All Kinds of Insurance & Opportunities

Discover various types of insurance such as pet, flood, cyber, travel, and home insurance along with career options in the insurance industry. Explore diverse opportunities in insurance sales, marketing, analytics, risk management, and more. Uncover the world of insurance and the potential it holds

1 views • 18 slides

Non-traditional Life Insurance Product

Delve into the world of non-traditional life insurance products like Universal Life Insurance, Variable Life Insurance Plans, and Unit-Linked Insurance Plans. These innovative plans offer a mix of insurance coverage and investment opportunities, allowing policyholders to tailor their premiums and po

2 views • 23 slides

Understanding Life Insurance Plans

Life insurance plans are essential financial products that offer protection and financial security to loved ones in the event of the insured's death. There are various types of life insurance plans, including whole life insurance and term insurance, each serving different purposes and offering uniqu

0 views • 16 slides

The Digital Revolution in the Insurance Sector of the Democratic Republic of Congo

Explore the impact of the SNECA (National System for Issuing Insurance Certificates) in regulating and controlling the insurance sector in the DRC. Learn about the legal framework, the purpose of SNECA, compliance with insurance obligations in the country, and the operational methods of SNECA for en

0 views • 14 slides

CII Award in Insurance (W01) Course Overview

The CII Award in Insurance (W01) is a course aimed at insurance sector professionals, including those in HR, accounts, compliance, and other roles related to insurance. It covers topics such as risk management, insurance market, law of contract, and ethical standards. The course is suitable for indi

1 views • 24 slides

How to Delete a Deposit in QuickBooks

How to Delete a Deposit in QuickBooks\nAccurate financial records are crucial for any business. In QuickBooks, deposits can occasionally be entered incorrectly. To delete a deposit, first, back up your data. Then, navigate to the Banking menu, select Make Deposits, and locate the deposit. Once found

0 views • 7 slides

Auto Insurance Companies Port St.Lucie

When contacting various auto insurance companies port st.lucie . With the Lucie, many turn to Triple L Insurance which is recognized for its standardization and exceptional service with Triple L Insurance distinguished by its commitment to providing comprehensive strategies that meet the needs of th

1 views • 4 slides

Car Insurance Port St. Lucie

Triple L Insurance is your trusted partner for comprehensive car insurance port st. lucie. With a focus on bespoke service and competitive pricing, Triple Lbima caters to both new drivers and experienced travelers. They offer customized defense mechanisms to meet individual needs, providing peace of

0 views • 4 slides

If you are looking for Health Insurance in St Andrews

If you are looking for Health Insurance in St Andrews, R Milne Financial Adviser LTD is your local insurance broker in Pukete, Hamilton. Welcome to Guardian Assurance Solutions, your trusted partner for all your insurance needs! We specialise in providing personalised insurance solutions tailored to

0 views • 6 slides

Veterans Affairs Life Insurance Programs Overview

Department of Veterans Affairs (V.A.) administers or supervises eight insurance programs for veterans and active duty servicemembers from various eras. All insurance activities are centralized to the V.A. Regional Office and Insurance Center in Philadelphia, Pennsylvania. The programs include Servic

1 views • 24 slides

Understanding Different Types of Insurance Contracts

This unit delves into the various kinds of insurance contracts, focusing on life insurance and non-life insurance classifications. It covers essential topics such as property and liability losses, workers' compensation, social insurance versus private insurance, and direct insurance versus indirect

1 views • 64 slides

Understanding Federal Crop Insurance in Agricultural Systems Management

Explore the current crop insurance programs for major crops, including different insurance options, how they work, and the decisions farmers make. Gain insights into CBO projected USDA spending, trends in WI crop insurance participation, and comparisons with neighboring states. Learn about the types

0 views • 63 slides

PDIC Self-Assessment Process for Effective Deposit Insurance System

Evaluation of adherence to core principles, identification of legal, policy, and program gaps, and informing key stakeholders through a structured self-assessment process led by Ma. Ana Carmela L. Villegas, Senior Vice President of the Deposit Insurance Sector at the Philippine Deposit Insurance Cor

0 views • 17 slides

UF Insurance Requirements and Procurement Guidelines

UF requires suppliers coming onto their property to provide proof of insurance for liability coverage to protect the university's faculty, staff, students, and property. Specific insurance requirements include Commercial General Liability, Automobile Liability, and Worker's Compensation Insurance. P

