FY22 Departmental Offices Metrics Report

The FY22 Departmental Offices Metrics Report includes metrics related to internal control audit liaison, billings, and collections. It covers topics such as response to audit PBC requests, outstanding debt referral to Treasury, close of sales and distribution modules in FBMS, and T&M agreement collections. The report provides detailed data and comparisons for each quarter, reflecting the agency's adherence to deadlines and schedules.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

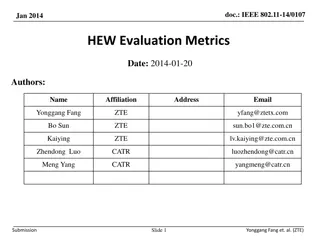

IBC IBC FY22 DEPARTMENTAL OFFICES METRICS REPORT

INTERNAL CONTROL AUDIT LIAISON INTERNAL CONTROL AUDIT LIAISON AOSD - 1 Metrics Definition: Respond to 100% audit PBC requests by agreed to PBC date. Audit PBC date will be compared to received date of PBC item. Total # of PBC items received for the month Total # of PBC items completed upon agreed dates Total # of PBC items NOT completed upon agreed dates 100% response to PBC request on item and agreed date QTR 1 12 12 0 100% QTR 2 0 0 0 100% QTR 3 0 0 0 100% QTR 4 5 5 0 100%

BILLINGS & COLLECTIONS BILLINGS & COLLECTIONS Metrics Definition: 95% of outstanding debt is referred to Treasury in accordance with agency deadlines and/or Treasury schedules. Metrics Definition: 95% of outstanding debt is referred to Treasury in accordance with agency deadlines and/or Treasury schedules. AOSD - 2 AOSD - 3 Amount of stale debt greater than 2yrs is reported to the client and recommended for reclassification or to be written off within 30 days of receipt Total stale debt greater than 2yrs identified to the client and recommended for reclassification or to be written off within 30 days of receipt Amount referred to Treasury in accordance with agency deadlines and/or Treasury schedules Total amount eligible to be referred to Treasury in accordance with agency deadlines and/or Treasury schedules % of metrics % of metrics QTR 1 $862.00 $862.00 100% QTR 1 .00 .00 100% QTR 2 $9,961.00 $9,961.00 100% QTR 2 .00 .00 100% QTR 3 .00 .00 100% QTR 3 $2643.00 $2643.00 100% QTR 4 .00 .00 100% QTR 4 $313,090.91 $313,090.31 100%

BILLINGS & COLLECTIONS BILLINGS & COLLECTIONS Metrics Definition: Complete Month End Close of Sales and Distribution (SD) Module in FBMS within the first business day of each month (assuming availability of FBMS on the first business day) Metrics Definition: 98% of T&M collections are processed in accordance with the IAA specifications for the months ending December, March, June, and September. Metrics Definition: Complete Year End Close of Sales and Distribution (SD) Module in FBMS by COB September 30th. SD Close has other dependencies and this metric assumes that expense activity is static before 9/30. Metric only applicable for 4th Quarter reporting. AOSD - 4 AOSD - 5 Total amount of T&M agreements to be collected as of 2nd business day of the month based on ending. Earned/Unbilled Actual collections from Earned/Unbilled plus additional collections made throughout the rest of the month based on additional expenses that came through resource related billing in SD. Collected During the Month Completed Month End Close of Sales & Distribution(SD) module in FBMS within 1st business day of each month AOSD - 6 % of metrics Completed Year End Close of SD Module in FBMS by COB on Sept 30th. Metric only applicable in 4th qtr QTR 1 $142,191,018.74 $146,418,651.12 102.97% QTR 1 YES QTR 2 $112,347,105.25 $179,145,064.12 159.46% QTR 2 YES QTR 3 $169,642,843.53 $206,485,559.75 121.72% QTR 4 $146,470,766.63 $185,200,851.24 126.73% QTR 3 YES YES QTR 4 QTR 4 YES

BILLINGS & COLLECTIONS BILLINGS & COLLECTIONS Metrics Definition: By the end of each monthly reporting period, 100% of commercial deposits will be processed in FBMS (no Statement of Difference present at end of reporting period) Metrics Definition: Process Bankcard Reallocations upon request of program offices with 2 business days of receipt. Metric indicates IBC processed initial file submission within this timeframe and provided feedback to submitter with either the posted file or error messages Metrics Definition: Process Standard Vouchers (VA's) upon request of program offices within 2 business days of receipt. Metric indicates IBC processed initial file submission within this timeframe and provided feedback to submitter with either the posted file or error messages Metrics Definition: 95% of fixed price agreements were collected according to terms of the IAA within the reporting period. AOSD - 8 AOSD - 10 AOSD - 9 AOSD -7 Monthly total$ of fixed price agreements collected within IAA terms (Excludes FCG) Monthly total$ of fixed price agreements collectable according to IAA terms (Excludes FCG) Total# of completed Standard Vouchers (VA) Total# of completed Standard Vouchers (VA) within 2 business days Total# of completed Bankcard Reallocations Total# of Bankcard Reallocations completed within 2 days Monthly total commercial deposits processed (SOD) % of metrics % of metrics % of metrics QTR 1 46 46 100% QTR 1 112 112 100% QTR 1 100% QTR 1 $49,019,934.31 $49,453,850.09 99.12% QTR 2 69 69 100% QTR 2 159 159 100% QTR 2 $89,324,203.94 $89,698,198.34 99.58% QTR 2 100% QTR 3 55 55 100% QTR 3 159 159 100% QTR 3 $107,216,611.50 $107,236,141.81 99.98% QTR 3 100% QTR 4 194 194 100% QTR 4 69 69 100% QTR 4 $91,709,078.73 $92,717,738.88 98.91% QTR 4 100%

