UK Export Finance

UK Export Finance is the world's first export credit agency, supporting UK businesses in winning contracts, fulfilling orders, and getting paid for their exports. They offer a range of financial products to assist in all sectors, including insurance, buyer finance, and guarantees. With a mission to

3 views • 16 slides

Update on Credit Finance Sub-Group Activities

The Credit Finance Sub-Group (CFSG) provided updates on recent meetings, voting matters, and NPRR reviews. Changes to the CFSG charter and discussion on letter of credit concentration limits were highlighted. The CFSG also voted to amend the group charter regarding TAC review requirements. Details o

1 views • 17 slides

Credit Finance Sub-Group and NPRR Updates

Updates from the Credit Finance Sub-Group include discussions on operational NPRRs, new invoice reports, EAL changes, and DC Energy's exposure calculations. The group considered improvements in credit implications, concentration limits, and more. NPRR 1186 was reviewed for enhancements to ESR monito

0 views • 12 slides

ERCOT Credit and Finance Sub-Group Updates - June 2023

Updates from the Credit and Finance Sub-Group meeting including discussions on NPRRs, changes in collateral forms, background checks for QSEs, and endorsement of market standard electronic communications for LC documents. The group reviewed NPRRs impacting credit implications and voted on operationa

1 views • 14 slides

Credit Finance Sub Group update to the. Technical Advisory Committee

Updates from the recent ERCOT Credit Finance Sub-Group meeting include discussions on voting matters, operational NPRRs without credit impacts, new invoice report implementation, and evaluation of changes to the Letter of Credit Concentration limits. Additionally, NPRRs related to State of Charge wi

0 views • 11 slides

Dual Credit Options at Champion High School

Champion High School offers Advanced Placement (AP) and Dual Credit programs in partnership with various institutions like Northwest Vista College, Angelo State University, UT On-Ramps, and Tarleton Today. Students can earn college credit by meeting testing requirements, with some classes being free

1 views • 14 slides

University of Glasgow Finance Department Organizational Structure

The University of Glasgow's Finance Department is structured with key positions such as Executive Director of Finance, Heads of Finance for Colleges and University Services, Procurement Team, Management Accounts Team, and Tax, Treasury & Financial Reporting Team. The organization chart outlines repo

0 views • 21 slides

Resolving Financial Abuse: Legal Issues and Consumer Credit Law

Learn about resolving legal issues related to financial abuse, consumer credit law, crafting financial hardship requests, negotiating with creditors, getting specialist legal advice, and testing your knowledge on financial matters. Gain insights into consumer credit law, the National Consumer Credit

0 views • 67 slides

Credit Reports and Scores: A Comprehensive Overview

Explore the importance of credit reports and scores in financial empowerment through modules on reviewing credit reports, understanding credit scores, and mastering credit basics. Learn how good credit can impact your ability to obtain loans, credit cards, secure rentals, insurance coverage, and emp

3 views • 35 slides

Mastering Credit and Debt in Head Start Program

Understand the complexities of credit and debt to make informed financial decisions. Learn about different types of credit, pros and cons of credit cards, debit cards, prepaid cards, and secured credit cards. Gain insights on how to manage your finances effectively and build a strong credit history

0 views • 29 slides

Infrastructure Financing Options and Principles

This presentation discusses the various tools and principles of infrastructure financing, including project finance, corporate finance, public finance, and blended finance. It covers the differences between financing and funding in infrastructure provision, the challenges faced by infrastructure ser

0 views • 32 slides

Sub-Letting in Rental Properties

Assured tenancies come with a statutory prohibition on sub-letting under the Housing Act 1988. If a tenant sub-lets, they breach their contract with the landlord, potentially leading to possession orders. The sub-tenants have a legal status, but the contractual relationship for paying rent lies with

0 views • 18 slides

Market Credit Working Group Updates to Wholesale Market Subcommittee

The Market Credit Working Group provided updates on various topics, including NPRRs reviewed for credit impacts, late payment enforcement provisions, and a software error identified in ERCOT's Credit Monitoring and Management System. Key discussions revolved around potential conflicts, proposed enfo

0 views • 9 slides

Qualitative Credit Control Methods Explained

Selective/Qualitative credit control methods involve regulating the quality and direction of credit flows by implementing controls such as ceilings on credit, margin requirements, discriminatory interest rates, directives, direct action, and moral suasion. These methods are used by central banks lik

