Driving Economic Recovery with Recapitalisation Instruments for Smaller EU Corporates

"Amid the aftermath of the Covid-19 pandemic, the need for recapitalisation instruments for smaller EU corporates has become apparent. These instruments, such as equity and hybrid options, can provide essential fresh capital for companies to invest in innovation and drive economic growth. AFME's exploration of state-aid compliant instruments highlights the potential benefits for mid-size and SME companies looking to retain control while accessing necessary funding."

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

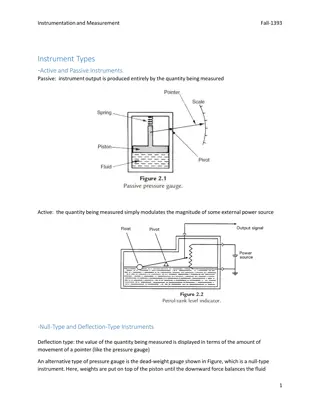

Recapitalisation instruments for smaller EU corporates How equity and hybrid instruments can drive economic recovery September 2022

Our board member firms Dan Watkins Head of Markets Clearing and Collateral EMEA Vanessa Holtz OlivierOsty Head of Global Markets (AFME Vice Chair) Nat Tyce Juan Blasco Head ofSyndicate and Head ofLeveraged Finance EMEA Head of EU FICC Trading, Co-Head ofEMEA FX G10Trading &Global Head ofG10 FXOptions (Vanillas &Electronic) Co-Head ofMacro Trading Gavin Colquhoun EMEAHead ofGlobal Financing & Credit Trading &Co-Head of Investment Bank EMEA Jonathan Moore Head of Global Credit Productsin EMEA PierreGay Thalia Chryssikou Co-Head Global Sales Strats & Structuring acrossFICC and Equities (AFME Chair) Head of Global Markets Division Leonardo Arduini Head of EMEA Markets Gary Prince Guy America Patrick George Head ofGlobal Markets EMEA & Global Head of ICG Massimo Mocio Deputy Chief ofIMI CIB Division - Head ofGlobal Markets & Investment Banking Global Headof FX & Rates Trading and, Headof Financial Markets EMEA Head ofGlobal Credit Markets (AFME Vice Chair) Nick Hughes Head of Capital Markets James Lancaster WholesaleChief Operating Officer JustinChapman Executive Vice President GlobalExecutive Securities Services and Global Head Market Advocacy & Innovation Davide Menini Global Head ofFixed Income Structuring and Structured NotesTrading, Fixed Income Division Michael Haize Global Head of Markets Corporate & Investment Banking. Jos Manuel Colina Head of Global Markets Europeand Asia at SCIB JonathanPeberdy Interim Head of Capital Markets Lionel Bignone Managing Director Co-Head of Global Markets Paolo Croc Managing Director Head ofGlobal Markets EMEA SylvainCartier Co- Head ofGlobal Markets Activities ClareFrancis MartineBond Executive Vice President and Head ofState Street Global Markets Regional Head ofGlobal Banking, Europeand CEO,Standard Chartered UK 8

The case for recapitalisation instruments The relatively low level of bankruptcies in the aftermath of the Covid-19 pandemic could be due in part to the impact of the temporary public support measures put in place. In periods of economic stress or when credit is constrained, it is vital that smaller, unlisted companies and midcapsin the EU with the potential to drive economic growth have access to ample fresh capital to invest in innovation. In January 2021, AFME and PwC published the first recapitalisation report, titled Recapitalising EU businesses post COVID-19: How equity and hybrid markets instruments can drive recovery . Many mid-size and SME corporates do not wish to give up control of their business but are willing to pay a premium not to dilute their voting rights, as well as are willing to distribute a share of profits to investors. Hybrid subordinated debt instruments are ideally suited to address these needs. AFME explored the potential of a common EU-level state-aid compliant recapitalisation instrument with (reasonably) standardised legal, accounting, tax bases, and economic terms, for use across Member States.

