Guidelines for Direct Costs in H2020 Funding

Direct costs in Horizon 2020 funding must be accurately measured and attributed only to the specific action being funded. Costs must be directly linked to the implementation of the action and supported with sufficient evidence. It is crucial to avoid errors in other direct costs, ensure proper recor

0 views • 26 slides

Understanding CONFIA: The Brazilian Cooperative Compliance Program

Cooperative Compliance is a relationship between taxpayers and Tax Administration based on principles like good faith, collaboration, and transparency. CONFIA aims to provide legal certainty, prevent disputes, reduce compliance costs, and improve tax compliance through voluntary and cooperative deve

1 views • 14 slides

Cost Accounting Standards for Determining Transportation Costs

Understanding the importance of transportation costs in procurement and distribution, this guide outlines the standards for determining average costs, separation of transportation costs in accounting records, objectives for maintaining cost uniformity, components of transportation costs, and treatme

0 views • 11 slides

RRH Student Re-Entry Process for Clinical Requests & Compliance

The RRH Student Re-Entry Process outlines steps for clinical request processing, approval, and compliance requirements for various disciplines within the nursing program and other departments. It includes sending requests to the Nursing Institute, communication procedures, compliance documentation,

0 views • 10 slides

Grant Management Flexibility under Horizon 2020 During COVID-19

Grant management under Horizon 2020 during COVID-19 requires maximum flexibility with eligibility of costs incurred, force majeure clause usage, and flexibility in actual personnel costs. Teleworking costs are eligible, and personnel costs can be adjusted for exceptional circumstances. Travel costs

1 views • 12 slides

Understanding Administrative Costs in Grant Management

Administrative costs are essential for managing grants effectively. Learn about the difference between direct and indirect costs, and why tracking and reporting accurately is crucial to avoid disallowed costs. Explore the definition, classification, and significance of administrative costs in grant

0 views • 22 slides

Understanding Activities Delivery Costs and Program Administrative Costs in CDBG Programs

Exploring the allocation of staff costs between Activities Delivery Costs (ADCs) and Program Administrative Costs (PACs) in Community Development Block Grant (CDBG) programs. ADCs cover non-profit staff expenses for carrying out eligible activities, while PACs include costs for planning, general adm

1 views • 10 slides

Understanding the Costs of Inflation and Its Impact on Purchasing Power

Inflation is a crucial economic phenomenon with both winners and losers. While inflation itself doesn't necessarily reduce real purchasing power, it leads to various costs such as shoeleather costs, menu costs, and unit of account costs. These costs emerge due to the changing dynamics of prices, wag

0 views • 16 slides

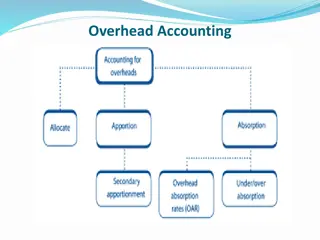

Understanding Overhead Accounting and Allocation Process

Overhead accounting involves allocating and apportioning overhead costs to different departments or cost centers in a company. This process includes dividing cost centers into production and service departments, assigning overhead costs accurately, and distributing common overhead costs proportionat

0 views • 18 slides

Understanding Costs for Defendants in Legal Proceedings

This article provides detailed information on the costs involved for defendants in legal cases, including the starting point for cost allocation, costs at different stages of the legal process, and considerations for recovery of costs. It covers aspects such as costs at the pre-action stage, costs a

2 views • 54 slides

Understanding Facilities and Administration (F&A) Costs in Research Grants

Universities have a long history of partnering with the federal government in conducting research. This partnership incurs various costs known as Facilities and Administration (F&A) costs, which cover infrastructure, administrative, and compliance expenses. F&A costs are essential for supporting res

0 views • 28 slides

Overview of New Civil Procedure Rules on Costs: CPR Parts 58 & 59

The new Civil Procedure Rules (CPR) Parts 58 & 59 introduce changes in the assessment and taxation of costs in legal proceedings. Detailed assessment replaces taxation, standard basis, fixed costs, and more defined, with new definitions and procedures outlined. Order 59 expands the powers to tax cos

0 views • 22 slides

Understanding Engineering Costs and Estimation Methods

This informative content delves into the concept of engineering costs and estimations, covering important aspects such as fixed costs, variable costs, semi-variable costs, total costs, average costs, marginal costs, and profit-loss breakeven charts. It provides clear explanations and examples to hel

