GASB 96: Subscription-Based Information Technology Arrangements (SBITAs) Overview

GASB 96 provides guidance on accounting for subscription-based information technology arrangements for government end users. It outlines criteria for determining control of IT assets, distinguishes SBITAs from leases, and explains the recognition and measurement of subscription liabilities and asset

0 views • 26 slides

Understanding Piecemeal Distribution of Cash in Partnership Dissolution

Piecemeal distribution of cash in partnership dissolution involves systematically distributing cash over stages as assets are realized and liabilities settled. Realization expenses, contingent liabilities, outside liabilities, partners' loans, and partners' capitals are settled in a specific order.

0 views • 6 slides

Overview of Working Capital Management in Financial Management

Working capital management involves strategic decision-making regarding a company's current assets and liabilities to optimize liquidity, profitability, and risk. This process includes understanding working capital concepts, financing current assets, managing liability structure, and maintaining the

1 views • 26 slides

Introduction to Principles of Accounts Level 1: Basics of Accounting and Bookkeeping

Understanding the fundamentals of accounting including bookkeeping, classification of data, users of accounting information, assets, liabilities, and capital. Practice exercises to classify items and review concepts of assets, liabilities, and equity.

0 views • 24 slides

Understanding Independent Branches in Accounting

Independent branches in accounting operate autonomously, making purchases externally, receiving goods from the head office, setting their selling prices, and managing expenses from their own cash flow. They keep complete books, prepare financial statements independently, and may engage in inter-bran

1 views • 10 slides

Accounting for Foreign Branches: Converting Trial Balances and Exchange Rates

A foreign branch maintains its accounts in a foreign currency, requiring the head office to convert the trial balance into its own currency before finalizing accounts. Fixed and fluctuating exchange rates impact the conversion process, with specific rules for fixed assets, liabilities, and current a

0 views • 7 slides

Capital Gains and Assets Overview in Income Tax Law and Accounts

This content provides an overview of capital gains and assets in income tax law and accounts, covering topics such as types of capital assets, assets not considered capital assets, kinds of capital assets (short-term and long-term), transfer year of chargeability, computation of capital gains, and c

0 views • 15 slides

Monitoring of Returned Assets: Abacha's Legacy in Nigeria

International efforts led by civil society in Nigeria and Switzerland have successfully monitored the return of assets linked to the Abacha regime. Initiatives like the Nigerian Network on Stolen Assets and the Conditional Cash Transfer program demonstrate transparency and accountability in handling

0 views • 10 slides

Understanding IAS 39: Financial Instruments Recognition and Measurement

This content provides an overview of an IFRS seminar on IAS 39, focusing on key concepts such as the classification and measurement of financial assets, impairment, reclassification, and more. It covers definitions of financial instruments, financial assets, equity instruments, and financial liabili

1 views • 43 slides

Understanding Liquidation Estate and Key Asset Components

In the process of liquidation, the liquidator forms an estate comprising various assets of the corporate debtor for the benefit of creditors. These assets include ownership rights, tangible and intangible assets, proceeds of liquidation, and more. However, certain assets owned by third parties or he

0 views • 39 slides

University Asset Management Guidelines

University asset management guidelines cover the physical inventory policy, procedures, and fixed asset terminology for safeguarding, tracking, and reporting assets. Departments designate equipment liaisons to manage assets and conduct physical inventories regularly. Assets are categorized as capita

1 views • 21 slides

Understanding Provisions, Contingent Liabilities, and Assets in Accounting

This content covers the concept of provisions, contingent liabilities, and contingent assets in accounting, highlighting the criteria for recognizing a liability as a provision. It explains the types of obligations, the importance of a reliable estimate, and specific applications such as onerous con

0 views • 13 slides

Working Capital and Current Ratio in Accounting

Understanding indicators like net current assets (working capital) and current ratio is crucial in accounting. Net current assets reflect the ability to settle current liabilities and the capital required for operational functions. Managing working capital effectively involves factors like stock man

0 views • 12 slides

Understanding Cost of Credit and Financial Statements

The cost of credit refers to the additional amount a borrower must pay, including interest and fees, while financial statements are crucial reports that present a business's financial position and performance. These statements help users make informed economic decisions by providing clear, relevant,

0 views • 17 slides

Revolutionizing Asset Valuation: Longevity Specialty Finance, LLC's Competitive Advantage

