Cross-Border Cooperation Project for Sustainable Peace and Social Cohesion

Context: Addressing tensions along the Liberia and Côte d'Ivoire border post-civil crisis and war, a joint review meeting was conducted to enhance cooperation, trust, and security between the border communities. The project, supported by the United Nations and the Peace Building Fund, aimed to prom

0 views • 30 slides

Cross-Border Injury Claims in Canada_ Navigating Legal Complexities for Fair Compensation(20_03_2024)

Cross-Border Injury Claims in Canada: Navigating Legal Complexities for Fair Compensation\n\nIn the vast landscape of Canadian law, navigating the complexities of cross-border accidents and injuries requires a specialized approach. From out-of-province accidents to cross-border motor vehicle collisi

0 views • 2 slides

Protecting Your Rights Across Borders_ Expert Legal Assistance for Cross-Border Injuries in Canada(20_03_2024)

Protecting Your Rights Across Borders: Expert Legal Assistance for Cross-Border Injuries in Canada\n\nIn today's interconnected world, accidents don't always adhere to national borders. Whether you're a resident or a visitor, being injured in Canada can present unique legal challenges, especially wh

0 views • 2 slides

Understanding Taxes: An Overview of Taxation Principles and Collection in Ireland

This content covers the fundamental aspects of taxation, including its definition, purpose, principles (fairness, certainty, efficiency, convenience), and tax collection in Ireland by the Revenue Commissioners. It explores key concepts related to taxation and aims to enhance understanding of tax sys

2 views • 26 slides

Accounting and Taxation of Securities Organized by Belgaum Branch of ICAI

Explore the accounting treatment and taxation of securities in a seminar organized by the Belgaum branch of ICAI. Learn about various types of securities, their accounting principles, taxation rules, and important points through case studies and insightful discussions led by CA Kinjal Shah. Gain val

4 views • 74 slides

Update on Cross-Border M&A in Corporate/International Taxation

This update covers key discussions on cross-border M&A in corporate and international taxation, including PTEP and Section 961 Basis implications, IRS Notice 2024-16, and regulations to be issued for covered inbound transactions. The content delves into intricate scenarios involving basis adjustment

2 views • 67 slides

Stay Ahead in NRI Taxation in England with Bharat's Lower Tax Service

Stay ahead of the curve in NRI taxation in England with Bharat's Lower Tax Service. Our specialised solutions cater to the unique tax needs of Non-Resident Indians, ensuring compliance and maximising returns. With expert guidance and personalised strategies, navigate the complexities of cross-border

7 views • 3 slides

nritaxationbharat_blogspot_com_2024_05_nri_income_tax_return

Mastering NRI Taxation: Guidelines for Delhi Residents\" offers comprehensive insights into navigating the complexities of taxation for Non-Resident Indians (NRIs) residing in Delhi. This resource provides expert guidance on understanding tax laws, claiming exemptions, and optimizing deductions spec

3 views • 3 slides

Understanding the Purpose of Taxation: Financial, Social, Legal, and Ethical Perspectives

Taxation is a crucial method governments use to collect funds for public services. This chapter delves into the principles of a fair tax system, exploring how taxes should be related to income, predictable, cost-effective to collect, and convenient for taxpayers. It also discusses the redistribution

0 views • 19 slides

Analysis of "Borders" by Thomas King

In "Borders" by Thomas King, the story revolves around Laetitia, her mother, and their interaction with border guards. The characters exhibit different traits, with Laetitia displaying courage and curiosity, while the border guards represent discrimination. The conflict arises from the unfair treatm

0 views • 15 slides

Enhancing Efficiency in Border Control Procedures Along the Silk Road

Along the historic Silk Road, the implementation of Joint Border Control Posts (JBCPs) is a strategic move to streamline processes, reduce duplication, and enhance efficiency in cross-border trade. By consolidating control efforts, leveraging technology, and optimizing infrastructure, the initiative

0 views • 13 slides

Understanding Principles of Taxation

Principles of taxation, including concepts such as public revenue, sources of revenue, types of taxes (direct and indirect), and non-tax revenue, are essential for students of commerce to grasp. Taxation serves as a means for the government to collect revenue for the common good through compulsory c

0 views • 12 slides

Cross-Border Insolvency: Challenges and Solutions at Ritz-Carlton, Grand Cayman

Explore recent developments and potential reforms in cross-border insolvency at the event held at Ritz-Carlton, Grand Cayman. The program includes discussions on restructuring, obtaining documents abroad, a case study on cross-border insolvency, and more. Learn about practical problems facing direct

