Departmental Security Administrator (DSA) Training Overview

The roles and responsibilities of a Departmental Security Administrator (DSA) and how to become one. Discover how DSAs assist new employees with self-registration and access to core data systems.

1 views • 38 slides

Europe Medical Image Management Market by Product [PACS (Departmental, Enterpris

Europe Medical Image Management Market by Product [PACS (Departmental, Enterprise) Delivery (On-Premise, Cloud-based) VNA (Delivery, Procurement, Vendor) AICA (Vendor), Universal Viewer] End User (Hospitals, Diagnostic Imaging Centers) - Forecast to 2030

2 views • 4 slides

Departmental Accounting in Business Organizations

Departmental accounting involves analyzing and recording financial information by department to evaluate performance, efficiency, and growth potential. It helps in allocating expenses, preparing income statements, and identifying successful managers. The advantages include performance evaluation, gr

7 views • 12 slides

Departmental Racial Equity Action Plan Guidance and Coordination

Comprehensive guidance is provided for utilizing a slide template to report on departmental racial equity action plans. Suggestions for setting priorities, coordinating divisions, and utilizing the template effectively are highlighted for departments aiming to align with Racial Equity Action Plans.

3 views • 12 slides

Tax Expenditures and Their Impact on Government Revenue

Tax expenditures are provisions in the U.S. federal tax laws that result in revenue losses by allowing exclusions, exemptions, deductions, credits, preferential tax rates, and deferrals. This concept is crucial as it affects government revenue, and there are challenges in reporting these expenditure

3 views • 18 slides

Silo Effect in Business Organizations

Organizational silos in companies hinder communication between units, leading to inefficiencies and potential losses. The Silo Effect occurs due to the lack of cross-departmental communication, often exacerbated by different departmental goals and incentives. To eliminate the Silo Effect, companies

4 views • 9 slides

Quick Course on Setting up Fund Accounting in QuickBooks Pro for Municipalities

Discover how to set up fund accounting in QuickBooks Pro for municipalities using class tracking features. Learn to define funds, track balances for revenues and expenditures, and create new revenue accounts. Explore examples of recording revenue and managing expenditures effectively.

0 views • 19 slides

Departmental Accounts in Business

Departmental accounts are essential in business to evaluate the performance of various departments separately, compare results, reward managers based on performance, and formulate effective business policies. This accounting method offers insights into department affairs, aids in budgeting, and faci

1 views • 26 slides

County Budgeting Process in Mississippi

The process of county budgeting in Mississippi involves identifying needs, forecasting requirements, preparing departmental budget requests, reviewing requests, adopting and implementing the budget, amending the budget, and adopting the final amended budget. Various revenue sources, such as local ad

1 views • 12 slides

Overview of Food Price Trends and Consumer Expenditures in the US

The presentation highlights the consumer spending on food, food price trends over time, 2021 food prices, and forecasts for 2022 in a historical context. It emphasizes that U.S. consumers spent 12% of their expenditures on food in 2020, aligning with historical averages. Food price inflation remaine

1 views • 21 slides

Rochdale AFC Academy Sport Science & Medicine Departmental Plans 2018/19

The Rochdale AFC Academy aims to provide elite sports science and medical support services for player development. The departmental plans include areas such as physiology, psychology, nutrition, and injury rehabilitation. Key objectives involve maximizing player performance, using data for individua

1 views • 35 slides

Overview of Ontario's Expenditures and Revenues

Ontario's projected expenditures for 2018-2019 are around $158 billion, with 30 ministries grouped into six major sectors. The top spending sectors include Health, Education, Other Programs, and Interest on Debt. Revenue sources for the same fiscal year are projected to be approximately $152 billion

7 views • 16 slides

Managing Inter-Departmental Transfers in Financial Accounting

Inter-departmental transfers involve recording and charging costs from one department to another, with different pricing bases like cost-based and market-based transfers. Unrealized profits in transfers are adjusted using stock reserves. Entries are made at the selling price to include costs and pro

1 views • 7 slides

Departmental Audits in GST

Departmental audits in GST involve the examination of records, returns, and other documents to verify the correctness of turnover declared, taxes paid, refunds claimed, and input tax credit availed. This audit ensures compliance with the provisions of the CGST Act, 2017. Types of audits under GST in