0 views • 5 slides

Understanding Risk Management and Insurance in Economic Context

This content delves into the economic basis of insurance, risk management strategies, and the essential role insurance plays in sharing and transferring risks. It covers topics like historical development of insurance, classification of insurance contracts, and the benefits of risk management. By pr

0 views • 115 slides

Deposit Insurance Systems: Building Confidence and Stability in Banking

This presentation for New Zealand Treasury and RBNZ staff by David Walker focuses on the importance of deposit insurance systems worldwide. It covers the rationale behind deposit insurance, IADI's core principles, lessons learned from the financial crisis, and new challenges in the field. The advant

0 views • 49 slides

Functions of Commercial Banks

Primary functions of commercial banks include acceptance of deposits such as fixed deposit, current deposit, saving deposit, and recurring deposit. Banks also advance loans for productive purposes, including call money, overdraft, cash credit, and discounting of bills. Another crucial function is cr

0 views • 6 slides

Insurance and Inventory Management Lecture Insights

Explore the fundamentals of insurance with a focus on risk management and insurance policies, premiums, and a brief history of federal crop insurance. Discover how insurance plays a crucial role in mitigating losses and protecting businesses from various risks, including low yields, natural disaster

0 views • 37 slides

Dragon Boat NSW Insurance Presentation Overview

Dragon Boat NSW Insurance Presentation provides a comprehensive overview of insurance policies, expertise, coverage details, and benefits offered by V-Insurance Group for members and volunteers involved in Dragon boating activities. The presentation covers key topics such as insurance policies summa

0 views • 29 slides

Role Expansion of Deposit Insurers in Crisis Management

In the realm of financial stability, the role of deposit insurers is evolving to encompass broader responsibilities, including risk analysis, crisis management, and cross-border resolutions. This transformation involves expanding mandates, enhancing resolution activities, and ensuring the protection

0 views • 24 slides

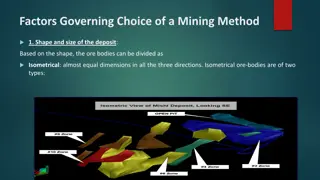

Factors Influencing Mining Method Selection

Factors affecting the selection of a mining method include the shape and size of the deposit, the deposit's contact with country rock, thickness of the ore body, and the dip of the deposit. The shape of the deposit, contact with country rock, and thickness of the ore body impact the feasibility and

0 views • 14 slides

Foundational Training for Deposit Transmittal in FY 2021-22

Discover the key processes and documentation involved in completing deposit transmittal forms, supporting gift acceptance, and donor intent fulfillment. Learn about the life cycle of a deposit, what constitutes a charitable contribution, and how to identify different types of gifts. Understand the i

0 views • 22 slides

Enhancing Insurance Penetration in Ghana Through Digital Innovation

Dr. Gideon Amenyedor explores how digital insurance can enhance insurance penetration in Ghana by leveraging technology to improve existing insurance models and create new ones. The strategic application of digital technology aims to address the low insurance penetration rate in the country by consi

0 views • 18 slides

Strengthening Financial Stability Architecture through Deposit Insurance Assessment

The presentation discusses the importance of effective deposit insurance systems in the wake of the global financial crisis. It outlines the core principles for evaluating deposit insurance systems, emphasizing the significance of self-assessment and the role of expert reviews. The desired outcomes

0 views • 15 slides

Enhancing and Testing Repository Deposit Interfaces

Talk by Steve Hitchcock at Open Repositories Conference on enhancing and testing repository deposit interfaces, focusing on open access Institutional Repositories, user value, new deposit interfaces, testing results with SWORDv2, and boosting deposit rates. Credits and acknowledgements for the proje

0 views • 23 slides

Student Direct Deposit Setup Instructions

Follow these step-by-step instructions to set up direct deposit for your student accounting account. Start by accessing the Account Inquiry link under My Account, then navigate to the Account Services tab to enroll in Direct Deposit. Enter your Bank ID/Routing and Account number, agree to the terms,

0 views • 6 slides

Understanding the Mississippi Insurance Department and Health Insurance Exchanges

The Mississippi Insurance Department plays a vital role in overseeing insurance regulations, and Health Insurance Exchanges provide a marketplace for major medical insurance in a similar fashion to online travel booking platforms. While details about the Exchange are still emerging, the Affordable C