1 views • 36 slides

Exploring Taxation Acts and Their Impact on Revolutionary Sentiments

The provided content delves into historical taxation acts, including their specifics and potential implications on the onset of the American Revolution. It also draws parallels to modern-day examples of product taxation, prompting reflection on the fairness and consequences of such levies. The disco

4 views • 6 slides

Enhancing State Revenue Generation Through Effective Taxation Strategies

State governments rely on taxation to finance their expenditures, prioritizing revenue generation over borrowing. By engaging taxpayers in voluntary compliance, taxation strengthens government accountability and citizen participation in governance. Understanding the tax landscape, including federal,

0 views • 27 slides

Taxation Procedures and Authorities

Explore the principles and application of taxation laws, tax provisions, duties of tax authorities, and obligations during taxation procedures. Learn about the essential role of tax authorities in determining facts crucial for legitimate decision-making, benefiting taxpayers diligently, and conducti

0 views • 35 slides

Windfall Profit Taxation: Past, Present, and Future

The presentation discusses windfall profit taxation measures in Europe, specifically in Italy, comparing the old Robin Hood tax with new contributions. It explores the aims, issues, tax rates, and bases of windfall profit taxation, highlighting its redistributive purposes and challenges in constitut

1 views • 14 slides

Understanding Taxation in Macao SAR: A Comprehensive Overview

Delve into the intricacies of taxation in Macao SAR with a virtual seminar featuring prominent speakers. Explore topics such as tax administration, profits tax framework, and tax declaration processes. Gain insights into the role of the Financial Services Bureau in ensuring tax compliance and the va

1 views • 25 slides

All About Cross Border Operations

Experience seamless cross-border operations with Healthcareabroad.In other words, accessing high-quality healthcare abroad without the associated anxiety and tension. Make your reservation today!\n\n\/\/healthcareabroad.ie\/eu-cross-border-directive

1 views • 1 slides

All About Cross Border Operations

Experience seamless cross-border operations with Healthcareabroad.In other words, accessing high-quality healthcare abroad without the associated anxiety and tension. Make your reservation today!\n\n\n\/\/healthcareabroad.ie\/eu-cross-border-directiv

3 views • 1 slides

Affordable Cross Border Cataract Surgery

Experience the affordable and high-quality cross-border cataract surgery with Healthcareabroad.In other words, bid farewell to hazy vision and welcome to a more promising future.\n\n\/\/healthcareabroad.ie\/eu-cross-border-directive

3 views • 1 slides

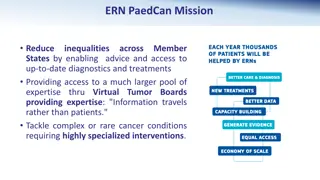

Improving Cancer Care Across European Countries with Cross-Border Healthcare Directive Evaluation

The content discusses the mission of ERN PaedCan to reduce cancer cases by providing advice, access to modern diagnostics and treatments, and expertise through Virtual Tumor Boards. It also highlights the European Governance structure, Key Performance Indicators, a Evaluation Study on the Cross-Bord

0 views • 7 slides

Commercial Federal Holiday Hours of Operation - 2022 Otay Mesa

Comprehensive schedule for U.S. and Mexican federal holidays in 2022 at Otay Mesa commercial border crossing, including hours of operation for laden and empty trucks, restrictions, and border closures. Specific details provided for both U.S. and Mexico-bound shipments on designated holidays. Hazmat

0 views • 4 slides

Euroscepticism in Border Regions: The Identity Crisis of Europe

Euroscepticism in border regions reflects frustration, disillusionment, and disengagement with the European idea at the borders of the EU. The identity crisis of Europe is showcased through sentiments of dissatisfaction and detachment towards the EU, as evidenced in various border regions. This phen

0 views • 29 slides

Managing Cross-Border Interference in Laos: Insights and Challenges

Explore the management of cross-border interference in Laos through the country's profile, regulator policies, bilateral agreements, and key conclusions. Learn about the frequencies, bilateral relationships with neighboring countries, and the complexities of technological differences along border li

0 views • 10 slides

Impact Analysis of New Corporate Taxation Regime Under Taxation Laws (Amendment) Ordinance, 2019

The new corporate taxation regime introduced through the Taxation Laws (Amendment) Ordinance, 2019 brings significant changes, including a lower tax rate for domestic companies. The regime allows companies to opt for a 22% tax rate, with implications on exemptions and deductions. Companies opting fo