0 views • 33 slides

Enhancing Compliance Monitoring in South African Public Service

The Compliance Monitoring Framework developed by the Office of Standards and Compliance aims to improve adherence to public administration norms and standards in South Africa. This framework is designed to reduce non-compliance through ongoing supervision, investigation, and promotion of proper beha

3 views • 19 slides

Effective Corporate Compliance Program Overview

Corporate compliance is essential to prevent fraud, waste, and abuse within organizations. This program aims to detect and prevent deceptive practices, unnecessary costs, and improper behaviors. Key elements include appointing a Compliance Officer, establishing policies and procedures, providing edu

1 views • 19 slides

Understanding Budget Basics for Comprehensive Budget Development

Components necessary for comprehensive budget development include categories of spending like direct costs, personnel costs, and facilities & administrative costs. Budget construction may vary by sponsor, but a detailed budget is required at submission. Personnel costs cover various types of employe

1 views • 19 slides

Understanding Costs in Business: Types and Significance

Costs in business play a crucial role in determining profitability and decision-making. This article explores various types of costs such as direct, indirect, fixed, and variable costs, along with their definitions, uses, and impact on business operations. Understanding these costs is essential for

0 views • 13 slides

Understanding Marginal Costing in Cost Accounting

Marginal Costing is a cost analysis technique that helps management control costs and make informed decisions. It involves dividing total costs into fixed and variable components, with fixed costs remaining constant and variable costs changing per unit of output. In Marginal Costing, only variable c

1 views • 7 slides

Post Award Fiscal Compliance: Who We Are and What We Do

Post Award Fiscal Compliance (PAFC) assists campus and central administrative units in mitigating non-compliance risks with sponsor terms and conditions by monitoring compliance, interpreting award requirements, providing training, and enhancing internal controls. The team includes Matt Gardner, Ass

0 views • 11 slides

How to Fill Out a Nursing Assistant Certification Reimbursement Request Form

Detailed instructions on filling out Form 06-123 for Nursing Assistant Certification (NAC) reimbursement requests. Sections covered include Provider Information, Direct Care Costs, Operating Costs, Total Costs, and Provider Authorization. The form requires manual entry of some totals and provides au

0 views • 16 slides

Analysis of 2021 Marginal Generation Costs for San Diego Gas & Electric

The analysis presents the 2021 Marginal Generation Costs methodology filed by San Diego Gas & Electric in April 2016 for the Time-of-Use (TOU) OIR Workshop. It includes forecasts for Marginal Energy Costs (MEC) and Marginal Generation Capacity Costs (MGCC) for the calendar year 2021, based on market

0 views • 6 slides

Understanding Overhead Costs and Their Importance in Business

Overhead costs play a crucial role in cost allocation and management within an organization. These costs, which include indirect expenses such as labor, materials, and services, cannot be directly linked to specific units of production. Instead, overhead costs are apportioned and absorbed using vari

0 views • 16 slides

Questionable Costs and Risk Management Practices

This document discusses the concept of questionable costs, why they are important to ECU, and the risks associated with pre-award and active award stages. It also covers management reports, best practices for addressing late charges, and the process for justifying questionable costs. The content emp

0 views • 11 slides

Project Cost Estimation for Microgrid Equipment and Installation

This module delves into estimating project costs for microgrid equipment, including procurement, installation, design, and engineering. It covers categories such as installation costs, design and engineering costs, overhead costs, and contingency costs, to provide a comprehensive understanding of es

0 views • 18 slides

Importance of Compliance Training in Ensuring Ethical Business Practices

Compliance training at West Cancer Center plays a vital role in educating employees on laws, regulations, and company policies to ensure ethical conduct. With a commitment to compliance, the center's Code of Ethics emphasizes activities that adhere to laws and regulations, prioritize quality care, a

0 views • 31 slides

Understanding Migration Costs in Low-skilled Labor Migration

This content delves into the work of KNOMAD and The World Bank in measuring migration costs for low-skilled labor migration. It outlines the objectives, phases, and methodologies used to assess various costs incurred throughout the migration cycle, such as compliance costs, transportation expenses,

1 views • 21 slides

Guidelines on Allowable Costs and Related Parties in Long-term Debt Training

Explore guidelines on allowable costs and transactions with related parties in long-term debt training programs. Learn about costs paid to other agencies, examples of allowed costs, and costs not allowed. Gain insights into the XI-Q Bond Agency Guide and upcoming training sessions. Have questions? F

