Understanding Climate Change: Insights from Reed B. Haslam, NYSC Delegate 1972

Reed B. Haslam, an experienced atmospheric scientist, reflects on his early weather observations, noticing the impact of climate change through warming temperatures and reduced precipitation. He emphasizes the key contributors to global warming, such as deforestation and carbon dioxide emissions. Co

1 views • 54 slides

Tax Considerations for Incentive, Recognition & Safety Programs

This presentation provides guidelines on tax implications, exemptions, and reporting obligations related to incentive, recognition, and safety programs. It emphasizes the importance of understanding tax considerations for program sponsors and participants to ensure compliance with applicable laws an

3 views • 14 slides

Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary

The public hearing on the 2023 Tax Rates and FY 2024 Schedule of Fees highlighted the importance of real estate taxes as the major revenue source for the Town's General Fund. The proposed tax rate of 16.25 per $100 assessed for FY 2024 was discussed, along with the impact on residential units and ta

1 views • 9 slides

Developing the CAST Highlight CO2 Emission Estimator (Beta) - February 2024

CAST Research Labs studied the impact of removing green deficiencies detected by CAST Highlight on CO2 emissions and energy consumption in custom software applications. The study led to a formula for estimating potential CO2 emission reductions, which was integrated into the new CAST Highlight CO2 E

0 views • 11 slides

Empowering NRIs: Indian Tax Services for England-Residing Individuals

Empowering NRIs: Indian Tax Services for England-Residing Individuals\" embodies our commitment to providing comprehensive tax solutions tailored specifically for Non-Resident Indians (NRIs) living in England. At NRI Taxation Bharat, we understand the unique challenges faced by NRIs abroad and striv

6 views • 11 slides

Professional Tax Assistance for NRIs in Canada from India

If you are a non-resident Indian (NRI) in Canada, we are here to help you with your tax needs. Our team of experts can handle all the international tax complexities to make sure you are compliant and get the maximum tax benefits. We offer NRI\u2019s tax filing, tax planning, and tax advisory service

0 views • 12 slides

Overview of Car and Van CO2 Regulation Working Group Meeting, 9th December 2021

The Car and Van CO2 Regulation Working Group convened on 9th December 2021 to discuss recent and upcoming legislative changes impacting CO2 emission regulations for vehicles. The meeting included agenda items such as collecting on-board fuel consumption monitoring data, manufacturer requirements for

0 views • 28 slides

Tax Benefits and Double Tax Treaties in Cyprus

Cyprus offers an attractive tax regime, with a corporate tax rate of 12.5%, exempt capital gains, and favorable personal tax rates for residents. Additionally, Cyprus has double tax treaties with numerous countries, making it an ideal location for individuals and businesses seeking tax efficiency.

0 views • 21 slides

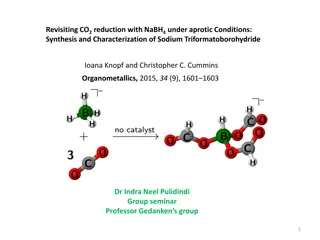

Sodium Triformatoborohydride Formation via NaBH4-CO2 Reaction

Sodium triformatoborohydride, Na[HB(OCHO)3], is synthesized by reacting NaBH4 with CO2 under aprotic conditions. The choice of reductant is crucial for CO2 reduction methods, highlighting the role of NaBH4 as a cost-effective and reactive reducing agent for formate production. The exclusive formatio

1 views • 12 slides

Enhancing CO2 Absorption Through Prioritizing Agriculture in UNFCCC Deliberation

COP 24 aims to address the challenges of global warming but faces obstacles in reducing CO2/GHG emissions. Emphasizing agriculture as a key solution due to its CO2 absorption capabilities can lead to breakthroughs. Implementing measures like modern technology in agriculture and promoting initiatives

1 views • 12 slides

CO2 Czech Solution Group: Advancing Industrial Carbon Capture and Utilization

The .CO2 Czech Solution Group, led by Ing. Leo G.l.mobil, is focused on CO2 capture and utilization from industrial processes. They prioritize BioCCS, CCU technologies, and aim to establish expert groups, engage in international cooperation for a low-carbon economy, and create a cooperative environm

1 views • 17 slides

Understanding Taxes for Ministers

Explore the complex world of taxes for ministers, covering topics such as denial, anger, bargaining, depression, and acceptance. Learn about current and future tax obligations, including federal income tax, state income tax, Medicare tax, Social Security tax, and self-employment tax. Discover key di

2 views • 32 slides

Horizon 2020 MefCO2 Methanol Fuel From CO2 Project Sustainability Impacts

The Horizon 2020 MefCO2 project focuses on producing methanol fuel from CO2, aiming to reduce CO2 emissions significantly and achieve renewable energy goals. The project aims to displace fossil fuels with green chemicals and advanced fuel production, providing solutions for energy storage and grid s

