Dual Credit Options at Champion High School

Champion High School offers Advanced Placement (AP) and Dual Credit programs in partnership with various institutions like Northwest Vista College, Angelo State University, UT On-Ramps, and Tarleton Today. Students can earn college credit by meeting testing requirements, with some classes being free

1 views • 14 slides

Resolving Financial Abuse: Legal Issues and Consumer Credit Law

Learn about resolving legal issues related to financial abuse, consumer credit law, crafting financial hardship requests, negotiating with creditors, getting specialist legal advice, and testing your knowledge on financial matters. Gain insights into consumer credit law, the National Consumer Credit

0 views • 67 slides

Explore Irish Traditional Instruments and Music

Discover the diverse world of Irish traditional instruments such as the Flute, Fiddle, Tin Whistle, Low Whistle, Uilleann Pipes, Accordion, Concertina, Bodhrán, and Harp. Learn about the history and unique characteristics of these instruments, as well as the evolution of Irish music to include mode

0 views • 12 slides

Understanding the Negotiable Instruments Act, 1881: Types of Instruments and Holders

The Negotiable Instruments Act, 1881 was enacted to provide legal recognition to credit instruments easily transferable as money. It defines negotiable instruments like promissory notes, bills of exchange, and cheques, including local usages. Instruments can be negotiated multiple times until maturi

0 views • 25 slides

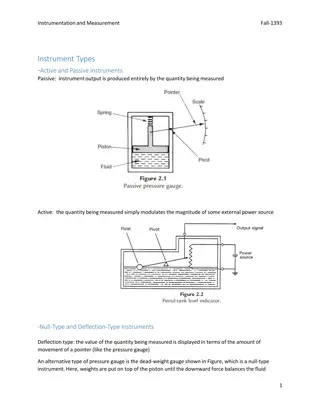

Understanding Instrument Types and Performance Characteristics

This content discusses different types of instruments, including active and passive, null-type and deflection-type, analog and digital, as well as smart and non-smart instruments. It delves into the static characteristics of instruments such as accuracy, precision, tolerance, linearity, and sensitiv

2 views • 39 slides

Understanding Credit Analysis for Farmers and Fishers

Credit analysis is crucial for farmers and fishers to access the right amount of credit at the right time. Economic feasibility tests such as returns on investment, repayment capacity, and risk-bearing ability are essential factors to evaluate credit worthiness. The 3Rs of credit - returns, repaymen

0 views • 30 slides

Understanding Credit Reports and Scores: A Comprehensive Overview

Explore the importance of credit reports and scores in financial empowerment through modules on reviewing credit reports, understanding credit scores, and mastering credit basics. Learn how good credit can impact your ability to obtain loans, credit cards, secure rentals, insurance coverage, and emp

3 views • 35 slides

Mastering Credit and Debt in Head Start Program

Understand the complexities of credit and debt to make informed financial decisions. Learn about different types of credit, pros and cons of credit cards, debit cards, prepaid cards, and secured credit cards. Gain insights on how to manage your finances effectively and build a strong credit history

0 views • 29 slides

EBA Opinion on Legacy Instruments Monitoring Implementation Overview - Feb 2022 Meeting

The European Banking Authority (EBA) provided an opinion on legacy instruments monitoring at their Feb 2022 meeting. The presentation covers the monitoring in 2021, surveys, letters to competent authorities, and the overview of monitoring results. It discusses calls for input on the implementation o

0 views • 20 slides

Understanding Instruments in Instrumentation and Measurement

Passive and active instruments play key roles in measurement, with null-type and deflection-type instruments providing different ways to display values. Analogue and digital instruments offer varying outputs, while indicating instruments and those with signal outputs serve different purposes. Smart

2 views • 12 slides

Qualitative Credit Control Methods Explained

Selective/Qualitative credit control methods involve regulating the quality and direction of credit flows by implementing controls such as ceilings on credit, margin requirements, discriminatory interest rates, directives, direct action, and moral suasion. These methods are used by central banks lik

0 views • 7 slides

Overview of EBA Opinion on Legacy Instruments Monitoring Implementation Results Feb 2022

In February 2022, the European Banking Authority (EBA) conducted monitoring on legacy instruments implementation. The presentation covers surveys, input from competent authorities, and outcomes. Efforts to address infection risks posed by legacy instruments were highlighted, with actions taken by in