Longevity Specialty Finance, LLC (LSF) is setting new standards in valuing level-3 assets and liabilities through their exclusive use of the Longevity Cost Calculator (LCC). The LCC, based on a proven longevity predictive algorithm, allows LSF to accurately price and value assets with unknown future

0 views • 11 slides

A Comparison of ELI and UNIDROIT Principles on Digital Assets

A comparison between the principles of Electronic Liability Initiative (ELI) and the International Institute for the Unification of Private Law (UNIDROIT) regarding digital assets. ELI focuses on security over digital assets, while UNIDROIT covers a broader range, including transfers, custody, and m

0 views • 5 slides

Understanding Equitable Distribution in Florida

Equitable distribution in Florida, governed by statutes 61.075 and 61.076, determines the fair division of marital assets and liabilities in divorce cases. Key considerations include identification, valuation, distribution presumption, and justification for unequal distribution. Assets are classifie

0 views • 28 slides

Managing Debt and Protecting Client Assets in Victoria

Consumer Action Law Centre in Victoria focuses on assisting low-income clients in managing debt and protecting their assets. The presentation emphasizes assessing the need for debt payment, considering the client's financial position, and exploring options to handle debt where income and assets are

1 views • 29 slides

Guide to Filling Out Parent's Financial Statement Section 4: Assets and Liabilities

Learn how to accurately complete Section 4 - Assets and Liabilities of the Parent's Financial Statement. This section covers details on rental payments, homeownership information, bank accounts, investments, retirement savings, and education funds. Follow the instructions provided to showcase the fa

0 views • 8 slides

Understanding Society: Wealth and Assets Survey Research

The Wealth and Assets Survey (WAS) conducted by Oliver Tatum and Angie Osborn at the Understanding Society Research Conference in 2013 focuses on longitudinal issues, experiment design, research findings, and future plans related to the survey. The WAS background includes collecting data on personal

3 views • 28 slides

Accounting for Biological Assets and Agricultural Produce

At the end of this lesson, you will be able to identify the principal issues in accounting for biological assets and agricultural produce at the time of harvest. Topics include the recognition, measurement, presentation, and disclosure of biological assets in financial statements. Questions regardin

0 views • 26 slides

Accounting for Biological Assets and Agricultural Produce (LKAS 41: Agriculture) by Rangajewa Herath

This content provides insights into the accounting standards for biological assets and agricultural produce under LKAS 41, discussing classification, presentation, measurement, gain or loss recognition, and disclosure requirements. It covers the unique nature of biological assets, the scope of LKAS

0 views • 20 slides

Comprehensive Fixed Assets Management Guidelines for Educational Institutions

Explore a detailed guide on tracking and recording fixed assets in educational institutions, covering key aspects such as capital assets accounting procedures, general ledger accounts, and the definition of capital assets. Learn the minimum standards for valuing assets, recording guidelines, and the

0 views • 25 slides

Update on BSEE Program and Action Plan for Orphan Assets

Advisory updates on BSEE program focusing on bankruptcies, orphan assets, and decommissioning liabilities. Actions include contracting procedures, financial assurance coverage, and funding strategies to address wells, pipelines, and structures. Attention given to MIGO, ANGLO SUISSE, and ATP/BENNU as

0 views • 22 slides

Proposed Process Improvements for Fixed Assets Management

Implementing Oracle Fixed Assets for managing fixed assets and capital projects, the proposed process aims to streamline capitalization, improve financial reporting controls, and enhance operational efficiencies. By organizing accounts based on asset categories, tracking ownership, and providing det

0 views • 9 slides

Understanding Intangible Assets and Business Combinations in Accounting

In accounting, recognition of intangible assets as assets requires the expectation of future economic benefits flowing to the entity and reliable measurement of the asset's cost. Intangible assets acquired separately are recognized based on their fair value, while those acquired in business combinat

0 views • 23 slides

Understanding Impairment of Assets in Financial Management

Entities must periodically test for impairment to ensure assets are not overstated. An impairment loss occurs when an asset's carrying amount exceeds its recoverable amount. Assets like inventories and deferred tax assets may require testing. Learn when to undertake impairment tests, key indicators,