0 views • 6 slides

Resource Analysis Summary Report for Instructional Costs

This Resource Analysis Summary Report analyzes instructional costs for different campuses based on subject code and course level. It outlines how model costs used in the State Share of Instruction (SSI) are calculated by dividing the sum of unrestricted costs by Full-Time Equivalents (FTE). The repo

0 views • 9 slides

Understanding the Victorian Regulatory Change Measurement (RCM)

The Victorian Regulatory Change Measurement (RCM) methodology introduced in June 2010 aims to measure reductions in regulatory burden through different categories such as administrative costs, substantive compliance costs, delay costs, and more. The RCM formula helps in calculating the total regulat

0 views • 63 slides

Financial Aspects and Budgeting in PRIMA Programme

This training material covers eligible and ineligible costs, budgeting templates, third-party involvement, archiving procedures, reporting requirements, and checks in the PRIMA Programme under Horizon 2020. It explains the types of costs, such as actual costs, unit costs, and lump sum payments, with

0 views • 29 slides

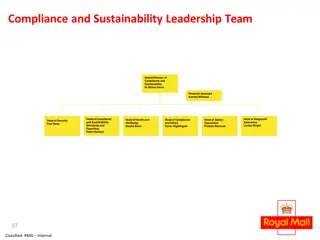

Compliance and Sustainability Leadership Team Overview

This document provides an overview of the Compliance and Sustainability Leadership Team structure, including key positions such as Global Director, Head of Compliance and Sustainability Standards, and various advisors and managers responsible for safety, health, compliance, ethics, and risk manageme

0 views • 6 slides

Understanding Tariff of Electricity and Principles of Calculation

Electrical energy production involves costs that are shared by consumers based on the amount and nature of electricity consumed. This includes fixed costs for setting up power plants and variable costs for generating electricity, which covers fuel expenses. The calculation of electricity costs is ba

0 views • 18 slides

Understanding Accounting for Borrowing Costs in Financial Management

Borrowing costs in financial management refer to interest and other expenses incurred when borrowing funds. These costs are crucial to account for correctly to ensure accurate financial reporting. Borrowing costs directly attributable to acquiring, constructing, or producing a qualifying asset are c

0 views • 8 slides

Sri Lanka Accounting Standards LKAS 23: Borrowing Cost Overview

This document provides an overview of Sri Lanka Accounting Standards LKAS 23 on borrowing costs, covering its introduction, scope, definition, and accounting treatment. It explains how borrowing costs are recognized, the scope of the standard, and the classification of borrowing costs. Additionally,

0 views • 12 slides

Compliance Assurance Report on Dental Services in Q1 2024

A compliance assurance report was conducted on dental services in Q1 2024 as part of the HSE Children First Compliance Assurance Checks. The report highlighted areas of compliance and partial compliance, with efforts noted to meet Children First requirements. Areas of improvement were identified in

0 views • 19 slides

Financial Guidelines Overview for Collaborative Projects

Introduction to the financial framework for collaborative projects, including budget formats, budget lines, and principles of alignment in accordance with partner universities. Details on budget limits, implementation periods, activity year breakdown, and justification requirements are provided. Key

0 views • 27 slides

Analysis of Manufacturing Costs for Trunnion Speaker Production

This analysis breaks down the manufacturing costs for producing Trunnion Speakers, including variable costs, fixed costs, overhead costs, total costs, mark-up values, and break-even points. The detailed breakdown provides insight into cost per unit and helps in pricing decisions for achieving profit

0 views • 8 slides

Understanding Costs in Power Sector Decision-Making

Operational, decommissioning, and investment decisions in the power sector are influenced by different categories of costs. Operational decisions focus on variable costs like fuel and CO2 expenses, while decommissioning decisions consider both variable and fixed costs. Investment decisions require a

0 views • 6 slides

Understanding Relevant Revenues and Costs in Decision-Making

Explore the concepts of relevant revenues and costs in decision-making, including differential costs, avoidable costs, sunk costs, opportunity costs, and relevant costs. Learn how to analyze costs, make add or drop decisions, and apply these principles through an example scenario with Recovery Sanda

0 views • 16 slides

Compliance Testing by ERA for IT Systems Developed and Deployed for TAF TSI

Compliance testing for IT systems developed and deployed for TAF TSI involves checking if messages comply with TAF XSD and basic parameters, assessing compliance of IT tools against TSI requirements, and issuing compliance assessment reports. The process includes testing messages for mandatory eleme

0 views • 4 slides