2 views • 20 slides

Understanding Credit Reporting and Credit Scores in CARE Presentation

Explore the essential concepts of credit reporting and credit scores in the context of Credit Abuse Resistance Education (CARE). Learn about credit history, its impact on financial decisions, ways to establish credit, the significance of credit reports, and how credit behaviors affect one's financia

0 views • 21 slides

Understanding IFRS 9 Significant Increase in Credit Risk

Explore the principles and indicators of Significant Increase in Credit Risk (SICR) under IFRS 9, including assessment methods, change in risk of default, and timing considerations. Learn about lifetime expected credit losses, rebuttable presumptions, and common indicators of credit risk escalation

4 views • 19 slides

Statistical Treatment of Islamic Financial Instruments

Explore the classification and examples of Islamic financial instruments, such as Restricted Mudaraba and Waqf Funds. Understand the scope, process, and economic substance of these instruments, along with their classification in terms of financial assets and liabilities. Learn how to analyze and cla

0 views • 10 slides

Understanding Credit Cards: A Beginner's Guide

Explore the basics of credit cards, including how they work, differences from debit and prepaid cards, obtaining one, and building credit. Learn about credit character, revolving credit, and tips for getting approved for a credit card. Discover the importance of good credit and income when applying

0 views • 20 slides

Understanding Credit Reports and Building Credit in 2017

Understanding credit reports is essential for financial well-being. A credit report is a record of your payment history on loans and credit cards. This report is used to calculate your credit score, which determines your creditworthiness. Building and maintaining credit involves making payments on t

5 views • 22 slides

Dual Credit Reporting Guidelines for College Courses

Dual Credit Reporting provides definitions, guidelines, and validation rules for reporting college courses that allow students to earn both high school and college credit. Key elements covered include credit indicators, college credit hours, course sequencing, and validation rules to avoid overrepor

0 views • 6 slides

Guidelines for Verifying Transitional Credit and Important Authorities' Orders

The guidelines for verifying transitional credit include directives from the Hon'ble Supreme Court, the opening of a common portal for filing forms, the verification process timeline, and the reflection of approved transitional credit in the Electronic Credit Ledger. Relevant orders and circulars fr

1 views • 19 slides

Understanding Child and Dependent Care Expenses Credit

The Child and Dependent Care Expenses Credit allows taxpayers to reduce their tax liability by a portion of expenses incurred for caring for qualifying persons. Qualifying persons include children under 13, incapacitated spouses or dependents, and certain criteria must be met to claim the credit. Th

8 views • 10 slides

The Case for Private Credit Investments in the Global Market

Private credit investments are gaining significance in the global market, offering innovative financing solutions outside traditional avenues like public markets. With a focus on innovation, independence, and integrity, private credit investments cater to diverse sectors such as real estate, natural

1 views • 9 slides

Understanding Financial Instruments and Markets

Explore asset classes like fixed income securities, money market instruments, and capital market instruments. Learn about different financial instruments in various markets including money market, bond market, equity markets, and derivative markets. Dive into money market instruments like Treasury b

0 views • 47 slides

Take Control of Your Credit Report: A Comprehensive Guide

Learn how to take control of your credit report, understand why it matters, spot credit repair scams, and fix mistakes. Discover why your credit history is important and how to get your free credit reports. Explore the significance of your credit score, review your credit reports, and know how to ha

0 views • 16 slides

Analyzing Opposition to Musical Instruments in Worship

The opposition to using musical instruments in worship is based on beliefs stemming from biblical references that emphasize singing, the lack of explicit authorization for instruments in the Bible, and arguments regarding the essence of worship as prescribed by God. Various scriptures and interpreta

0 views • 19 slides

Understanding Longitudinal Standing Waves in Musical Instruments and the Human Ear Canal

Musical instruments in the wind family rely on longitudinal standing waves to produce sound, with wind instruments like trumpet, flute, clarinet, and pipe organ being modified tubes of air. This article explores the concept of standing waves in open tubes of air and their relevance to instruments an

0 views • 4 slides

Empirical Credit Risk Management at FMB Group Credit Union

Empirical Credit-Risk Management (ECM) presentation to FMB Group Credit Union by Financial Analytics Ltd discusses the background, traditional forecasting methods, income and risk recognition, provisioning approaches, and benefits for credit unions. ECM offers expert retail credit risk management th