The second AFME recapitalisation report On 18 November 2021, AFME has published its second report on post-Covid Recapitalisation, titled Introducing a new hybrid recapitalisation instrument for smaller EU corporates , developed in partnership with Linklaters and PwC. Building on the previous study, the report provided a practical guide for European authorities and Member States looking to introduce a new hybrid recapitalisation instrument. The report features the following analysis: An overview of the key hybrid instrument attributes required to achieve the desired equity accounting, tax deductibility and insolvency treatment in Member States. A summary of state aid considerations for such hybrid instruments to achieve compliance with EU state aid requirements; A generic sample term sheet outlining the proposed instrument features which can be used as a reference for discussion with officials, investors and mid-cap/SME corporate issuers. (1) (1) While AFME expresses support for an EU-level approach, the varying national environments and legal frameworks in the EU means that the implementation of such a solution needs to be tailored to the national contexts in member states.

AFMEs proposal for a hybrid instrument framework Hybrid instrument solutions need to be tailored to the localaccounting, legal, tax and insolvency treatments in individual EU Member States, to achieve thekey attributes necessary for creating an instrument which effectively meets the needs of both investors and corporate issuers. AFME members believe that small corporates will generally care most about equity accounting treatment under national GAAP (and IFRS, if relevant), tax deductibility and the all-in cost of issuance (including financial guarantee costs). Individual hybrid subordinated debt issuances by smaller corporates will be too small to be cost-effective for most investors, who will need to do extensive credit and business plan research for a relatively small reward in absolute earnings terms. Therefore some form of public support and pooling of individual issuances is necessary to attract the right investors. An EU-wide approach would be ideal: A common European instrument model could benefit from the visibility, liquidity and scale of the single market and generate broad appeal amongst institutional investors seeking debt and hybrid-type risk profiles but with better returns, while catering to the needs of smaller companies. With sufficient EU-wide scale, a successful framework could develop into a well- defined asset class encouraging investment and EU integration these are the goals of the CMU.

Key instrument features: Accounting treatment The report includes a table (pages 9-10) setting out the accounting treatment for hybrid financial instruments. It is key that the instrument is treated as equity for accounting purposes. A deeply subordinated debt instrument with no maturity date is likely to be accounted for as equity under IFRS and in many but not in all EU member states, under national GAAP. We start with IFRS treatment, as local GAAP accounting treatment in most EU member states is aligned with this. While not uniformly the case, an equity instrument for IFRS purposes will in many jurisdictions also be equity under local GAAP. We then note some differences between IFRS and local GAAP accounting treatment for Germany, France, Italy, Spain and the Netherlands.

Key instrument features: Tax treatment The report includes a table (pages 11-16) which defines the tax treatment for hybrid financial instruments. To achieve a cost-effective instrument for the issuer, the instrument must be considered to be debt for tax purposes, to achieve tax deductibility. Another important point for the issuer and investors alike is that the periodic interest paid on the subordinated debt instrument must not be subject to any tax withholding or deduction at source so that the pool receives the interest income on a gross basis. This precludes use of equity instruments such as preferred shares, which were suggested in our January report. The UK is used as a reference point as it has a regime that specifically defines the tax treatment of hybrid capital instruments. It is also a jurisdiction in which at least pre-Brexit a significant share of EU hybrid capital instruments have been arranged for issuance by EU issuers and purchase by EU and non-EU investors. The report lists specific rules across selected EU member states which should be taken into consideration in defining the desired tax treatment.

Key instrument features: Insolvency treatment The report includes a table (pages 17-19) setting out the insolvency treatment of hybrid capital instruments. A small corporate will need to ensure that the debt is subordinated below the rights of all its other creditors, in the event of an insolvency. Failure to construct the debt like this would likely impact the corporate s ability to raise debt from traditional sources and to transact on normal terms with trade creditors. We start with the generalised principles used across the EU, but insolvency regimes can be very different across member states. Indeed, the Capital Markets Union action plan from the European Commission has maintained a long-term aim to harmonise these rules. We then present some of the major differences across Germany, France, Italy, Spain and the Netherlands.