0 views • 23 slides

Federal Crop Insurance and Disaster Programs Overview

Overview of current crop insurance and disaster programs in the US agricultural sector, detailing the functioning of crop insurance programs, emphasis on crop insurance over disaster programs, commodity support, trends in Wisconsin crop insurance participation, comparison with neighboring states, hi

0 views • 51 slides

Understanding the Importance of Insurance: Types and Coverage Explained

The Insurance Act of 1938 marked a significant milestone in regulating insurance businesses. This legislation aims to protect the interests of insured parties and streamline insurance operations. Insurance plays a crucial role in safeguarding individuals against uncertainties, sharing risks, facilit

0 views • 17 slides

Insurance Contracts in Greece: Boundaries and Definitions

The boundaries and definitions of insurance contracts in Greece are outlined in terms of statutory requirements, minimum contents, and various business models such as Peer-to-Peer insurance. The lack of a uniform European definition and the evolving nature of insurance activities present challenges

0 views • 9 slides

Overview of the Austrian Insurance Industry

The Austrian insurance industry comprises 122 companies supervised by the Financial Market Authority. It offers a range of products including personal insurance, social insurance, supplementary health insurance, travel insurance, and accident insurance. Social insurance in Austria includes mandatory

0 views • 30 slides

Supporting Access to Agricultural Insurance Through Regulation and Supervision

Enhancing wider access to index-based agricultural insurance is crucial in Africa due to the significant risks faced in the agricultural sector. This presentation by Dr. Grace Muradzikwa, Commissioner of Insurance, Pension, and Provident Funds, highlights the role of regulation and supervision in ad

0 views • 18 slides

University Funds Deposit Procedures and Transmittal Form Guidelines

Deposit university funds daily with Student and Departmental Account Services according to set thresholds. Utilize the standardized transmittal form provided to ensure accurate and timely processing. Follow guidelines for filling out the form and verifying chart fields to avoid deposit delays. Learn

0 views • 34 slides

CDIC Taiwan: Addressing Poor Data Quality

The article discusses CDIC Taiwan's approach to addressing poor data quality through the establishment of E-data files, inspection processes, and overcoming challenges. CDIC, founded in 1985, is the sole deposit insurer in Taiwan with a mandate to handle deposit insurance issues, control insurance r

1 views • 40 slides

Malaysia Deposit Insurance Corporation: Ensuring Seamless Access to Insured Deposits

Malaysia Deposit Insurance Corporation (MDIC) plays a crucial role in safeguarding depositors' funds and promoting financial stability in Malaysia. Through its seamless payout framework and efficient reimbursement approach, MDIC aims to protect depositors and insured persons from potential losses in

0 views • 20 slides

Understanding Various Aspects of Insurance in the Financial Sector

Insurance serves as a vital tool for managing financial risks and protecting against uncertainties. This article delves into types of insurance, advantages, regulatory issues, and the role of credit rating agencies. It covers life insurance, property insurance, and marine insurance among others, hig

0 views • 27 slides

Understanding Public Deposit Insurance in Massachusetts

Explore the intricacies of public deposit insurance in Massachusetts through an in-depth discussion on the regulations, investment policies, and the role of the Federal Deposit Insurance Corporation (FDIC) and Depositors Insurance Fund (DIF).

0 views • 18 slides

Overview of IPAB's Deposit Insurance and Resolution Framework in Mexico

In Mexico, IPAB plays a crucial role as a public agency, deposit insurer, and resolution authority within the financial safety net. With coverage of up to $154,085, IPAB ensures the protection of depositors' funds through various accounts. The legal framework includes stages such as Prompt Correctiv

0 views • 20 slides

European Deposit Insurance Scheme (EDIS) - Towards a Safer Banking Industry in Europe

The European Commission initiated the European Deposit Insurance Scheme (EDIS) to strengthen confidence in the banking industry in Europe, solidifying the European monetary union. EDIS will be phased in from 2017 to 2024, providing more stability for European depositors and addressing potential pitf

0 views • 10 slides

Understanding Basic Banking Services and Deposit Insurance

This module covers the fundamental services offered by financial institutions, guidance on selecting the right banking account, understanding rights and responsibilities, ensuring the safety of accounts, and taking action against potential unauthorized account use. It also explains basic banking ser

0 views • 36 slides