0 views • 19 slides

Understanding Net Investment in Capital Assets and Its Importance

Net Investment in Capital Assets is a critical component of an entity's financial position, reflecting the value of capital assets owned. It represents the portion of the net position that is not spendable as it is invested in assets. Calculating Net Investment in Capital Assets involves subtracting

1 views • 17 slides

Understanding Liabilities of Directors under Companies Act, 2013

Director's liabilities under the Companies Act, 2013 include definitions of directors, shadow directors, officers, and those in default. Responsibility for default and potential prosecutions for wrongful actions are discussed. Changes in definitions and concepts are highlighted to illustrate the leg

0 views • 37 slides

Understanding Final Accounts: Key Concepts and Definitions

Explore the essential key words related to final accounts such as Debtors, Creditors, Assets, Liabilities, Fixed Assets, Current Assets, Current Liabilities, Long-term Liabilities, Purchases, Sales, and Gains. These images provide a visual representation of the concepts to help you grasp the fundame

0 views • 12 slides

Understanding Net Worth: Integers and Financial Assets

Learn about net worth, liabilities, and assets by exploring how integers are used to determine the financial standing of individuals. Discover the concepts of liabilities, responsibilities, and assets through real-life examples of notable personalities. Dive into calculations and understand how net

0 views • 18 slides

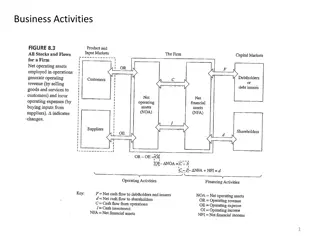

Understanding Reformulated Balance Sheets in Financial Analysis

Reformulated balance sheets in financial analysis involve categorizing assets and liabilities into operating and financial components for a more detailed credit analysis. This process helps differentiate between assets and liabilities used in business operations versus financing activities, providin

0 views • 17 slides

CADCAI Audited Financial Report 2016 Summary & Analysis

The CADCAI Audited Financial Report for 2016 reveals key insights into the organization's financial performance. CADCAI is a not-for-profit organization with income tax exemption and registered GST. The report showcases a current year profit of $14,067 and total retained profit since 1986 of $412,30

0 views • 19 slides

Understanding Financial Instruments in IFRS: Key Concepts and Overview

This content provides an overview of financial instruments under IFRS, focusing on their classification as assets, liabilities, or equity. It explains the presentation of compound financial instruments and outlines key concepts related to financial assets, financial liabilities, and equity instrumen

0 views • 28 slides

Understanding Capital Assets in Financial Reporting

A capital asset is a long-term asset used in operations with a useful life extending beyond a single reporting period, such as land, buildings, and infrastructure. These assets are reported at historical cost, including ancillary charges. Special assets like works of art or historical treasures are

0 views • 35 slides

Insights on the Canadian Charity Sector 2010-2018: A Blumberg Snapshot Analysis

Analysis of the Canadian charity sector from 2010 to 2018 based on Blumberg's Snapshot. The report covers data on the number of charities filing T3010s, charities with websites, charities per capita in Canada, charity assets and liabilities, and inflation trends during the period. Key findings inclu

0 views • 16 slides

Understanding Balance Sheets and Income Statements in Financial Reporting

Balance sheets provide a snapshot of a company's assets, liabilities, and shareholders' equity at a specific point in time, with assets listed on the left and liabilities and equity on the right. Current assets are those expected to be converted into cash within a year, while non-current assets are

0 views • 34 slides

Understanding Debt Capital in Chapter 8 of Accounting for Managers

Explore the concept of debt capital and liabilities in Chapter 8 of Accounting for Managers by Professor Zhou Ning from Beihang University. Learn about the nature of liabilities, legal obligations, contingencies, and levels of likelihood in financial reporting. Discover how to differentiate between

0 views • 21 slides

Digital Assets and Social Media Estate Planning

Explore the world of digital assets and social media estate planning presented by Patricia E. Kefalas Dudek & Howard H. Collens. Understand what digital assets entail, the categories they fall into, and how to assist clients in planning for their digital legacies. Learn about the importance of estat

0 views • 56 slides

Understanding Balance Sheets in Financial Management

A balance sheet is a crucial financial statement that reflects the assets, liabilities, and owner's equity of a business at a specific point in time. It provides a snapshot of the financial health of a company, helping stakeholders assess its overall standing. Assets are items of value owned by the

0 views • 9 slides