Preparing for the CPA Exam

Get ready for the CPA exam with this informative session featuring panelists from top accounting firms. Learn about exam requirements, application process, and test-taking tips. Contact information available for further inquiries.

0 views • 25 slides

2023 WV ASBO Conference

Dive into the world of ethics and fraud in education with Dr. Scott Fleming as he discusses the importance of instilling proper values to promote ethical behavior, the factors influencing trust violations, characteristics of fraud actions, and the evolution of fraud theory. Gain valuable insights in

0 views • 96 slides

TORCH Conference Spring 2023 Updates and Topics

The TORCH Conference Spring 2023, featuring J. Brandon Durbin, CPA, covers various topics including reimbursement law changes, low volume payments, Medicare DSH and 340B programs, CAH mileage modifications, and more. The conference provides important updates for healthcare providers and facilities.

0 views • 55 slides

Unlocking the Power of Cloud Accounting for Streamlined Payroll Processes in Canada

Given that business is a fast-paced environment, management of payroll is a major determinant of the functioning and the staff satisfaction in an organization. Payroll services now have a simpler process and Vancouver accounting firms including the Taxlink CPA are aware of this. There is also the fa

2 views • 3 slides

Social Media Tune-Up: Enhancing Your Chapter's Online Presence

Join Kara Brostron, CLM, and Paul Walker, CPA, MBA on Sept. 26 at 2PM PST for a session on optimizing social media for your chapter. Learn about hashtags, tagging, URL shorteners, Facebook strategies, and more to engage your audience effectively.

0 views • 28 slides

Accounting & Accounting Controls Workshop with Tom Walters

Explore the Minnesota District Leadership Workshop focusing on accounting controls led by retired CPA Tom Walters. Learn about preventive, detective, and corrective controls in a congregational setting to ensure accurate financial management. Gain insights on safeguarding cash receipts, cash disburs

0 views • 12 slides

Public Financial Management Challenges and Principles by Robinson Kweyu

Public Financial Management under PFM CPA Robinson Kweyu involves reporting requirements, legal documents, institutional players, and principles like openness, accountability, and public participation. It emphasizes the responsible and equitable use of public resources to promote a transparent and e

0 views • 11 slides

Child Placing Agencies and Child Caring Institutions Overview

Explore the procedures and protocols followed by Special Investigations and Regular Investigations units when dealing with allegations of maltreatment in Child Placing Agencies (CPA) and Child Caring Institutions (CCI). Learn about the different types of investigations and how cases are handled base

1 views • 16 slides

Potential Careers with an Accounting Degree

Explore the diverse career opportunities available to individuals with an accounting degree, ranging from audit services and tax compliance to management advisory services, forensic accounting, financial consulting, and more. Discover the wide array of industries and sectors where accountants can wo

1 views • 15 slides

Financial Highlights and Audit Results for Town of Beech Mountain, North Carolina

The Town of Beech Mountain, North Carolina, under Misty D. Watson, CPA, saw positive financial outcomes in the fiscal year ending June 30, 2017. Key highlights include an increase in assets exceeding liabilities, strong property tax collection rates, and prudent management of funds. The independent

1 views • 7 slides

Impact of 2018 Tax Act: Key Changes Explained

Explore how the new 2018 tax act impacts taxpayers, including changes to deductions, tax brackets, and the SALT deduction. Learn about the standard deduction increase, personal exemptions elimination, new tax brackets, and more insights from a CPA.

0 views • 34 slides

Update Reports: Baroka Ba Nkwana, Bakoni-Ba-Mmamaro CPA, and Enquiry from Mr. C. Mathebe Presentation to the Portfolio Committee on Agriculture, Land Reform, and Rural Development

This report provides updates to the Portfolio Committee on Agriculture, Land Reform, and Rural Development regarding Mr. Collen Mathebe's matter, Bakoni-Ba-Mmamaro CPA, and Baroka Ba Nkwana Land Claim. Mr. Mathebe's issue cannot be resolved through the Land Title Adjustment Act, and alternative opti

0 views • 38 slides

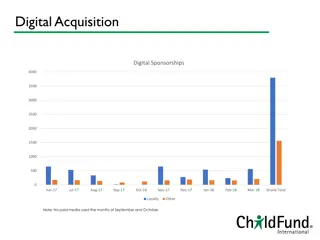

Insights and Recommendations for Loyalty Program Optimization

Analysis of digital acquisition and loyalty program conversions reveals a positive trend in retention and decreased CPA. Recommendations include assessing new acquisition channel performance, comparing audience profiles, tailoring retention plans for specific converters, updating conversion pages, a

