Maximum Price Calculation for Callable Bond with Annual Yield Requirement

A 20-year callable bond example is provided with a $1000 face value and 3% annual coupons, callable at different redemption values over specific years. The task is to determine the maximum price a buyer should pay to achieve a minimum annual yield of 5%. The calculation involves identifying the time

0 views • 33 slides

Understanding Callable Bonds in Bond Investments

Callable bonds are a type of bond where the issuer reserves the right to redeem the bond at different times, potentially at different values. Investors face uncertainty about when the bond will be redeemed, but it can only be called at predetermined times. Common questions revolve around determining

0 views • 13 slides

Granny's Tree Climbing - A Poetic Adventure by Ruskin Bond

In this whimsical poem by Ruskin Bond, we are introduced to Granny, a sprightly sixty-two-year-old who defies convention by indulging in her lifelong passion for tree climbing. Despite admonishments from her family, Granny remains steadfast in her joy as she embarks on a delightful tree-climbing esc

0 views • 19 slides

Bringing Up Kari: A Tale of Compassion and Bond Between a Boy and an Elephant

Revolving around a young elephant named Kari and a nine-year-old boy, this heartwarming story explores the strong bond they share. Through adventures and challenges, the narrator teaches Kari valuable skills, nurturing a deep connection built on compassion and understanding. As Kari grows, so does t

0 views • 7 slides

Understanding Agricultural Price Policy and Its Importance

Agricultural price policy plays a crucial role in determining, regulating, and controlling prices of agricultural products. Its objectives include preventing violent price fluctuations, ensuring fair prices for farmers, and integrating prices across regions. The policy aims to provide remunerative p

2 views • 33 slides

Understanding Financial Concepts: Savings, Inflation, Bond Prices, Mortgages, and Investments

Savings accounts earn interest over time, impacted by inflation rates. Bond prices fall when interest rates rise. Shorter mortgages result in lower total interest payments. Investing in stock mutual funds offers diversification for lower risk compared to single stock investments.

0 views • 6 slides

Exploring the Human-Animal Bond in Veterinary Medicine

Delve into the significance of the human-animal bond in veterinary medicine, highlighting the mutually beneficial relationship between animals and humans over time. Understand how this bond has evolved, the role of veterinary assistants in fostering this connection, and the changing dynamics of huma

0 views • 26 slides

Sensitivity Analysis and LP Duality in Optimization Methods

Sensitivity analysis and LP duality play crucial roles in optimization methods for energy and power systems. Marginal values, shadow prices, and reduced costs provide valuable insights into the variability of the optimal solution and the impact of changes in input data. Understanding shadow prices h

0 views • 40 slides

Understanding Alkynes in Organic Chemistry

Alkynes are unsaturated hydrocarbons with at least one triple bond, following a molecular formula of CnH2n-2. This group of compounds is discussed in Chapter three, covering topics like structure, hybridization, common naming, physical properties, preparation, and reactions. The sp hybridization of

1 views • 20 slides

Understanding Discounts, Markups, and Sale Prices in Retail

Explore the concepts of discounts and markups in retail through real-life scenarios with skateboards, DVDs, and aquariums. Learn how to calculate sale prices, original prices, and selling prices to understand pricing strategies used in stores.

0 views • 6 slides

Exploring Growth and Opportunities in the Green Bond Markets

Delve into the burgeoning Chinese green bond market with insights on green bonds growth, sector allocations, Latin American issuance trends, sustainable investment needs in Latin America, China's green bond growth, and global green bond market size comparisons. Discover the significance of Green Pan

0 views • 14 slides

Innovative CPC Futures Contract Program for Agribusiness Sustainability

The Commodity Plus Carbon (CPC) Futures Contract Program integrates agricultural commodity prices with carbon valuation to incentivize good agricultural practices and reduce carbon footprint. By combining ag commodity prices with carbon reductions, CPC contracts offer hedging opportunities and incen

0 views • 8 slides

2018/19 Rugby Season Pricing and Membership Details

Explore the detailed pricing and membership options for the 2018/19 rugby season including MRSC subscription and payment plans, European Cup prices, Thomond Park PRO14 prices, Irish Independent PRO14 prices, and Junior Season Ticket prices. Uncover the various categories and discounts applied to ful

1 views • 7 slides

Arlington ISD Citizens Bond Oversight Committee Report August 2016

The Arlington ISD Citizens Bond Oversight Committee (CBOC) was established to provide transparency, enhance public confidence, provide findings and recommendations to the Board of Trustees, monitor progress of the 2014 Bond program, and find ways to maximize the bond's potential. The committee compr

