Behavioral Finance in "Finance for Normal People

Delve into the world of behavioral finance as presented in "Finance for Normal People," exploring how investors and markets behave based on cognitive and emotional factors. The book covers topics such as cognitive shortcuts and errors, emotional biases, and correcting investment mistakes. It also discusses experienced happiness, life-evaluation, and various behavioral finance puzzles. Additionally, learn about behavioral finance in portfolios, life cycles, asset pricing, and market efficiency through a comprehensive overview of standard and behavioral finance concepts.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Finance for Normal People: How Investors and Markets Behave Introduction and Chapter 1

Finance For Normal People: How Investors and Markets Behave Introduction: What is Behavioral Finance? Part 1: Behavioral People are Normal People Chapter 1: Normal people Chapter 2: Our wants for utilitarian, expressive, and emotional benefits Chapter 3: Cognitive shortcuts and errors Chapter 4: Emotional shortcuts and errors Chapter 5: Correcting cognitive and emotional errors

Finance For Normal People: How Investors and Markets Behave Chapter 6: Experienced happiness, life-evaluation, and choices: Expected Utility Theory and Prospect Theory Chapter 7: Behavioral Finance Puzzles: The dividend puzzle, the disposition puzzle, and the puzzles of dollar-cost- averaging and time-diversification

Finance For Normal People: How Investors and Markets Behave Part 2: Behavioral Finance in Portfolios, Life-Cycles, Asset Prices, and Market Efficiency Chapter 8: Behavioral portfolios Chapter 9: Behavioral life-cycle of saving and spending Chapter 10: Behavioral asset pricing Chapter 11: Behavioral market efficiency Chapter 12: Lessons of behavioral finance

Foundation blocks of standard and behavioral finance Standard finance Behavioral finance 1. People are rational 1. People are normal

Foundation blocks of standard and behavioral finance Standard finance Behavioral finance 2. People construct portfolios as described by mean- variance portfolio theory, where people s portfolio wants include only high expected returns and low risk 2. People construct portfolios as described by behavioral portfolio theory, where people s portfolio wants extend beyond high expected returns and low risk, such as for social responsibility and social status

Foundation blocks of standard and behavioral finance Standard finance Behavioral finance 3. People save and spend as described by standard life- cycle theory, where people find it easy to find and follow the right way to save and spend 3. People save and spend as described by behavioral life- cycle theory, where impediments, such as weak self-control, make it difficult to find and follow the right way to save and spend

Foundation blocks of standard and behavioral finance Standard finance Behavioral finance 4. Expected returns of investments are accounted for by standard asset pricing theory, where differences in expected returns are determined only by differences in risk 4. Expected returns of investments are accounted for by behavioral asset pricing theory, where differences in expected returns are determined by more than differences in risk, such as by levels of social responsibility and social status

Foundation blocks of standard and behavioral finance Standard finance Behavioral finance 5. Markets are not efficient in the sense that prices equal values in them, but they are efficient in the sense that they hard to beat 5. Markets are efficient, in the sense that prices equal values in them and in the sense that they are hard to beat

Why do we behave as we do? Rational, Irrational, and Normal Behavior 2nd generation behavioral finance 1st generation behavioral finance Because we are normal, pursuing what normal people want Because we are irrational We fall victim to cognitive and emotional errors on our way to what we want We fall victim to cognitive and emotional errors

Why do we behave as we do? Rational, Irrational, and Normal Behavior Standard Finance says: Rational people do not buy lottery tickets

Why do we behave as we do? Rational, Irrational, and Normal Behavior 1st generation Behavioral Finance says: Irrational people buy lottery tickets because they are fooled by cognitive errors exaggerating the odds of winning

Why do we behave as we do? Rational, Irrational, and Normal Behavior 2nd generation Behavioral Finance says: Normal people buy lottery tickets for the emotional benefits of hope of winning and the utilitarian benefits of the miniscule odds of winning

Rational and Normal Standard finance People are rational Merton Miller and Franco Modigliani in their 1961 article on dividends: a. Rational people always prefer more wealth to less b. Rational people are never confused by the form of wealth Rational people are indifferent between company-paid dividends and homemade dividends created by selling shares Normal people are not indifferent between company-paid dividends and homemade dividends

Rational and Normal Behavioral finance - People are normal Normal people have normal wants, such as social responsibility, social status, and caring for family Normal people use cognitive and emotional shortcuts on the way to their want At times, cognitive and emotional shortcuts become cognitive and emotional errors Framing errors are one example: Normal people are often confused by the form of wealth

Rational and Normal Company-paid dividends versus homemade dividends (in the absence of transaction costs or taxes) $50,000 Capital $48,500 Capital $1,500 Dividend

Cognitive and Emotional Shortcuts and Errors Which restaurant should we choose for dinner tonight? Good shortcuts take us close to the best choices, solutions, and answers Cognitive and emotional shortcuts turn into errors when they take us far from our best choices

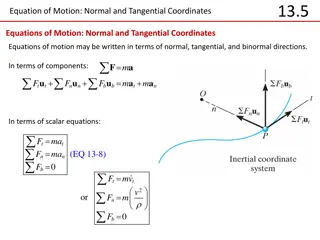

System 1 and System 2 Intuition, reflected in cognitive and emotional shortcuts, leads us right in most of life. But reflection leads us better when intuition misleads System 1 is the intuitive blink system in our minds - automatic, fast, and effortless System 2 is the reflective think system in our minds - controlled, slow, and effortful

Three kinds of knowledge 1. Financial-facts knowledge - Facts about finance and financial markets 2. human-behavior knowledge - Knowledge is about our wants, the cognitive and emotional shortcuts we take, and the errors we make 3. Information knowledge Exclusively-available, narrowly available, and widely-available information

Transformation from ignorant to knowledgeable Teachers guide in the search and application of financial-facts, human- behavior, and information knowledge Experience can also be a good teacher We pay in money, time, and exertion, both physical and mental, when we transform ourselves from ignorant into knowledgeable We pay in money, time, and exertion when we substitute the reflective System 2 for the intuitive System 1 Transformation is worthwhile when benefits exceed costs