GENERAL ACCOUNTING GENERAL ACCOUNTING AOSD - 11 Metrics Definition: Process Payroll Adjustments upon request of program offices within 2 business days of receipt. Metric indicates IBC processed initial file submission within this timeframe and provided feedback to submitter with either the posted file or error messages Completed NRDAR monthly recon, analyze/resolve all FBWT, investment balances by 5th business day following month end, and required recon to PFM by COB on 5th business day AOSD - 12 Metrics Definition: IBC will complete required NRDAR reconciliations (NRDAR monthly recon) on a monthly basis and analyze/resolve all FBWT and investment balances involving NRDAR investment activity by the 5TH business day following the end of the month and provide required reconciliations to PFM by COB on the 5TH business day. Processed Payroll Adjustments with 2 business days of receipt QTR 1 YES QTR 2 YES QTR 1 YES QTR 3 YES QTR 2 YES QTR 4 YES QTR 3 YES QTR 4 YES

IPACS IPACS Metrics Definition: By the end of each monthly reporting period, 100% of Federal IPAC payments will be processed in FBMS (no Statement of Difference present at end of reporting period) Metrics Definition: 98% of Federal IPAC payments are processed within 10 business days. AOSD - 13 AOSD - 14 Monthly total# of ipacs processed Total # of IPAC's processed in < 10 business days Total # of IPAC's processed in > 10 business days Monthly total# of IPACS received total# of IPACS processed within month end % of metrics % of metrics QTR 1 789 787 2 99.82% QTR 1 789 789 100% QTR 2 936 928 8 99.17% QTR 2 936 936 100% QTR 3 1027 984 43 96.48% QTR 3 1027 985 96.59% QTR 4 1350 1344 6 99.57% QTR 4 1350 1350 100%

PERMANENT CHANGE of STATION PERMANENT CHANGE of STATION AOSD - 15 Metrics Definition: 90% of PCS payments are processed within 20 business days after receipt of complete and properly executed documents. Total# of PCS payments completed within 20 business days 3 Total# of PCS payments completed past 20 business days 0 Total# of PCS completed vouchers 3 % of metrics 100% QTR 1 QTR 2 3 3 0 100% QTR 3 14 14 0 100% QTR 4 5 5 0 100%

TDY VOUCHER AUDIT/PAYMENTS TDY VOUCHER AUDIT/PAYMENTS Metrics Definition: 95% of travel vouchers are paid within 5 business days for automated vouchers and within 7 business days for paper vouchers when a complete package is submitted. Travel vouchers are returned after the 7th business day if proper information has not been received to process payment. AOSD - 16 Monthly total# of automated vouchers processed within 5 business days 161 Monthly total# of paper vouchers processed within 7 business days 29 Monthly total# of vouchers received 190 % of metrics 100% QTR 1 QTR 2 189 154 35 100% QTR 3 426 359 67 100% QTR 4 822 745 77 100%

VENDOR PAYMENTS VENDOR PAYMENTS Metrics Definition: By the end of each monthly reporting period, 100% of commercial vendor payments will be processed in FBMS (no Statement of Difference present at end of reporting period) Metrics Definition: Interest paid does not exceed 3% of total applicable monthly payments provided supporting documentation is received timely. Metrics Definition: 98% of commercial payments are processed in accordance with the Prompt Payment regulations upon timely receipt of valid documentation. AOSD -17 AOSD - 18 AOSD - 19 Monthly total# of commercial payments processed within prompt pay Monthly total# of commercial payments received Monthly total# of commercial payments processed Monthly total $ of interest paid on commercial payments Monthly total# of commercial payments received Monthly total # of commercial payments processed outside of prompt pay Monthly total $ of commercial payments % of metrics % of metrics % of metrics QTR 1 3841 3841 100% QTR 1 $429,729,298.50 $137.30 100% QTR 1 3841 3824 16 99.57% QTR 2 3839 3839 100% QTR 2 $361,018,878.01 $557.06 100% QTR 2 3839 3810 29 99.26% QTR 3 6452 6452 100% QTR 3 $1,053,905,812.10 $348.33 100% QTR 3 6452 6442 10 99.78% QTR 4 5646 5646 100% QTR 4 $592,208,193.60 $10.51 100% QTR 4 5647 5644 3 99.95%

Explanations Explanations for DO SLA for DO SLA Metric Not Metric Not Met Met