7 views • 27 slides

Empowering Gram Panchayats: Development Plan and Implementation Challenges

The Gram Panchayat Development Plan (GPDP) aims for inclusive growth and development but faces challenges like lack of awareness, limited sectoral presence, and isolated departmental work. The process involves setting long-term goals, data collection, prioritizing activities, and reviewing progress

0 views • 19 slides

Departmental Correction Requests (DCR) in Financial Management Operations

Departmental Correction Requests (DCRs) in financial management operations play a critical role in correcting accounting entries, such as Accounts Payable vouchers and journal entries, through the CANOPY-based module. Learn about the benefits, timing, allowable transactions, and restrictions associa

0 views • 12 slides

Departmental Performance Review Overview

The Departmental Performance Review (PR) is a comprehensive evaluation process conducted for faculty members to assess their performance in various academic settings. It includes determining Right of First Refusal (RoFR) for sessional and LTC faculty, evaluating eligibility for contract extensions,

0 views • 23 slides

Significance of Departmental Accounting in Business Operations

Departmental accounting plays a crucial role in tracking departmental activities and financial information within an organization. It helps evaluate departmental performance, identify strengths and weaknesses, determine profitability, and guide decision-making for future growth and efficiency. This

0 views • 9 slides

Provincial Treasury Process for Dealing with Irregular Expenditures

The Provincial Treasury outlines the process for handling irregular expenditures, including the definition of irregular expenditure, regulations introduced, legal opinions, and duties of Accounting Officers (AOs) and Authorized Officials (AAs) to prevent and address irregularities. Various steps and

0 views • 12 slides

Approaches to Faculty Assignments for Departmental Success

Understanding the importance of assignments in maintaining departmental efficiency and facilitating necessary changes. Exploring different levels of assignments - individual and departmental, while focusing on enhancing teaching, research, and service areas. Emphasizing the need to establish an accu

0 views • 23 slides

Colorado Expenditures on the Medically Indigent Presentation

The presentation focuses on Colorado's expenditures for the medically indigent, conducted by Yondorf & Associates. It outlines the background of the expenditures project, preliminary findings, and possible policy implications. The project aims to estimate current spending on Coloradans who cannot af

0 views • 12 slides

Evaluation Process for AAU Membership and Indicators

AAU evaluates universities for membership based on research and education profiles. Non-member universities exceeding standards may be invited to join, while current members falling below may face review. The process involves membership and phase 1 indicators, federal R&D expenditures, and expenditu

0 views • 12 slides

Missouri HealthNet Pharmacy Program and Budget Update Summary

The Missouri HealthNet Pharmacy Program and Budget Update for July 2023 provides detailed insights into the enrollees, expenditures, and services covered. It highlights the distribution of enrollees among different categories such as children, custodial parents, pregnant women, elderly, and disabled

0 views • 9 slides

Musculoskeletal Disorders in Norway: Statistics and Analysis

This information provides an in-depth look at musculoskeletal disorders in Norway, including disease categories, public expenditures, burden of disease, DALYs by ICD10 chapters, health expenditures, productivity loss, deaths, and YLDs in 2013. The data sheds light on the prevalence, impact, and dist

0 views • 9 slides

Financial Reporting Tools Overview for FSU Controllers Office

Detailed overview of the financial reporting tools available for the FSU Controllers Office, including OMNI/BI Departmental Ledger review, other BI reports and queries, OMNI Financials, and daily updates for monthly department financial activity. These tools provide essential information for monitor

0 views • 19 slides

UC Merced Entertainment Policy Overview for Catering Recharges

University of California, Merced's entertainment policy (BUS-79) outlines expenditures for business meetings, entertainment, and other occasions, including guidelines for catering recharges. The policy covers purposes, maximum rates, general limitations, approval of expenditures, exceptions, busines

0 views • 17 slides

Public Safety Canada 2019-20 Financial Situation Presentation

Public Safety Canada's 2019-20 Departmental Financial Situation Presentation highlights the main estimates for operating expenditures and grants/contributions, including changes over the last five years. It discusses the authorities and programs funded, such as Disaster Financial Assistance Arrangem