0 views • 27 slides

Bonded Warehouse Facility and New Bond Process

Bonded warehouse facilities offer a convenient way for traders and industrialists to store goods without paying duties. The process involves applying for a new bond with specific requirements and inspections by officers. Necessary documents and approvals are essential to secure the bond premises, en

0 views • 31 slides

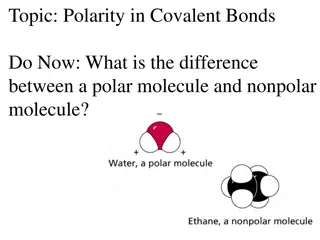

Understanding Polarity in Covalent Bonds

The difference between a polar molecule and a nonpolar molecule lies in the distribution of electrons. A polar molecule has an asymmetric electron distribution due to a significant difference in electronegativity, while a nonpolar molecule has a symmetric electron distribution. You can predict polar

0 views • 15 slides

Understanding the Bond Market: Maturity, Yield, and Pricing

Financial markets facilitate borrowing and lending, influencing interest rates, stock prices, and bond prices. Bonds promise future payments in exchange for current prices, while stocks offer ownership rights and dividends. The bond market involves maturity dates, coupon rates, and yield to maturity

0 views • 17 slides

Understanding Callable Bonds and Bond Amortization

Callable bonds provide issuers with the right to redeem the bond before maturity under certain conditions. This article discusses the concept of callable bonds, bond amortization, premium bonds, discount bonds, and provides examples of calculating bond values based on specific scenarios.

0 views • 12 slides

Understanding Bond Premiums and Their Impact on Financial Decision-Making

Bond premiums occur when bond prices increase in the secondary market due to a drop in market interest rates. They can be used for approved project costs, debt service, or reducing bond principal. Utilizing bond premiums wisely can lead to cost savings for taxpayers. Learn how bond premiums can affe

0 views • 5 slides

Exploring the Legacy of James Bond: 60 Years, 27 Films, and Countless Adventures

James Bond, the iconic British spy character, has been portrayed by various actors over the past 60 years in a total of 27 films. From Sean Connery to Daniel Craig, the character has evolved while maintaining his charm and mystery. The latest film, "No Time to Die," continues the legacy with action-

0 views • 11 slides

Determinants of Liquidity in the South African Bond Market

The presentation explores the determinants of liquidity in the South African bond market, emphasizing its importance for economic stability and growth. It discusses the significance of market liquidity, impacts of illiquidity, and compares the efficiency of the South African bond market with others

0 views • 24 slides

Understanding Bond Valuation Models and Yield Relationship

Explore the fundamentals of bond valuation, including the present value model and the yield model, to understand how bond prices are determined based on factors like market price, coupon payments, and yield to maturity. Learn about the price-yield curve, convexity, and how to calculate expected yiel

0 views • 25 slides

Understanding Elderly Bond Property Compliance in Oregon

Oregon Housing and Community Services (OHCS) issues tax-exempt bonds for the development of housing for low-income elderly and disabled individuals. Bond properties must meet program requirements to maintain compliance and avoid risks to bond series and credit ratings. OHCS plays a vital role in mon

0 views • 57 slides

Lowell Joint School District Bond Feasibility Survey Findings

The conducted survey by Dr. Timothy McLarney aimed to determine the feasibility of a bond measure for the Lowell Joint School District. The study focused on gathering community input to create a measure aligned with priorities, with an emphasis on education quality, crime reduction, job creation, an

0 views • 15 slides

Overview of the Common Agricultural Policy (CAP) in Europe

The Common Agricultural Policy (CAP) in Europe emerged after World War II to address food shortages. It aims to increase agricultural productivity, support farmers' livelihoods, stabilize markets, ensure food security, and maintain reasonable prices for consumers. CAP is guided by principles of a si

0 views • 21 slides

Exploring the World of Cherries and Ruskin Bond

Delve into the fascinating world of cherries and acclaimed Indian author Ruskin Bond. Learn about the rich cultivation of cherries in the northern regions of India, particularly in Jammu and Kashmir. Discover key details about Ruskin Bond's life and literary achievements, including his extensive bod

0 views • 8 slides

International Sugar Market Quarterly Outlook Analysis

The ISO 60th MECAS Meeting highlights currency movements, domestic prices, commodity prices, and fuel ethanol trends. The report discusses the performance of selected currencies against the US Dollar, domestic price changes in various countries, and the efforts of the International Sugar Organizatio

0 views • 15 slides

ICE Price Analysis for ERCOT Credit Risk Exposure

CWG/MCWG is exploring the use of ICE futures prices to assess ERCOT's credit risk exposure. This involves analyzing the relationship between ICE prices and actual RTM prices. The data inputs and transformations include calculations of daily average prices, logarithmic adjustments for linear regressi