0 views • 7 slides

Legal Infrastructure for Asset Finance in Civil Law Jurisdictions

The Civil Code outlines obligations and guarantees in asset finance, with specific qualifications like lawful causes of preference and security trusts. Privileges and hypotecas play key roles in the legal system. Title transfer by way of security fosters integrated asset finance systems. The aviatio

1 views • 106 slides

Credit Reporting and Credit Scores in CARE Presentation

Explore the essential concepts of credit reporting and credit scores in the context of Credit Abuse Resistance Education (CARE). Learn about credit history, its impact on financial decisions, ways to establish credit, the significance of credit reports, and how credit behaviors affect one's financia

0 views • 21 slides

Fisheries Finance: Macro vs. Micro Level Perspectives

Fisheries finance involves studying the financial aspects of the fishing and aquaculture business. It can be approached at both macro and micro levels, focusing on raising funds, lending procedures, and individual enterprise financial management. Macro-finance deals with the aggregate financial need

0 views • 27 slides

Behavioral Finance in "Finance for Normal People

Delve into the world of behavioral finance as presented in "Finance for Normal People," exploring how investors and markets behave based on cognitive and emotional factors. The book covers topics such as cognitive shortcuts and errors, emotional biases, and correcting investment mistakes. It also di

1 views • 20 slides

Credit Cards: A Beginner's Guide

Explore the basics of credit cards, including how they work, differences from debit and prepaid cards, obtaining one, and building credit. Learn about credit character, revolving credit, and tips for getting approved for a credit card. Discover the importance of good credit and income when applying

0 views • 20 slides

Understanding Credit Reports and Building Credit in 2017

Understanding credit reports is essential for financial well-being. A credit report is a record of your payment history on loans and credit cards. This report is used to calculate your credit score, which determines your creditworthiness. Building and maintaining credit involves making payments on t

5 views • 22 slides

Dual Credit Reporting Guidelines for College Courses

Dual Credit Reporting provides definitions, guidelines, and validation rules for reporting college courses that allow students to earn both high school and college credit. Key elements covered include credit indicators, college credit hours, course sequencing, and validation rules to avoid overrepor

0 views • 6 slides

Guidelines for Verifying Transitional Credit and Important Authorities' Orders

The guidelines for verifying transitional credit include directives from the Hon'ble Supreme Court, the opening of a common portal for filing forms, the verification process timeline, and the reflection of approved transitional credit in the Electronic Credit Ledger. Relevant orders and circulars fr

4 views • 19 slides

Child and Dependent Care Expenses Credit

The Child and Dependent Care Expenses Credit allows taxpayers to reduce their tax liability by a portion of expenses incurred for caring for qualifying persons. Qualifying persons include children under 13, incapacitated spouses or dependents, and certain criteria must be met to claim the credit. Th

8 views • 10 slides

Take Control of Your Credit Report: A Comprehensive Guide

Learn how to take control of your credit report, understand why it matters, spot credit repair scams, and fix mistakes. Discover why your credit history is important and how to get your free credit reports. Explore the significance of your credit score, review your credit reports, and know how to ha

0 views • 16 slides

Green Finance: Understanding Financial Solutions for Sustainable Projects

Explore the world of green finance, focusing on the use of financial products and services to support eco-friendly projects beyond just climate finance. Learn about the need for additional finance in various sectors like conservation, energy, and renewables. Discover the main financial instruments u

0 views • 41 slides

Reassessing Scholarly and Sub-Scientific Mathematical Cultures

Scholarly and sub-scientific mathematical cultures are reevaluated through the works of Jens Hoyrup, focusing on the organized nature of sub-scientific knowledge. The distinction between theoretical and practical knowledge, applications to mathematical cultures, and misconceptions related to the sup

0 views • 53 slides

Credit Finance Sub-Group Report to the Technical Advisory Committee

The Credit Finance Sub-Group's report to the Technical Advisory Committee includes updates on membership approvals and leadership candidates. Chair Brenden Sager from Austin Energy and Vice Chair Loretto Martin from Reliant are highlighted. The report also mentions new members approved by the TAC an

0 views • 4 slides

Empirical Credit Risk Management at FMB Group Credit Union

Empirical Credit-Risk Management (ECM) presentation to FMB Group Credit Union by Financial Analytics Ltd discusses the background, traditional forecasting methods, income and risk recognition, provisioning approaches, and benefits for credit unions. ECM offers expert retail credit risk management th