0 views • 7 slides

Litchfield Elementary School District Bond Update June 30, 2021

Litchfield Elementary School District provides an update on the 2014 Bond Authorization as of June 30, 2021. The District has issued bonds totaling $35 million with expenditures and available cash detailed. Expenditures include school remodeling, new construction projects, operational expenses, and

0 views • 11 slides

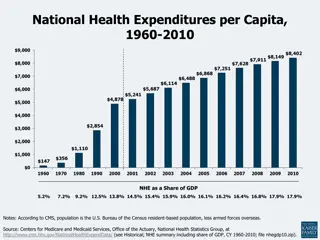

Trends in National Health Expenditures and Care Costs, 1960-2010

National health expenditures per capita and as a share of GDP from 1960 to 2010, along with average annual growth rates, show the evolving landscape of healthcare spending in the U.S. The data reveals changing patterns in healthcare expenditure and outlines the concentration of health care spending

0 views • 20 slides

Office Administration Guidelines and Contact Information

Detailed information on office administration policies, departmental purchases, accounts payable, print shop services, and contact details for various personnel. Tips provided on making departmental purchases, managing accounts payables, utilizing print shop services, and understanding the purchasin

0 views • 21 slides

Salary Cycle Training and Course Objectives for Departmental Fiscal Officers

The training, presented by the CAL Financial Advisory Board, focuses on salary cycle management, reconciliation, and budgeting for Departmental Fiscal Officers. The course objectives include understanding salary lines, data entry, reconciliations, and communication with stakeholders. Expectations in

1 views • 22 slides

Audit Report on Adult Corrections Expenditures

Adult corrections expenditures report from the Legislative Audit Bureau highlights trends in inmate population, operating expenditures, employee wages, turnover rates, vacancy rates, and inmate health care management issues. The report identifies areas of growth in corrections spending and offers re

0 views • 14 slides

Eastern Carolina Council Annual Budget 2017-2018 Overview

This document provides an overview of the Eastern Carolina Council's annual budget for the fiscal year 2017-2018. It includes details on membership dues, departmental usage, personnel, board of directors, budget ordinance, anticipated revenues, proposed expenditures by department, and the overall fi

0 views • 27 slides

FY22 Departmental Offices Metrics Report

The FY22 Departmental Offices Metrics Report includes metrics related to internal control audit liaison, billings, and collections. It covers topics such as response to audit PBC requests, outstanding debt referral to Treasury, close of sales and distribution modules in FBMS, and T&M agreement colle

0 views • 11 slides

New IDT/ICT Form: Streamlining Inter-Departmental and Inter-Company Transactions

Streamline inter-departmental and inter-company transactions with the new IDT/ICT form. Easily transfer funds between different departments within the same company and across different companies. Two identical forms cater to Foundation and Philanthropic accounts, enhancing efficiency in financial pr

0 views • 13 slides

Navigating Departmental Leadership as Head of Geography

As the Head of Geography, the journey involves transitioning between schools, managing staff, setting priorities, and fostering a clear vision for the department. Embracing effective leadership, defining goals, and ensuring staff alignment are key for success in navigating departmental complexities.

0 views • 26 slides

Houston County Budget Preparation Process Overview

Houston County's budget preparation process, presented by Bill Dempsey, CAO, involves calculating departmental expenses in categories like salaries and benefits, operations, and capital expenditures. The budget comparative analysis and projections provide insights into expenditure variations and bud

0 views • 12 slides

Enhancing Departmental Strengths for Future Success

The Department of Psychology, under the leadership of Doug Gillan, focuses on maintaining high-quality programs and strategic resource allocation to support graduate training, scholarly reputation, interdisciplinary initiatives, and advocacy for departmental initiatives. Emphasizing the importance o

0 views • 5 slides

Summary of Departmental Plan

Departmental plan led by Associate Professor Olya Keen focuses on ongoing support, future success, outreach, and welcome initiatives for graduate students. Activities include establishing recruiting relationships, creating a welcome package, implementing Individualized Development Plans, encouraging

0 views • 6 slides

Departmental Procedure and Accounting Responsibilities

This content highlights the responsibilities of an accounting officer in managing financial reports, budgets, audits, and preparation of financial statements. It also discusses accounting procedures, standards, and administrative approvals required for departmental works.

0 views • 33 slides