0 views • 22 slides

Offshore Renminbi Bond Markets: Achievements and Challenges

The article discusses the achievements and challenges of the offshore Renminbi bond markets, highlighting the role of foreign currency debt in public debt management, the development of the RMB market, examples of sovereign issuances, and the practice and goals of international FX. It covers the evo

0 views • 7 slides

Bond Analysis and Valuation Techniques by Binam Ghimire

Explore the analysis and valuation of bonds in-depth with a focus on present value techniques, bond yields, and calculating future bond prices. Understand the process of pricing a bond by determining cash flows, coupon payments, and par value. Dive into the calculations involved in determining the p

0 views • 40 slides

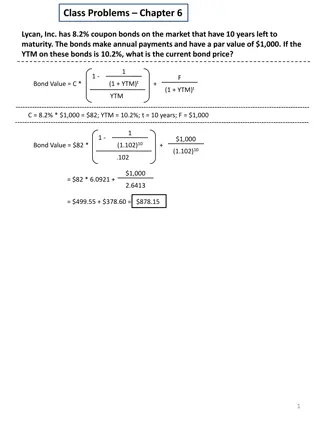

Bond Pricing and Yield Calculation Examples

The provided content illustrates calculations for bond pricing and yield in various scenarios. It covers topics such as determining current bond prices based on coupon rates, yield to maturity, and time to maturity. Additionally, it explores scenarios with different bond characteristics like annual

0 views • 5 slides

Understanding Bond Valuation and Types

Explore the world of bond valuation, from the definition of bonds to the different types such as zero-coupon, coupon, self-amortizing, and perpetual bonds. Learn about bond issuers, including the US government and agencies, and delve into the specifics of US government bonds like Treasury Bills, Not

0 views • 39 slides

Understanding Bond Valuation and Pricing

This informative content delves into valuing bonds, explaining concepts such as face value, coupon rates, and the relationship between bond prices and interest rates. It covers terminology, misconceptions about coupon rates, and provides examples to illustrate bond valuation calculations. The conten

0 views • 41 slides

Understanding Bond Basics for Investing Success

Explore the fundamental concepts of bonds and learn how market rates impact bond prices, guiding you through making informed investment decisions. Discover the relationship between interest rates and bond values, essential for navigating the world of public funds investing.

0 views • 30 slides

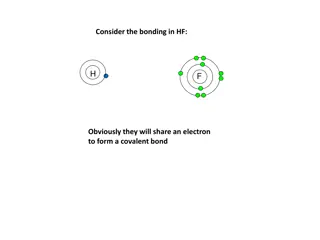

Understanding Bonding in HF Molecule

In HF bonding, hydrogen and fluorine share an electron to form a covalent bond. Fluorine, being more electronegative, attracts the bonding electrons more, resulting in a polar covalent bond. If hydrogen was less electronegative, the bonding electrons would shift further towards fluorine until an ion

0 views • 11 slides

Impact of Global Oil Price Rise on Local Maize Market Prices in Africa

The presentation discusses the potential impact of a rise in global oil prices on local maize market prices in Africa, focusing on the interconnected factors such as transport costs, biofuels, and price transmission within and between countries. It explores the correlation between global oil prices

0 views • 27 slides

Analyzing Local Procurement and Market Prices Across Multiple Countries

The study delves into the effects of local procurement on market prices and price volatility across various countries. It explores the motivations behind studying price effects, the impact of procurement and distribution on prices, and the scope of the analysis focusing on retail prices. The identif

0 views • 15 slides

Detailed Pricing Information for 2019-20 Season Tickets and Game Tickets

In the 2019-20 season, detailed pricing information is provided for MRSC Membership, European Cup Tickets, Thomond Park PRO14 Prices, Irish Independent PRO14 Prices, and Junior Season Ticket Prices. The data includes various membership levels, payment options, game prices, and discount details for d

0 views • 7 slides

Understanding Contract Capacity Prices in Energy Markets

Exploring the nuances of contract capacity prices in the energy sector, this content delves into the differences between contract capacity prices and PJM capacity auction clearing prices, shedding light on the financial implications for generators and ratepayers.

0 views • 13 slides

Understanding Bond Lengths and Strengths in Chemistry

Bond lengths represent the critical distance between bonded atoms for maximum stability, while bond strengths are measured through dissociation energy and average bond energy. Methods for measuring bond lengths include X-ray diffraction and spectroscopic methods, with bond energies reflecting the st

0 views • 38 slides