0 views • 31 slides

Enhancing Border Protection and Cross-Border Cooperation Strategies by UNODC

The United Nations Office on Drugs and Crime (UNODC) works to address border protection challenges through intelligence-led approaches, training, and equipment support. This includes fostering cross-border cooperation, establishing border liaison offices, implementing risk assessment programs like A

0 views • 12 slides

An Open Dutch-German Border in Times of Corona

Explore the impact of border restrictions at the Dutch-German border during the Covid-19 pandemic. From semi-closures affecting commuting, shopping, and socio-cultural visits to the resilience shown in gradually returning to pre-corona levels. The coordinated policy measures, relative leniency, and

0 views • 7 slides

The Impact of Artists and Creatives in Border Regions on Culture and Economy

Artists and creatives play a crucial role in the cultural and economic landscape, particularly in border regions where diverse cultures intersect, fostering creativity and innovation. Despite facing challenges, they significantly contribute to social cohesion, the European economy, and the cultural

1 views • 21 slides

Red Cross Shelter Partnership Initiative in Missouri

The Red Cross supports a Faith-Based Organization (FBO) Initiative in Missouri, inviting organizations to assist primarily in sheltering efforts for disaster response in the community. The National Shelter System shows numerous Red Cross shelters in Missouri, with advantages to partnering with the R

0 views • 16 slides

Feasibility Study of Italy-France Cross-Border Intraday Trading

A technical feasibility study conducted during the CSE SG Group meeting in Rome on May 15, 2012, explored the cross-border intraday trading between Italy and France. The study highlighted the current challenges, high-level requirements, IT needs, and clearing processes for implementing a continuous

0 views • 16 slides

All About Cross Border Operations

Experience seamless cross-border operations with Healthcareabroad.In other words, accessing high-quality healthcare abroad without the associated anxiety and tension. Make your reservation today!\n\n\/\/healthcareabroad.ie\/eu-cross-border-directive

3 views • 1 slides

Cross-Border Railway Interoperability Challenges: Handbrake Requirements

This document discusses the challenges faced in cross-border railway operations due to differing handbrake requirements, focusing on the need for the last wagon of international trains to be equipped with a handbrake as per national regulations. Issues at border stations in Romania, Hungary, and Bul

0 views • 18 slides

Overview of International Taxation in Italian Law

International taxation refers to rules governing tax laws in different countries, covering various aspects such as cross-border trade, investments, and taxation of individuals working abroad. Tax treaties play a crucial role in limiting the taxation power of treaty partners, with over 2,000 bilatera

0 views • 25 slides

Taxation Challenges for Cross-Border Teleworkers Post Covid-19

Challenges in international taxation arise for cross-border teleworkers post-Covid-19, especially regarding the taxation of income from employment under Article 15 of the OECD Model Tax Treaty. Issues such as physical presence, bilateral agreements during the pandemic, and future taxation scenarios

0 views • 7 slides

Euroscepticism in Border Regions: A Deep Dive into Cross-Border Practices and Perceptions

Explore the phenomenon of Euroscepticism in border regions, delving into cross-border practices and perceptions at the EU's internal borders. This study sheds light on how border regions emerge both functionally and institutionally, emphasizing the importance of understanding Euroscepticism in these

0 views • 16 slides

Negative List Based Taxation of Services by S.B. Gabhawalla & Co.

This content delves into the conceptual framework of negative list based taxation of services, including the definition of service, elements such as service territory and value, and the framework dissecting the charge at 12%. It also explains what services are excluded from taxation and provides exa

0 views • 36 slides

Cross-Border Accidents_ Finding the Right Legal Help

Cross-border travel has become ordinary in a society that is becoming more and more connected. But there are also intricate legal issues that arise with more cross-border mobility, particularly in the case of cross-border accidents. Know how to handl

1 views • 2 slides

Overview of Interreg and Cross-Border Cooperation Projects in Greece

This content provides detailed information on various Interreg V-A and Cross-Border Cooperation projects in Greece, covering funding priorities, thematic objectives, and key initiatives aimed at enhancing competitiveness, promoting sustainable development, and fostering cross-border collaboration. T

0 views • 10 slides

Cross-Border Cooperation and Mobility in European Regions

Explore the complexities and challenges of cross-border cooperation and mobility in European regions, focusing on the impact of Schengen agreements, harmonization of legislation, and threats to social, economic, and citizenship aspects. Discover case studies and insights from various studies and ins

0 views • 16 slides