0 views • 25 slides

Classification of Class Aves and its Sub-Classes

Class Aves is divided into two sub-classes based on characteristics like teeth, claws, and bone structure. The sub-classes are Archaeornithes and Neornithes, each with distinct features and orders. Archaeornithes include the extinct order Archaeopterigiforms, exhibiting reptilian and avian traits. N

0 views • 13 slides

Credit Derivatives and Managing Credit Risk

This chapter delves into credit derivatives, exploring their purpose, types such as credit default swaps and total return swaps, and the development of the market over the years. It discusses credit risk, problems associated with it, methods for estimating credit risk, and the role of credit derivat

0 views • 35 slides

Market Credit Working Group Update to Wholesale Market Subcommittee

The Market Credit Working Group provided updates to the Wholesale Market Subcommittee regarding NPRR review, focusing on NPRR 1088 which addresses credit impacts related to the elimination of RFAF and DFAF applications to prior and ongoing market positions. The discussion revolved around ERCOT credi

0 views • 8 slides

- Credit Finance Sub-Group Update to the Technical Advisory Committee

- July 31, 2023, the Credit Finance Sub-Group provided an update to the Technical Advisory Committee with discussions on voting matters, operational NPRRs, revisions to credit qualification requirements for banks and insurance companies, and more. NPRR1205 introduced changes related to LC issuing ba

0 views • 17 slides

The Importance of Sub-Editing in Journalism

Sub-editing plays a crucial role in journalism by enhancing news stories for clarity, accuracy, and readability. Reporters provide the content, but sub-editors refine it to align with publication policies and style. Editing involves more than just fixing grammar and factual errors; it shapes the ess

0 views • 15 slides

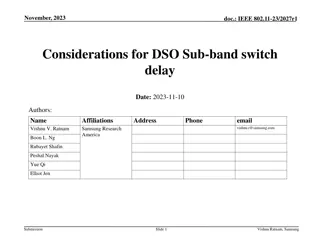

Considerations for Dynamic Sub-band Operation Switch Delay in IEEE 802.11-23/2027r1

This document addresses issues related to sub-band switch delay in Dynamic Sub-band Operation (DSO) within IEEE 802.11-23/2027r1. It proposes strategies like no-ACK initial control frames and follow-up frames to manage channel reservations for DSO sub-band switches efficiently.

0 views • 14 slides

The Importance of Credit Policies in Business Operations

A credit policy/manual serves as a comprehensive guide detailing rules, regulations, and procedures within a company. It helps new employees understand the company's credit processes and establishes clear guidelines for decision-making. Without a credit policy, conflicts may arise in approving credi

0 views • 9 slides

High School Articulated Credit: Benefits, Transferability & Responsibilities

High school articulated credit allows students to earn college credit by aligning high school CTE classes with college-level courses. This collaboration between high school teachers and college professors can save students time and money by reducing the need to repeat coursework in college. Students

0 views • 8 slides

All About Credit Cards: A Comprehensive Guide

Explore the world of credit cards, from understanding the basics to managing credit wisely. Delve into the advantages and disadvantages, learn about different types of credit cards, and discover how to use credit cards responsibly. Discuss whether high school students, college students, and adults s

0 views • 36 slides

Comprehensive Information on ESL Department's Fall 2020 Offerings

Explore ESL class options starting Fall 2020, including credit vs. non-credit courses, new course offerings, course numbering system, differences between credit and non-credit classes, and more. Discover details on certificates, financial aid, graduation, and transfer information, with insights on c

0 views • 12 slides

Evolution of Credit Reporting and Consumer Awareness

Credit access is crucial for consumers, yet inaccurate credit reporting can have significant impacts on credit scores. Studies show that errors in credit reports are common, with many consumers disputing inaccurate information. The regulatory landscape has evolved since the 2012 FTC study, with incr

1 views • 10 slides

Relativistic Heavy-Ion and Spin Physics Sub-group Mandate and Tasks

The Relativistic Heavy-Ion and Spin Physics Sub-group, part of the JINR Strategic Long-Range Plan, is tasked with identifying scientific priorities and research infrastructure to maintain JINR's global scientific leadership. Members include experts from various institutions collaborating to develop

0 views • 8 slides