1 views • 6 slides

Algorithm for Tree Crops CO2 Removal Potential

Algorithm for the Calculation of Tree Crops CO2 Removal Potential (LIFE14.CCM/GR/000635) focuses on efficiently determining the capacity of tree crops to remove CO2 from the atmosphere. This algorithm considers various factors such as the biological cycle of the tree, cultivation practices, and carb

1 views • 17 slides

Understanding Taxation in Macao SAR: A Comprehensive Overview

Delve into the intricacies of taxation in Macao SAR with a virtual seminar featuring prominent speakers. Explore topics such as tax administration, profits tax framework, and tax declaration processes. Gain insights into the role of the Financial Services Bureau in ensuring tax compliance and the va

1 views • 25 slides

International Workshop on Offshore CO2 Storage: Goals, Expectations, Logistics

The International Workshop held in Texas aimed to foster collaboration and knowledge sharing on offshore CO2 storage. Topics included understanding requirements, sharing best practices, and identifying challenges and opportunities for offshore storage. The event highlighted the global potential for

1 views • 18 slides

Techno-Economic Analysis of Calcium Looping Processes for Low CO2 Emission Cement Plants

This study explores the application of Calcium Looping (CaL) processes in cement plants to reduce CO2 emissions. The process involves using CaO as a sorbent to capture CO2 from flue gas, with the potential for integration at different points in the cement production process. The Tail-end CaL configu

3 views • 14 slides

Insights from CO2 Measurement in Classroom Ventilation

Understand the significance of CO2 measurements in classroom ventilation for better indoor air quality and reduced infection risks. Explore the use of CO2 sensors, data analysis, and proxy models to improve ventilation systems in schools. Discover findings on airborne infection risk and variations w

2 views • 9 slides

Carbon Balance of Arctic Tundra in North America: An Overview

This assessment delves into the carbon balance of Arctic tundra in North America, comparing observations, models, and atmospheric inversions. Co-authored by researchers from various institutions, the study analyzes data from 1960 onwards, addressing the changing CO2 sink in high latitudes. It evalua

0 views • 17 slides

Multiatmosphere CO2 Laser Amplification Funded by Department of Energy

A project funded by DOE HEP focuses on developing a multiatmosphere CO2 amplifier optically pumped by a 4.3m Fe:ZnSe laser. The motivation lies in exploring the potential of optically pumped CO2 lasers for generating picosecond pulses at a high repetition rate. The project involves a collaboration b

0 views • 11 slides

CO2-Laser-Driven Dielectric Laser Accelerator Proposal

Study and experimental demonstration of a CO2-laser-driven dielectric laser accelerator, addressing the limitations of current accelerator technologies by utilizing longer laser wavelengths for increased charge and improved beam control. The proposal aims to develop a novel in-vacuo scheme for ultra

0 views • 13 slides

Evolution of Progressive Income Tax Systems

The concept of modern progressive income tax, developed in the early 20th century in countries like the UK, US, France, India, and Argentina, is based on the principle of a comprehensive tax base encompassing various income categories. The system involves effective vs. marginal tax rates, different

0 views • 19 slides

Understanding Tax Morale and the Shadow Economy in Greece

Tax morale plays a crucial role in determining the size of the shadow economy in Greece. Factors such as unemployment, tax burden, and self-employment also influence the shadow economy. Tax compliance decisions are driven not only by enforcement but also by tax morale. Various determinants of tax mo

0 views • 21 slides

Understanding U.S. Income Tax for Nonresident Students

This presentation provides an overview of U.S. income tax requirements for nonresident alien students in the United States. It covers topics such as federal and state taxation, income tax treaties, tax filing obligations, and exemptions. Nonresident aliens may be subject to tax on income received in

0 views • 23 slides

CO2 Emissions and Global Value Chains: Trends in Decoupling and Regional Impacts

The discussion focuses on the relationship between CO2 emissions and Global Value Chains (GVCs) from 1990 to 2015, exploring how GVC participation can aid in decoupling. It covers the environmental implications of GVCs, such as the effects on CO2 footprints, trade patterns, and emission intensities

0 views • 19 slides

Understanding Tax Transparency and Revenue Cycles

Exploring the complexities of the tax gap, this piece highlights the hidden aspects of revenue cycles and tax evasion. It emphasizes the need for a new approach to assess tax expenditures and spillovers for a balanced tax system, contrasting it with the repercussions of poor tax design. Richard Murp