Summary of key state aid considerations European Commission process State aid issue only arises if State funds are involved A recapitalisation at market economy conditions is not State aid, but unlikely in COVID-19 context State aid must be notified for prior approval from the EU Commission (EC) Review process requires time and close cooperation / negotiation with the EC Recent recapitalisation measures have required 3-5 months The EC generally aims to ensure equal treatment and follows previous decisions Thorough examination to ensure aid is proportionate and kept to the minimum necessary. Close assessment of instruments, to ensure e.g. temporary nature and adequate remuneration for taxpayers risk Temporary COVID-19 rules EC s Temporary Framework (TF) runs until mid-2022. Measures (schemes or individual measures) to help companies weather the effects of the pandemic Initially limited to liquidity tools (loans / guarantees), extension to equity / hybrid measures resulted in stricter conditions More favourable and generally quicker than normal State aid rules, but still entails stringent conditions Much media focus on individual recapitalisations of airlines Air France, Lufthansa, SAS but also numerous schemes German umbrella schemes under which federal and regional authorities can invest through debt and equity instruments Also Denmark, Hungary, Italy, Latvia, Lithuania, Poland, Spain Several cases include hybrid instrument treated as equity under IFRS, e.g. non-convertible, perpetual with non-mandatory payments of coupons at the discretion of the beneficiary For a detailed overview of the conditions imposed under the Temporary Framework, please refer to page 24 of the report.

Illustrative transaction term sheet The report provides a generic term sheet (pages 25-31) for the issuance by an unrated unregulated corporate issuer of an unrated, undated callable subordinated bond ( Private Subordinated Bond or PSB ). The PSB will provide for the ability to absorb losses along the traditional dimensions of subordinated capital instruments: (a) On a going concern basis, the PSB gives the corporate issuer the ability to suspend coupon payments at its discretion on a cumulative basis. (b) On a gone concern basis, the PSB provides the holder of the bond a subordinated claim, thereby protecting senior creditors upon a voluntary or involuntary winding up of the issuer. (c) The PSB will be legally available for an undated period of time and be redeemed only at the discretion of the issuer. (d) The PSB does not give the holder of the bond any shareholder rights such as voting rights, rights to dividends or participation in the liquidation proceeds.

Observations on EU equity markets Equity markets remain undersized compared to the size of the EU economy and global peers. New equity issuance reduced its share in total corporate funding from 2.8% in 2021 to 1% in H1 2022. After record levels of capital raising during the pandemic, EU equity and debt issuance levels have fallen sharply in H1 2022. Market volatility and market uncertainty have contributed to this. EU equity investment via private equity funds, venture capital, business angels, and equity crowdfunding platforms has been increasing in recent years, but a growing challenge for investors is the capacity to exit investments as the IPO market continues subdued and as public markets see lower valuations. An attractive environment for IPOs and capital raising in public markets is vital to support innovative, fast- growing companies and an expansion of Europe s equity markets. The upcoming EU Listing Act will be an important initiative to boost the competitiveness of the EU markets for listings. As the EU competes with other global markets to attract company listings, it is important that the combined regimes in different legislations contribute to promoting the attractiveness of EU markets while retaining strong levels of legal certainty, transparency and investor protection.

Contacts Disclaimer and Methodology AFME Your receipt of this document is subject to paragraphs 3, 4, 5, 9, 10, 11 and 13 of the Terms of Use which are applicable to AFME s website (available at http://www.afme.eu/Legal/Terms-of-Use.aspx) and, for the purposes of such Terms of Use, this document shall be considered a Material (regardless of whether you have received or accessed it via AFME s website or otherwise). Rick Watson Managing Director, Head of Capital Markets, Membership and Events rick.watson@afme.eu AFME is registered on the EU Transparency Register, registration number 65110063986-76 Pablo Portugal Managing Director, Advocacy pablo.portugal@afme.eu For a description of the methodology of this report please visit https://www.afme.eu/en/reports/Statistics/ London Office 39th Floor 25 Canada Square London E14 5LQ United Kingdom +44 (0)20 3828 2700 Brussels Office Rue de la Loi, 82 1040 Brussels Belgium +32 (0)2 788 3971 Frankfurt Office Neue Mainzer Stra e 75 Taunusanlage 1 60311 Frankfurt am Main Germany +49 (0)69 5050 60 590 Follow AFME on Twitter @AFME_EU Association for Financial Markets in Europe www.afme.eu