, and steps for entering and approving time. Employees are required to adhere to the guidelines outlined

0 views • 8 slides

Understanding UW-Madison Salary and Activities Guidelines

This document covers the guidelines and policies related to salary, compensation, and activities for faculty members at UW-Madison. It explores topics such as institutional base salary, total UW effort components, exempt employee salaries, and overload policies. It emphasizes the importance of follo

0 views • 19 slides

Guide to IRS Tax Exempt Status Application for Non-Profit Organizations

This comprehensive guide provides essential information on applying for tax-exempt status with the IRS for non-profit organizations. It covers the benefits, application procedures, responsibilities, and tools needed for a successful application process. From determining eligibility to understanding

0 views • 14 slides

South Carolina Public Service Authority Revenue Obligations Investor Presentation

This investor presentation provides details on South Carolina Public Service Authority Revenue Obligations for 2024, including Tax-Exempt Improvement Series A, Tax-Exempt Refunding Series B, and Taxable Improvement Series C. It emphasizes the preliminary nature of the information and the need for ca

0 views • 24 slides

Understanding Knowledge Representation and Categories in Information Systems

Exploring various types of representations and categories, this content delves into Aristotle's classical view of categories, the contrast between Aristotle's empirical approach and Plato's Ideals, the concept of prototypes, and different models for categorization. It highlights how entities are cla

0 views • 21 slides

Addressing Issues in Supported Housing: Exempt Accommodation Oversight Act of 2023

A comprehensive overview of the Supported Housing Regulatory Oversight Act of 2023 and the challenges faced in the exempt accommodation sector. The narrative delves into the need for increased regulations, concerns about exploitation, and the positive impact of recent pilot programs on improving res

0 views • 15 slides

Data Disaggregation Taskforce: Assessment and Recommendations on Vulnerabilities

The Data Disaggregation Taskforce is conducting an assessment of current practices across sectors, assessing 10 sectors/clusters, 15 categories of affected populations, and identifying vulnerabilities in 17 categories. The Taskforce is working on harmonizing categories and finalizing recommendations

0 views • 6 slides

Understanding IRB and IRBNet Processes at Lehman College

Explore the different types of IRB review processes, including exempt, expedited, and full/convened reviews. Learn about human subjects research, not human subjects research, and exempt categories. Discover the importance of obtaining informed consent and navigating IRBNet for research compliance at

0 views • 74 slides

Understanding the Right to Know Law and Office of Open Records

The Right to Know Law (RTKL) in Pennsylvania grants access to public records held by various agencies, ensuring transparency and accountability. The law applies to Commonwealth, local, judicial, and legislative agencies. Records are presumed to be public but can be exempt under specific conditions.

0 views • 39 slides

Evolution of Welfare Impact Categories in Animal Research Guidelines

Canadian Council on Animal Care (CCAC) published updated guidelines titled "Categories of Welfare Impact" in 2024, replacing the Categories of Invasiveness. The new guidelines focus on animal experiences, procedures carried out on animals, and positive impacts on animal welfare. The categories (A-E)

0 views • 21 slides

Understanding Syntax and Lexical Categories in English Grammar

Syntax is the study of rules in generating grammatical sentences, focusing on building grammars that produce well-formed English sentences. It involves organizing words into categories like nouns, verbs, adjectives, and adverbs to form phrases and clauses. Lexical categories are determined based on

0 views • 33 slides

Understanding Human Subject Research and JIT Process at COMIRB

Explore the world of Human Subject Research and Just-In-Time (JIT) process as explained by Assistant Director Cat Sutherland at COMIRB. Learn about exempt categories, secondary research, grant approvals, and the intricate JIT process. Get insights into education research, surveys, behavioral interve

0 views • 7 slides