0 views • 11 slides

Exploring the Relationship Between CO2 and Temperature Increase

This lesson guides students through an investigation to show the correlation between CO2 levels and rising temperatures. The students design a model using water bottles, thermometers, and Alka-Seltzer to test if CO2 can cause a temperature increase. They analyze data and draw conclusions to understa

0 views • 9 slides

Systems-Oriented Concept Map Extension for Biogeochemical Flows of CO2

The Systems-Oriented Concept Map Extension (SOCME) explores the biogeochemical flows of CO2, detailing interactions within the ocean and land subsystems, including factors such as uptake by different biomes, anthropogenic CO2 generation, deforestation effects, and energy production contributions. It

0 views • 6 slides

Tax Arrears Collection Methods in Liberia

Explore the tax arrears management practices in Liberia as per the Liberia Revenue Code. Learn about the legal provisions, tax treatment, and debt collection procedures, including adjustment in tax credit, closure of businesses, seizure, and sale of goods. Understand when tax arrears arise and the a

0 views • 45 slides

Analysis of State Tax Costs on Businesses: Location Matters

Explore the comprehensive analysis of state tax costs on businesses in "Location Matters." The study reveals varying tax burdens across different states, with insights on the impact on business operations. Findings highlight the significance of location in determining corporate tax liabilities and p

0 views • 32 slides

Electrochemical Reduction of CO2 on Copper and Mixed Metal Oxides

Different methods for CO2 reduction have been studied, with electrochemical reduction showing promise due to its use of electricity from nonconventional sources. Research on copper's unique characteristics for producing various CO2 reduction products has led to investigations into optimizing activit

0 views • 30 slides

Tax Workshop for UC Graduate Students - Important Tax Information and Resources

Explore essential tax information for UC graduate students, featuring key topics such as tax filing due dates, IRS tax forms, California state tax forms, scholarships vs. fellowships, tax-free scholarships, emergency grants, and education credits. This informational presentation highlights resources

0 views • 18 slides

Understanding the Interaction Between Criminal Investigations and Civil Tax Audits in Sweden

The relationship between criminal investigations and civil tax audits in Sweden is explored, highlighting how tax audits and criminal proceedings run concurrently. The mens rea requirement for criminal sanctions and tax surcharge, as well as the integration between criminal sanctions and tax surchar

0 views • 13 slides

Understanding the Basics of Income Tax on Death for Estate Planning

This informative content explores the essentials of income tax implications upon death, including notional sales triggering capital gains, inclusion of income in the deceased's final tax return, and considerations for minimizing tax burdens. It also highlights which assets trigger income tax on deat

0 views • 8 slides

Optimizing Gain Tailoring in CO2 Amplifiers for Laser Applications

The research focuses on enhancing gain tailoring in a CO2 amplifier through resonant absorption in hot CO2 cells, crucial for applications such as generating light channels in air, particle acceleration, and laser fusion. The study involves amplification of short pulses, CO2 laser gain spectra analy

0 views • 9 slides

Understanding Sales and Use Tax in Arizona

The University in Arizona is not tax-exempt and sales made to the University are subject to sales tax as per the Arizona Revised Statutes. This guide explains what is taxable under sales and use tax, the difference between sales tax and use tax, exceptions to tax rules, and reporting use tax on P-Ca

0 views • 13 slides

Guide to Reducing Tax Withholding for Nonresident Aliens

Learn how to reduce or stop tax withholding as a nonresident alien by completing the Foreign National Tax Information Form and following the steps outlined by the Tax Department. This guide includes instructions on logging into the Foreign National Information System, tax analysis, signing tax forms

0 views • 21 slides

Effect of Citrate Anticoagulation on CO2 Extraction in Low Flow Extracorporeal Venovenous CO2 Removal Therapy

This study evaluates the impact of citrate anticoagulation on CO2 extraction during low flow extracorporeal veno-venous CO2 removal therapy. The experiment conducted on a pig model comparing citrate anticoagulation to standard heparin protocol showed a trend towards improved CO2 extraction with citr

0 views • 6 slides

Overview of Minnesota State Airports Fund Revenue Sources

The Minnesota State Airports Fund, overseen by Aeronautics Director Cassandra Isackson, is funded through various sources including Aviation Fuel Tax, Airline Flight Property Tax, Aircraft Registration Tax, Aircraft Sales Tax, and more. Revenue sources like Aircraft Sales Tax, Airline Flight Propert

0 views • 11 slides

Overview of Goods and Services Tax (GST) in Nagaland

GST in Nagaland was introduced on July 1, 2017, with the aim of simplifying the tax structure by subsuming multiple indirect state taxes. It is a destination-based tax system that promotes ease of doing business, reduces tax burden, and creates a common market across India. The tax is levied on the

1 views • 18 slides

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)