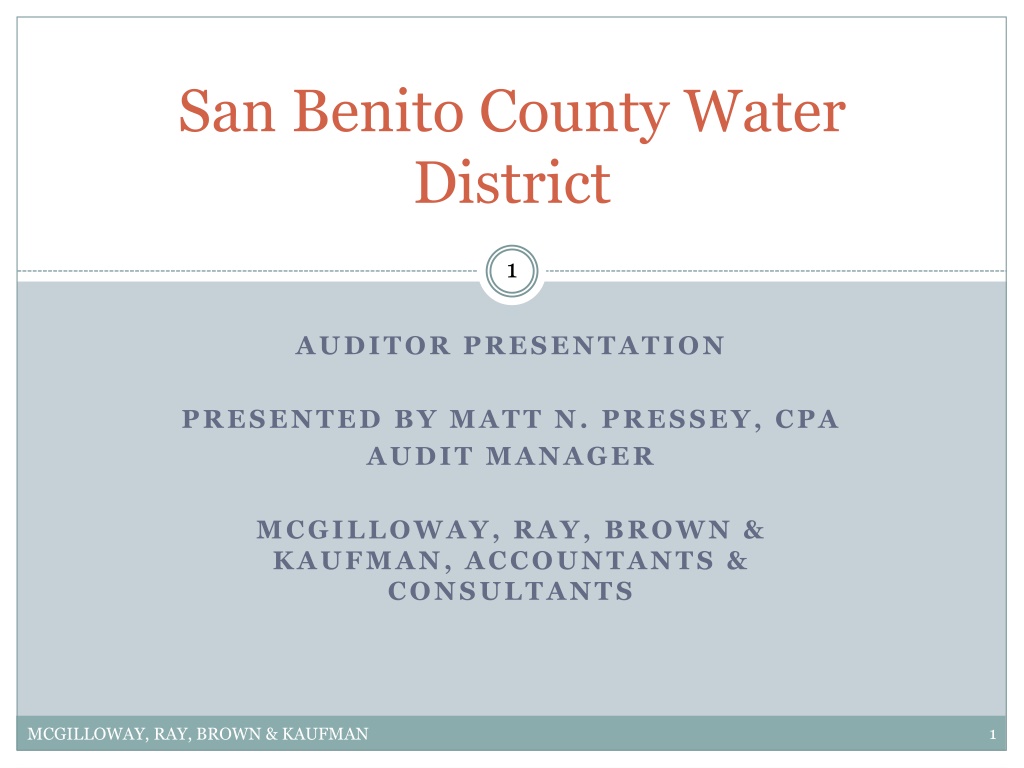

San Benito County Water District Auditor Presentation

The auditor presentation by Matt N. Pressey, CPA, Audit Manager at McGilloway, Ray, Brown & Kaufman, highlighted the audited financial statements for the year ended June 30, 2021. The district received a GFOA award for excellence in financial reporting, and the presentation included statements of net position, revenues, expenses, cash flows, and more. Changes in assets, liabilities, deferred charges, and capital assets were also discussed.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

San Benito County Water District 1 AUDITOR PRESENTATION PRESENTED BY MATT N. PRESSEY, CPA AUDIT MANAGER MCGILLOWAY, RAY, BROWN & KAUFMAN, ACCOUNTANTS & CONSULTANTS 1 MCGILLOWAY, RAY, BROWN & KAUFMAN

Reports Issued 2 Audited Financial Statements for the year ended June 30, 2021 Communication with those Charged with Governance Management Letter Communications no material weaknesses New GASB Pronouncements 2 MCGILLOWAY, RAY, BROWN & KAUFMAN

Audited Financial Statements 3 Audit Opinions o Independent Auditor s Report on Financial Statements (unmodified) (Page 1) o District received GFOA award for excellence in financial reporting Basic Financial Statements Management s Discussion and Analysis (Page 4) Statement of Net Position (Page 14) Statement of Revenues, Expenses and Changes in Net Position (Page 16) Statement of Cash Flows (Page 17) Notes to Financial Statements (Page 21) 3 MCGILLOWAY, RAY, BROWN & KAUFMAN

Condensed Statement of Net Position 4 2021 2020 Change ASSETS Current assets: Cash (unrestricted and restricted) Other current assets Total current assets Increase is primiarily due to increase in LAIF balance of $7.5 million. $ 63,263,995 3,190,470 66,454,465 55,169,312 $ 3,810,977 58,980,289 8,094,683 (620,507) 7,474,176 $ Decrease due timing of CY receivables and decrease in prepaid expenses Noncurrent assets: Deferred charges and capital assets, net Contract receivable Total noncurrent assets Total assets 81,545,452 21,801,049 103,346,501 169,800,966 79,742,123 22,902,636 102,644,759 161,625,048 1,803,329 (1,101,587) 701,742 8,175,918 Increase is due to $3.3 million pension contribution made subsequent to year end 06/30/2020 Deferred outflows of resources: Deferred pensions Deferred OPEB Total deferred outflows of resources 3,657,783 602,803 4,260,586 716,045 70,399 786,444 2,941,738 532,404 3,474,142 Increase is due to $500k OPEB contribution made subsequent to year end 06/30/2020 4 MCGILLOWAY, RAY, BROWN & KAUFMAN