0 views • 4 slides

Streamline Your Payroll Process with SAI CPA Services in East Brunswick

Managing payroll can be a time-consuming and complex task for any business. From ensuring compliance with tax regulations to keeping up with ever-changing labor laws, it\u2019s easy to see how payroll can become overwhelming. At SAI CPA Services, we

2 views • 3 slides

Security with Functional Re-Encryption in Cryptography

Exploring the concept of functional re-encryption from the perspective of security in encryption schemes lies between CPA and CCA security levels. The work done by Yevgeniy Dodis, Shai Halevi, and Daniel Wichs delves into how functional re-encryption can enhance the security and privacy of encrypted

0 views • 12 slides

Worried About IRS Audits? Here’s How SAI CPA Services Can Help You Avoid Them!

IRS audits can be stressful, but with the right preparation, you can minimize your chances of being audited. Audits often stem from discrepancies or unusual patterns in tax returns. Common triggers include math errors, large deductions, unreported in

3 views • 2 slides

Path to Becoming a CPA: Requirements and Process Overview

Discover the steps to becoming a Certified Public Accountant (CPA), including education requirements, the Uniform CPA Examination, gaining experience, obtaining licensure, and maintaining your license through continuing education. State-by-state variations are highlighted to guide aspiring CPAs thro

0 views • 15 slides

San Benito County Water District Auditor Presentation

The auditor presentation by Matt N. Pressey, CPA, Audit Manager at McGilloway, Ray, Brown & Kaufman, highlighted the audited financial statements for the year ended June 30, 2021. The district received a GFOA award for excellence in financial reporting, and the presentation included statements of ne

0 views • 11 slides

CPA Orientation Networking Event Tips and Preparation Guide

Discover essential tips and preparation strategies for making the most of a Chartered Professional Accountants (CPA) orientation wine and cheese networking evening. Learn how to engage with recruiters, students, and partners effectively, including what to do, how to prepare, and valuable insights fo

0 views • 5 slides

Exploring the White Rose Maths Approach in a Parent Workshop

Dive into the innovative White Rose Maths (WRM) approach at Buttsbury schools through a parent workshop led by experienced staff members. Discover the blocked units, small steps, and varied fluency of the approach, along with the importance of Concrete-Pictorial-Abstract (CPA) method for enhancing c

0 views • 19 slides

Oblivious RAM and Software Protection: An Overview

Oblivious RAM (ORAM) and software protection against piracy involve securing hardware and encrypted programs to prevent unauthorized access. With a focus on achieving security through encryption and indistinguishability, concepts like access patterns and data request sequences play a crucial role. T

0 views • 26 slides

The CPA's Guide to Ethical Behavior by Jolene A. Lampton, Ph.D., MBA, BSE, CPA, CGMA & CFE

Delve into the ethical realm with insights from Jolene A. Lampton, a seasoned CPA, as she explores the essence of ethical behavior in the accounting profession. Discover the fundamental principles of honesty, integrity, and compassion that underpin ethical conduct, drawing from historical philosophe

1 views • 39 slides

Disaster Preparedness and Planning Presentation for Tallahassee Chapter of AGA

The presentation for the Tallahassee Chapter of AGA on Disaster Preparedness and Planning, conducted by Ben A. (Steve) Stevens III, CPA, Director of Assurance Services at Thomas Howell Ferguson P.A. CPAs, covers the National Preparedness Goal, Four Phases of Emergency Management, Mitigation, Prepare

0 views • 30 slides

Analysis of Winners and Losers in Tax Cuts and Jobs Act

Explore the impact of the Tax Cuts and Jobs Act on different individuals and groups as presented by Timothy J. Sundstrom, a CPA and CFP known as "Some Call Me Tim". Gain insights into who benefits and who may face challenges under this tax reform. Based in Broomall, PA, Tim provides valuable perspec

0 views • 196 slides

Bank Reconciliation Process Explained by Jon Worrall, CPA

Bank reconciliations ensure accuracy by comparing an entity's ledger cash balance with the bank statement. This process includes identifying uncleared checks, deposits in transit, interest earned, and more. Utilize software or paper/excel methods for reconciling, focusing on accuracy to detect error

0 views • 6 slides

Combating Elder Abuse in Montgomery County: Initiatives and Reporting Requirements

The Montgomery County Prosecutors Office, led by Mat Heck Jr., is actively combatting elder abuse through prosecuting various types of abuse like physical neglect and financial exploitation. Mandatory reporters have been expanded to include professionals like CPA's and investment advisors. A new law