0 views • 25 slides

Understanding Credit Instruments and Negotiable Instruments

Credit instruments play a crucial role in modern business by facilitating the transfer of money between lenders and borrowers. These instruments, such as Payroll Credit, Book Credit, and Documentary Credit, come in various forms like oral agreements and written documents. Negotiable instruments, on

0 views • 11 slides

Understanding Timbre in Musical Instruments

Explore the concept of timbre in musical instruments, including how different instruments produce unique sounds through vibration. Learn about woodwind, brass, and string families, and use descriptive words to describe timbre qualities. Enhance your knowledge of how instruments such as clarinet, obo

0 views • 12 slides

Advancements in Plasma Instruments for Space Weather Monitoring

Explore the latest developments in plasma instruments for space weather monitoring, including the PLA Plasma Instrument and MSSL Heritage in Plasma Instruments. These instruments enable precise measurement of plasma parameters in deep space, supporting missions to study solar wind, ion densities, an

0 views • 22 slides

Understanding Credit Derivatives and Managing Credit Risk

This chapter delves into credit derivatives, exploring their purpose, types such as credit default swaps and total return swaps, and the development of the market over the years. It discusses credit risk, problems associated with it, methods for estimating credit risk, and the role of credit derivat

0 views • 35 slides

Understanding Research Instruments in Academic Studies

Research instruments play a crucial role in academic research by helping researchers collect data effectively. These instruments need to be valid, reliable, and usable to ensure accurate results. Different types of research instruments exist, including questionnaires, interviews, and checklists. Val

0 views • 25 slides

Understanding Financial Instruments in IFRS: Key Concepts and Overview

This content provides an overview of financial instruments under IFRS, focusing on their classification as assets, liabilities, or equity. It explains the presentation of compound financial instruments and outlines key concepts related to financial assets, financial liabilities, and equity instrumen

0 views • 28 slides

Driving Economic Recovery with Recapitalisation Instruments for Smaller EU Corporates

Amid the aftermath of the Covid-19 pandemic, the need for recapitalisation instruments for smaller EU corporates has become apparent. These instruments, such as equity and hybrid options, can provide essential fresh capital for companies to invest in innovation and drive economic growth. AFME's expl

0 views • 12 slides

Understanding Negotiable Instruments: Law and Characteristics

The Negotiable Instruments Act of 1881 governs the law related to negotiable instruments in India. These instruments are transferable written documents entitling the holder to a certain sum of money. Characteristics include free transferability, title free from defects, transferee's right to sue, an

0 views • 34 slides

Overview of Payment Systems and Instruments

Explore the world of payment systems, instruments, and their relationships in the financial market. Understand the characteristics of payment instruments, such as cash, cards, credit transfers, and digital currencies. Dive into the security features of payment cards and the technology behind fraud p

0 views • 30 slides

Understanding the Importance of Credit Policies in Business Operations

A credit policy/manual serves as a comprehensive guide detailing rules, regulations, and procedures within a company. It helps new employees understand the company's credit processes and establishes clear guidelines for decision-making. Without a credit policy, conflicts may arise in approving credi

0 views • 9 slides

Understanding High School Articulated Credit: Benefits, Transferability & Responsibilities

High school articulated credit allows students to earn college credit by aligning high school CTE classes with college-level courses. This collaboration between high school teachers and college professors can save students time and money by reducing the need to repeat coursework in college. Students

0 views • 8 slides

All About Credit Cards: A Comprehensive Guide

Explore the world of credit cards, from understanding the basics to managing credit wisely. Delve into the advantages and disadvantages, learn about different types of credit cards, and discover how to use credit cards responsibly. Discuss whether high school students, college students, and adults s

0 views • 36 slides

Comprehensive Information on ESL Department's Fall 2020 Offerings

Explore ESL class options starting Fall 2020, including credit vs. non-credit courses, new course offerings, course numbering system, differences between credit and non-credit classes, and more. Discover details on certificates, financial aid, graduation, and transfer information, with insights on c

0 views • 12 slides

Evolution of Credit Reporting and Consumer Awareness

Credit access is crucial for consumers, yet inaccurate credit reporting can have significant impacts on credit scores. Studies show that errors in credit reports are common, with many consumers disputing inaccurate information. The regulatory landscape has evolved since the 2012 FTC study, with incr

0 views • 10 slides