Condensed Statement of Net Position, cont. 5 2021 2020 Change LIABILITIES Current liabilities: Other current liabilities Total current liabilities 5,066,170 5,066,170 5,044,838 5,044,838 21,332 21,332 Noncurrent liabilities: OPEB Liability Pension liability Deposits City National Bank loan payable 2021 Water Refunding Obligation Bonds 2021 Taxable Revenue Obligation Bonds Unearned contract revenue Total noncurrent liabilities Total liabilities Changes in actuarial assumptions 866,970 2,924,121 57,000 3,434,601 2,794,000 2,734,000 21,801,054 34,611,746 39,677,916 1,227,302 2,690,997 (360,332) 233,124 16,079 (346,257) 2,794,000 2,734,000 (1,101,582) 3,969,032 3,990,364 Financing agreement to pay for in-basin portion of Central Valley Project 40,921 3,780,858 22,902,636 30,642,714 35,687,552 - - Financing agreement to pay for underfunded accrued liability (UAL) with CalPERS. Changes in actuarial assumptions Deferred inflows of resources: Deferred pensions Deferred OPEB Total deferred inflows of resources 62,572 442,719 505,291 155,527 85,646 241,173 (92,955) 357,073 264,118 Changes in actuarial assumptions NET POSITION $ 133,878,345 126,482,767 $ $ 7,395,578 5 MCGILLOWAY, RAY, BROWN & KAUFMAN

Condensed Statement of Revenue & Expenses & Changes in Net Position 6 2021 2020 Change Revenues: Operating revenues Nonoperating revenues Total Revenues 12,233,531 11,581,360 23,814,891 12,052,072 11,658,844 23,710,916 181,459 (77,484) 103,975 Expenses: Depreciation and amortization expense Operating expense Capital contribution to other government Nonoperating expense Total Expenses (2,505,513) (16,419,313) (3,115,945) (10,797,855) (2,991,941) (10,889,558) (845,349) (14,726,848) (1,660,164) (1,692,465) (124,004) 91,703 - - - Increase primarily due to write offs of previously capitalized construction projects Change in Net Position Net Position, Beginning of Year Net Position, End of Year 7,395,578 126,482,767 133,878,345 8,984,068 117,498,699 126,482,767 (1,588,490) 8,984,068 7,395,578 6 MCGILLOWAY, RAY, BROWN & KAUFMAN

Communication with those Charged with Governance 7 Management is responsible for the selection and use of appropriate accounting policies. We noted no transactions entered into by the District during the year for which there is lack of authoritative guidance or consensus. All significant transactions have been recognized in the financial statements in the proper period. Accounting estimates allowance for uncollectible accounts, capitalization and depreciation of fixed assets, pension liability, other postemployment benefits, and deferred outflows and inflows of resources. o Evaluated the underlying assumptions in estimates and found them to be appropriate. Sensitive Financial Statement Disclosures - Note 10, Employee Retirement Plans; and Note 12, Other Postemployment Benefit Plan: and Note 15 7 MCGILLOWAY, RAY, BROWN & KAUFMAN

Communication with those Charged with Governance (cont.) 8 Difficulties Encountered in Performing the Audit - None Disagreements with Management - None Management Consultations with Other Independent Accountants None Timing of the audit Timing went according to schedule and we found no delays, and we had no disagreements with management. Other Matters Required Supplementary Information, Other Information accompanying the financial statements that are not RSI, Limited Assurance. 8 MCGILLOWAY, RAY, BROWN & KAUFMAN

Management Letter Communications and Observations 9 No Material Weaknesses 9 MCGILLOWAY, RAY, BROWN & KAUFMAN

Prior Year Management Letter 10 None! 10 MCGILLOWAY, RAY, BROWN & KAUFMAN

New GASB Pronouncements 11 Statement No. 84, Fiduciary Activities Effective Date: The provisions in Statement 87 are effective for reporting periods beginning after December 15, 2018 Statement No. 90, Major Equity Interests Effective Date: The provisions in Statement 90 are effective for reporting periods beginning after December 15, 2019 Statement No. 93, Replacement of Interbank Offer Rates Effective Date: The provisions in Statement 93 are effective for reporting periods beginning after June 15, 2020 Statement No. 98, The Annual Comprehensive Financial Report Effective Date: The provisions in Statement 98 are effective for reporting periods beginning after December 15, 2021. o o o o 11 MCGILLOWAY, RAY, BROWN & KAUFMAN

undefined

undefined