0 views • 23 slides

California School Finance Authority SB740 Webinar Overview

The California School Finance Authority is hosting a webinar on May 6, 2020, to provide information on the SB740 program, which offers funding to assist charter schools with facility costs. The program aims to support schools demonstrating a need for financial assistance and serving students eligibl

0 views • 23 slides

Graduates Convocation Dinner and Dance Registration Tutorial

This PowerPoint tutorial provides step-by-step guidance on how graduates can register themselves and their guests for the CPA Alberta Convocation Dinner and Dance 2024 event in either Edmonton or Calgary. Detailed instructions include selecting tickets, entering information, and ensuring seating pre

0 views • 15 slides

Overview of Tax Incentive Strategy for U.S. Exporters by Edward K. Dwyer, CPA

This presentation by Edward K. Dwyer, a renowned CPA, delves into the tax incentive strategies for U.S. exporters, focusing on the Interest Charge Domestic International Sales Corporation (IC-DISC). It covers the historical background, recent legislative impacts, IC-DISC requirements, intercompany p

0 views • 31 slides

Ensuring Compliance with Form 990 Filing Requirements

Explore common pitfalls in filling out Form 990 after a decade, presented by Elaine L. Sommerville, CPA. Learn about different Form 990 variations based on organization size and revenue, along with crucial sections like mission statement clarity, detailed program accomplishments, Schedule A for 501(

0 views • 20 slides

Overview of Oregon Board of Accountancy Exam and Licensing

The Oregon Board of Accountancy plays a crucial role in public protection by ensuring only qualified licensees practice public accountancy. The Board outlines CPA exam prerequisites, emphasizing the educational requirements and experience needed to qualify for the exam. Candidates must meet specific

0 views • 21 slides

CPA-Security and Multiple Message Security in Cryptography

Today's goal is to build a CPA-secure encryption scheme focusing on multiple message security. The concept of indistinguishable multiple encryptions against eavesdropping attackers is explored, highlighting the importance of secure encryption schemes in the presence of an eavesdropper. The experimen

0 views • 22 slides

BIKE Cryptosystem: Failure Analysis and Bit-Flipping Decoder

The BIKE cryptosystem is a code-based KEM in the NIST PQC standardization process, utilizing the Niederreiter variant of the McEliece Construction with a QC-MDPC code. It ensures security against IND-CPA, and efforts are made to further confirm or disconfirm its estimates for IND-CCA security requir

0 views • 14 slides

Unlocking the Power of Phraseology in Linguistics Research

CPA, led by Patrick Hanks, delves into collocation analysis and meaning interpretation in linguistics. By examining phraseological patterns, the institute aims to build a comprehensive inventory for various verb senses, highlighting the significance of normative and exploitative linguistic uses. The

0 views • 9 slides

5 Key Metrics to Track in Google Ads to Maximize ROI (1)

\"Track 5 key Google Ads metrics like CTR, Conversion Rate, CPA, Quality Score, and ROAS to optimize ROI and boost campaign performance for long-term growth.\

0 views • 8 slides

After-Election Tax Strategies for 2024

As we digest the results of the 2024 election, it\u2019s essential to prepare for possible tax policy changes that could impact individuals, families, and businesses across the U.S. At SAI CPA Services, we are committed to helping you navigate these

4 views • 3 slides

Updates on Nonprofit Financial Statements and Net Assets

Stacy Smith, a CPA Shareholder at Mize Houser & Company, discusses key changes in nonprofit financial statements brought about by ASU 2016-14. The update includes improvements in presenting operating cash flows, net asset classes, liquidity information, expense reporting, and investment return. The

0 views • 32 slides

Overview of the CPA Exam and License Process

The CPA Exam is a crucial step toward obtaining a CPA license, allowing individuals to practice as CPAs in the U.S. The exam is regulated by the AICPA and administered by NASBA and Prometric. To become a CPA, one must meet specific education, examination, and experience requirements set by individua

0 views • 38 slides

How Accounting Firms in Canada Support Small Businesses

If you\u2019re searching for chartered accountants near me or exploring reliable accounting firms in Surrey, TaxLink CPA is your trusted partner. Let\u2019s delve into how accounting firms like TaxLink CPA empower small businesses to thrive.

1 views • 3 slides

Management of CPA

This content outlines the principles and objectives of managing Chronic Pulmonary Aspergillosis (CPA) focusing on medical interventions, prognosis, and predictors of poor outcomes. It emphasizes the key role of oral azole therapy, the use of IV antifungals, and the necessity for long-term treatment.

22 views • 17 slides